UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ChromaDex Corporation

(Exact Name of Registrant As Specified in Its Charter)

|

Delaware

|

26-2940963

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification Number)

|

10900 Wilshire Blvd., Suite 600

Los Angeles, California 90024

(310) 388-6706

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Robert Fried

Chief Executive Officer

10900 Wilshire Blvd., Suite 600

Los Angeles, California 90024

(310) 388-6706

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

With copies to:

|

Ben D. Orlanski, Esq.

Matthew O’Loughlin, Esq.

Louis Rambo, Esq.

Proskauer Rose LLP

2029 Century Park East

Suite 2400

Los Angeles, CA 90067-3010

(310) 557-2193

|

Brianna Gerber

Interim Chief Financial Officer

10900 Wilshire Blvd., Suite 600

Los Angeles, California 90024

(310) 388-6706

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell or accept an offer to buy the securities under this prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 3, 2022

PROSPECTUS

2,480,000 Shares

Common Stock Offered by the Selling Stockholders

This prospectus relates to the offer and resale by certain selling stockholders from time to time of up to 2,480,000 shares of our common stock, par value $0.001 per share (“Common Stock”).

The selling stockholders may sell the shares of Common Stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell their shares of Common Stock in the section entitled “Plan of Distribution” on page 10. The selling stockholders will bear all commissions and discounts, if any, attributable to the sale or disposition of the shares, or interests therein. We will bear all costs, expenses and fees in connection with the registration of the shares. We will not be paying any underwriting discounts or commissions in this offering.

We are not selling any shares of Common Stock under this prospectus and will not receive any proceeds from the sale of the shares by the selling stockholders.

Our common stock is listed on The Nasdaq Capital Market under the symbol “CDXC.” On October 31, 2022, the closing sale price of our Common Stock on The Nasdaq Capital Market was $1.52 per share. You are urged to obtain current market quotations for our Common Stock.

A prospectus supplement may add, update, or change information contained in this prospectus. You should carefully read this prospectus, any applicable prospectus supplement, and the information incorporated by reference in this prospectus and any applicable prospectus supplement before you make your investment decision.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISKS. YOU SHOULD CAREFULLY READ AND CONSIDER THE SECTION ENTITLED “RISK FACTORS” ON PAGE 6 AND THE RISK FACTORS INCLUDED IN OUR PERIODIC REPORTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, IN ANY APPLICABLE PROSPECTUS SUPPLEMENT AND IN ANY OTHER DOCUMENTS WE FILE WITH THE SECURITIES AND EXCHANGE COMMISSION.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy and adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022

TABLE OF CONTENTS

| |

Page |

|

ABOUT THIS PROSPECTUS

|

1

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

2

|

|

PROSPECTUS SUMMARY

|

3

|

|

RISK FACTORS

|

5

|

|

USE OF PROCEEDS

|

7

|

|

SELLING STOCKHOLDERS

|

8

|

|

PLAN OF DISTRIBUTION

|

10

|

|

LEGAL MATTERS

|

12

|

|

EXPERTS

|

12

|

|

INFORMATION INCORPORATED BY REFERENCE

|

12

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

13

|

ABOUT THIS PROSPECTUS

We urge you to read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities being offered.

You should rely only on the information contained or incorporated by reference in this prospectus and the applicable prospectus supplement or in any amendment to this prospectus. Neither we nor any selling stockholder has authorized anyone to provide you with different information, and if anyone provides, or has provided you, with different or inconsistent information, you should not rely on it. The selling stockholders are offering to sell, and seeking offers to buy, shares of our Common Stock, only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, as well as the information filed previously with the SEC, and incorporated herein by reference, is accurate only as of the date of the document containing the information, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or any sale of our Common Stock.

A prospectus supplement may add to, update or change the information contained in this prospectus. You should read both this prospectus and any applicable prospectus supplement together with additional information described below under the heading “Where You Can Find Additional Information.”

In this prospectus, references to “ChromaDex,” the “Company,” “registrant,” “we,” “us,” and “our” refer to ChromaDex Corporation and its consolidated subsidiaries. The phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement, unless the context requires otherwise.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and any applicable prospectus supplement or free writing prospectus, including the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to statements about:

● our business;

● our business strategy;

● products and services we may offer in the future;

● the outcome and impact of litigation;

● the timing and results of future regulatory filings;

● the timing and results of future clinical trials;

● the success of our joint venture in China;

● our ability to collect from major customers;

● our sales and marketing strategy and capital outlook; and

● our estimates regarding our capital requirements, future expenses and need for additional financing.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “intend,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” “continue,” “likely,” and similar expressions (including their use in the negative) intended to identify forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these risks and uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” in our SEC filings, and may provide additional information in any applicable prospectus supplement. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. Before deciding to purchase our Common Stock, you should carefully consider the risk factors incorporated by reference herein, in addition to the other information set forth in this prospectus and in the documents incorporated by reference herein.

PROSPECTUS SUMMARY

This summary highlights important features of this offering and the information included or incorporated by reference in this prospectus. This summary does not contain all of the information you should consider before investing in our Common Stock. You should carefully read this prospectus, any applicable prospectus supplement and the information incorporated by reference in this prospectus and any applicable prospectus supplement before you invest in our Common Stock.

Company Overview

ChromaDex is a global bioscience company dedicated to healthy aging. Our team, which includes world-renowned scientists, is pioneering research pertaining to nicotinamide adenine dinucleotide (NAD+) which is found in every cell of human bodies and levels of which decline with age.

NAD+ is an essential coenzyme, a key regulator of cellular metabolism and is required for mitochondria to function efficiently. Best known for its role in cellular energy production, NAD+ is now thought to play an important role in healthy aging. Many cellular functions related to health and healthy aging are sensitive to levels of locally available NAD+ and this represents an active area of research in the field of NAD+.

NAD+ levels are not constant, and in humans, NAD+ levels have been shown to decline by more than 50% from young adulthood to middle age. There are other factors linked to NAD+ depletion, including poor diet, excess alcohol consumption and a number of disease states. NAD+ levels may also be increased, including through calorie restriction, moderate exercise and supplementation with NAD+ precursors, such as nicotinamide riboside (NR). Healthy aging, mitochondrial health and NAD+ continue to be areas of focus in the research community. To date, there are over 450 published human clinical studies related to NAD+ and its impact on health. Areas of study include understanding NAD+’s role in Alzheimer’s disease, Parkinson’s disease, neuropathy, sarcopenia, liver disease and heart failure.

In 2013, we commercialized NIAGEN®, a proprietary form of NR, a novel form of vitamin B3. Data from numerous preclinical studies, and confirmed in human clinical trials, show that NR is a highly efficient NAD+ precursor that significantly raises blood and tissue NAD+ levels. NIAGEN® is safe for human consumption. NIAGEN® has twice been successfully reviewed under the United States (U.S.) Food and Drug Administration’s (FDA) new dietary ingredient (NDI) notification program, it has been successfully notified to the FDA as generally recognized as safe (GRAS), and has been approved by Health Canada, the European Commission and the Therapeutic Goods Administration of Australia. Clinical studies of NIAGEN® have demonstrated a variety of outcomes including increased NAD+ levels, altered body composition, increased cellular metabolism and increased cellular energy production. NIAGEN® is protected by patents to which we are the owner or have exclusive rights.

ChromaDex is among the world leaders in the emerging NAD+ space. We have amassed more than 245 research partnerships with leading universities and research institutions around the world including the National Institutes of Health, Cornell, Dartmouth, Harvard, Massachusetts Institute of Technology, University of Cambridge and the Mayo Clinic. Additional relationships are currently being developed.

Our scientific advisory board is led by Chairman Dr. Roger Kornberg, Nobel Laureate Stanford Professor, Dr. Charles Brenner, one of the world’s recognized experts in NAD+ and discoverer of NR as a NAD+ precursor and chair of the Department of Diabetes & Cancer Metabolism at the City of Hope National Medical Center, Dr. Rudy Tanzi, the co-chair of the department of neurology at Harvard Medical School, Sir John Walker, Nobel Laureate and Emeritus Director, MRC Mitochondrial Biology Unit in the University of Cambridge, England, Dr. Bruce German, Chairman of food, nutrition and health at the University of California, Davis, Dr. Brunie Felding, Associate Professor, Department of Molecular Medicine at Scripps Research Institute, California Campus, and Dr. David Katz, the Founder and former director of Yale University’s Yale-Griffin Prevention Research Center; President and Founder of the non-profit True Health Initiative; and Founder and Chief Executive Officer of Diet ID, Inc.

Private Placement

Securities Purchase Agreement

On September 30, 2022, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the purchasers named therein (the “Purchasers”), pursuant to which we agreed to sell and issue an aggregate of $3.1 million of our Common Stock at a purchase price of $1.25 per share (the “Financing”). On October 7, 2022, we closed the Financing and issued an aggregate of 2,480,000 shares of Common Stock to the Purchasers.

The shares of Common Stock issued to the Purchasers were not initially registered under the Securities Act or any state securities laws. We have relied on the exemption from the registration requirements of the Securities Act by virtue of Section 4(a)(2) thereof and Rule 506 of Regulation D thereunder. In connection with its execution of the Purchase Agreement, each Purchaser represented to us that it is an “accredited investor” as defined in Regulation D of the Securities Act and that the shares of Common Stock purchased by it were being acquired solely for its own account and for investment purposes and not with a view to its future sale or distribution.

Registration Rights Agreement

On September 30, 2022, in connection with the Financing, we entered into a Registration Rights Agreement with the Purchasers (the “Registration Rights Agreement”), pursuant to which we agreed to (i) file one or more registration statements with the SEC to cover the resale of the shares of Common Stock issued to the Purchasers, (ii) use our reasonable best efforts to have all such registration statements declared effective within the timeframes set forth in the Registration Rights Agreement, and (iii) use our commercially reasonable efforts to keep such registration statements effective during the timeframes set forth in the Registration Rights Agreement. In the event that such registration statements are not filed or declared effective within the timeframes set forth in the Registration Rights Agreement, any such effective registration statements subsequently become unavailable, or the Purchasers are unable to sell the shares of Common Stock issued pursuant to the Purchase Agreement because we have failed to satisfy the current public information requirement of Rule 144 under the Securities Act, we would be required to pay liquidated damages to the Purchasers equal to 1.0% of the aggregate purchase price per month for each default (up to a maximum of 5.0% of such aggregate purchase price).

The registration statement of which this prospectus is a part relates to the offer and resale of the shares of Common Stock issued to the Purchasers pursuant to the Purchase Agreement (the “Shares”). When we refer to the selling stockholders in this prospectus, we are referring to the Purchasers named in this prospectus as the selling stockholders and, as applicable, any donees, pledgees, assignees, transferees or other successors-in-interest selling Shares received after the date of this prospectus from the selling stockholders as a gift, pledge, or other non-sale related transfer.

Corporate Information

On May 21, 2008, Cody Resources, Inc., a Nevada corporation and a public company, (“Cody”) entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among Cody, CDI Acquisition, Inc., a California corporation and wholly-owned subsidiary of Cody, and ChromaDex, Inc. Subsequent to the signing of the Merger Agreement, Cody merged with and into a Delaware corporation. On June 20, 2008, Cody amended its certificate of incorporation to change its name to ChromaDex Corporation. Our principal executive offices are located at 10900 Wilshire Blvd., Suite 600, Los Angeles, California 90024. Our telephone number at that address is (310) 388-6706. Our website address is www.chromadex.com. The information contained in, or that can be accessed through, our website is not part of this prospectus.

THE OFFERING

|

Common Stock Offered by the Selling Stockholders

|

2,480,000 Shares

|

| |

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of Shares covered by this prospectus

|

| |

|

|

Nasdaq Capital Market Symbol

|

CDXC

|

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. Prior to making a decision about investing in our Common Stock, you should consider carefully the specific risk factors discussed in the sections entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K for the year ended December 31, 2021, as filed with the SEC on March 14, 2022, or Quarterly Reports on Form 10-Q for the quarter ended March 31, 2022, as filed with the SEC on May 12, 2022, or for the quarter ended June 30, 2022, as filed with the SEC on August 10, 2022, and for the quarter ended September 30, 2022, as filed with the SEC on November 2, 2022, which are incorporated in this prospectus by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with the SEC, including any prospectus supplement hereto. These risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and adversely affected. In that case, the trading price of our Common Stock could decline and you might lose all or part of your investment.

USE OF PROCEEDS

The proceeds from the sale of the Shares of Common Stock offered pursuant to this prospectus are solely for the accounts of the selling stockholders. We will not receive any proceeds from the sale of the Shares by the selling stockholders.

SELLING STOCKHOLDERS

The selling stockholders, or their donees, pledgees, assignees, transferees or other successors-in-interest, are offering for resale, from time to time, up to an aggregate of 2,480,000 Shares. The foregoing Shares represent all shares of our Common Stock issued to the selling stockholders in connection with the Financing. The following table sets forth certain information with respect to beneficial ownership of our Common Stock as of October 31, 2022 by the selling stockholders, as determined in accordance with Rule 13d-3 of the Exchange Act. This information has been obtained from the selling stockholders or in Schedules 13G or 13D and other public documents filed with the SEC.

The number of shares of Common Stock beneficially owned after this offering assumes the sale of all of the Shares offered by the selling stockholders pursuant to this prospectus. However, because the selling stockholders may sell all or some of their Shares under this prospectus from time to time, or in another permitted manner, we cannot assure you as to the actual number of Shares that will be sold by the selling stockholders or that will be held by the selling stockholders after completion of any sales. We do not know how long any of the selling stockholders will hold the Shares before selling them. Information concerning the selling stockholders may change from time to time and changed information will be presented in a supplement to this prospectus if and when necessary and required.

|

Name of Selling Stockholder

|

|

Shares of Common Stock Beneficially Owned Prior to this Offering(1)

|

|

|

Maximum Number of Shares of Common Stock Being Offered

|

|

|

Shares of Common Stock Beneficially Owned After this Offering(1)(2)

|

|

| |

|

Number

|

|

|

Percentage

|

|

|

|

|

|

|

Number

|

|

|

Percentage

|

|

|

Pioneer Step Holdings Limited(3)

|

|

|

7,885,641 |

|

|

|

10.6 |

% |

|

|

960,000 |

|

|

|

6,925,641 |

|

|

|

9.3 |

% |

|

Champion River Ventures Limited(4)

|

|

|

7,940,937 |

|

|

|

10.7 |

% |

|

|

1,440,000 |

|

|

|

6,500,937 |

|

|

|

8.7 |

% |

|

Robert Fried (5)

|

|

|

3,554,994 |

|

|

|

4.7 |

% |

|

|

80,000 |

|

|

|

3,474,994 |

|

|

|

4.5 |

% |

|

(1)

|

“Beneficial ownership” means that a person, directly or indirectly, has or shares voting or investment power with respect to a security or has the right to acquire such power within 60 days. The number of shares beneficially owned is determined as of October 31, 2022, and the percentage is based upon 74,468,669 shares of our Common Stock outstanding as of October 31, 2022.

|

|

(2)

|

Assumes sale of all Shares available for sale under this prospectus and no further acquisitions of shares of Common Stock by the selling stockholders.

|

|

(3)

|

Based on beneficial ownership reported on Schedule 13D/A filed with the SEC on October 3, 2022, (i) Pioneer Step Holdings Limited (“Pioneer Step”) beneficially owned and had voting and dispositive power with respect to 6,917,783 shares (the “Pioneer Shares”), (ii) Dvorak International Limited (“Dvorak International”) beneficially owned and had voting and dispositive power with respect to 420,000 shares (the “Dvorak Shares”) and (iii) Skyinvest Associates Limited (“Skyinvest”) beneficially owned and had voting and dispositive power with respect to 547,858 shares (the “Skyinvest Shares”). Chau Hoi Shuen Solina Holly (“Solina Chau”), by virtue of being the sole shareholder of each of Pioneer Step, Dvorak International and Skyinvest, may be deemed to beneficially own and have voting and dispositive power with respect to the Pioneer Shares, the Dvorak Shares and the Skyinvest Shares. Pioneer Step has exercised its right to designate for appointment one director to our board of directors. The registered office address for Pioneer Step, Dvorak International and Skyinvest is Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands and its correspondence address is c/o Suites PT. 2909 & 2910, Harbour Centre, 25 Harbour Road, Wanchai, Hong Kong.

|

|

(4)

|

Based on beneficial ownership reported on Schedule 13D/A filed with the SEC on October 3, 2022, Champion River Ventures Limited (“Champion River”) beneficially owns and has voting and dispositive power with respect to 7,940,937 shares (the “Champion Shares”). Prime Tech Global Limited, a British Virgin Islands corporation (“Prime Tech”), is the sole shareholder of Champion River, Mayspin Management Limited, a British Virgin Islands corporation (“Mayspin”), is the sole shareholder of Prime Tech. Li Ka Shing is the sole shareholder of Mayspin. Li Ka Shing, by virtue of being sole shareholder of Mayspin, may be deemed to beneficially own and have voting and dispositive power with respect to the Champion Shares. Champion River has exercised its right to designate for appointment one director to our board of directors. The registered office address for Champion River is Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands and its correspondence address is c/o 7/F, Cheung Kong Center, 2 Queen’s Road Central, Hong Kong.

|

|

(5)

|

Includes 1,981,933 stock options exercisable within 60 days.

|

Relationship with Selling Stockholders

As discussed in greater detail above under the section titled “Prospectus Summary—Private Placement,” in September 2022, we entered into the Purchase Agreement with the selling stockholders pursuant to which we sold and issued shares of our Common Stock and also entered into the Registration Rights Agreement with the selling stockholders pursuant to which we agreed to file a registration statement with the SEC to cover the resale of the shares of our Common Stock issued pursuant to the Purchase Agreement by the selling stockholders.

Robert Fried is a member of our board of directors and our Chief Executive Officer. Pioneer Step, Champion River and Mr. Fried are each existing stockholders of the Company.

In April 2020, we entered into a securities purchase agreement and a registration rights agreement with Pioneer Step, and another purchaser, pursuant to which (i) we sold and issued an aggregate of 490,196 shares of our Common Stock at a purchase price of $4.08 per share to Pioneer Step, and (ii) we filed a registration statement with the SEC in May 2020 to cover the resale of such shares of our Common Stock by Pioneer Step and the other purchaser.

Except as noted in the footnotes to the table above, none of the selling stockholders has held any position or office with us or our affiliates within the last three years or has had a material relationship with us or any of our predecessors or affiliates within the past three years, other than as a result of the ownership of our shares of Common Stock or other securities.

PLAN OF DISTRIBUTION

We are registering the Shares issued to the selling stockholders to permit the resale of these Shares by the holders of the Shares from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholders of the Shares. We will bear all fees and expenses incident to our obligation to register the Shares.

The selling stockholders may sell all or a portion of the Shares beneficially owned by them and offered hereby from time to time directly or through one or more underwriters, broker-dealers or agents. If the Shares are sold through underwriters or broker-dealers, the selling stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The Shares may be sold on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale, in the over-the-counter market or in transactions otherwise than on these exchanges or systems or in the over-the-counter market and in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions. The selling stockholders may use any one or more of the following methods when selling Shares:

● ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

● block trades in which the broker-dealer will attempt to sell the Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

● purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

● an exchange distribution in accordance with the rules of the applicable exchange;

● privately negotiated transactions;

● settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

● broker-dealers may agree with a selling stockholder to sell a specified number of such Shares at a stipulated price per share;

● through the writing or settlement of options or other hedging transactions, whether such options are listed on an options exchange or otherwise;

● a combination of any such methods of sale; or

● any other method permitted pursuant to applicable law.

The selling stockholders also may resell all or a portion of the Shares in open market transactions in reliance upon Rule 144 under the Securities Act, as permitted by that rule, or Section 4(a)(1) under the Securities Act, if available, rather than under this prospectus, provided that they meet the criteria and conform to the requirements of those provisions.

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. If the selling stockholders effect such transactions by selling Shares to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the Shares for whom they may act as agent or to whom they may sell as principal. Such commissions will be in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction will not be in excess of a customary brokerage commission in compliance with FINRA Rule 5110.

In connection with sales of the Shares, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Shares in the course of hedging in positions they assume. The selling stockholders may also sell Shares short and if such short sale shall take place after the date that the registration statement of which this prospectus is a part is declared effective by the SEC, the selling stockholders may deliver the Shares covered by this prospectus to close out short positions and to return borrowed Shares in connection with such short sales. The selling stockholders may also loan or pledge Shares to broker-dealers that in turn may sell such Shares, to the extent permitted by applicable law. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of Shares offered by this prospectus, which Shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). Notwithstanding the foregoing, the selling stockholders have been advised that they may not use Shares registered on the registration statement of which this prospectus is a part to cover short sales of our Common Stock made prior to the date the registration statement, of which this prospectus forms a part, has been declared effective by the SEC.

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Shares from time to time pursuant to this prospectus or any amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending, if necessary, the list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this prospectus. The selling stockholders also may transfer and donate the Shares in other circumstances in which case the donees, pledgees, assignees, transferees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

The selling stockholders and any broker-dealer or agents participating in the distribution of the Shares may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act in connection with such sales. In such event, any commissions paid, or any discounts or concessions allowed to, any such broker-dealer or agent and any profit on the resale of the Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of, including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act.

Each selling stockholder has informed us that it is not a registered broker-dealer and does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Common Stock. Upon us being notified in writing by a selling stockholder that any material arrangement has been entered into with a broker-dealer for the sale of Common Stock through a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer, a supplement to this prospectus will be filed, if required, pursuant to Rule 424(b) under the Securities Act, disclosing (i) the name of each such selling stockholder and of the participating broker-dealer(s), (ii) the number of shares involved, (iii) the price at which such shares of Common Stock were sold, (iv) the commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable, (v) that such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus, and (vi) other facts material to the transaction. In no event shall any broker-dealer receive fees, commissions and markups, which, in the aggregate, would exceed eight percent (8%).

Under the securities laws of some states, the Shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless such Shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that any selling stockholder will sell any or all of the Shares registered pursuant to the registration statement of which this prospectus forms a part.

Each selling stockholder and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the Shares by the selling stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the Shares. All of the foregoing may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

We will pay all expenses of the registration of the shares of common stock pursuant to the registration rights agreement, including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that each selling stockholder will pay all underwriting discounts and selling commissions, if any, and any legal expenses incurred by it. We will indemnify the selling stockholders against certain liabilities, including some liabilities under the Securities Act, in accordance with a registration rights agreement, or the selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus, in accordance with the related registration rights agreements, or we may be entitled to contribution.

LEGAL MATTERS

The validity of the Shares to be offered for resale by the selling stockholders under this prospectus will be passed upon for us by Proskauer Rose, LLP, Los Angeles, California.

EXPERTS

The consolidated financial statements as of December 31, 2021 and 2020 and for each of the years then ended incorporated by reference in this prospectus and elsewhere in the registration statement of which this prospectus is a part have been so incorporated by reference in reliance upon the report of Marcum LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information we file with them, which means that we can disclose important information to you by referring you to those documents. In accordance with Rule 412 of the Securities Act, any statement contained or incorporated by reference in this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, or in any subsequently filed document which also is incorporated by reference herein, modifies or supersedes such earlier statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We incorporate by reference the documents listed below:

| |

●

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 14, 2022;

|

| |

●

|

Our Quarterly Reports on Form 10-Q for the quarterly period ended March 31, 2022, filed with the SEC on May 12, 2022, the quarterly period ended June 30, 2022, filed with the SEC on August 10, 2022 and the quarterly period ended September 30, 2022, filed with the SEC on November 2, 2022;

|

| |

●

|

Our Current Reports on Form 8-K (other than information furnished rather than filed), filed with the SEC on April 8, 2022, April 11, 2022, April 15, 2022, April 18, 2022, May 19, 2022, June 9, 2022, June 21, 2022, August 10, 2022, October 3, 2022, and October 11, 2022; and

|

| |

●

|

The description of our Common Stock in our registration statement on Form 8-A filed with the SEC on April 21, 2016, including any amendments or reports filed for the purpose of updating such description, including exhibit 4.6 of the 2020 10-K.

|

We also incorporate by reference into this prospectus all documents (other than Current Reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items) that are subsequently filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of the offering of the securities made by this prospectus (including documents filed after the date of the initial registration statement of which this prospectus is a part and prior to the effectiveness of the registration statement).

You may request a copy of these filings at no cost, by contacting us at the following address or telephone number:

ChromaDex Corporation

10900 Wilshire Blvd., Suite 600

Los Angeles, California 90024

Attention: Corporate Secretary

(310) 388-6706

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits which are part of the registration statement. For further information with respect to us and the securities offered by this prospectus, we refer you to the registration statement and the exhibits filed as part of the registration statement. We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public at the SEC’s website at www.sec.gov. You may obtain a copy of these filings at no cost by writing us at the following address: ChromaDex Corporation, 10900 Wilshire Blvd., Suite 600, Los Angeles, California 90024, Attention: Corporate Secretary. We also maintain a website at www.chromadex.com. The information contained in, or that can be accessed through, our website is not part of this prospectus

2,480,000 Shares

PROSPECTUS

, 2022

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The Securities and Exchange Commission registration fee and the estimated expenses in connection with the offering are as follows:

|

Securities and Exchange Commission Registration Fee

|

|

$ |

415 |

|

|

Accounting fees and expenses

|

|

|

15,000 |

|

|

Legal fees and expenses

|

|

|

250,000 |

|

|

Miscellaneous

|

|

|

9,585 |

|

|

Total

|

|

$ |

275,000 |

|

Item 15. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law (the “DGCL”) empowers a Delaware corporation to indemnify any persons who are, or are threatened to be made, parties to any threatened, pending, or completed legal action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or in the right of such corporation), by reason of the fact that such person was an officer or director of such corporation, or is or was serving at the request of such corporation as a director, officer, employee, or agent of another corporation or enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit, or proceeding, provided that such officer or director acted in good faith and in a manner he reasonably believed to be in or not opposed to the corporation’s best interests, and, for criminal proceedings, had no reasonable cause to believe his conduct was illegal. A Delaware corporation may indemnify officers and directors in an action by or in the right of the corporation under the same conditions, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable to the corporation in the performance of his duty. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him against the expenses which such officer or director actually and reasonably incurred.

Our certificate of incorporation and bylaws provide that we will indemnify our directors and officers to the fullest extent permitted by Delaware law, except that no indemnification will be provided to a director, officer, employee, or agent if the indemnification sought is in connection with a proceeding initiated by such person without the authorization of our board of directors. The bylaws also provide that the right of directors and officers to indemnification shall be a contract right and shall not be exclusive of any other right now possessed or hereafter acquired under any statute, provision of the certificate of incorporation, bylaw, agreement, vote of stockholders or disinterested directors or otherwise. The bylaws also permit us to secure insurance on behalf of any officer, director, employee, or other agent for any liability arising out of his or her actions in such capacity, regardless of whether the bylaws would permit indemnification of any such liability.

Section 102(b)(7) of the DGCL provides that directors shall not be personally liable for monetary damages for breaches of their fiduciary duty as directors except for (i) breaches of their duty of loyalty to us or our stockholders, (ii) acts or omissions not in good faith or which involve intentional misconduct or knowing violations of law, (iii) certain transactions under Section 174 of the DGCL (unlawful payment of dividends or unlawful stock purchases or redemptions), or (iv) transactions from which a director derives an improper personal benefit. Our certificate of incorporation includes such a provision. The effect of this provision is to eliminate the personal liability of directors for monetary damages or actions involving a breach of their fiduciary duty of care, including any actions involving gross negligence.

In addition, we have entered into indemnification agreements with our directors and officers that require us, among other things, to indemnify them against certain liabilities that may arise by reason of their status or service, so long as the indemnitee acted in good faith and in a manner the indemnitee reasonably believed to be in or not opposed to the best interests of the Company, and, with respect to any criminal action or proceeding, the indemnitee had no reasonable cause to believe his or her conduct was unlawful. We also maintain director and officer liability insurance to insure our directors and officers against the cost of defense, settlement or payment of a judgment under specified circumstances.

Item 16. Exhibits

The following documents are filed as exhibits to this registration statement, including those exhibits incorporated herein by reference to a prior filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, as indicated in parentheses:

|

Exhibit

No.

|

Description

|

|

3.1

|

Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Annual Report on Form 10-K filed with the SEC on March 15, 2018).

|

|

3.2

|

Certificate of Amendment to the Certificate of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed with the SEC on April 12, 2016).

|

|

3.3

|

Amended and Restated Bylaws of the Registrant (incorporated by reference to Exhibit 3.3 to the Registrant’s Annual Report on Form 10-K filed with the SEC on March 15, 2022).

|

|

4.1

|

Reference is made to Exhibits 3.1, 3.2, and 3.3.

|

|

4.2

|

Form of Stock Certificate representing shares of the Registrant’s Common Stock (new design effective as of December 10, 2018, incorporated by reference to Exhibit 4.5 to the Registrant’s Annual Report on Form 10-K filed with the SEC on March 07, 2019).

|

|

4.4

|

Registration Rights Agreement, dated as of September 30, 2022, by and between the Registrant and the Purchasers (incorporated by reference to Exhibit 10.3 to the Registrant’s Current Report on Form 8-K filed with the SEC on October 3, 2022).

|

|

5.1

|

Opinion of Proskauer Rose LLP.

|

|

10.1

|

Securities Purchase Agreement, dated as of September 30, 2022, by and between the Registrant and the Purchasers (incorporated by reference to Exhibit 10.2 to the Registrant’s Current Report on Form 8-K filed with the SEC on October 3, 2022).

|

|

23.1

|

Consent of Marcum LLP, Independent Registered Public Accounting Firm.

|

|

23.2

|

Consent of Proskauer Rose LLP (included in Exhibit 5.1).

|

|

24.1

|

Power of Attorney (included on the signature pages to this Form S-3).

|

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(a)

| |

(1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

| |

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

| |

(ii)

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

| |

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

| |

(2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

| |

(3)

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

| |

(4)

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

| |

(i)

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

| |

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

(b) The undersigned registrant undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit, or proceeding) is asserted by such director, officer, or controlling person of the registrant in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Los Angeles, State of California, on November 3, 2022.

| |

CHROMADEX CORPORATION

/s/ Robert Fried

Robert Fried

Chief Executive Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, THAT each person whose signature appears below constitutes and appoints Robert Fried and Brianna Gerber, and each of them, as his or her true and lawful attorney-in-fact and agent, each acting alone, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

/s/ Robert Fried

Robert Fried

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

November 3, 2022

|

| |

|

|

|

/s/ Brianna Gerber

Brianna Gerber

|

Interim Chief Financial Officer

(Principal Financial and Accounting Officer)

|

November 3, 2022

|

| |

|

|

|

/s/ Frank L. Jaksch, Jr.

Frank L. Jaksch, Jr.

|

Chairman of the Board

|

November 3, 2022

|

| |

|

|

|

/s/ Kristin Patrick

Kristin Patrick

|

Director

|

November 3, 2022

|

| |

|

|

|

/s/ Ann Cohen

Ann Cohen

|

Director

|

November 3, 2022

|

| |

|

|

|

/s/ Steven Rubin

Steven Rubin

|

Director

|

November 3, 2022

|

| |

|

|

|

/s/ Wendy Yu

Wendy Yu

|

Director

|

November 3, 2022

|

| |

|

|

|

/s/ Gary Ng

Gary Ng

|

Director

|

November 3, 2022

|

| |

|

|

|

/s/ Hamed Shahbazi

Hamed Shahbazi

|

Director

|

November 3, 2022

|

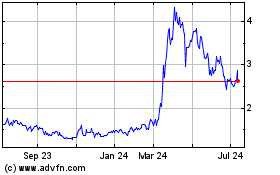

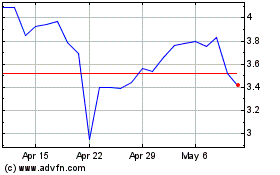

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Jun 2024 to Jul 2024

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Jul 2023 to Jul 2024