Option Care and BioScrip Complete Merger to Form Option Care Health

August 07 2019 - 8:00AM

Business Wire

Largest Independent Home and Alternate Site

Infusion Provider Establishes the Standard of Care Across the

United States Through Its Clinical Leadership and

Technology-Enabled Patient-Centered Model

Option Care Enterprises, Inc. (“Option Care”) and BioScrip, Inc.

(“BioScrip”) today announced the successful completion of their

merger, which follows the satisfaction of the transaction’s closing

conditions, including approval by BioScrip shareholders and the

receipt of all necessary regulatory approvals.

The newly combined company, Option Care Health, Inc. (“Option

Care Health” or the “Company”), emerges as the largest independent

home and alternate site infusion services provider in the United

States. Option Care Health’s common stock will be listed on the

Nasdaq Global Select Market under the ticker symbol BIOS.

John Rademacher, Chief Executive Officer of Option Care Health,

said, “Today marks the beginning of an exciting new chapter as we

unite two strong organizations with proud histories as market

leaders. This combination enables us to reimagine the infusion care

experience to unleash the full potential of high-quality care in a

lower cost setting on a national scale. We are now the only

independent provider focused on delivering a full spectrum of

infusion therapies to patients across the country. Our deep

clinical expertise, broad therapy portfolio and enhanced financial

profile empower us to deliver superior outcomes and set the

standard for patient care.”

Option Care Health will continue to focus on:

- Patient-Centered Care Model, providing deeply

personalized care to patients in all 50 states, supported by the

broadest commercial and clinical coverage with our unique product

offering.

- Clinical and Market Leadership, leveraging our

best-in-class clinical team to consistently raise quality standards

and patient outcomes while collaborating with health systems,

payers and manufacturers to broaden our therapy portfolio and

clinical reach.

- Investing in People, Technology and Operations to drive

profitable growth, while setting the industry standard for infusion

services.

Daniel E. Greenleaf, former Chief Executive Officer of BioScrip,

commented, “I’m proud of the BioScrip team and the care that we

delivered every day to patients who trusted us to provide

extraordinary care. This new enterprise combines two independent

market leaders and enables the organization to truly redefine

infusion therapy in the alternate site setting. With a

significantly improved capital structure and financial profile, I’m

confident Option Care Health will continue to build upon the

momentum of BioScrip and Option Care.”

Option Care Health will be headquartered in Bannockburn,

Illinois and led by Rademacher as Chief Executive Officer and Mike

Shapiro as Chief Financial Officer. Harry Kraemer, former Chairman

and Chief Executive Officer of Baxter International Inc., will

serve as Chairman of the Board of Option Care Health.

Advisors

In connection with the transaction, Jefferies LLC and Moelis

& Company LLC acted as joint financial advisors to BioScrip,

and Gibson, Dunn & Crutcher LLP served as legal advisor.

Goldman Sachs & Co. LLC and BofA Merrill Lynch acted as

financial advisors and Kirkland & Ellis LLP acted as legal

advisor to Option Care.

Forward Looking Statements

This communication contains “forward-looking statements” (as

defined in the Private Securities Litigation Reform Act of 1995)

regarding, among other things, future events or the future

financial performance of Option Care Health. All statements other

than statements of historical facts are forward-looking statements.

In addition, words such as “anticipate,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or the negative of these words, and words and

terms of similar substance used in connection with any discussion

of future plans, actions or events identify forward-looking

statements. Forward-looking statements relating to Option Care

Health include, but are not limited to: statements about the

benefits of the combined company, including future financial and

operating results; expected synergies; the Company’s plans,

objectives, expectations and intentions; and other statements

relating to the merger that are not historical facts.

Forward-looking statements are based on information currently

available to BioScrip and Option Care and involve estimates,

expectations and projections. Investors are cautioned that all such

forward-looking statements are subject to risks and uncertainties

(both known and unknown), and many factors could cause actual

events or results to differ materially from those indicated by such

forward-looking statements. With respect to the combination of

BioScrip and Option Care, these factors could include, but are not

limited to: (i) the impact the significant debt incurred in

connection with the merger may have on the Company’s ability to

operate the combined business, (ii) risks relating to the

integration of the BioScrip and Option Care operations, solutions

and employees into the combined company and the possibility that

the anticipated synergies and other benefits of the combination,

including cost savings, will not be realized or will not be

realized within the expected timeframe, (iii) the Company’s status

as a “controlled company” within the meanings of NASDAQ, including

the Company’s reliance on exemptions from certain corporate

governance standards and the significantly less influence that

pre-merger holders now have on the Company, and (iv) risks relating

to the combined businesses and the industries in which the combined

company operates. These risks and uncertainties, as well as other

risks and uncertainties, are more fully discussed in Bioscrip’s

definitive proxy statement filed with the SEC on June 26, 2019 and

the Company’s subsequent filings with the SEC. While the lists of

risk factors presented here and in the Company’s public filings are

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties. Many

of these risks, uncertainties and assumptions are beyond Bio

Scrip’s and Option Care’ ability to control or predict. Because of

these risks, uncertainties and assumptions, you should not place

undue reliance on these forward-looking statements. Furthermore,

forward-looking statements speak only as of the information

currently available to the parties on the date they are made, and

neither BioScrip nor Option Care undertakes any obligation to

update publicly or revise any forward-looking statements to reflect

events or circumstances that may arise after the date of this

communication.

About Option Care Health

At Option Care Health, Inc. (Option Care Health) (NASDAQ: BIOS),

we are the largest independent home and alternate site infusion

services provider in the United States. With over 6,000 teammates

including 2,900 clinicians, we work compassionately to elevate

standards of care for patients with acute and chronic conditions in

all 50 states. Through our clinical leadership, expertise and

national scale, Option Care Health is reimagining the infusion care

experience for patients, customers and employees. To learn more,

please visit our website at www.OptionCareHealth.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190807005403/en/

For Media Inquiries: Rachel Bowen, PCI 312.558.1770

RBowen@pcipr.com For Investor Inquiries: Mike Shapiro, Chief

Financial Officer Option Care Health 312.940.2538

Investor.relations@optioncare.com

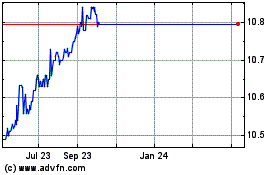

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Nov 2024 to Dec 2024

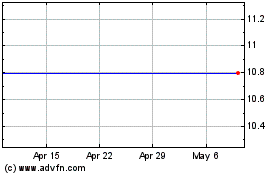

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Dec 2023 to Dec 2024