Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 10 2023 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2023

Commission File Number: 001-38764

APTORUM GROUP LIMITED

17 Hanover Square

London W1S 1BN, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On

November 18, 2022, Aptorum Group, Inc. (the “Company”) disclosed that it received a deficiency letter from the Nasdaq

Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying

the Company that its ordinary shares failed to maintain a minimum bid price of $1.00 over the previous 30 consecutive business days as

required by the continued listing on The Nasdaq Global Market pursuant to Nasdaq Listing Rule 5450(a)(1) (“Rule 5450(a)(1)”).

We are filing this Current Report on Form 6-K to disclose that Nasdaq informed the Company that has regained compliance with Rule 5450(a)(1)

and the matter is closed.

On

February 8, 2023, the Company received a deficiency letter from Nasdaq notifying the Company that the Company does not meet the minimum

Market Value of Publicly Held Shares (“MVPHS”) of $5,000,000 for the previous 30 consecutive business days. The Nasdaq

deficiency letter has no immediate effect on the listing of the Company’s Class A Ordinary Shares, and its Class A Ordinary Shares

will continue to trade on The Nasdaq Global Market under the symbol “APM” at this time.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(D), the Company has been given 180 calendar days, or until August 7, 2023, to regain compliance

with Rule 5450(b)(1)(C). If at any time before August 7, 2023, the MVPHS closes at $5,000,000 or more for a minimum of ten consecutive

business days, the Staff will provide written confirmation that the Company has achieved compliance and the matter will be closed.

If

the Company does not regain compliance with Rule 5450(b)(1)(C) by August 7, 2023, the Company will receive written notification that its

securities are subject to delisting and the Company may appeal the delisting determination to a Hearing’s Panel. Alternatively,

the Company may consider applying to transfer the Class A Ordinary Shares to The Nasdaq Capital Market. The Company intends to remain

on the Nasdaq Global Market and will actively monitor its MVPHS and will consider available options to resolve the deficiency and regain

compliance with Rule 5450(b)(1)(C).

On

February 10, 2023, the Company issued a press release regarding the deficiency. A copy of the press release is attached hereto as Exhibit 99.1.

Neither this report nor the

exhibits constitute an offer to sell, or the solicitation of an offer to buy our securities, nor shall there be any sale of our securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction.

The information in this Form

6-K, including the exhibits shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as

shall be expressly set forth by specific reference in such filing.

This Form 6-K is hereby incorporated

by reference into the registration statements of the Company on Form

S-8 (Registration Number 333-232591) and Form

F-3 (Registration Number 333-268873) and into each prospectus outstanding under the foregoing registration statements, to the

extent not superseded by documents or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended,

or the Securities Exchange Act of 1934, as amended.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Aptorum Group Limited |

| |

|

|

| Date: February 10, 2023 |

By: |

/s/ Darren Lui |

| |

|

Name: |

Darren Lui |

| |

|

Title: |

Chief Executive Officer |

3

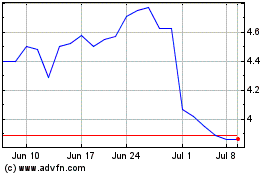

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

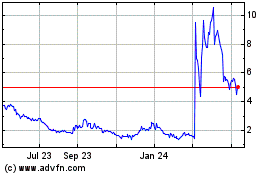

Aptorum (NASDAQ:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024