Beasley Broadcast Group, Inc. (Nasdaq: BBGI), a large- and mid-size

market radio broadcaster, today announced operating results for the

three- and nine-month periods ended September 30, 2005. For the

three months ended September 30, 2005, consolidated net revenue

rose 1% to $32.1 million from $31.8 million in the same period of

2004. Operating income for the period declined 7% to $7.9 million,

compared to $8.5 million in the third quarter of 2004. Station

Operating Income (SOI), a non-GAAP financial measure, rose 4% to

$11.2 million from $10.8 million in the year-ago period. Operating

income for all periods presented in this announcement includes $0.8

million of stock-based employee compensation as a result of

restricted stock grants during the third quarter of 2005 at both

the station and corporate level. SOI reflects $46,735 of

stock-based employee compensation related to restricted stock

grants during the third quarter of 2005 to employees at our radio

stations, but excludes stock-based employee compensation costs

during that period at the corporate level. Please refer to the

"Calculation of SOI" and "Reconciliation of SOI to Net Income"

tables at the end of this announcement for a break down of

stock-based employee compensation expense between the station and

corporate levels. Net income was $3.8 million, or $0.15 per diluted

share, in the three months ended September 30, 2005, compared to

net income of $4.1 million, or $0.17 per diluted share, in the

three months ended September 30, 2004. Per share results for the

three months ended September 30, 2005 and 2004 are based on

24,291,056 and 24,363,737 diluted shares outstanding, respectively.

For the nine months ended September 30, 2005, consolidated net

revenue increased 6% to $93.7 million from $88.8 million in the

same period of 2004. Operating income from continuing operations

was $20.2 million, compared to $21.3 million in the year-ago

period, while SOI grew 2% to $28.6 million from $28.1 million. The

Company reported net income of $9.2 million, or $0.38 per diluted

share, for the first nine months of 2005, compared to net income of

$8.1 million, or $0.33 per diluted share, in the comparable 2004

period. Net income for the first nine months of 2004 reflects a

$2.4 million loss on extinguishment of long-term debt. Per share

results for the nine months ended September 30, 2005 and 2004 are

based on 24,356,335 and 24,496,979 diluted shares outstanding,

respectively. Reported and same-station results were the same for

the periods presented above, as no station acquisitions or

dispositions were completed in the relevant periods. Commenting on

the results, George G. Beasley, Chairman and Chief Executive

Officer, said, "Third quarter revenue growth reflects improved

performance at our Philadelphia and Fort Myers-Naples station

clusters, partially offset by decreases at our Augusta, Las Vegas

and Miami station clusters. Net revenues for the period also

reflect a decrease in trade sales revenue due to a company-wide

effort to reduce the non-cash use of our station advertising

inventory." "We anticipate that many of the trends that affected

third quarter revenue performance will continue into the fourth

quarter. Early in the fourth quarter of 2005, we reformatted a

station in Las Vegas, which is not airing commercials during its

first month of operation. Revenue in the 2005 fourth quarter will

also reflect decreased revenues at our Miami cluster, where our

sport-talk station did not renew the program rights agreement to

broadcast the Miami Dolphins football games this year, as well as

the absence of $1.1 million in political advertising revenue.

"Despite these short-term operating challenges, we remain

optimistic about our long-term prospects. We believe that many of

the changes we are implementing in 2005 will make the company

stronger and more competitive in 2006, and we are looking forward

to reporting back on progress in the periods ahead." Fourth Quarter

Guidance For the three-month period ending December 31, 2005, the

Company anticipates reporting a net revenue decrease of 12%

compared to the year-ago level. This guidance assumes no material

changes in economic conditions or extraordinary world events. The

Company can give no assurance as to whether these conditions will

continue, or if they change, how such changes may affect the

Company's current expectations. While the Company may, from time to

time, issue updated guidance, it assumes no obligation to do so.

Conference Call Information: The Company will host a conference

call and simultaneous webcast today, November 3, 2005, at 10:00

a.m. EDT to discuss its financial results and operations. Both the

call and webcast are open to the general public. The dial in number

for the conference call is 973/409-9261; please call five minutes

in advance to ensure that you are connected prior to the

presentation. Interested parties may also access the live call on

the Internet at the Company's Web site at www.bbgi.com; allow 15

minutes to register and download and install any necessary

software. Following its completion, a replay of the call can be

accessed for 14 days on the Internet from the Company's Web site or

for 24 hours via telephone at 973/341-3080 (reservation #6573953).

Founded in 1961, Beasley Broadcast Group, Inc. is a radio

broadcasting company that owns or operates 41 stations (26 FM and

15 AM) located in ten large- and mid-size markets in the United

States. Definitions Same-station results compare stations operated

by our company at September 30, 2005 to those same-stations

operated by our company at September 30, 2004. Station Operating

Income (SOI) consists of net revenue less station operating

expenses. We define station operating expenses as costs of services

(excluding depreciation and amortization) and selling, general and

administrative expenses (including stock-based employee

compensation related to restricted stock grants to employees at our

radio stations, but excluding stock-based employee compensation

costs at the corporate level). SOI and same-station SOI are

financial measures of performance that are not calculated in

accordance with U.S. generally accepted accounting principles,

which we refer to as GAAP. We use these non-GAAP financial measures

for internal budgeting purposes and to evaluate the performance of

our radio stations. We also use SOI to make decisions as to the

acquisition and disposition of radio stations. SOI excludes

corporate-level costs and expenses, stock-based employee

compensation related to stock grants to corporate employees, and

depreciation and amortization, which may be material to an

assessment of the Company's overall operating performance.

Management compensates for this limitation by separately

considering the impact of these excluded items to the extent they

are material to operating decisions or assessments of the Company's

operating performance. Moreover, the corresponding amounts of the

non-cash and corporate-level costs and expenses excluded from the

calculation are available to investors as they are presented as

separate line items on our statements of operations contained in

our periodic reports filed with the Securities and Exchange

Commission (SEC). While the Company recognizes that because SOI is

not calculated in accordance with GAAP, it is not necessarily

comparable to similarly titled measures employed by other

companies, SOI is a measure widely used in the radio broadcast

industry. Management believes that SOI provides meaningful

information to investors because it is an important measure of how

effectively we operate our business (i.e., operate radio stations)

and assists investors in comparing our operating performance with

that of other radio companies. We also believe that providing SOI

on a same station basis is a useful measure of our performance

because it presents SOI before the impact of any acquisitions or

dispositions completed during the relevant periods. This allows

management and investors to measure the performance of radio

stations we owned and operated during the entirety of two operating

periods being compared. Note Regarding Forward-Looking Statements:

Statements in this release that are "forward-looking statements"

are based upon current expectations and assumptions, and involve

certain risks and uncertainties within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. Words or

expressions such as "intends," "expects," "expected," "anticipates"

or variations of such words and similar expressions are intended to

identify such forward-looking statements. Key risks are described

in the Company's reports filed with the SEC. Readers should note

that these statements are subject to change and to inherent risks

and uncertainties and may be impacted by several factors,

including: economic and regulatory changes, the loss of key

personnel, a downturn in the performance of our radio stations, the

Company's substantial debt levels, and changes in the radio

broadcast industry generally. The Company's actual performance and

results could differ materially because of these factors and other

factors discussed in the "Management's Discussion and Analysis of

Results of Operations and Financial Condition" of our SEC filings,

including but not limited to annual reports on Form 10-K or

quarterly reports on Form 10-Q, copies of which can be obtained

from the SEC, www.sec.gov, or our website, www.bbgi.com. These

statements do not include the potential impact of any acquisitions

or dispositions announced or completed after November 3, 2005. All

information in this release is as of November 3, 2005, and the

Company undertakes no obligation to update the information

contained herein to actual results or changes to the Company's

expectations. -0- *T BEASLEY BROADCAST GROUP, INC. Consolidated

Statements of Operations (unaudited) Three Months Ended Nine Months

Ended September 30, September 30, 2005 2004 2005 2004 ------------

------------ ------------ ------------ Net revenue $32,051,349

$31,771,720 $93,699,011 $88,799,482 ------------ ------------

------------ ------------ Costs and expenses: Cost of services

(excluding depreciation and amortization) (1) 9,995,258 9,992,362

30,729,669 28,940,458 Selling, general and administrative

(excluding stock-based employee compensation) (1) 10,853,577

11,029,209 34,323,178 31,793,317 Corporate general and

administrative (excluding stock-based employee compensation)

1,810,095 1,538,538 5,277,128 4,636,491 Stock-based employee

compensation(2) 807,137 - 807,137 - Depreciation and amortization

705,351 725,994 2,171,465 2,133,345 Asset purchase agreement

termination costs - - 141,449 - ------------ ------------

------------ ------------ Total costs and expenses 24,171,418

23,286,103 73,450,026 67,503,611 Operating income 7,879,931

8,485,617 20,248,985 21,295,871 Interest expense (1,779,972)

(1,779,535) (5,564,008) (5,604,167) Loss on extinguishment of

long-term debt(3) - - - (2,418,781) Gain on increase in fair value

of derivative Financial instruments - 23,382 - 175,331 Interest

income 122,217 96,395 376,657 275,779 Other non-operating income

(expense) (413) (2,109) 125,897 (62,179) ------------ ------------

------------ ------------ Income before income taxes 6,221,763

6,823,750 15,187,531 13,661,854 Income tax expense 2,463,818

2,722,479 6,014,262 5,544,481 ------------ ------------

------------ ------------ Net income $3,757,945 $4,101,271

$9,173,269 $8,117,373 ============ ============ ============

============ Basic net income per share: 0.16 0.17 0.38 0.33

Diluted net income per share: 0.15 0.17 0.38 0.33 Basic common

shares outstanding 24,199,515 24,263,608 24,223,549 24,272,107

============ ============ ============ ============ Diluted common

shares outstanding 24,291,056 24,363,737 24,356,335 24,496,979

============ ============ ============ ============ (1) We refer to

our "Cost of services (excluding depreciation and amortization),"

"Selling, general and administrative" and "stock-based employee

compensation related to restricted stock grants to employees at our

radio stations" together as our "station operating expenses" for

the "Calculation of SOI" and "Reconciliation of SOI to Net Income"

below. (2) On July 1, 2005, we granted 267,500 shares of restricted

stock to certain employees under our 2000 Equity Plan and recorded

stock-based employee compensation related to these grants. Of this

amount, $46,735 is attributable to grants at the radio station

level, while $760,402 is attributable to grants at the corporate

level. (3) In the 2004 first quarter, we incurred a loss on

extinguishment of debt of $2.4 million to write-off debt issuance

costs related to the old credit facility and certain fees related

to the establishment of a new credit facility. Selected Balance

Sheet Data - Unaudited (in thousands) ------------- -------------

September 30, December 31, ------------- ------------- 2005 2004

------------- ------------- Cash and cash equivalents $15,753

$14,850 Working capital 27,426 26,580 Total assets 285,783 286,300

Long term debt, less current installments 140,737 153,362 Total

stockholders' equity 88,780 81,075 Selected Statement of Cash Flows

Data - Unaudited (in thousands) ---------------------------- Nine

Months Ended September 30, ---------------------------- 2005 2004

-------------- ------------- Net cash provided by operating

activities $14,049 $16,425 Net cash used in investing activities

(1,199) (3,066) Net cash used in financing activities (11,948)

(10,682) -------------- ------------- Net increase in cash and cash

equivalents $902 $2,677 ============== ============= Calculation of

SOI (Unaudited): -------------------------------

------------------------- ------------------------- Three Months

Ended Nine Months Ended September 30, September 30,

------------------------- ------------------------- 2005 2004 2005

2004 ------------ ------------ ------------ ------------ Net

revenue $32,051,349 $31,771,720 $93,699,011 $88,799,482 Station

operating expenses (20,848,835) (21,021,571) (65,052,847)

(60,733,775) Station stock-based employee compensation (46,735) -

(46,735) - ------------ ------------ ------------ ------------ SOI

$11,155,779 $10,750,149 $28,599,429 $28,065,707 ============

============ ============ ============ Reconciliation of SOI to Net

Income (Unaudited):

------------------------------------------------

-------------------------- ------------------------ Three Months

Ended Nine Months Ended September 30, September 30,

-------------------------- ------------------------ 2005 2004 2005

2004 ------------- ------------ ------------ ----------- SOI

$11,155,779 $10,750,149 $28,599,429 $28,065,707 Corporate general

and administrative (1,810,095) (1,538,538) (5,277,128) (4,636,491)

Corporate stock- based employee compensation (760,402) - (760,402)

- Depreciation and amortization (705,351) (725,994) (2,171,465)

(2,133,345) Asset purchase agreement termination costs - -

(141,449) - Interest expense (1,779,972) (1,779,535) (5,564,008)

(5,604,167) Loss on extinguishment of long-term debt - - -

(2,418,781) Gain on increase in fair value of derivative financial

instruments - 23,382 - 175,331 Interest income 122,217 96,395

376,657 275,779 Other non-operating income (expense) (413) (2,109)

125,897 (62,179) Income tax expense (2,463,818) (2,722,479)

(6,014,262) (5,544,481) ------------ ------------ ------------

------------ Net income $3,757,945 $4,101,271 $9,173,269 $8,117,373

============ ============ ============ ============ *T

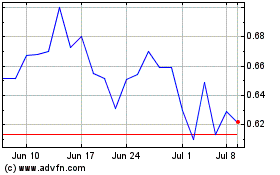

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

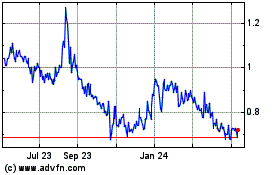

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Jul 2023 to Jul 2024