Beasley Broadcast Group, Inc. (Nasdaq: BBGI), a large- and mid-size

market radio broadcaster, today announced operating results for the

three-month period ended March 31, 2005 in line with previously

issued guidance on April 14, 2005. For the three months ended March

31, 2005, consolidated net revenue increased 10% to $28.6 million

from $26.1 million in the same period of 2004. Operating income for

the period decreased 12% to $4.1 million from $4.7 million in the

first quarter of 2004, while Station Operating Income (SOI) fell 7%

to $6.6 million in the first quarter of 2005 from $7.1 million in

the year-ago period. Operating results reflect a 16% increase in

station operating expenses, which includes approximately $1.4

million of non-recurring employee separation costs, as well as

higher programming and promotional expenses. Station operating

expenses consist of cost of services (excluding depreciation and

amortization) and selling, general and administrative expenses. Net

income for the period ended March 31, 2005 rose to $1.6 million, or

$0.7 per diluted share, from $0.2 million, or $0.01 per diluted

share, in the comparable year-ago period. Net income for the 2004

period reflects a $2.4 million loss on extinguishment of long-term

debt. Per share results for the first quarters of 2005 and 2004 are

based on 24,551,108 and 24,773,845 shares outstanding on a fully

diluted basis, respectively. Commenting on the results, George G.

Beasley, Chairman and Chief Executive Officer, said, "As noted in

our preview of first quarter results, consolidated net revenue

growth during the first quarter was consistently strong in each

month of the period. The increase reflects improved performances at

seven of our ten market clusters, including continued gains at our

Philadelphia, Las Vegas and Ft. Myers clusters. Excluding the

non-recurring employee separation cost, station operating expenses

increased approximately 9%, reflecting our continued investment in

station programming and promotions, which we believe makes our

clusters more competitive." "We also continued to invest in HD

Radio(TM) technology during the period. By the end of 2005, we

expect to have at least 50 percent of our stations broadcasting

with this technology. We believe HD Radio's higher fidelity, its

ability to multi-cast several programs at once, and its ability to

provide listeners with a richer entertainment experience through

music, traffic or weather data will provide an attractive return on

this investment in the years to come." Second Quarter Guidance For

the three-month period ending June 30, 2005, the Company

anticipates reporting a net revenue increase of up to 5% over

year-ago levels, reflecting continued strength at its Philadelphia

market cluster. This guidance is based on the economic and market

conditions as of May 2, 2005, and assumes no material changes in

economic conditions or other major world events. The Company can

give no assurance as to whether these conditions will continue, or

if they change, how such changes may affect the Company's current

expectations. While the Company may, from time to time, issue

updated guidance, it assumes no obligation to do so. Conference

Call Information The Company will host a conference call and

simultaneous webcast today, May 2, 2005, at 10:00 a.m. EDT to

discuss its financial results and operations. Both the call and

webcast are open to the general public. The dial in number for the

conference call is 973-409-9261; please call five minutes in

advance to ensure that you are connected prior to the presentation.

Following its completion, a replay of the call can be accessed for

14 days on the Internet from the Company's Web site (www.bbgi.com)

or for 24 hours via telephone at 973/341-3080 (reservation

#5957910). About Beasley Broadcast Group Founded in 1961, Beasley

Broadcast Group, Inc. is a radio broadcasting company that owns or

operates 41 stations (26 FM and 15 AM) located in ten large- and

mid-size markets in the United States. Definitions Same-station

results compare stations operated by our company at March 31, 2005

to those same-stations operated by our company at March 31, 2004.

Station Operating Income (SOI) consists of net revenue less station

operating expenses. We define station operating expenses as costs

of services (excluding depreciation and amortization) and selling,

general and administrative expenses. SOI and same-station SOI are

financial measures of performance that are not calculated in

accordance with U.S. generally accepted accounting principles. We

use these non-GAAP financial measures for internal budgeting

purposes and to evaluate the performance of our radio stations.

Management uses SOI to evaluate the operating performance of our

radio stations because SOI enables management to measure the

performance of our radio stations before non-cash expenses for

depreciation and amortization and general and administrative costs

and expenses related to our corporate and capital structure.

Management also uses SOI to make decisions as to the acquisition

and disposition of radio stations. SOI excludes recurring non-cash

and corporate-level costs and expenses, which may also be material

to an assessment of the Company's overall operating performance.

Management compensates for this limitation by separately

considering the impact of these excluded items to the extent they

are material to operating decisions or assessments of the Company's

operating performance. Moreover, the corresponding amounts of the

non-cash and corporate-level costs and expenses excluded from the

calculation are available to investors as they are presented as

separate line items on our statements of operations contained in

our periodic reports filed with the SEC. While the Company

recognizes that because SOI is not calculated in accordance with

U.S. generally accepted accounting principles, it is not

necessarily comparable to similarly titled measures employed by

other companies, SOI is a measure widely used in the radio

broadcast industry. Management believes that SOI provides

meaningful information to investors because it is an important

measure of how effectively we operate our business (i.e., operate

radio stations) and assists investors in comparing our operating

performance with that of other radio companies. We also believe

that providing SOI on a same station basis is a useful measure of

our performance because it presents SOI before the impact of any

acquisitions or dispositions completed during the relevant periods.

This allows management and investors to measure the performance of

radio stations we owned and operated during the entirety of two

operating periods being compared. Note Regarding Forward-Looking

Statements: Statements in this release that are "forward-looking

statements" are based upon current expectations and assumptions,

and involve certain risks and uncertainties within the meaning of

the U.S. Private Securities Litigation Reform Act of 1995. Words or

expressions such as "intends", "expects," "expected," "anticipates"

or variations of such words and similar expressions are intended to

identify such forward-looking statements. Key risks are described

in the Company's reports filed with the Securities and Exchange

Commission (SEC). Readers should note that these statements are

subject to change and to inherent risks and uncertainties and may

be impacted by several factors, including: economic and regulatory

changes, the loss of key personnel, a downturn in the performance

of our large-market radio stations, the Company's substantial debt

levels, and changes in the radio broadcast industry generally. The

Company's actual performance and results could differ materially

because of these factors and other factors discussed in the

"Management's Discussion and Analysis of Results of Operations and

Financial Condition" of our SEC filings, including but not limited

to annual reports on Form 10-K or quarterly reports on Form 10-Q,

copies of which can be obtained from the SEC, www.sec.gov, or our

website, www.bbgi.com. These statements do not include the

potential impact of any acquisitions or dispositions announced or

completed after May 2, 2005. All information in this release is as

of May 2, 2005, and the Company undertakes no obligation to update

the information contained herein to actual results or changes to

the Company's expectations. -0- *T BEASLEY BROADCAST GROUP, INC.

Consolidated Statements of Operations (unaudited) Three Months

Ended March 31, 2005 2004 ------------ ------------ Net revenue

$28,636,183 $26,068,618 ------------ ------------ Costs and

expenses: Cost of services (excluding depreciation and

amortization) 9,849,947 8,923,760 Selling, general and

administrative 12,174,373 10,039,239 Corporate general and

administrative 1,632,218 1,562,610 Depreciation and amortization

846,588 822,826 ------------ ------------ Total costs and expenses

24,503,126 21,348,435 Operating income 4,133,057 4,720,183 Interest

expense (1,758,895) (1,964,500) Loss on extinguishment of long-term

debt (1) -- (2,418,781) Gain on increase in fair value of

derivative financial instruments -- 39,113 Interest income 124,654

88,856 Other non-operating income (expense) 200,289 (60,070)

------------ ------------ Income before income taxes 2,699,105

404,801 Income tax expense 1,071,545 161,920 ------------

------------ Net income $1,627,560 $242,881 ============

============ Basic and diluted net income per share $0.07 $0.01

============ ============ Basic common shares outstanding

24,234,975 24,275,700 ============ ============ Diluted common

shares outstanding 24,551,108 24,773,845 ============ ============

(1) In the 2004 first quarter, Beasley incurred a loss on

extinguishment of debt of $2.4 million to write-off debt issuance

costs related to the old credit facility and certain fees related

to establish a new credit facility. Selected Balance Sheet Data

(Unaudited) (in thousands) -------------------------- March 31,

December 31, 2005 2004 ------------ ------------ Cash and cash

equivalents $17,149 $14,850 Working capital 25,012 26,580 Total

assets 286,337 286,300 Long term debt, less current installments

148,487 153,362 Total stockholders' equity 82,103 81,075 Selected

Statement of Cash Flows Data (Unaudited) (in thousands)

-------------------------- Three Months Ended March 31,

-------------------------- 2005 2004 ------------ ------------ Net

cash provided by operating activities $5,057 $7,649 Net cash

provided by (used in) investing activities 216 (1,029) Net cash

used in financing activities (2,975) (4,284) Net increase in cash

and cash equivalents 2,298 2,336 Calculation of SOI (Unaudited):

------------------------------- -------------------------- Three

Months Ended March 31, -------------------------- 2005 2004

------------ ------------ Net revenue $28,636,183 $26,068,618

Station operating expenses (22,024,320) (18,962,999) ------------

------------ SOI $6,611,863 $7,105,619 ============ ============

Reconciliation of SOI to Net Income (Unaudited):

------------------------------------------------

-------------------------- Three Months Ended March 31,

-------------------------- 2005 2004 ------------ ------------ SOI

$6,611,863 $7,105,619 Corporate general and administrative

(1,632,218)) (1,562,610) Depreciation and amortization (846,588)

(822,826) Interest expense (1,758,895) (1,964,500) Loss on

extinguishment of long-term debt -- (2,418,781) Gain on increase in

fair value of derivative financial instruments -- 39,113 Interest

income 124,654 88,856 Other non-operating income (expense) 200,289

(60,070) Income tax expense (1,071,545) (161,920) ------------

------------ Net income $1,627,560 $242,881 ============

============ *T

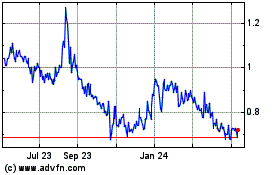

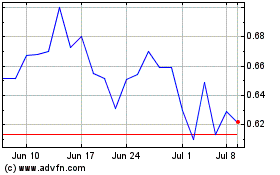

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Beasley Broadcast (NASDAQ:BBGI)

Historical Stock Chart

From Jul 2023 to Jul 2024