Citizens First Financial Corp. Announces Second Quarter Unaudited Results and Dividend to Be Paid

August 02 2004 - 12:53PM

PR Newswire (US)

Citizens First Financial Corp. Announces Second Quarter Unaudited

Results and Dividend to Be Paid BLOOMINGTON, Ill., Aug. 2

/PRNewswire-FirstCall/ -- Citizens First Financial Corp. (the

"Company") (NASDAQ:CFSB), the parent company of Citizens Savings

Bank (the "Bank"), announced that the Board of Directors has

declared a dividend of $0.10 per share to be paid on August 24,

2004, to stockholders of record on August 12, 2004. In addition,

the Company announced net income for the six months ended June 30,

2004 of $1,418,000, compared to net income of $1,463,000 for the

six months ended June 30, 2003, a decrease of $45,000 or 3.1%. The

Company had basic and diluted earnings per share of $0.94 and

$0.89, respectively for the six months ended June 30, 2004 compared

to basic and diluted earnings per share of $1.00 and $0.91,

respectively, for the six months ended June 30, 2003. The Company

had net income for the three months ended June 30, 2004 of

$731,000, compared to net income of $721,000 for the three months

ended June 30, 2003, an increase of $10,000 or 1.4%. The Company

had basic and diluted earnings per share of $0.48 and $0.46, for

the three months ended June 30, 2004, compared to basic and diluted

earnings per share of $0.49 and $0.45, respectively, for the three

months ended June 30, 2003. Net interest income increased from

$5,235,000 for the six months ended June 30, 2003 to $5,491,000 for

the six months ended June 30, 2004, an increase of $256,000 or

4.9%. Interest income decreased to $9,030,000 for the six months

ended June 30, 2004 from $9,822,000 for the six months ended June

30, 2003. The decrease was attributable to a 37 basis point

decrease in the average yield on interest-earning assets and a $4.6

million decrease in the average balance of interest earning assets.

Interest expense decreased to $3,539,000 for the six months ended

June 30, 2004 from $4,587,000 for the six months ended June 30,

2003. The decrease was due to a 66 basis point decrease in the

average rate paid on interest-bearing liabilities and a $6.8

million decrease in the average balance of interest-bearing

liabilities. There was a negative provision for loan losses of

$250,000 for the six months ended June 30, 2004, compared to a

provision for loan losses of $391,000 for the six months ended June

30, 2003, a change of $641,000. The decrease was primarily due to

the recovery in the first quarter of 2004 of $389,000 from a loan

that had been previously charged off and the decrease in the size

of the loan portfolio. Noninterest income decreased from $1,583,000

for the six months ended June 30, 2003 to $976,000 for the six

months ended June 30, 2004, a decrease of $607,000. The decrease

was primarily due to a decrease of $787,000 in net gains on loan

sales, offset by a $106,000 increase in service charges on deposit

accounts and an $89,000 increase in the cash surrender value of

life insurance policies. Noninterest expense increased from

$4,046,000 for the six months ended June 30, 2003 to $4,461,000 for

the six months ended June 30, 2004, an increase of $415,000,

because of an increase of $411,000 in net loss on sale or

write-down of foreclosed assets. Additional write-downs were taken

in the first quarter of 2004 on commercial properties included in

foreclosed assets based on the sales price of one property and

lower expectations for the sale of another property. The Bank

currently has five offices in central Illinois. CITIZENS FIRST

FINANCIAL CORP. SELECTED FINANCIAL INFORMATION (In thousands except

for per share data) 06/30/04 12/31/03 (Unaudited) Balance Sheet

Data Total assets $334,225 $349,515 Cash and cash equivalents

$38,750 $16,831 Investment securities $22,945 $20,746 FHLB stock

$15,682 $15,206 Loans held for sale $1,762 $376 Loans $244,388

$282,477 Allowance for loan losses $3,137 $3,072 Deposits $239,557

$250,013 Borrowings $58,825 $63,975 Equity capital $33,656 $32,992

Book value per common share $22.46 $22.00 Quarter ended Six months

ended 06/30/04 06/30/03 06/30/04 06/30/03 (Unaudited) (Unaudited)

(Unaudited) (Unaudited) Summary of Operations Interest income

$4,361 $4,840 $9,030 $9,822 Interest expense 1,626 2,192 3,539

4,587 Net interest income 2,735 2,648 5,491 5,235 Provision for

loan losses (76) 306 (250) 391 Noninterest income 307 790 976 1,583

Noninterest expense 1,953 1,964 4,461 4,046 Income before income

tax 1,165 1,168 2,256 2,381 Income tax expense 434 447 838 918 Net

income $731 $721 $1,418 $1,463 Earnings per share: Basic $0.48

$0.49 $0.94 $1.00 Diluted $0.46 $0.45 $0.89 $0.91 Ratios Based on

Net Income Return on average stockholders' equity 8.64% 8.94% 8.45%

9.08% Return on average assets 0.85% 0.83% 0.82% 0.83% Net interest

yield on average earning assets 3.40% 3.27% 3.39% 3.18% DATASOURCE:

Citizens First Financial Corp. CONTACT: C. William Landefeld,

President & Chief Executive Officer of Citizens First Financial

Corp., +1-309-661-8700

Copyright

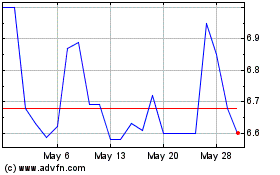

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Nov 2024 to Dec 2024

CFSB Bancorp (NASDAQ:CFSB)

Historical Stock Chart

From Dec 2023 to Dec 2024