Amended Issuer Tender Offer Statement Filed Pursuant to Rule 13(e)(4) by Foreign Issuers (sc13e4f/a)

July 23 2019 - 8:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13E-4F

(Amendment No. 2)

(Rule

13e-102)

TENDER OFFER STATEMENT PURSUANT TO SECTION 13(e)(1) OF THE SECURITIES

EXCHANGE ACT OF 1934 AND RULE

13e-4

THEREUNDER

BRP Inc.

(Exact name of

Issuer as specified in its Charter)

Quebec, Canada

(Jurisdiction of Issuer’s Incorporation or Organization)

BRP Inc.

(Name(s) of

Person(s) Filing Statement)

Subordinate Voting Shares

(Title of Class of Securities)

05577W200

(CUSIP Number

of Class of Securities)

726 Saint-Joseph Street

Valcourt, Quebec

Canada,

J0E 2L0

(450)

532-6154

Attention: Martin Langelier

(Name, address and telephone number of person authorized to

receive notices and communications on behalf of the person(s) filing statement)

with a copy to:

|

|

|

|

|

Warren Katz

Aniko Pelland

Stikeman

Elliott LLP

1155

René-Lévesque

Blvd. West

Montreal, Quebec

Canada,

H3B 3V2

(514)

397-3000

|

|

Thomas Holden

Ropes & Gray LLP

Three Embarcadero Center

San Francisco, CA 94111

(415)

315-6300

|

June 13, 2019

(Date tender offer first published, sent or given to security holders)

CALCULATION OF FILING FEE:

|

|

|

|

|

Transaction Valuation

|

|

Amount of Filing Fee

|

|

US$226,124,971.73

(1)(2)

|

|

US$27,406.35

(1)(2)(3)

|

|

(1)

|

The fee has been calculated pursuant to the instructions for Schedule

13E-4F

as prescribed by Section 13(e)(3) of the Securities Exchange Act of 1934, as amended, based on a maximum aggregate purchase price of US$226,124,971.73.

|

|

(2)

|

Determined based on the proposed maximum aggregate purchase price in Canadian dollars of CDN$300,000,000.00

converted into U.S. dollars based on the average rate of exchange on June 10, 2019, as reported by the Bank of Canada, for the conversion of Canadian dollars into U.S. dollars of CDN$1.3267 equals U.S.$1.00.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $27,406.35

|

|

Registration No.:

005-90665

|

|

Filing Party: BRP Inc.

|

|

|

|

Form:

13E-4F

|

|

Date Filed: June 13, 2019

|

EXPLANATORY NOTE

This Amendment No. 2 (this “

Amendment No.

2

”) amends and supplements the Schedule

13E-4F

(as amended, the “

Schedule

13E-4F

”) filed with the Securities Exchange Commission on June 13, 2019 by BRP Inc. (the

“

Company

”), a company organized under the laws of Canada, in connection with the Company’s substantial issuer bid/tender offer (the “

SIB

”) pursuant to which the Company offered to purchase from shareholders for

cancellation up to CDN$300 million of its outstanding subordinate voting shares (“

Subordinate Voting Share

s”) at a purchase price that will allow it to purchase the maximum number of Subordinate Voting Shares properly tendered

to the SIB, and not properly withdrawn, having an aggregate purchase price not exceeding CDN$300 million, on and subject to the terms and conditions set forth in the Offer to Purchase and Circular dated June 13, 2019 and the accompanying

Letter of Transmittal.

The Schedule

13E-4F

is hereby amended and supplemented by adding the following:

|

|

•

|

|

The Company has taken up and purchased for cancellation 6,342,494 Subordinate Voting Shares at a purchase price

of CDN$47.30 per share, for a total cost of approximately CDN$300 million. The Subordinate Voting Shares purchased represented 6.6% of the Subordinate Voting Shares issued and outstanding on a

non-diluted

basis at the time that the SIB was announced. After giving effect to the SIB, 39,289,683 Subordinate Voting Shares will be issued and outstanding. The Company’s principal shareholders, Beaudier Inc., 4338618 Canada Inc. (together,

“

Beaudier Group

”) and Bain Capital Luxembourg Investments S.à r.l. (“

Bain Capital

”), made proportionate tenders, which maintained proportionate equity ownership in the Company of Beaudier Group at

approximately 29.0%, and of Bain Capital at approximately 22.1%, upon completion of the SIB.

|

|

|

•

|

|

Reference is hereby made to the press release issued by the Company on July 23, 2019, a copy of which is

attached hereto as Exhibit 99.11, and the material change report issued by the Company on July 23, 2019, a copy of which is attached hereto as Exhibit 99.12.

|

PART II

INFORMATION NOT REQUIRED TO BE SENT TO SHAREHOLDERS

The Issuer has filed the following as Exhibits to this Schedule:

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

99.11

|

|

Press release of BRP Inc., dated July 23, 2019

|

|

|

|

|

99.12

|

|

Material change report dated July 23, 2019

|

SIGNATURES

By signing this Schedule, the person filing the Schedule consents without power of revocation that any administrative subpoena may be served,

or any administrative proceeding, civil suit or civil action where the cause of action arises out of or relates to or concerns any offering made or purported to be made in connection with the filing on Schedule

13E-4F

or any purchases or sales of any security in connection therewith, may be commenced against it in any administrative tribunal or in any appropriate court in any place subject to the jurisdiction of any

state or of the United States by service of said subpoena or process upon the registrant’s designated agent.

After due inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date:

July 23, 2019

|

|

|

|

|

|

|

|

|

BRP INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Paule Morisset

|

|

|

|

|

|

Name: Paule Morisset

|

|

|

|

|

|

Title: Assistant Secretary

|

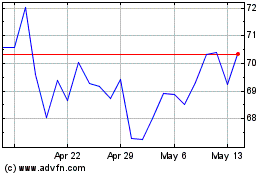

BRP (NASDAQ:DOOO)

Historical Stock Chart

From Jul 2024 to Aug 2024

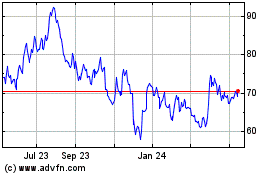

BRP (NASDAQ:DOOO)

Historical Stock Chart

From Aug 2023 to Aug 2024