Bank of the James Financial Group, Inc. (the “Company”)

(NASDAQ:BOTJ), the parent company of Bank of the James, a

full-service commercial and retail bank serving Region 2000

(Greater Lynchburg MSA), and the Charlottesville, Harrisonburg,

Roanoke, Blacksburg, and Lexington, Virginia markets, today

announced unaudited results for the three months and nine months

ended September 30, 2019.

Net income for the three months ended September

30, 2019 was $1.47 million or $0.34 per diluted share, compared

with $1.40 million or $0.32 per diluted share for the three months

ended September 30, 2018. Net income for the nine months ended

September 30, 2019 was $4.09 million or $0.93 per diluted share,

compared with $3.83 million or $0.87 per diluted share for the nine

months ended September 30, 2018.

Robert R. Chapman III, President and CEO, commented: “Our

Company continued to generate steady earnings growth, driven by a

diverse range of products and services and increased production and

productivity from the expanded size and scope of our organization.

In the third quarter of 2019, commercial and retail banking

performed well, with a particularly strong quarter in residential

mortgage originations. Our ability to generate consistent growth in

mortgage originations throughout the franchise has been an ongoing

highlight for the Company, contributing significantly to

noninterest income growth.

“Commercial lending has been steadily increasing as we continue

to develop activity in our Charlottesville, Roanoke, Harrisonburg

and most recently Lexington, Virginia, markets. This has

complemented strong performance in the Region 2000 market. Credit

quality has been excellent, with a low provision for loan losses

that has supported quality earnings.

“We established a Lexington office several months ago, and

expect to open a new office in Rustburg, Virginia this fall, which

we anticipate will support banking activity, and particularly

deposit-gathering in Campbell County. We are pleased that even

while making investments in personnel and infrastructure to reach a

broader customer base, the Company’s value to shareholders has

consistently grown.”

Highlights

- Loans, net of the allowance for loan losses, were a

Company-record $551.01 million at September 30, 2019, increasing by

approximately $21 million during the first nine months of 2019 from

$530.02 million at December 31, 2018.

- Commercial loan growth was highlighted by expanded commercial

real estate (CRE) lending throughout the Company’s served markets.

Non-owner occupied CRE loans were $177.95 million at September 30,

2019, up 7.8% compared with a year earlier.

- Total interest income primarily reflected year-over-year

commercial loan growth. In the third quarter of 2019, total

interest income was $7.60 million compared with $6.98 million in

the third quarter of 2018. For the nine months of 2019, total

interest income rose to $22.22 million from $19.86 million.

- Income from gains on sales of residential mortgages to the

secondary market and fees from corporate treasury services have

generated increased total noninterest income throughout the year.

Noninterest income in the third quarter of 2019 was $2.16 million

compared with $1.32 million in the three months of 2018. In the

nine months of 2019 noninterest income increased to $5.04 million,

compared with $3.95 million in the nine months of 2018.

- Reflecting the Company’s emphasis on growing its deposit base,

total deposits rose to $633.03 million at September 30, 2019,

compared with $612.04 million at December 31, 2018. Core deposits

(noninterest-bearing demand, NOW, savings and money market

accounts) comprised approximately 70% of the Company’s total

deposits.

- Total assets rose to a Company-record $708.11 million at

September 30, 2019, with consistently high asset quality.

- New full-service facilities are now open in Charlottesville and

Roanoke, as the Company recently established its second

full-service branches in both markets. The Company has opened an

office in Lexington, and plans to open an office in Rustburg,

Virginia in the fall of 2019.

- Expansion and growth have generated value. Total stockholders’

equity increased to $61.04 million at September 30, 2019, compared

to $55.14 million at December 31, 2018. Tangible book value per

share rose to $13.94, compared to $12.59 at December 31, 2018 and

$12.13 at September 30, 2018.

- Based on the results achieved in the third quarter of 2019, on

October 15, 2019 the Company’s board of directors approved a $0.06

per share dividend payable to stockholders of record on November

29, 2019, to be paid on December 13, 2019.

Third Quarter, Nine Months of 2019 Operational

Review

Total interest income was $7.60 million in the third quarter of

2019, up from $6.98 million a year earlier, reflecting loan growth

and adjustable rate loans that repriced to reflect prevailing

interest rates. Income from lending represented more than 90% of

total interest income. Interest expense rose year-over-year,

primarily reflecting a larger deposit base and rate increases in

demand and time deposits.

Net interest income after provision for loan losses was $6.06

million for the three months ended September 30, 2019, compared

with $5.80 million for the same period a year earlier. Commercial

lending growth and modest loan yield increases contributed to the

net interest margin of 3.75% in the third quarter of 2019 and an

interest spread of 3.64%.

For the nine months of 2019, total interest income rose nearly

12% to $22.22 million at September 30, 2019 from $19.86 million

from at September 30, 2018. Total interest expense increased

year-over-year, reflecting a larger deposit base and modest rate

increases on interest-bearing deposits. In the third quarter of

2019, net interest income was $6.17 million compared with $5.99

million in the third quarter of 2018. For the nine months of 2019,

net interest income was $18.45 million, up 8% from $17.12 million

for the nine months of 2018. The net interest margin was 3.83% for

the nine months ended September 30, 2019 and the interest spread

was 3.67%.

J. Todd Scruggs, Executive Vice President and CFO, commented:

“We maintained our margin and spread throughout 2019, even as

interest paid on deposits increased. We also experienced some

downward pressure on loan yields tied to the prime interest rate as

the Federal Reserve lowered rates, and we anticipate that increased

cost of liabilities may put further pressure on margins in the

fourth quarter. We continue to exercise discipline in the rates we

pay on deposits, which enables the Company to minimize costlier

borrowings.”

Noninterest income, including gains from the sale of residential

mortgages to the secondary market, revenue contributions from BOTJ

Investment Services, and fee income from the Bank’s line of

treasury management services for commercial customers was $2.16

million in the third quarter of 2019 compared with $1.32 million in

the third quarter of 2018. Gains on sales of loans grew

primarily due to increased presence in Roanoke and Blacksburg and

was also bolstered by the favorable interest rate environment.

In the third quarter of 2019, gains on sale of loans held for

sale was $1.34 million compared with $767,000 in the third quarter

of 2018. In the nine months of 2019, noninterest income rose to

$5.04 million compared with $3.95 million in the nine months of

2018.

Noninterest expense for the three and nine months ended

September 30, 2019 increased, primarily reflecting increased

personnel, marketing, and equipment costs related to market

expansion as well as credit expenses associated with origination of

residential mortgage loans.

In the third quarter of 2019, Return on Average Assets (ROAA)

was 0.83% and Return on Average Equity (ROAE) was 9.84%. In the

nine months of 2019, ROAA was 0.79% and ROAE was 9.36%. The

Company’s efficiency ratio was higher in both periods compared to a

year earlier, primarily reflecting the addition of personnel and

facilities and an increase in variable compensation related to

increased production in the mortgage and investment divisions.

Balance Sheet Review: Steady Loan and Deposit Growth,

Asset Quality

Total assets increased to a Company-record $708.11 million at

September 30, 2019, highlighted by loans, net of allowance, of

$551.01 million, up from $530.02 million at December 31, 2018 and

$524.10 million at September 30, 2018. Reflecting strong

residential mortgage originations, loans held-for-sale at September

30, 2019 were $5.63 million compared with $1.67 million at December

31, 2018 and $2.53 million at September 30, 2018. Fair value of

securities available-for-sale was $54.40 million at September 30,

2019 compared to $52.73 million at December 31, 2018.

The loan portfolio continued to provide balanced performance and

year-over-year growth. Although the overall loan portfolio

was slightly down from the end of the second quarter ended June 30,

2019, the decrease was expected due to pay-downs associated with

the completion of commercial construction projects.

Commercial lending has led the Company’s loan growth through the

first nine months of 2019. Non-owner occupied commercial real

estate (primarily commercial and investment property), was $177.95

million at September 30, 2019 compared with $165.01 million a year

earlier. Owner-occupied commercial real estate was $106.26 million

at September 30, 2019, up from $103.65 million at September 30,

2018.

“We continue to build momentum in commercial lending throughout

our served markets, and, importantly, have maintained strong asset

quality as we have grown,” explained Michael A. Syrek, Executive

Vice President and Chief Loan Officer. “Our focus continues to be

on establishing and maintaining long-lasting partnerships with

clients. We are providing the loan, deposit and electronic treasury

products to meet a wide range of our clients’ financial needs, and

we have the flexibility to quickly respond to their ongoing

requirements.”

Total deposits at September 30, 2019 were $633.03 million, up

from $612.04 million at December 31, 2018, led by expanded core

deposits, which comprised 70% of total deposits. Interest-bearing

demand deposits were $350.89 million at September 30, 2019 compared

with $331.30 million at December 31, 2018. Noninterest bearing

demand deposits were $90.43 million at September 30, 2019 compared

with $91.36 million at December 31, 2018.

Asset quality remained strong, with a ratio of nonperforming

loans to total loans of 0.32% at September 30, 2019, compared to

0.55% at December 31, 2018. The allowance for loan losses to total

loans was 0.86% at September 30, 2019 compared with 0.86% at

December 31, 2018. Lower levels of nonperforming loans contributed

to a 270% ratio of allowance for loan losses to nonperforming loans

compared with 156% at December 31, 2018.

Chapman noted: “We believe our longstanding trend of maintaining

strong asset quality while consistently growing commercial loans

and originating quality residential mortgage loans makes a strong

statement about the credit policies and procedures in place. It

also speaks to the strong judgment of our people involved in

determining creditworthiness, and their commitment to analyzing

every borrower and situation. Prudent lending and disciplined

credit analysis has greatly contributed to the quality of our

earnings.”

As noted in the highlights, total stockholders’ equity and

tangible book value per share increased at September 30, 2019 as

compared to the prior year end. Retained earnings increased to

$19.82 million at September 30, 2019 from $16.52 million at

December 31, 2018. The Bank's regulatory capital ratios continued

to exceed accepted regulatory standards for a well-capitalized

institution.

About the Company

Bank of the James, a wholly owned subsidiary of Bank of the

James Financial Group, Inc. opened for business in July 1999 and is

headquartered in Lynchburg, Virginia. The bank currently services

customers in Virginia from offices located in Altavista, Amherst,

Appomattox, Bedford, Blacksburg, Charlottesville, Forest,

Harrisonburg, Lexington, Lynchburg, Madison Heights, and Roanoke.

The bank offers full investment and insurance services through its

BOTJ Investment Services division and BOTJ Insurance, Inc.

subsidiary. The bank provides mortgage loan origination

through Bank of the James Mortgage, a division of Bank of the

James. Bank of the James Financial Group, Inc. common stock is

listed under the symbol “BOTJ” on the NASDAQ Stock Market,

LLC. Additional information on the Company is available at

www.bankofthejames.bank.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains statements that constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. The words "believe,"

"estimate," "expect," "intend," "anticipate," "plan" and similar

expressions and variations thereof identify certain of such

forward-looking statements which speak only as of the dates on

which they were made. Bank of the James Financial Group, Inc. (the

"Company") undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise. Readers are cautioned

that any such forward-looking statements are not guarantees of

future performance and involve risks and uncertainties, and that

actual results may differ materially from those indicated in the

forward-looking statements as a result of various factors. Such

factors include, but are not limited to, competition, general

economic conditions, potential changes in interest rates, and

changes in the value of real estate securing loans made by Bank of

the James (the "Bank"), a subsidiary of the Company. Additional

information concerning factors that could cause actual results to

materially differ from those in the forward-looking statements is

contained in the Company's filings with the Securities and Exchange

Commission and previously filed by the Bank (as predecessor of the

Company) with the Federal Reserve Board.

CONTACT: J. Todd Scruggs, Executive Vice President and Chief

Financial Officer (434) 846-2000.tscruggs@bankofthejames.com

FINANCIAL STATEMENTS FOLLOW

Bank of the James Financial Group, Inc. and

SubsidiariesDollar amounts in thousands, except

per share dataUnaudited

|

Selected Data: |

ThreemonthsendingSep

30,2019 |

ThreemonthsendingSep

30,2018 |

Change |

YeartodateSep

30,2019 |

YeartodateSep

30,2018 |

Change |

|

Interest income |

$ |

7,596 |

$ |

6,980 |

|

8.83% |

|

$ |

22,220 |

$ |

19,860 |

|

11.88% |

|

|

Interest expense |

|

1,431 |

|

990 |

|

44.55% |

|

|

3,773 |

|

2,736 |

|

37.90% |

|

|

Net interest income |

|

6,165 |

|

5,990 |

|

2.92% |

|

|

18,447 |

|

17,124 |

|

7.73% |

|

|

Provision for loan losses |

|

108 |

|

190 |

|

-43.16% |

|

|

434 |

|

527 |

|

-17.65% |

|

|

Noninterest income |

|

2,161 |

|

1,319 |

|

63.84% |

|

|

5,039 |

|

3,946 |

|

27.70% |

|

|

Noninterest expense |

|

6,373 |

|

5,364 |

|

18.81% |

|

|

17,947 |

|

15,767 |

|

13.83% |

|

|

Income taxes |

|

371 |

|

351 |

|

5.70% |

|

|

1,020 |

|

949 |

|

7.48% |

|

|

Net income |

|

1,474 |

|

1,404 |

|

4.99% |

|

|

4,085 |

|

3,827 |

|

6.74% |

|

|

Weighted average shares outstanding - basic |

|

4,378,436 |

|

4,378,436 |

|

- |

|

|

4,378,436 |

|

4,378,436 |

|

- |

|

|

Weighted average shares outstanding - diluted |

|

4,385,331 |

|

4,378,436 |

|

6,895 |

|

|

4,383,128 |

|

4,378,466 |

|

4,662 |

|

|

Basic net income per share |

$ |

0.34 |

$ |

0.32 |

$ |

0.02 |

|

$ |

0.93 |

$ |

0.87 |

$ |

0.06 |

|

|

Fully diluted net income per share |

$ |

0.34 |

$ |

0.32 |

$ |

0.02 |

|

$ |

0.93 |

$ |

0.87 |

$ |

0.06 |

|

|

Balance Sheet atperiod end: |

Sep 30,2019 |

Dec 31,2018 |

Change |

Sep 30,2018 |

Dec 31,2017 |

Change |

|

Loans, net |

$ |

551,005 |

$ |

530,016 |

|

3.96% |

|

$ |

524,104 |

$ |

491,022 |

|

6.74% |

|

|

Loans held for sale |

|

5,630 |

|

1,670 |

|

237.13% |

|

|

2,529 |

|

2,626 |

|

-3.69% |

|

|

Total securities |

|

58,090 |

|

56,427 |

|

2.95% |

|

|

56,036 |

|

61,025 |

|

-8.18% |

|

|

Total deposits |

|

633,033 |

|

612,043 |

|

3.43% |

|

|

607,447 |

|

567,493 |

|

7.04% |

|

|

Stockholders' equity |

|

61,039 |

|

55,143 |

|

10.69% |

|

|

53,117 |

|

51,665 |

|

2.81% |

|

|

Total assets |

|

708,114 |

|

674,897 |

|

4.92% |

|

|

668,438 |

|

626,341 |

|

6.72% |

|

|

Shares outstanding |

|

4,378,436 |

|

4,378,436 |

|

- |

|

|

4,378,436 |

|

4,378,436 |

|

- |

|

|

Book value per share |

$ |

13.94 |

$ |

12.59 |

$ |

1.35 |

|

$ |

12.13 |

$ |

11.80 |

$ |

0.33 |

|

|

Daily averages: |

ThreemonthsendingSep

30,2019 |

ThreemonthsendingSep

30,2018 |

Change |

YeartodateSep

30,2019 |

YeartodateSep

30,2018 |

Change |

|

Loans, net |

$ |

558,483 |

$ |

522,944 |

6.80% |

|

$ |

547,833 |

$ |

511,573 |

7.09% |

|

|

Loans held for sale |

|

4,435 |

|

3,134 |

41.51% |

|

|

3,471 |

|

3,096 |

12.11% |

|

|

Total securities |

|

55,528 |

|

60,281 |

-7.88% |

|

|

57,779 |

|

61,302 |

-5.75% |

|

|

Total deposits |

|

628,110 |

|

602,549 |

4.24% |

|

|

621,572 |

|

590,319 |

5.29% |

|

|

Stockholders' equity |

|

59,415 |

|

54,967 |

8.09% |

|

|

58,350 |

|

53,917 |

8.22% |

|

|

Interest earning assets |

|

651,644 |

|

625,693 |

4.15% |

|

|

644,363 |

|

614,290 |

4.90% |

|

|

Interest bearing liabilities |

|

546,657 |

|

519,235 |

5.28% |

|

|

536,261 |

|

490,947 |

9.23% |

|

|

Total assets |

|

701,007 |

|

663,685 |

5.62% |

|

|

690,015 |

|

651,489 |

5.91% |

|

|

Financial Ratios: |

ThreemonthsendingSep

30,2019 |

ThreemonthsendingSep

30,2018 |

Change |

YeartodateSep

30,2019 |

YeartodateSep

30,2018 |

Change |

|

Return on average assets |

0.83% |

|

0.84% |

|

(0.01 |

) |

0.79% |

|

0.79% |

|

- |

|

|

Return on average equity |

9.84% |

|

10.13% |

|

(0.29 |

) |

9.36% |

|

9.49% |

|

(0.13 |

) |

|

Net interest margin |

3.75% |

|

3.80% |

|

(0.05 |

) |

3.83% |

|

3.73% |

|

0.10 |

|

|

Efficiency ratio |

76.54% |

|

73.39% |

|

3.15 |

|

76.42% |

|

74.83% |

|

1.59 |

|

|

Average equity to average assets |

8.48% |

|

8.28% |

|

0.20 |

|

8.46% |

|

8.28% |

|

0.18 |

|

|

Allowance for loan losses: |

ThreemonthsendingSep

30,2019 |

ThreemonthsendingSep

30,2018 |

Change |

YeartodateSep

30,2019 |

YeartodateSep

30,2018 |

Change |

|

Beginning balance |

$ |

4,724 |

|

$ |

4,688 |

|

0.77% |

|

$ |

4,581 |

|

$ |

4,752 |

|

-3.60% |

|

|

Provision for losses |

|

108 |

|

|

190 |

|

-43.16% |

|

|

434 |

|

|

527 |

|

-17.65% |

|

|

Charge-offs |

|

(100 |

) |

|

(324 |

) |

-69.14% |

|

|

(319 |

) |

|

(879 |

) |

-63.71% |

|

|

Recoveries |

|

41 |

|

|

7 |

|

485.71% |

|

|

77 |

|

|

161 |

|

-52.17% |

|

|

Ending balance |

|

4,773 |

|

|

4,561 |

|

4.65% |

|

|

4,773 |

|

|

4,561 |

|

4.65% |

|

|

Nonperforming assets: |

Sep 30,2019 |

Dec 31,2018 |

Change |

Sep 30,2018 |

Dec 31,2017 |

Change |

|

Total nonperforming loans |

$ |

1,771 |

$ |

2,939 |

-39.74% |

|

$ |

2,350 |

$ |

4,308 |

-45.45% |

|

|

Other real estate owned |

|

2,242 |

|

2,431 |

-7.77% |

|

|

2,455 |

|

2,650 |

-7.36% |

|

|

Total nonperforming assets |

|

4,013 |

|

5,370 |

-25.27% |

|

|

4,805 |

|

6,958 |

-30.94% |

|

|

Troubled debt restructurings - (performing portion) |

|

413 |

|

424 |

-2.59% |

|

|

428 |

|

440 |

-2.73% |

|

|

Asset quality ratios: |

Sep 30,2019 |

Dec 31,2018 |

Change |

Sep 30,2018 |

Dec 31,2017 |

Change |

|

Nonperforming loans to total loans |

0.32% |

|

0.55% |

|

(0.23 |

) |

0.44% |

|

0.87% |

|

(0.43 |

) |

|

Allowance for loan losses to total loans |

0.86% |

|

0.86% |

|

0.00 |

|

0.86% |

|

0.96% |

|

(0.10 |

) |

|

Allowance for loan losses to nonperforming loans |

269.51% |

|

155.87% |

|

113.64 |

|

194.09% |

|

110.31% |

|

83.78 |

|

Bank of the James Financial Group, Inc. and

SubsidiariesConsolidated Balance

Sheets(dollar amounts in thousands, except per

share amounts)

| Assets |

(unaudited)9/30/2019 |

|

12/31/2018 |

|

|

|

|

|

|

|

|

| |

|

|

|

| Cash and due from banks |

$ |

27,315 |

|

$ |

26,725 |

|

| Federal funds sold |

|

22,141 |

|

|

23,600 |

|

|

Total cash and cash equivalents |

|

49,456 |

|

|

50,325 |

|

| |

|

|

|

| Securities held-to-maturity

(fair value of $3,938 in 2019 and $3,515 in 2018) |

$ |

3,690 |

|

$ |

3,700 |

|

| Securities available-for-sale,

at fair value |

|

54,400 |

|

|

52,727 |

|

| Restricted stock, at cost |

|

1,506 |

|

|

1,462 |

|

| Loans, net of allowance for

loan losses of $4,773 in 2019 and $4,581 in 2018 |

|

551,005 |

|

|

530,016 |

|

| Loans held for sale |

|

5,630 |

|

|

1,670 |

|

| Premises and equipment,

net |

|

16,365 |

|

|

13,233 |

|

| Software, net |

|

213 |

|

|

193 |

|

| Interest receivable |

|

1,755 |

|

|

1,742 |

|

| Cash value - bank owned life

insurance |

|

13,606 |

|

|

13,359 |

|

| Other real estate owned |

|

2,242 |

|

|

2,431 |

|

| Income taxes receivable |

|

83 |

|

|

1,102 |

|

| Deferred tax asset |

|

1,085 |

|

|

1,755 |

|

| Other assets |

|

7,078 |

|

|

1,182 |

|

|

Total assets |

$ |

708,114 |

|

$ |

674,897 |

|

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Deposits |

|

|

|

|

Noninterest bearing demand |

$ |

90,426 |

|

$ |

91,356 |

|

|

NOW, money market and savings |

|

350,885 |

|

|

331,298 |

|

|

Time |

|

191,722 |

|

|

189,389 |

|

| Total deposits |

|

633,033 |

|

|

612,043 |

|

| |

|

|

|

| Capital notes |

|

5,000 |

|

|

5,000 |

|

| Interest payable |

|

167 |

|

|

127 |

|

| Other liabilities |

|

8,875 |

|

|

2,584 |

|

|

Total liabilities |

$ |

647,075 |

|

$ |

619,754 |

|

| |

|

|

|

| Stockholders' equity |

|

|

|

|

Common stock $2.14 par value; authorized 10,000,000 shares; issued

and outstanding 4,378,436 as of September 30, 2019 and December 31,

2018 |

$ |

9,370 |

|

$ |

9,370 |

|

|

Additional paid-in-capital |

|

31,575 |

|

|

31,495 |

|

|

Accumulated other comprehensive income (loss) |

|

277 |

|

|

(2,243 |

) |

|

Retained earnings |

|

19,817 |

|

|

16,521 |

|

| Total stockholders'

equity |

$ |

61,039 |

|

$ |

55,143 |

|

| |

|

|

|

| Total liabilities and

stockholders' equity |

$ |

708,114 |

|

$ |

674,897 |

|

| |

|

|

|

|

|

|

Bank of the James Financial Group, Inc. and

SubsidiariesConsolidated Statements of

Income(dollar amounts in thousands, except per

share amounts)(unaudited)

| |

For the Three MonthsEnded September

30, |

|

For the Nine MonthsEnded September

30, |

|

Interest Income |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

Loans |

$ |

7,080 |

|

$ |

6,460 |

|

$ |

20,550 |

|

$ |

18,329 |

|

Securities |

|

|

|

|

|

|

|

|

US Government and agency obligations |

|

176 |

|

|

187 |

|

|

545 |

|

|

571 |

|

Mortgage backed securities |

|

54 |

|

|

62 |

|

|

171 |

|

|

196 |

|

Municipals |

|

77 |

|

|

83 |

|

|

239 |

|

|

248 |

|

Dividends |

|

9 |

|

|

9 |

|

|

60 |

|

|

40 |

|

Other (Corporates) |

|

23 |

|

|

23 |

|

|

70 |

|

|

70 |

| Interest bearing deposits |

|

88 |

|

|

60 |

|

|

253 |

|

|

151 |

| Federal Funds sold |

|

89 |

|

|

96 |

|

|

332 |

|

|

255 |

|

Total interest income |

|

7,596 |

|

|

6,980 |

|

|

22,220 |

|

|

19,860 |

| |

|

|

|

|

|

|

|

| Interest

Expense |

|

|

|

|

|

|

|

|

Deposits |

|

|

|

|

|

|

|

|

NOW, money market savings |

|

414 |

|

|

261 |

|

|

1,082 |

|

|

684 |

|

Time Deposits |

|

876 |

|

|

597 |

|

|

2,294 |

|

|

1,641 |

|

FHLB borrowings |

|

- |

|

|

- |

|

|

- |

|

|

17 |

|

Finance leases |

|

41 |

|

|

- |

|

|

41 |

|

|

- |

|

Brokered time deposits |

|

50 |

|

|

82 |

|

|

206 |

|

|

244 |

|

Capital notes |

|

50 |

|

|

50 |

|

|

150 |

|

|

150 |

|

Total interest expense |

|

1,431 |

|

|

990 |

|

|

3,773 |

|

|

2,736 |

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

6,165 |

|

|

5,990 |

|

|

18,447 |

|

|

17,124 |

| |

|

|

|

|

|

|

|

| Provision for loan losses |

|

108 |

|

|

190 |

|

|

434 |

|

|

527 |

| |

|

|

|

|

|

|

|

|

Net interest income after provision for loan

losses |

|

6,057 |

|

|

5,800 |

|

|

18,013 |

|

|

16,597 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Noninterest

income |

|

|

|

|

|

|

|

|

Gains on sale of loans held for sale |

|

1,337 |

|

|

767 |

|

|

3,103 |

|

|

2,260 |

|

Service charges, fees and commissions |

|

448 |

|

|

446 |

|

|

1,348 |

|

|

1,375 |

|

Increase in cash value of life insurance |

|

80 |

|

|

86 |

|

|

247 |

|

|

255 |

|

Other |

|

5 |

|

|

20 |

|

|

50 |

|

|

56 |

|

Gain on sales of available-for-sale securities |

|

291 |

|

|

- |

|

|

291 |

|

|

- |

| |

|

|

|

|

|

|

|

|

Total noninterest income |

|

2,161 |

|

|

1,319 |

|

|

5,039 |

|

|

3,946 |

| |

|

|

|

|

|

|

|

| Noninterest

expenses |

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

3,356 |

|

|

2,853 |

|

|

9,437 |

|

|

8,398 |

|

Occupancy |

|

414 |

|

|

388 |

|

|

1,252 |

|

|

1,143 |

|

Equipment |

|

527 |

|

|

414 |

|

|

1,521 |

|

|

1,191 |

|

Supplies |

|

163 |

|

|

124 |

|

|

467 |

|

|

413 |

|

Professional, data processing, and other outside expense |

|

887 |

|

|

761 |

|

|

2,561 |

|

|

2,413 |

|

Marketing |

|

228 |

|

|

165 |

|

|

649 |

|

|

492 |

|

Credit expense |

|

195 |

|

|

140 |

|

|

478 |

|

|

377 |

|

Other real estate expenses |

|

200 |

|

|

110 |

|

|

340 |

|

|

236 |

|

FDIC insurance expense |

|

87 |

|

|

99 |

|

|

275 |

|

|

299 |

|

Other |

|

316 |

|

|

310 |

|

|

967 |

|

|

805 |

|

Total noninterest expenses |

|

6,373 |

|

|

5,364 |

|

|

17,947 |

|

|

15,767 |

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

1,845 |

|

|

1,755 |

|

|

5,105 |

|

|

4,776 |

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

371 |

|

|

351 |

|

|

1,020 |

|

|

949 |

|

|

|

|

|

|

|

|

|

|

Net Income |

$ |

1,474 |

|

$ |

1,404 |

|

$ |

4,085 |

|

$ |

3,827 |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding - basic |

|

4,378,436 |

|

|

4,378,436 |

|

|

4,378,436 |

|

|

4,378,436 |

| |

|

|

|

|

|

|

|

| Weighted average shares

outstanding - diluted |

|

4,385,331 |

|

|

4,378,436 |

|

|

4,383,128 |

|

|

4,378,466 |

| |

|

|

|

|

|

|

|

| Net income per common share -

basic |

$0.34 |

|

$0.32 |

|

$0.93 |

|

$0.87 |

| |

|

|

|

|

|

|

|

| Net income per common share -

diluted |

$0.34 |

|

$0.32 |

|

$0.93 |

|

$0.87 |

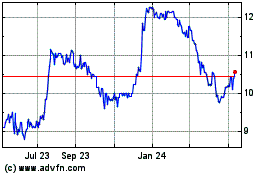

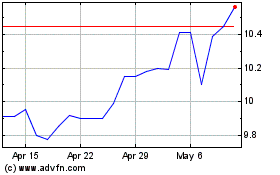

Bank of the James Financ... (NASDAQ:BOTJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bank of the James Financ... (NASDAQ:BOTJ)

Historical Stock Chart

From Jul 2023 to Jul 2024