UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 18, 2024

BURTECH ACQUISITION CORP.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41139 |

|

85-2708752 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

1300 Pennsylvania Ave NW, Suite 700

Washington, DC 20004

(Address of principal executive offices, including

zip code)

Registrant’s telephone number,

including area code: (202) 600-5757

Not

Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Exchange Act:

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on

which registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

BRKHU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, par value $0.0001 per share |

|

BRKH |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of Class A Common Stock for $11.50 per share |

|

BRKHW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company x

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Explanatory Note

As previously described in a current report on

Form 8-K filed on December 29, 2023, on December 22, 2023, BurTech Acquisition Corp., a publicly traded special purpose acquisition company

incorporated under the laws of the State of Delaware (“BurTech”), entered into an Agreement and Plan of Merger (as

amended from time to time, the “Merger Agreement”) by and among BurTech, BurTech Merger Sub Inc., a Delaware corporation

and a direct, wholly owned subsidiary of BurTech (“Merger Sub”), Blaize, Inc., a Delaware corporation (“Blaize”),

and, solely for the limited purposes set forth therein, Burkhan Capital LLC, a Delaware limited liability company (“Burkhan”),

pursuant to which Merger Sub will merge with and into Blaize, whereupon the separate corporate existence of Merger Sub will cease and

Blaize will be the surviving company and continue in existence as a direct, wholly owned subsidiary of BurTech, on the terms and subject

to the conditions set forth therein (the “Merger” and, collectively with the other transactions described in the Merger

Agreement, the “Business Combination”). In connection with the consummation of the Business Combination, BurTech will

be renamed “Blaize Holdings, Inc.”

Item 8.01 Other Events.

On July 18, 2024, BurTech and Blaize issued a

joint press release (the “Press Release”) announcing the filing of a registration statement of BurTech and Blaize on

Form S-4 (the “Registration Statement”) with the U.S. Securities and Exchange Commission on July 18, 2024 relating to their

previously announced Business Combination.

The Registration Statement contains a preliminary

proxy statement/prospectus in connection with the proposed Business Combination. While the Registration Statement has not yet become effective

and the information contained therein is subject to change, it provides important information about BurTech, Blaize and the Business Combination.

The Press Release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

No Offer or Solicitation

This Form 8-K is not a proxy statement or solicitation

of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and does not constitute

an offer to sell or a solicitation of an offer to buy any securities of BurTech or Blaize, nor shall there be any sale of any such securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of the Securities Act.

Additional Information and Where to Find It

This Form 8-K does not contain all the information

that should be considered concerning the Business Combination and is not intended to form the basis of any investment decision or any

other decision in respect of the Business Combination. BurTech has filed a Registration Statement on Form S-4 with the U.S. Securities

and Exchange Commission (“SEC”), which includes a preliminary prospectus and proxy statement of BurTech in connection

with the Business Combination, referred to as a proxy statement/prospectus, and after the Registration Statement is declared effective,

BurTech will mail a definitive proxy statement/prospectus relating to the Business Combination to its stockholders. BurTech may file other

documents regarding the Business Combination with the SEC, and BurTech’s stockholders and other interested persons are advised to

read, when available, the preliminary proxy statement/prospectus and the amendments thereto, the definitive proxy statement/prospectus

and the other documents filed in connection with the Business Combination, as these materials will contain important information about

Blaize, BurTech and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for

the Business Combination will be mailed to stockholders of BurTech as of a record date to be established for voting on the Business Combination

and the other matters to be voted upon at a meeting of BurTech’s stockholders to be held to approve the Business Combination and

such other matters. Such stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive

proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov,

or by directing a request to BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson,

Chief Financial Officer.

Before making any voting decision, investors

and security holders of BurTech are urged to read the registration statement, the proxy statement/prospectus, and amendments thereto,

and the definitive proxy statement/prospectus in connection with BurTech’s solicitation of proxies for its stockholders’ meeting

to be held to approve the Business Combination, and all other relevant documents filed or that will be filed with the SEC in connection

with the Business Combination as they become available because they will contain important information about BurTech, Blaize and the Business

Combination.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

Participants in Solicitation

BurTech, Blaize, and their respective directors,

executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation

of proxies from BurTech’s stockholders in connection with the Business Combination. Information regarding the persons who may, under

SEC rules, be deemed participants in the solicitation of BurTech’s stockholders in connection with the Business Combination, including

the names of such persons and a description of their respective interests, is set forth in BurTech’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information regarding the interests of those persons and other

persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement regarding

the proposed business combination when it becomes available. Stockholders will be able to obtain copies of the documents described in

this paragraph that are filed with the SEC, once available, without charge at the SEC’s website at www.sec.gov, or by directing

a request to BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, New York, NY 20006, Attention: Roman Livson, Chief Financial

Officer.

Forward-Looking Statements Legend

This Form 8-K contains forward-looking statements

within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section

21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on beliefs and assumptions

and on information currently available to BurTech and Blaize. In some cases, you can identify forward-looking statements by the following

words: “may,” “will,” “could,” “would,” “should,” “expect,” “intend,”

“plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “continue,” “ongoing,” “target,” “seek” or the negative or plural

of these words, or other similar expressions that are predictions or indicate future events or prospects, although not all forward-looking

statements contain these words. Forward-looking statements are predictions, projections and other statements about future events that

are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that

the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of BurTech’s securities;

(ii) the risk that the Business Combination may not be completed by BurTech’s business combination deadline and the potential failure

to obtain an extension of the business combination deadline if sought by BurTech; (iii) the failure to satisfy the conditions to the consummation

of the Business Combination, including the approval of the Business Combination by BurTech’s stockholders, the satisfaction of the

minimum aggregate transaction proceeds amount following redemptions by BurTech’s public stockholders and the receipt of certain

governmental and regulatory approvals; (iv) the failure to obtain financing to complete the Business Combination and to support the future

working capital needs of Blaize and the combined company; (v) the effect of the announcement or pendency of the Business Combination on

Blaize’s business relationships, performance, and business generally; (vi) risks that the Business Combination disrupts current

plans of Blaize and potential difficulties in the retention of Blaize employees as a result of the Business Combination; (vii) the outcome

of any legal proceedings that may be instituted against BurTech or Blaize related to the Merger Agreement and the Business Combination;

(viii) changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws

or regulations or as a condition to obtaining regulatory approval of the Business Combination; (ix) the ability to maintain the listing

of BurTech’s securities on Nasdaq; (x) the price of BurTech’s securities, including volatility resulting from changes in the

competitive and highly regulated industries in which Blaize operates, variations in performance across competitors, changes in laws and

regulations affecting Blaize’s business and changes in the combined capital structure; (xi) the ability to implement business plans,

forecasts, and other expectations after the completion of the Business Combination, including the possibility of cost overruns or unanticipated

expenses in development programs, and the ability to identify and realize additional opportunities; (xii) the enforceability of Blaize’s

intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security

risks or potential breaches of data security; (xiii) the incurrence of significant expenses to remediate, or damage to Blaize’s

reputation as a result of, any defects in Blaize’s products; (xiv) the risk that Blaize may never achieve or sustain profitability;

(xv) changes in the competitive and regulated industries in which Blaize operates, variations in operating performance across competitors,

changes in laws and regulations affecting Blaize’s business and changes in the combined capital structure, and (xvi) other risks

and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in BurTech’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on the

website of the SEC at www.sec.gov and other documents filed, or to be filed with the SEC by BurTech, including the Registration Statement.

The foregoing list of factors is not exhaustive. There may be additional risks that neither BurTech nor Blaize presently know or that

BurTech or Blaize currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking

statements. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the definitive

proxy statement to be filed by BurTech with the SEC, including those under “Risk Factors” therein, and other documents filed

by BurTech from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and BurTech and Blaize

assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. Neither BurTech nor Blaize gives any assurance that either BurTech or Blaize will

achieve its expectations.

Item 9.01 Financial Statements and Exhibits.

(d) List of Exhibits.

The Exhibit Index is incorporated by reference herein.

Exhibit Index

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BurTech Acquisition Corp. |

| |

|

|

| Date: July 19, 2024 |

By: |

/s/ Shahal Khan |

| |

Name: |

Shahal Khan |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

BurTech Acquisition Corp. and Blaize Announce

filing of registration statement on Form S-4 Related to Proposed Business Combination

Washington, DC, July 18, 2024 — BurTech

Acquisition Corp. (“BurTech”) (NASDAQ: BRKH), a publicly traded special purpose acquisition company, and Blaize, Inc., a provider

of purpose-built, artificial intelligence (“AI”)-enabled edge computing solutions today announced its filing with the U.S.

Securities and Exchange Commission (“SEC”) of a registration statement on Form S-4 (the “Registration Statement”).

The Registration Statement contains a preliminary

proxy statement/prospectus in connection with the proposed business combination between Blaize and Burtech. While the Registration Statement

has not yet become effective and the information contained therein is subject to change, it provides important information about Blaize,

Burtech, and the proposed business combination.

CEO and Chairman of BurTech Shahal Khan, commented,

“We are thrilled to reach this milestone with Blaize as we continue the partnership. The potential

of edge AI is immense, and this partnership positions the combined company for success. We are confident Blaize is poised to be a leading

player and are eager to continue on the path ahead.”

Transaction Overview

Under the terms of the merger agreement entered

into by BurTech and Blaize, among others, with respect to the proposed business combination, Blaize will merge with and into a wholly

owned subsidiary of BurTech that was formed for the proposed transaction (the “Merger”), with Blaize surviving the Merger

as a direct wholly owned subsidiary of BurTech. At the effective time of the Merger, stockholders of Blaize immediately prior to the effective

time of the Merger will receive shares of BurTech common stock based on an implied pro forma enterprise value of approximately $1.14 billion

at a price of $10.00 per share.

Advisors

Norton Rose Fulbright US LLP is acting as U. S.

legal counsel to BurTech. Latham & Watkins LLP is acting as legal counsel to Blaize. Blueshirt Capital Advisors is also serving as

an investor relations advisor to Blaize.

About BurTech Acquisition Corp.

BurTech Acquisition Corp. (NASDAQ: BRKH) is a

special purpose acquisition company dedicated to partnering with exceptional businesses and providing them with the resources and expertise

to excel in the public market. With a focus on delivering long-term value to stockholders and supporting innovative companies, BurTech

Acquisition Corp. is committed to creating success stories in technology industries. With steadfast stockholders, a robust financial footing,

and an unyielding commitment to innovation, BurTech Acquisition Corp. is a visionary force in the technology world.

About Blaize

Blaize provides a full-stack programmable processor

architecture suite and low-code/no-code software platform that enables AI processing solutions for high-performance computing

at the network’s edge and in the data center. Blaize solutions deliver real-time insights and decision-making capabilities at low

power consumption, high efficiency, minimal size, and low cost. Blaize has raised over $330 million from strategic investors such as DENSO,

Mercedes-Benz AG, Magna, and Samsung and financial investors such as Franklin Templeton, Temasek, GGV, Bess Ventures, BurTech LP

LLC, Rizvi Traverse, and Ava Investors. Headquartered in El Dorado Hills (CA), Blaize has more than 200 employees worldwide with

teams in San Jose (CA), Cary (NC), and subsidiaries in Hyderabad (India), Leeds and Kings Langley (UK), and Abu Dhabi (UAE).

BurTech Acquisition Corporation Contact

Roman Livson

Chief Financial Officer

1300 Pennsylvania Avenue, Suite 700

Washington, DC 20006

investors@burtechacq.us

Blaize Media Contact

Leo Merle | Blaize, Inc.

leo.merle@blaize.com

Blaize Investor Contact

Mark Roberts

Blueshirt Capital Advisors

ir@Blaize.com

Cautionary Statement Regarding Forward Looking

Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of

the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are based on beliefs and assumptions and on

information currently available to BurTech and Blaize, including statements regarding Blaize’s business plans and growth strategies,

market opportunities, and financial prospects. In some cases, you can identify forward-looking statements by the following words: “may,”

“will,” “could,” “would,” “should,” “expect,” “intend,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “ongoing,” “target,” “seek” or the negative or plural of these words, or other

similar expressions that are predictions or indicate future events or prospects, although not all forward-looking statements contain these

words. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations

and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially

from the forward-looking statements in this document, including but not limited to: (i) the risk that the previously disclosed proposed

business combination (the “proposed transaction”) may not be completed in a timely manner or at all, which may adversely affect

the price of BurTech’s securities; (ii) the risk that the proposed transaction may not be completed by BurTech’s business

combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by BurTech; (iii)

the failure to satisfy the conditions to the consummation of the proposed transaction, including the approval of the proposed transaction

by BurTech’s stockholders, the satisfaction of the minimum aggregate transaction proceeds amount following redemptions by BurTech’s

public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the failure to obtain adequate financing to

complete the proposed transaction and to support the future working capital needs of Blaize and the combined company; (v) the effect of

the pendency of the proposed transaction on Blaize’s business relationships, performance, and business generally; (vi) risks that

the proposed transaction disrupts current plans of Blaize and potential difficulties in the retention of Blaize’s employees as a

result of the proposed transaction; (vii) the outcome of any legal proceedings that may be instituted against BurTech or Blaize related

to the merger agreement and the proposed transaction; (viii) changes to the proposed structure of the proposed transaction that may be

required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the proposed

transaction; (ix) the ability to maintain the listing of BurTech’s securities on Nasdaq; (x) the price of BurTech’s securities,

including volatility resulting from changes in the competitive and highly regulated industries in which Blaize operates, variations in

performance across competitors, changes in laws and regulations affecting Blaize’s business and changes in the combined capital

structure; (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction,

including the possibility of cost overruns or unanticipated expenses in development programs, and the ability to identify and realize

additional opportunities; (xii) the enforceability of Blaize’s intellectual property, including its patents, and the potential infringement

on the intellectual property rights of others, cyber security risks or potential breaches of data security; (xiii) the incurrence of significant

expenses to remediate, or damage to Blaize’s reputation as a result of, any defects in Blaize’s products; and (xiv) other

risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” in BurTech’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that

are available on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov and other documents filed,

or to be filed with the SEC by BurTech, including the Registration Statement. The foregoing list of factors is not exhaustive. There may

be additional risks that neither BurTech nor Blaize presently know or that BurTech or Blaize currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. You should carefully consider the foregoing

factors and the other risks and uncertainties that will be described in the definitive proxy statement to be filed by BurTech with the

SEC, including those under “Risk Factors” therein, and other documents filed by BurTech from time to time with the SEC. These

filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from

those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned

not to put undue reliance on forward-looking statements, and BurTech and Blaize assume no obligation and, except as required by law, do

not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

Neither BurTech nor Blaize gives any assurance that either BurTech or Blaize will achieve its expectations.

Additional Information and Where to Find It

In connection with the proposed transaction, BurTech

filed with the SEC the Registration Statement on Form S-4, and after the Registration Statement is declared effective, BurTech will mail

a definitive proxy statement/prospectus relating to the proposed transaction to its stockholders. This press release does not contain

all the information that should be considered concerning the proposed transaction and is not intended to form the basis of any investment

decision or any other decision in respect of the proposed transaction. BurTech may file other documents regarding the proposed transaction

with the SEC, and BurTech’s stockholders and other interested persons are advised to read, when available, the preliminary proxy

statement/prospectus and the amendments thereto, the definitive proxy statement/prospectus and the other documents filed in connection

with the proposed transaction, as these materials will contain important information about Blaize, BurTech and the proposed transaction.

When available, the definitive proxy statement/prospectus and other relevant materials for the proposed transaction will be mailed to

stockholders of BurTech as of a record date to be established for voting on the proposed transaction and the other matters to be voted

upon at a meeting of BurTech’s stockholders to be held to approve the proposed transaction and such other matters. Such stockholders

will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other

documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to

BurTech Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, Washington, DC 20006, Attention: Roman Livson, Chief Financial Officer.

Participants in Solicitation

BurTech, Blaize, and their respective directors,

executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation

of proxies from BurTech’s stockholders in connection with the proposed transaction. Information regarding the persons who may, under

SEC rules, be deemed participants in the solicitation of BurTech’s stockholders in connection with the proposed transaction, including

the names of such persons and a description of their respective interests, is set forth in BurTech’s Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information regarding the interests of those persons and other

persons who may be deemed participants in the proposed transaction may be obtained by reading the Registration Statement regarding the

proposed transaction when it becomes available. Stockholders will be able to obtain copies of the documents described in this paragraph

that are filed with the SEC, once available, without charge at the SEC’s website at www.sec.gov, or by directing a request to BurTech

Acquisition Corp., 1300 Pennsylvania Avenue, Suite 700, Washington, DC 20006, Attention: Roman Livson, Chief Financial Officer.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed transaction and does not

constitute an offer to sell or a solicitation of an offer to buy any securities of BurTech or Blaize, nor shall there be any sale of any

such securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act.

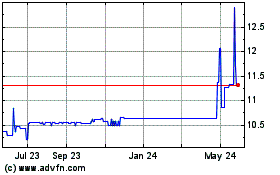

BurTech Acquisition (NASDAQ:BRKHU)

Historical Stock Chart

From Oct 2024 to Nov 2024

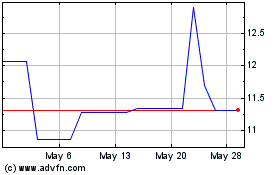

BurTech Acquisition (NASDAQ:BRKHU)

Historical Stock Chart

From Nov 2023 to Nov 2024