Abpro Corporation (“Abpro”), a biotech company with the mission of

improving the lives of mankind facing severe and life-threatening

diseases with next-generation antibody therapies, and Atlantic

Coastal Acquisition Corp. II (NASDAQ: ACAB), a special purpose

acquisition company (“Atlantic Coastal”), today announced the

filing of a registration statement on Form S-4 (the “Registration

Statement”) with the U.S. Securities and Exchange Commission

(“SEC”) on January 19, 2024, which includes a preliminary proxy

statement and prospectus in connection with its proposed business

combination.

Upon the closing of the proposed business

combination, the combined company is expected to be named “Abpro

Corporation” and to list its common stock on Nasdaq under the new

ticker symbol “ABP”. The proposed business combination sets Abpro’s

implied pre-money equity valuation at $500 million. Consistent with

the recent signing of the Business Combination Agreement, the

Atlantic Coastal and Abpro boards of directors have approved the

proposed business combination, which is expected to be completed in

the first half of 2024 subject to, among other things, the approval

by Atlantic Coastal and Abpro stockholders, and other customary

closing conditions.

“We are thrilled to be one step closer to

fulfilling our public journey to advance our pipeline of

next-generation antibody therapeutics, and to be closer to

providing critical therapies to those who need it most,” stated Ian

Chan, CEO and co-founder of Abpro. “We have made significant

strides in advancing our lead candidates in oncology and

ophthalmology, which are two areas of significant unmet medical

need. With this filing, we are excited for what lies ahead for both

our company and the future of antibody-driven therapeutics.”

“We are excited to be partnering with Abpro and

recognize the potential of the company’s robust drug discovery

platform, novel candidates and significant strategic partnerships,”

said Shahraab Ahmad, CEO of Atlantic Coastal. “Abpro is supported

by an experienced leadership team and board that we believe will

lead the company to create significant value for shareholders.”

“In my experience as a long-term biotech

investor, I have been most impressed with the caliber of the team

at Abpro and have confidence in their ability to achieve the

targets that they have set for themselves,” added Tony Eisenberg,

CSO of Atlantic Coastal. “Advancing towards a listing on Nasdaq is

the next step in the company’s journey to bring its pioneering

research and drug development platform to market.”

While the Registration Statement has not yet

become effective, and the information contained therein is subject

to change, it provides important information about Abpro, Atlantic

Coastal, and the proposed business combination.

Abpro at a Glance

- By leveraging its

proprietary DiversImmune® and MultiMabTM antibody

discovery and engineering platforms, Abpro is advancing a pipeline

of next-generation antibodies, both independently and through

collaborations with global pharmaceutical and research

institutions.

- Abpro’s lead candidate ABP-102, a

next generation immuno-oncology TetraBi antibody targeting HER2 and

CD3, is in development for the treatment of HER2+ solid tumors,

including breast and gastric cancer. ABP-102 is being developed and

commercialized through a worldwide strategic partnership with

Celltrion, Inc. (“Celltrion”) (KRX: 068270) a leading Korean

biopharmaceutical company. Celltrion is conducting a dose range

finding study in a xenograft mouse model. An in vivo efficacy study

in a xenograft mouse is planned for the first half of 2024.

- Abpro is advancing its lead

candidate ABP-201, a TetraBi antibody format designed to

simultaneously inhibit VEGF and ANG-2, into the clinic for the

treatment of wet age-related macular degeneration.

- Abpro is advancing a broad pipeline

of immuno-oncology agents that redirect T cells to a diverse range

of liquid and solid tumors. ABP-110, targeting GPC3 on

hepatocellular carcinoma, and ABP-150, targeting Claudin 18.2 on

gastric cancer, are currently in preclinical development.

Advisors

Brookline Capital Markets, a division of Arcadia

Securities, LLC, acted as a financial advisor to Abpro

Corporation.

Cohen & Company Capital Markets, a division

of J.V.B. Financial Group, LLC, is serving as financial advisor to

Atlantic Coastal.

About Abpro

Abpro Corporation is a biotechnology company

located in Woburn, Massachusetts. The company’s mission is to

improve the lives of mankind facing severe and life-threatening

diseases with next-generation antibody therapies. For more

information, please visit www.abpro.com.

About Atlantic Coastal Acquisition Corp. II

Atlantic Coastal Acquisition Corp. II (NASDAQ:

ACAB) is a special purpose acquisition company. On January 13,

2022, Atlantic Coastal announced the closing of its IPO and listing

on Nasdaq. The Atlantic Coastal team is led by Chairman and CEO

Shahraab Ahmad, President and Director Burt Jordan, CSO and

Director Tony Eisenberg, and CFO and Director Jason Chryssicas. For

more information, please visit www.atlantic-coastal.com.

No Offer or Solicitation

This communication is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of the potential transaction between

Atlantic Coastal and Abpro. This communication does not constitute

an offer to sell or exchange, or the solicitation of an offer to

buy or exchange, any securities of Atlantic Coastal and Abpro, nor

shall there be any sale of securities in any jurisdiction in which

such offer, sale or exchange would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

U.S. Securities Act of 1933, as amended.

Participants in the Solicitation

Atlantic Coastal and Abpro and their respective

directors and certain of their respective executive officers and

other members of management and employees may be considered

participants in the solicitation of proxies with respect to the

proposed transaction. Information about the directors and executive

officers of Atlantic Coastal is set forth in its Annual Report on

Form 10-K for the fiscal year ended December 31, 2022. Additional

information regarding the persons who may, under the rules of the

SEC, be deemed participants in the proxy solicitation of the

shareholders of Atlantic Coastal and a description of their direct

and indirect interests in Atlantic Coastal, by security holdings or

otherwise, will be included in the proxy statement/prospectus and

other relevant materials to be filed with the SEC regarding the

proposed transaction when they become available. Shareholders,

potential investors and other interested persons should read the

proxy statement/prospectus carefully when it becomes available

before making any voting or investment decisions. When available,

these documents can be obtained free of charge from the sources

indicated above.

Additional Information and Where To Find It

In connection with the proposed transaction,

Atlantic Coastal has filed a registration statement on Form S-4

(the “Registration Statement”) with the SEC, which includes a

preliminary proxy statement to be distributed to holders of

Atlantic Coastal’s ordinary shares in connection with Atlantic

Coastal’s solicitation of proxies for the vote by Atlantic

Coastal’s shareholders with respect to the proposed transaction and

other matters as described in the Registration Statement, as well

as the prospectus relating to the offer of securities to be issued

to Abpro stockholders in connection with the proposed transaction.

After the Registration Statement has been declared effective,

Atlantic Coastal will mail a definitive proxy statement, when

available, to its shareholders. The Registration Statement will

include information regarding the persons who may, under SEC rules,

be deemed participants in the solicitation of proxies to Atlantic

Coastal’s shareholders in connection with the proposed transaction.

Atlantic Coastal will also file other documents regarding the

proposed transaction with the SEC. Before making any voting

decision, investors and security holders of Atlantic Coastal and

Abpro are urged to read the Registration Statement, the proxy

statement/prospectus contained therein, and all other relevant

documents filed or that will be filed with the SEC in connection

with the proposed transaction as they become available because they

will contain important information about the proposed

transaction.

Investors and security holders will be able to

obtain free copies of the proxy statement/prospectus and all other

relevant documents filed or that will be filed with the SEC by

Atlantic Coastal through the website maintained by the SEC at

www.sec.gov. In addition, the documents filed by Atlantic Coastal

may be obtained free of charge from Atlantic Coastal’s website at

www.atlantic-coastal.com or by written request to Atlantic Coastal

at Atlantic Coastal Acquisition Corp., 6 St Johns Lane, Floor 5,

New York, NY 10013.

Investor Inquiries:ICR

WestwickeStephanie

Carringtonstephanie.carrington@westwicke.com646-277-1282

Media InquiresICR WestwickeSean

Leoussean.leous@westwicke.com646-866-4012

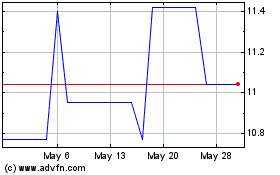

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Historical Stock Chart

From Jan 2025 to Feb 2025

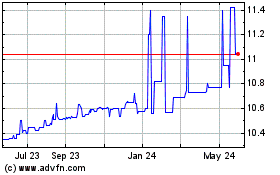

Atlantic Coastal Acquisi... (NASDAQ:ACAB)

Historical Stock Chart

From Feb 2024 to Feb 2025