UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF

1934

For the month of March 2020

Commission File Number: 333-231839

CHINA SXT PHARMACEUTICALS, INC.

(Translation of registrant’s name

into English)

178 Taidong Rd North, Taizhou

Jiangsu, China

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

Entry into Material Definitive Agreements

As previously disclosed, China SXT Pharmaceuticals,

Inc. (the “Company”) entered into certain Forbearance and Amendment Agreements (each a “Forbearance

Agreement”, collectively, the “Forbearance Agreements”) on December 13, 2019 with each investor who

purchased certain series A convertible note and Series B convertible note (the “Series A Note” and “Series

B Note”, collectively, “Notes”) and warrants in a private placement in May 2019 (each an “Investor”,

collectively, “Investors”). Simultaneously with the execution of Forbearance Agreements, each Investor also

entered into certain leak-out agreement (each a “Leak-Out Agreement”), among other agreements with the Company.

Due to the Company’s failure to obtain

timely approval from State Administration of Foreign Exchange in People’s Republic of China to redeem Series A Notes in cash

as previously contemplated, we separately amended and restated the Leak-Out Agreements (each an “Amended Leak-Out Agreement”)

with each Investor on March 3, 2020 (“Effective Date”).

Terms of the Amended Leak-Out Agreement

Daily Limit

Pursuant to the Amended Leak-Out Agreements,

each Investor (together with certain of its affiliates) has agreed to not sell, dispose or otherwise transfer, directly or indirectly

(including, without limitation, any sales, short sales, swaps or any derivative transactions that would be equivalent to any sales

or short positions) any Series A Conversion Shares converted during the period commencing on the Effective Date and ending on the

later of (x) the date the Series A Note issued to the Investor no longer remains outstanding and (y) such date as the Investor

(and/or its Affiliates) shall have sold all Series A Conversion Shares, (collectively, the “Restricted Securities”),

on any Trading Day (as defined in Series A Notes) (each date of determination, each a “Measuring Date”), if

such sale, together with all prior sales of Restricted Securities by the Investor on such Measuring Date, exceed 20% of the daily

composite trading volume of the Ordinary Shares (as reported by Bloomberg, LP for such Measuring Date) (the “Daily Limit”);

provided that the sales of any other shares of Ordinary Shares (excluding any sales of Restricted Securities) on such applicable

Measuring Date shall not be included in the Daily Limit calculation above.

Conversion Limit

In addition, if the Investor on a given

date desires to convert the Series A Note, in whole or in part, and the aggregate of the Conversion Amount of all conversions from

December 13, 2019 through, and including, such date of determination (including the Conversion Amount of the proposed conversion)

exceeds the sum of (x) the aggregate New Installment Amounts (as set forth in the Forbearance Agreement) and (y) any other unpaid

amounts under the Forbearance Agreement (including, without limitation, the Initial Forbearance Fee), in the aggregate, that have

become due and payable (or would have become due and payable, assuming the Forbearance Agreement remained in full force and effect

through, and including, such date of determination) in accordance with the Forbearance Agreement on or prior to such date of determination,

the Investor shall be prohibited from effecting such conversion (the “Conversion Limit”).

Permitted Excess Conversion

Notwithstanding the foregoing Conversion

Limit, as of any time of determination, if both (x) the daily average composite trading volume of the Ordinary Share (as reported

by Bloomberg, LP for such Measuring Date) exceeds 1.5 million and (y) the trading price of the Ordinary Share as of such time of

determination exceeds the Closing Bid Price (as defined in the Series A Note) of the Ordinary Share as of the Trading Day immediately

prior to such Measuring Date, the Investor shall be permitted to convert, in one or more conversions on such Measuring Date, up

to an additional aggregate amount (which shall be excluded from the Conversion Limit) not to exceed the lesser of (i) 500,000 shares

of Ordinary Share and (ii) 20% of the daily average composite trading volume of the Ordinary Shares.

A copy of the forms of Amended Leak-Out Agreement is attached

hereto as exhibits 10.1.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENT

This Current Report contains forward-looking

statements. All statements contained in this Current Report other than statements of historical fact are forward-looking statements.

The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “seek” and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely on our current expectations and projections about future events

and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term

business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties

and assumptions. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Current

Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking

statements.

You should not rely upon forward-looking

statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be

achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake

no duty to update any of these forward-looking statements after the date of this Current Report or to conform these statements

to actual results or revised expectations.

Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

CHINA SXT PHARMACEUTICAL, INC.

|

|

|

|

|

|

|

By:

|

/s/ Feng Zhou

|

|

|

|

Feng Zhou

|

|

|

|

Chief Executive Officer

|

Date: March 3, 2020

3

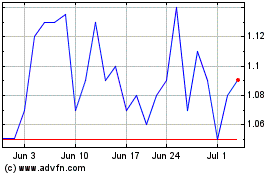

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Feb 2024 to Feb 2025