- Surgical revenue grew 30%; total revenue grew 27%

- Full-year revenue and profitability guidance increased

- Enhanced balance sheet flexibility with $50 million expansion

of existing term loan facility

Alphatec Holdings, Inc. (Nasdaq: ATEC), a provider of innovative

solutions dedicated to revolutionizing the approach to spine

surgery, today announced financial results for the quarter ended

September 30, 2024, and recent corporate highlights.

Third Quarter 2024 Financial Results

Quarter Ended September 30,

2024

Total revenue

$151 million

GAAP gross margin

68%

Non-GAAP gross margin

69%

GAAP operating expenses

$136 million

Non-GAAP operating expenses

$114 million

GAAP net loss

($40) million

Adjusted EBITDA

$7.4 million

Adjusted EBITDA margin

5%

Ending cash balance

$81 million

Recent Highlights

- Drove 20% procedural volume growth on continued momentum of

PTPTM and LTPTM;

- Achieved 19% growth in new surgeon adoption, a key leading

indicator of future growth;

- Continued to expand U.S. footprint, which fueled over 200

surgeon training engagements;

- Reduced free cash use to $21 million as accelerated investment

phase nears completion.

“At ATEC, our commitment continues to be to enhance spine care

through innovation,” said Pat Miles, Chairman and Chief Executive

Officer. “That commitment has fueled growth at multiples of our

industry for over five years. We recognize the importance of

converting growth to expand profitability so we can support our

long-term vision, and we are actively executing internal

initiatives to impact cash flow. Our view of the opportunity ahead

is unchanged: we are building a special company that is uniquely

positioned to revolutionize spine care."

Increased Existing Term Debt Facility

The Company reached an agreement with Braidwell LP, and

Pharmakon Advisors, LP, to expand the Company’s existing term loan

by $50 million, availing total capacity of up to $200 million. With

the close of the transaction, the Company has pro-forma cash of

approximately $128 million.

Pedro Gonzalez de Cosio, Co-Founder, Principal and CEO of

Pharmakon Advisors, said, “ATEC’s mission to improve spine care is

fueling exceptional growth. We are excited to partner with the team

in support of that important mission as the company continues to

expand profitability and inflects to positive cash flow.”

Additional details regarding the financing will be included in a

Current Report on Form 8-K, which ATEC will file with the

Securities and Exchange Commission today.

Financial Outlook for the Full-Year 2024

For the fiscal year ended December 31, 2024, the Company now

expects total revenue to grow 25% to $605 million compared to the

previous expectation of $602 million. This includes surgical

revenue of $540 million and EOS revenue of $65 million. The Company

now expects non-GAAP adjusted EBITDA of approximately $27 million

compared to the previous expectation of $25.5 million.

Financial Results Webcast

ATEC will present these results via a live webcast today at 1:30

p.m. PT / 4:30 p.m. ET. The live webcast can be accessed by

visiting the Investor Relations Section of ATEC’s Corporate

Website.

To dial into the live webcast, please register at this link.

Access details will be shared via email.

A replay of the webcast will remain available through the

Investor Relations Section of ATEC’s Corporate Website for twelve

months.

Non-GAAP Financial Information

To supplement the Company’s financial statements presented in

accordance with generally accepted accounting principles in the

United States of America (GAAP), the Company reports certain

non-GAAP financial measures, including non-GAAP gross margin,

non-GAAP operating expenses, non-GAAP operating loss, and non-GAAP

adjusted EBITDA. The Company believes that these non-GAAP financial

measures provide investors with an additional tool for evaluating

the Company's core performance, which management uses in its own

evaluation of continuing operating performance, and a baseline for

assessing the future earnings potential of the Company. The

Company’s non-GAAP financial measures may not provide information

that is directly comparable to that provided by other companies in

the Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. Non-GAAP financial results

should be considered in addition to, and not as a substitute for,

or superior to, financial measures calculated in accordance with

GAAP. Included below are reconciliations of the non-GAAP financial

measures to the comparable GAAP financial measures.

About Alphatec Holdings, Inc.

ATEC, through its wholly owned subsidiaries, Alphatec Spine,

Inc., EOS imaging S.A.S. and SafeOp Surgical, Inc., is a medical

device company dedicated to revolutionizing the approach to spine

surgery through clinical distinction. ATEC’s Organic Innovation

MachineTM is focused on developing new approaches that integrate

seamlessly with the Company’s expanding AlphaInformatiX Platform to

better inform surgery and more safely and reproducibly achieve the

goals of spine surgery. ATEC’s vision is to be the Standard Bearer

in Spine. For more information, visit us at www.atecspine.com.

Forward Looking Statements

This press release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainty. Such statements are based on

management's current expectations and are subject to a number of

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

The Company cautions investors that there can be no assurance that

actual results will not differ materially from those projected or

suggested in such forward-looking statements as a result of various

factors. Forward-looking statements include, but are not limited

to: references to the Company’s revenue, balance sheet, growth, and

financial outlook and commitments; and the Company's ability to

compel surgeon adoption, drive procedural growth and transform the

sales channel. Important factors that could cause actual operating

results to differ significantly from those expressed or implied by

such forward-looking statements include, but are not limited to:

the uncertainty of success in developing new products or products

currently in the pipeline; the uncertainties in the Company’s

ability to execute upon its strategic operating plan; the

uncertainties regarding the ability to successfully license or

acquire new products, and the commercial success of such products;

failure to achieve acceptance of the Company’s products by the

surgeon community; failure to obtain FDA or other regulatory

clearance or approval or unexpected or prolonged delays in the

process; continuation of favorable Third-party reimbursement;

unanticipated expenses or liabilities or other adverse events

affecting cash flow or the Company’s ability to achieve

profitability; uncertainty of additional funding and the form of

such funding; product liability exposure; an unsuccessful outcome

in any litigation; patent infringement claims; claims related to

the Company’s intellectual property; and the Company’s ability to

meet its financial obligations. A further list and description of

these and other factors, risks and uncertainties can be found in

the Company's most recent annual report, and any subsequent

quarterly and current reports, filed with the Securities and

Exchange Commission. ATEC disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events, or otherwise, unless

required by law.

Non-GAAP Definitions

Amortization of intangible assets: Represents amortization

expense associated with intangible assets including, but not

limited to customer relationships, intellectual property, and trade

names acquired in business combinations and asset acquisitions.

Litigation-related expenses: We are involved in various

litigation matters that from time-to-time result in settlements.

Litigation matters can vary in their characteristics, frequency and

significance to our operating results and core business operations.

We review litigation matters from both a qualitative and

quantitative perspective to determine whether such matters are a

normal and recurring part of our business. We include in our GAAP

financial statements litigation fees and settlement expenses that

we determine to be normal, recurring and routine to our business.

When we determine that certain litigation matters are not normal

and recurring to our core business operations, we believe excluding

these expenses will provide our management and investors with

useful incremental information. Litigation fees and settlement

expenses excluded from our non-GAAP financial measures in the

periods presented relate primarily to patent litigation and other

litigation matters that relate directly to the business

transformation that we started in 2018 and are discussed more fully

in our periodic reports filed with the Securities Exchange

Commission.

Other non-recurring expenses: These expenses represent

non-recurring expenses that we consider to be one-time in

nature.

Purchase accounting adjustments on acquisitions: Includes

non-cash expenses incurred as a result of fair value asset step-ups

associated with tangible assets acquired from business combinations

or asset acquisitions.

Restructuring expenses: From time-to-time, in order to realign

the Company’s operations or to achieve synergies associated with an

acquisition, the Company may eliminate roles or restructure its

operations and footprint. In such cases the Company may incur

one-time severance and personnel costs associated with workforce

reductions, or costs associated with exiting and/or relocating

facilities. We exclude these costs as we do not consider such

amounts to be part of the ongoing operations.

Stock-based compensation: Stock-based compensation is charged to

cost of revenue and operating expenses. We exclude stock-based

compensation from certain of our non-GAAP financial measures

because we believe that excluding these non-cash expenses provides

meaningful supplemental information regarding operational

performance. Because of the variety of equity awards used by

companies, the varying methodologies for determining stock-based

compensation expense, the subjective assumptions involved in those

determinations, and the volatility in valuations that can be driven

by market conditions outside the Company’s control, the Company

believes excluding stock-based compensation expense enhances the

ability of management and investors to understand and assess the

underlying performance of its business over time.

Transaction-related expenses: These expenses represent one-time

costs associated with business combinations and asset acquisitions.

These items may include but are not limited to consulting and legal

fees, contract termination costs and other related deal costs.

Adjusted EBITDA: Represents earnings before non-operating

income/expense, taxes, depreciation and amortization, as adjusted

for the applicable non-GAAP adjustments previously described.

Alphatec Holdings,

Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except per

share amounts)

Three Months Ended Nine Months Ended

September 30, September 30,

2024

2023

2024

2023

(unaudited) (unaudited) Revenue from products and services

$

150,719

$

118,262

$

434,769

$

344,292

Cost of sales

47,990

38,215

132,095

129,279

Gross profit

102,729

80,047

302,674

215,013

Operating expenses: Research and development

20,357

20,000

57,474

47,831

Sales, general and administrative

109,200

91,411

335,658

269,960

Litigation-related expenses

2,093

2,715

8,611

12,815

Amortization of acquired intangible assets

3,848

3,873

11,538

10,461

Transaction-related expenses

—

278

(117

)

2,178

Restructuring expenses

934

129

1,861

333

Total operating expenses

136,432

118,406

415,025

343,578

Operating loss

(33,703

)

(38,359

)

(112,351

)

(128,565

)

Other expense, net: Interest expense, net

(6,572

)

(4,459

)

(17,728

)

(12,225

)

Other income, net

623

47

897

3,077

Total other expense, net

(5,949

)

(4,412

)

(16,831

)

(9,148

)

Net loss before taxes

(39,652

)

(42,771

)

(129,182

)

(137,713

)

Income tax benefit

(36

)

(117

)

(391

)

(153

)

Net loss

$

(39,616

)

$

(42,654

)

$

(128,791

)

$

(137,560

)

Net loss per share, basic and diluted

$

(0.28

)

$

(0.35

)

$

(0.90

)

$

(1.18

)

Weighted average shares outstanding, basic and diluted

143,492

122,468

142,400

117,026

Stock-based compensation included in: Cost of sales

$

1,439

$

2,369

$

2,476

$

24,601

Research and development

7,207

6,790

17,137

9,587

Sales, general and administrative

8,816

10,914

32,131

26,541

$

17,462

$

20,073

$

51,744

$

60,729

Alphatec Holdings,

Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

September 30,2024 December 31,2023 (unaudited)

ASSETS Current assets: Cash and cash equivalents

$

80,976

$

220,970

Accounts receivable, net

78,452

72,613

Inventories

183,111

136,842

Prepaid expenses and other current assets

19,886

20,666

Total current assets

362,425

451,091

Property and equipment, net

171,430

149,835

Right-of-use assets

37,015

26,410

Goodwill

73,397

73,003

Intangible assets, net

98,785

102,451

Other assets

2,843

2,418

Total assets

$

745,895

$

805,208

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable

$

59,578

$

48,985

Accrued expenses and other current liabilities

76,262

87,712

Contract liabilities

11,602

13,910

Short-term debt

1,790

1,808

Current portion of operating lease liabilities

6,989

5,159

Total current liabilities

156,221

157,574

Total long-term liabilities

567,433

545,915

Redeemable preferred stock

23,603

23,603

Stockholders' equity

(1,362

)

78,116

Total liabilities and stockholders' equity

$

745,895

$

805,208

Alphatec Holdings,

Inc.

Reconciliation of Non-GAAP

Financial Measures

(in thousands)

Three Months Ended Nine Months Ended

September 30, September 30,

2024

2023

2024

2023

(unaudited) Gross profit, GAAP

$

102,729

$

80,047

$

302,674

$

215,013

Add: amortization of intangible assets

308

221

922

661

Add: stock-based compensation

1,439

2,369

2,476

24,601

Add: purchase accounting adjustments on acquisitions

—

—

197

195

Non-GAAP gross profit

$

104,476

$

82,637

$

306,269

$

240,470

Gross margin, GAAP

68.2

%

67.7

%

69.6

%

62.5

%

Add: amortization of intangible assets

0.2

%

0.2

%

0.2

%

0.2

%

Add: stock-based compensation

1.0

%

2.0

%

0.6

%

7.1

%

Add: purchase accounting adjustments on acquisitions

0.0

%

0.0

%

0.0

%

0.1

%

Non-GAAP gross margin

69.3

%

69.9

%

70.4

%

69.8

%

Three Months Ended Nine Months Ended

September 30, September 30,

2024

2023

2024

2023

(unaudited) Operating expenses, GAAP

$

136,432

$

118,406

$

415,025

$

343,578

Adjustments: Stock-based compensation

(16,023

)

(17,704

)

(49,268

)

(36,128

)

Litigation-related expenses

(2,093

)

(2,715

)

(8,611

)

(12,815

)

Amortization of intangible assets

(3,848

)

(3,873

)

(11,538

)

(10,461

)

Transaction-related expenses

—

(278

)

117

(2,178

)

Restructuring expenses

(934

)

(129

)

(1,861

)

(333

)

Other non-recurring expenses1, 2

—

—

(1,608

)

(1,349

)

Non-GAAP operating expenses

$

113,534

$

93,707

$

342,256

$

280,314

Three Months Ended Nine Months Ended

September 30, September 30,

2024

2023

2024

2023

(unaudited) Net loss, GAAP

$

(39,616

)

$

(42,654

)

$

(128,791

)

$

(137,560

)

Other expense, net

5,949

4,412

16,831

9,148

Income tax benefit

(36

)

(117

)

(391

)

(153

)

Depreciation

16,491

10,651

45,950

28,998

Amortization of intangible assets

4,156

4,094

12,460

11,122

EBITDA

(13,056

)

(23,614

)

(53,941

)

(88,445

)

Add back significant items: Stock-based compensation

17,462

20,073

51,744

60,729

Purchase accounting adjustments on acquisitions

—

—

197

195

Litigation-related expenses

2,093

2,715

8,611

12,815

Transaction-related expenses

—

278

(117

)

2,178

Restructuring expenses

934

129

1,861

333

Other non-recurring expenses1, 2

—

—

1,608

1,349

Adjusted EBITDA

$

7,433

$

(419

)

$

9,963

$

(10,846

)

Adjusted EBITDA margin

4.9

%

(0.4

%)

2.3

%

(3.2

%)

Adjusted EBITDA margin expansion 530 bps 1. Non-recurring

net charges on assets and liabilities associated with customer plan

of reorganization 2. Non-recurring consulting fees associated with

the implementation of our state tax-planning strategy

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030811157/en/

Investor/Media Contact: Tina Jacobsen, CFA Investor

Relations (760) 494-6790 investorrelations@atecspine.com

Company Contact: J. Todd Koning Chief Financial Officer

investorrelations@atecspine.com

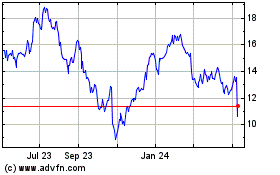

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

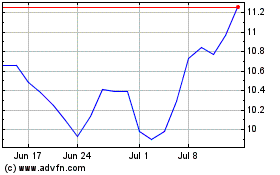

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Nov 2023 to Nov 2024