false

0001711933

0001711933

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 11, 2024

Akoya

Biosciences, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40344 |

47-5586242 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

100

Campus Drive, 6th Floor

Marlborough,

MA

(Address of principal executive offices) |

01752

(Zip Code) |

(855)

896-8401

(Registrant’s telephone number, including

area code)

Check the appropriate box below

if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.00001 per share |

|

AKYA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive

Agreement.

On December 11, 2024, the Board of Directors (the “Board”)

of Akoya Biosciences, Inc. (the “Company”) approved an updated form indemnification agreement (the “Agreement”)

for its non-employee directors and executive officers. Amendments to the form indemnification agreement include: (1) an expanded definition

of indemnifiable expenses; (2) a requirement that the Company purchase a six-year directors and officers (“D&O”) insurance

tail in the event of a Change in Control (as defined in the Agreement) of the Company; (3) a requirement that the Company pursue D&O

insurance coverage for indemnitees; (4) additional provisions concerning independent counsel indemnification determination rights; and

(5) clarifying amendments to the clawback indemnification preclusion provision. The Company intends to enter into the Agreement with each

of its current and future non-employee directors and executive officers.

The foregoing description of the indemnification agreement is qualified

in its entirety by reference to the form attached as Exhibit 10.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: December 13, 2024 |

Akoya Biosciences, Inc. |

| |

|

|

| |

By: |

/s/ Brian McKelligon |

| |

|

Brian McKelligon |

| |

|

Chief Executive Officer |

Exhibit 10.1

AKOYA BIOSCIENCES, INC.

INDEMNIFICATION AGREEMENT

This Indemnification Agreement,

dated _______ __, 2024, is made between Akoya Biosciences, Inc., a Delaware corporation (the “Company”),

and [______________] (the “Indemnitee”).

RECITALS

WHEREAS, the Company

desires to attract and retain the services of talented and experienced individuals, such as Indemnitee, to serve as directors and officers

of the Company and its subsidiaries and wishes to indemnify its directors and officers to the maximum extent permitted by law;

WHEREAS, the Company

and Indemnitee recognize that corporate litigation in general has subjected directors and officers to expensive litigation risks;

WHEREAS, Section 145

(“Section 145”) of the General Corporation Law of the State of Delaware, as amended (“DGCL”),

under which the Company is organized, empowers the Company to indemnify its directors and officers by agreement and to indemnify persons

who serve, at the request of the Company, as the directors and officers of other corporations or enterprises, and expressly provides that

the indemnification provided by Section 145 is not exclusive;

WHEREAS, Section 145(g) of

the DGCL allows for the purchase of director and officer (“D&O”) liability insurance by the Company, which

in theory can cover asserted liabilities without regard to whether they are indemnifiable by the Company or not;

WHEREAS, individuals

considering service or presently serving expect to be extended market terms of indemnification commensurate with their position, and that

entities such as Company will endeavor to maintain appropriate D&O insurance; and

WHEREAS, in order to

induce Indemnitee to serve or continue to serve as a director or officer of the Company and/or one or more subsidiaries of the Company,

or otherwise serve the Company in an indemnifiable capacity as set forth below, the Company and Indemnitee enter into this Agreement.

AGREEMENT

NOW, THEREFORE, in

consideration of the mutual covenants made herein and other good and valuable consideration, the receipt and sufficiency of which are

mutually acknowledged, Indemnitee and the Company agree as follows:

1. Definitions.

As used in this Agreement:

(a) “Agent”

means any person who is or was a director, officer, employee or other agent of the Company or a subsidiary of the Company; or is or was

serving at the request of, for the convenience of, or to represent the interests of the Company or a subsidiary of the Company as a director,

officer, employee, fiduciary, or agent of another foreign or domestic corporation, limited liability company, employee benefit plan, nonprofit

entity, partnership, joint venture, trust or other enterprise; or was a director, officer, employee, fiduciary, or agent of a foreign

or domestic corporation which was a predecessor corporation of the Company or a subsidiary of the Company, or was a director, officer,

employee, fiduciary, or agent of another enterprise at the request of, for the convenience of, or to represent the interests of such predecessor

corporation.

(b) “Board”

means the Board of Directors of the Company.

(c) “Change

in Control” shall be deemed to have occurred if (i) any “person,” as such term is used in Sections 13(d) and

14(d) of the Exchange Act, other than a trustee or other fiduciary holding securities under an employee benefit plan of the Company

or a corporation owned directly or indirectly by the stockholders of the Company in substantially the same proportions as their ownership

of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly

or indirectly, of securities of the Company representing a majority of the total voting power represented by the Company’s then

outstanding voting securities, (ii) during any period of two (2) consecutive years, individuals who at the beginning of

such period constituted the Board, together with any new directors whose election by the Board or nomination for election by the Company’s

stockholders was approved by a vote of at least two-thirds (2/3) of the directors then still in office who either were directors at the

beginning of the period or whose election or nomination was previously so approved, cease for any reason to constitute a majority of the

Board, (iii) the stockholders of the Company approve a merger or consolidation or a sale of all or substantially all of the Company’s

assets with or to another entity, other than a merger, consolidation or asset sale that would result in the holders of the Company’s

outstanding voting securities immediately prior thereto continuing to represent (either by remaining outstanding or by being converted

into voting securities of the surviving entity) at least a majority of the total voting power represented by the voting securities of

the Company or such surviving or successor entity outstanding immediately thereafter, or (iv) the stockholders of the Company approve

a plan of complete liquidation of the Company.

(d) “ERISA”

means Employee Retirement Income Security Act of 1974, as amended.

(e) “Exchange

Act” means Securities Exchange Act of 1934, as amended.

(f) “Expenses”

includes all out-of-pocket costs of any type or nature whatsoever, including, without limitation, expenses incurred in connection with

the defense of any action, suit, arbitration, alternative dispute resolution mechanism, investigation, inquiry, judicial, administrative,

or legislative hearing, or any other threatened, pending, or completed proceeding, whether brought by or in the right of the Company

or otherwise, including any and all appeals, whether of a civil, criminal, administrative, legislative, investigative, whether formal

or informal, or other nature, attorneys’ fees, witness fees and expenses, fees and expenses of accountants and other advisors,

retainers and disbursements and advances thereon, the premium, security for, and other costs relating to any bond (including cost bonds,

appraisal bonds, or their equivalents), or establishing or enforcing a right to indemnification under this Agreement, or Section 145

or otherwise; provided, however, that “Expenses” shall not include any judgments, fines, ERISA

excise taxes or penalties, or amounts paid in settlement of a Proceeding.

(g) “Final

Adjudication” and “finally adjudged” means a final judgment or other binding determination

from which there is no further procedural recourse, including without limitation following exhaustion or expiration of all available appeals.

(h) “Independent

Counsel” means a law firm, or a partner (or, if applicable, member) of such a law firm, that is experienced in relevant

matters of corporation law and neither currently is, nor in the past five years has been, retained to represent: (i) the Company

or Indemnitee in any matter material to either such party or (ii) any other party to or witness in the proceeding giving rise to

a claim for indemnification hereunder; provided however, that “Independent Counsel” shall not include any

person who, under the applicable standards of professional conduct then prevailing, would have a conflict of interest in representing

either the Company or Indemnitee in an action to determine Indemnitee’s rights under this Agreement. Where required by this Agreement, Independent

Counsel shall be retained at the Company’s sole expense.

(i) “Proceeding”

means any threatened, pending, or completed action, claim, demand, discovery request, subpoena, hearing, suit, arbitration, alternate

dispute resolution mechanism, investigation, administrative hearing, or any other proceeding whether formal or informal, civil, criminal,

administrative, or investigative, including any such investigation or proceeding instituted by or on behalf of the Company or its Board

of Directors, including any appeal of the foregoing, in which Indemnitee is or reasonably may be involved as a party or target, that

is associated with Indemnitee’s being an Agent of the Company.

(j) “Securities

Act” means the Securities Act of 1933, as amended.

(k) “Subsidiary”

means any corporation of which more than 50% of the outstanding voting securities is owned directly or indirectly by the Company, by the

Company and/or one or more other subsidiaries.

2. Agreement

to Serve. Indemnitee agrees to serve and/or continue to serve as an Agent of the Company, at its will (or under separate agreement,

if such agreement exists), in the capacity Indemnitee currently serves as an Agent of the Company, so long as Indemnitee is duly appointed

or elected and qualified in accordance with the applicable provisions of the Bylaws of the Company (“Bylaws”)

or any subsidiary of the Company or until such time as Indemnitee tenders his or her resignation in writing; provided, however,

that nothing contained in this Agreement is intended to create any right to continued employment or other service by Indemnitee.

3. Insurance.

(a) Maintenance

of D&O Insurance. The Company covenants and agrees that, so long as Indemnitee shall continue to serve as an Agent of the Company

and thereafter so long as Indemnitee shall be subject to any possible Proceeding by reason of the fact that Indemnitee was an Agent of

the Company, the Company, subject to Section 3(c), shall promptly obtain and maintain in full force and effect directors’

and officers’ liability insurance (“D&O Insurance”) in reasonable amounts from established and reputable

insurers of a minimum A.M. Best rating of A-VII, and as more fully described below. To the extent that the Company maintains an insurance

policy or policies providing liability insurance for directors, trustees, general partners, managing members, officers, employees, agents

or fiduciaries of the Company or other enterprise, Indemnitee shall be covered by such policy or policies to the same extent as the most

favorably-insured persons under such policy or policies in a comparable position.

(b) Limitations

on Required Maintenance of D&O Insurance. Notwithstanding the foregoing, the Company shall have no obligation to obtain or maintain

D&O Insurance at all, or of any type, terms, or amount, if the Company determines in good faith and after using commercially reasonable

efforts that: such insurance is not reasonably available; the premium costs for such insurance are disproportionate to the amount of coverage

provided; the coverage provided by such insurance is limited so as to provide an insufficient or unreasonable benefit; Indemnitee is covered

by similar insurance maintained by a subsidiary of the Company; or the Company is to be acquired and a tail policy of reasonable terms

and duration can be purchased for pre-closing acts or omissions by Indemnitee.

(c) Mandatory

Tail Policy. In the event of a Change in Control, the Company shall purchase, effective on such change in control, an extended reporting

period for a fixed period of six years thereafter (a “Tail Policy”). Such coverage shall be prepaid and non-cancellable.

Such coverage shall be placed with the incumbent insurance carriers or replacement carriers under terms equally as favorable to Indemnitee

and with carriers that have an A.M. Best FSR that is the same or better than the A.M. Best FSR of the incumbent insurers.

4. Mandatory

Indemnification. Subject to the terms of this Agreement:

(a) Third

Party Actions. If Indemnitee is a person who was or is a party or is threatened to be made a party to any Proceeding (other than an

action by or in the right of the Company) by reason of the fact that Indemnitee is or was an Agent of the Company, or by reason of anything

done or not done by Indemnitee in any such capacity, the Company shall indemnify Indemnitee against all Expenses and liabilities of any

type whatsoever (including, but not limited to, judgments, fines, ERISA excise taxes and penalties, and amounts paid in settlement) actually

and reasonably incurred by Indemnitee in connection with the investigation, defense, settlement or appeal of such Proceeding; provided that

Indemnitee acted in good faith and in a manner Indemnitee reasonably believed to be in or not opposed to the best interests of the Company,

and, with respect to any criminal action or Proceeding, had no reasonable cause to believe his or her conduct was unlawful.

(b) Derivative

Actions. If Indemnitee is a person who was or is a party or is threatened to be made a party to any Proceeding by or in the right

of the Company by reason of the fact that Indemnitee is or was an Agent of the Company, or by reason of anything done or not done by Indemnitee

in any such capacity, the Company shall indemnify Indemnitee against all Expenses actually and reasonably incurred by Indemnitee in connection

with the investigation, defense, settlement or appeal of such Proceeding; provided that Indemnitee acted in good faith

and in a manner Indemnitee reasonably believed to be in or not opposed to the best interests of the Company; except that no indemnification

under this Section 4(b) shall be made in respect to any claim, issue or matter as to which Indemnitee shall have

been finally adjudged to be liable to the Company by a court of competent jurisdiction that the Indemnitee is liable to the Company, unless

and only to the extent that the Delaware Court of Chancery or the court in which such Proceeding was brought shall determine upon application

that, despite the adjudication of liability but in view of all the circumstances of the case, Indemnitee is fairly and reasonably

entitled to indemnity for such amounts which the Delaware Court of Chancery or such other court shall deem proper.

(c) Actions

where Indemnitee is Deceased. If Indemnitee is a person who was or is a party or is threatened to be made a party to any Proceeding

by reason of the fact that Indemnitee is or was an Agent of the Company, or by reason of anything done or not done by Indemnitee in any

such capacity, and if, prior to, during the pendency of or after completion of such Proceeding Indemnitee is deceased, the Company shall

indemnify Indemnitee’s heirs, executors and administrators against all Expenses and liabilities of any type whatsoever to the extent

Indemnitee would have been entitled to indemnification pursuant to this Agreement were Indemnitee still alive.

(d) Certain

Terminations. The termination of any Proceeding or of any claim, issue, or matter therein by judgment, order, settlement, or conviction,

or upon a plea of nolo contendere or its equivalent, shall not (except as otherwise expressly provided in this Agreement)

of itself create a presumption that Indemnitee did not act in good faith and in a manner which Indemnitee reasonably believed to be in

or not opposed to the best interests of the Company or, with respect to any criminal action or Proceeding, that Indemnitee had reasonable

cause to believe that Indemnitee’s conduct was unlawful.

(e) Limitations.

Notwithstanding the foregoing provisions of Sections 4(a), 4(b), 4(c) and 4(d),

but subject to the exception set forth in Section 13 which shall control, the Company shall not be obligated to

indemnify the Indemnitee for Expenses or liabilities of any type whatsoever for which payment (and the Company’s indemnification

obligations under this Agreement shall be reduced by such payment) is actually made to or on behalf of Indemnitee, by the Company or otherwise,

under a corporate insurance policy, or under a valid and enforceable indemnity clause, right, by-law, or agreement; and, in the event

the Company has previously made a payment to Indemnitee for an Expense or liability of any type whatsoever for which payment is actually

made to or on behalf of the Indemnitee from any such source, Indemnitee shall return to the Company the amounts subsequently received

by the Indemnitee that source.

(f) Witness.

In the event that Indemnitee is not a party or threatened to be made a party to a Proceeding, but is subpoenaed (or given a written request

to be interviewed by or provide documents or information to a government authority of any jurisdiction) in such a Proceeding by reason

of the fact that the Indemnitee is or was an Agent of the Company, or by reason of anything witnessed or allegedly witnessed by the Indemnitee

in that capacity, the Company shall indemnify the Indemnitee against all actually and reasonably incurred out of pocket costs (including

without limitation legal fees) incurred by the Indemnitee in responding to such subpoena or written request for an interview. As a condition

to this right, Indemnitee must provide notice of such subpoena or request to the Company within 14 days, otherwise the Company’s

obligation to pay such costs shall only attach for costs incurred from the date of notice.

5. Indemnification

for Expenses in a Proceeding in Which Indemnitee is Wholly or Partly Successful.

(a) Successful

Defense. Notwithstanding any other provisions of this Agreement, to the extent Indemnitee has been successful, on the merits or otherwise,

in defense of any Proceeding (including, without limitation, an action by or in the right of the Company) in which Indemnitee was a party

by reason of the fact that Indemnitee is or was an Agent of the Company at any time, the Company shall indemnify Indemnitee against all

Expenses actually and reasonably incurred by or on behalf of Indemnitee in connection with the investigation, defense or appeal of such

Proceeding.

(b) Partially

Successful Defense. Notwithstanding any other provisions of this Agreement, to the extent that Indemnitee is a party to any Proceeding

(including, without limitation, an action by or in the right of the Company) in which Indemnitee was a party by reason of the fact that

Indemnitee is or was an Agent of the Company at any time and is successful, on the merits or otherwise, as to one or more but less than

all claims, issues or matters in such Proceeding, the Company shall indemnify Indemnitee against all Expenses actually and reasonably

incurred by or on behalf of Indemnitee in connection with each successfully resolved claim, issue or matter.

(c) Dismissal.

For purposes of this section and without limitation, the termination of any claim, issue or matter in such a Proceeding by dismissal,

with or without prejudice, shall be deemed to be a successful result as to such claim, issue or matter.

(d) Contribution.

If the indemnification provided in this Agreement is unavailable and may not be paid to Indemnitee, then to the extent allowed by law,

in respect of any threatened, pending or completed Proceeding in which the Company is jointly liable with Indemnitee (or would be if joined

in such Proceeding), the Company shall contribute to the amount of expenses (including attorneys’ fees), judgments, fines and amounts

paid in settlement actually and reasonably incurred and paid or payable by Indemnitee in such proportion as is appropriate to reflect

(i) the relative benefits received by the Company on the one hand and Indemnitee on the other hand from the transaction from which

such Proceeding arose, and (ii) the relative fault of Company on the one hand and of Indemnitee on the other in connection with the

events which resulted in such expenses, judgments, fines or settlement amounts, as well as any other relevant equitable considerations.

The relative fault of the Company on the one hand and of Indemnitee on the other shall be determined by reference to, among other things,

the parties' relative intent, knowledge, access to information, active or passive conduct, and opportunity to correct or prevent the circumstances

resulting in such expenses, judgments, fines or settlement amounts. The Company agrees that it would not be just and equitable if contribution

pursuant to this section were determined by pro rata allocation or any other method of allocation which does not take account of the foregoing

equitable considerations.

(e) Settlements

by Company. The Company may not settle any claim held by Indemnitee without express written consent of Indemnitee, which may be given

or withheld in Indemnitee’s sole discretion.

6. Mandatory

Advancement of Expenses.

(a) Subject

to the terms of this Agreement and following notice pursuant to Section 7(a) below, the Company shall advance, interest

free, all Expenses reasonably incurred by Indemnitee in connection with the investigation, defense, settlement or appeal of any Proceeding

to which Indemnitee is a party or is threatened to be made a party by reason of the fact that Indemnitee is or was an Agent of the Company

(unless there has been a Final Adjudication such that Indemnitee is not entitled to indemnification for such Expenses) upon receipt satisfactory

documentation supporting such Expenses. Such advances are intended to be an obligation of the Company to Indemnitee hereunder and shall

in no event be deemed to be a personal loan. Such advancement of Expenses shall otherwise be unsecured and without regard to Indemnitee’s

ability to repay. The advances to be made hereunder shall be paid by the Company to Indemnitee within 30 days following delivery of a

written request therefore by Indemnitee to the Company, along with such documentation and information as is reasonably available to the

Indemnitee and is reasonably necessary to determine whether and to what extent the claimant is entitled to advancement (which shall include

without limitation reasonably detailed invoices for legal services, but with disclosure of confidential work product not required if that

would work a waiver of privilege as to an adverse party). The Company shall discharge its advancement duty by, at its option, (a) paying

such Expenses on behalf of Indemnitee, (b) advancing to Indemnitee funds in an amount sufficient to pay such Expenses, or (c) reimbursing

Indemnitee for Expenses already paid by Indemnitee. In the event that the Company fails to pay Expenses as incurred by Indemnitee as required

by this paragraph, Indemnitee may seek mandatory injunctive relief (including without limitation specific performance) from any court

having jurisdiction to require the Company to pay Expenses as set forth in this paragraph. If Indemnitee seeks mandatory injunctive relief

pursuant to this paragraph, it shall not be a defense to enforcement of the Company’s obligations set forth in this paragraph that

Indemnitee has an adequate remedy at law for damages.

(b) Undertakings.

Indemnitee shall qualify for advances upon the execution and delivery to the Company of this Agreement, which constitutes an undertaking

whereby Indemnitee promises to repay any amounts advanced if and to the extent that it shall ultimately be determined that Indemnitee

is not entitled to indemnification by the Company.

7. Notice

and Other Indemnification Procedures.

(a) Notice

by Indemnitee. Promptly after receipt by Indemnitee of notice of the commencement of or the threat of commencement of any Proceeding, Indemnitee

shall, if Indemnitee believes that indemnification with respect thereto may be sought from the Company under this Agreement, notify the

Company in writing of the commencement or threat of commencement thereof provided, however, that a delay in giving

such notice will not deprive Indemnitee of any right to be indemnified under this Agreement unless, and then only to the extent that,

the Company did not otherwise learn of the Proceeding and such delay is materially prejudicial to the Company; provided, further,

that notice will be deemed to have been given without any action on the part of Indemnitee in the event the Company is a party to the

same Proceeding and already has notice of all the matters for which Indemnitee is demanding indemnification and advancement.

(b) Insurance.

If the Company receives notice pursuant to Section 7(a) of the commencement of a Proceeding that may be covered

under the Company’s directors’ and officers’ liability insurance (“D&O Insurance”) then

in effect, the Company shall give prompt notice of the commencement of such Proceeding to the insurers in accordance with the procedures

set forth in the respective policies. The Company shall thereafter take all necessary or desirable action to cause such insurers to pay,

on behalf of Indemnitee, all amounts payable as a result of such Proceeding in accordance with the terms of such policies. The Company

will instruct the insurers and their insurance brokers that they may communicate directly with Indemnitee regarding such claim.

(c) Defense.

In the event the Company shall be obligated to pay the Expenses of any Proceeding against Indemnitee, the Company shall be entitled to

assume the defense of such Proceeding, with counsel selected by the Company and approved by Indemnitee (which approval shall not be unreasonably

withheld), upon the delivery to Indemnitee of written notice of the Company’s election so to do. After delivery of such notice,

and the retention of such counsel by the Company, the Company will not be liable to Indemnitee under this Agreement for any fees of counsel

subsequently incurred by Indemnitee with respect to the same Proceeding; provided that (i) Indemnitee shall have

the right to employ his or her own counsel in any such Proceeding at Indemnitee’s expense; and (ii) Indemnitee shall have the

right to employ his or her own counsel in any such Proceeding at the Company’s expense if (A) the Company has authorized the

employment of counsel by Indemnitee at the expense of the Company; (B) Indemnitee shall have reasonably concluded based on the written

advice of Indemnitee’s legal counsel that there may be a conflict of interest between the Company and Indemnitee in the conduct

of any such defense; or (C) the Company shall not, in fact, have employed counsel to assume the defense of such Proceeding. In addition

to all the requirements above, if the Company has D&O Insurance, or other insurance, with a panel counsel requirement that may

cover the matter for which indemnity is claimed by Indemnitee, then Indemnitee shall use such panel counsel or other counsel approved

by the insurers, unless there is an actual conflict of interest posed by representation by all such counsel, or unless and to the extent Company

waives such requirement in writing. Indemnitee and his or her counsel shall provide reasonable cooperation with such insurer on request

of the Company.

8. Right

to Indemnification.

(a) Right

to Indemnification. In the event that Section 5(a) is inapplicable, the Company shall indemnify Indemnitee pursuant

to this Agreement unless, and except to the extent that, it shall have been determined by one of the methods listed in Section 8(b) that

Indemnitee has not met the applicable standard of conduct required to entitle Indemnitee to such indemnification.

(b) Determination

of Right to Indemnification. A determination of Indemnitee’s right to indemnification under this Section 8 shall

be made at the election: (i) by a majority vote of directors who are not parties to the Proceeding for which indemnification is being

sought, even though less than a quorum; (ii) by a committee of the Board consisting of directors who are not parties to the Proceeding

for which indemnification is being sought, who, even though less than a quorum, have been designated by a majority vote of the disinterested

directors; (iii) if there are no such disinterested directors or if the disinterested directors so direct, by Independent Counsel

chosen by the Company in a written opinion to the Board, a copy of which shall be delivered to Indemnitee; or (iv) by the Company’s

stockholders. However, in the event there has been a Change in Control, then the determination shall, at Indemnitee’s sole option,

be made by Independent Counsel. If it is determined that Indemnitee is entitled to indemnification, payment to Indemnitee shall be made

within ten days after such determination. Indemnitee shall cooperate with the person, persons or entity making the determination with

respect to Indemnitee’s entitlement to indemnification, including providing to such person, persons or entity upon reasonable advance

request any documentation or information that is not privileged or otherwise protected from disclosure and that is reasonably available

to Indemnitee and reasonably necessary to such determination. The Company will advance and pay any Expenses actually and reasonably incurred

by Indemnitee in so cooperating with the person, persons or entity making the indemnification determination irrespective of the determination

as to Indemnitee’s entitlement to indemnification and the Company hereby indemnifies and agrees to hold Indemnitee harmless therefrom.

In the event the determination of entitlement to indemnification is to be made by Independent Counsel pursuant to this Section 8(b),

such Independent Counsel shall be selected as follows: (i) if a Change in Control shall not have occurred, the Independent Counsel shall

be selected by the Board, and the Company shall give written notice to Indemnitee advising him or her of the identity of the Independent

Counsel so selected; and (ii) if a Change in Control shall have occurred, the Independent Counsel shall be selected by Indemnitee (unless

Indemnitee shall request that such selection be made by the Board, in which event the preceding sentence shall apply), and Indemnitee

shall give written notice to the Company advising it of the identity of the Independent Counsel so selected. In either event, Indemnitee

or the Company, as the case may be, may, within ten days after such written notice of selection shall have been given, deliver to the

Company or to Indemnitee, as the case may be, a written objection to such selection; provided, however, that such objection may be asserted

only on the ground that the Independent Counsel so selected does not meet the requirements of “Independent Counsel”

as defined in Section 1 of this Agreement, and the objection shall set forth with particularity the factual basis of such assertion. Absent

a proper and timely objection, the person so selected shall act as Independent Counsel. If such written objection is so made and substantiated,

the Independent Counsel so selected may not serve as Independent Counsel unless and until such objection is withdrawn or a court has determined

that such objection is without merit. The Company agrees to pay the reasonable fees and expenses of any Independent Counsel.

(c) Submission

for Decision. As soon as practicable, and in no event later than 30 days after Indemnitee’s written request for indemnification,

the Board shall select the method for determining Indemnitee’s right to indemnification. Indemnitee shall cooperate with the person

or persons or entity making such determination with respect to Indemnitee’s right to indemnification, including providing to such

person, persons or entity, upon reasonable advance request, any documentation or information which is not privileged or otherwise protected

from disclosure and which is reasonably available to Indemnitee and reasonably necessary to such determination. Any Independent Counsel

or member of the Board shall act reasonably and in good faith in making a determination regarding Indemnitee’s entitlement to indemnification

under this Agreement.

(d) Application

to Court. If (i) a claim for indemnification or advancement of Expenses is denied, in whole or in part, (ii) no disposition

of such claim is made by the Company within 60 days after the request therefore, (iii) the advancement of Expenses is not timely

made pursuant to Section 6 of this Agreement or (iv) payment of indemnification is not made pursuant to Section 5 of

this Agreement, Indemnitee shall have the right at his or her option to apply to the Delaware Court of Chancery, the court in which

the Proceeding is or was pending, or any other court of competent jurisdiction, for the purpose of enforcing Indemnitee’s right

to indemnification (including the advancement of Expenses) pursuant to this Agreement. Upon written request by Indemnitee, the Company

shall consent to service of process.

(e) Expenses

Related to the Enforcement or Interpretation of this Agreement. The Company shall indemnify Indemnitee against all reasonable Expenses

incurred by Indemnitee in connection with any hearing or proceeding under this Section 8 involving Indemnitee, and

against all reasonable Expenses incurred by Indemnitee in connection with any other proceeding between the Company and Indemnitee to the

extent involving the interpretation or enforcement of the rights of Indemnitee under this Agreement, if and to the extent Indemnitee is

successful.

(f) Determination

of Final Adjudication. In no event shall Indemnitee’s right to indemnification (apart from advancement of Expenses) be determined

prior to a Final Adjudication in a Proceeding at issue if the Proceeding is both ongoing, and of the nature to have a Final Adjudication,

unless a Final Adjudication in another Proceeding establishes that Indemnitee is not entitled to indemnification in the first Proceeding

(g) Standard.

In any proceeding to determine Indemnitee’s right to indemnification or advancement, Indemnitee shall be presumed to be entitled

to indemnification or advancement, with the burden of proof on the Company to prove, by a preponderance of the evidence (or higher standard

if required by relevant law) that Indemnitee is not so entitled.

(h) Good

Faith. Indemnitee shall be fully indemnified for those matters where, in the performance of his or her duties for the Company, he

or she relied in good faith upon the records of the Company and upon such information, opinions, reports or statements presented to the

Company by any of the Company’s officers or employees, or committees of the board of directors, or by any other person as to matters

Indemnitee reasonably believed were within such other person’s professional or expert competence and who was selected with reasonable

care by or on behalf of the Company.

9. Exceptions.

Any other provision herein to the contrary notwithstanding, the Company shall not be obligated:

(a) Claims

Initiated by Indemnitee. To indemnify or advance Expenses to Indemnitee with respect to Proceedings or claims initiated or brought

voluntarily by Indemnitee (including cross actions), with a reasonable allocation where appropriate, unless (i) such indemnification

is expressly required to be made by law, (ii) the Proceeding was authorized by the Board, (iii) such indemnification is provided

by the Company, in its sole discretion, pursuant to the powers vested in the Company under the DGCL or (iv) the Proceeding is brought

pursuant to Section 8 specifically to establish or enforce a right to indemnification under this Agreement or any

other statute or law or otherwise as required under Section 145 in advance of a Final Adjudication, in which case Section 8(e) provision

shall control. For clarity, the raising of defenses by the Company by way of argument or affirmative defenses in an Indemnitee-initiated

Proceeding against the Company shall not themselves be deemed to be a Proceeding.

(b) Fees

on Fees. To indemnify Indemnitee for any Expenses incurred by Indemnitee with respect to any Proceeding instituted by Indemnitee to

enforce or interpret this Agreement, to the extent Indemnitee is not successful in such a Proceeding.

(c) Unauthorized

Settlements. To indemnify Indemnitee under this Agreement for any amounts paid in settlement of a Proceeding unless the Company consents

to such settlement, which consent shall not be unreasonably withheld.

(d) Claims

Under Section 16(b). To indemnify Indemnitee for Expenses associated with any Proceeding related to, or the payment of profits

made from the purchase and sale (or sale and purchase) by Indemnitee of securities of the Company within the meaning of Section 16(b) of

the Exchange Act, or similar provisions of state statutory law or common law (provided, however, that the Company must advance Expenses

for such matters as otherwise permissible under this Agreement).

(e) Payments

Contrary to Law. To indemnify or advance Expenses to Indemnitee for which payment is prohibited by applicable law.

(f) Required

Reimbursement. To indemnify Indemnitee for any reimbursement of the Company by Indemnitee of any compensation, including bonus or

other incentive-based or equity-based compensation or of any profits realized by Indemnitee from the sale of securities of the Company,

in either case as required under any clawback or compensation recovery policy adopted by the Company, applicable securities exchange and

association listing requirements, including, without limitation, those adopted in accordance with Rule 10D 1 under the Securities Exchange

Act of 1934, as amended, and/or the Securities Exchange Act of 1934, as amended (including, without limitation, any such reimbursements

that arise from an accounting restatement of the Company pursuant to Section 304 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley

Act”), or the payment to the Company of profits arising from the purchase and sale by Indemnitee of securities in violation

of Section 306 of the Sarbanes-Oxley Act), if Indemnitee is held liable therefor, including pursuant to any settlement arrangements (provided,

however, that the Company must advance Expenses for such matters otherwise permissible under this Agreement).

10. Non-Exclusivity.

The provisions for indemnification and advancement of Expenses set forth in this Agreement shall not be deemed exclusive of any other

rights which Indemnitee may have under any provision of law, the Company’s Certificate of Incorporation or Bylaws, the vote of the

Company’s stockholders or disinterested directors, other agreements, or otherwise, both as to action in Indemnitee’s official

capacity and as to action in another capacity while occupying Indemnitee’s position as an Agent of the Company. Indemnitee’s

rights hereunder shall continue after Indemnitee has ceased acting as an Agent of the Company and shall inure to the benefit of the heirs,

executors and administrators of Indemnitee. This Agreement shall supersede all prior indemnification agreements with the Company; provided, Indemnitee

is entitled to any advancement or indemnification rights (pursuant to the Company’s Certificate of Incorporation, Bylaws, a prior

indemnification agreement, or other agreement) in effect at the time of Indemnitee’s service that is at issue in the matter potentially

subject to indemnification, to the extent such rights are more favorable to Indemnitee than those granted herein. To the extent any portion

of this Agreement, or this entire Agreement, providing rights to Indemnitee is deemed invalid or not enforceable for any reason, the relevant

terms of any prior indemnification agreement with Indemnitee will remain effective.

11. Permitted

Defenses. It shall be a defense to any action for which a claim for indemnification is made under this Agreement (other than an action

brought to enforce a claim for Expenses pursuant to Section 6; provided that the required documents

have been tendered to the Company) that Indemnitee is not entitled to indemnification because of the limitations set forth in Sections 4 and 9 .

Neither the failure of the Company or an Independent Counsel to have made a determination prior to the commencement of such enforcement

action that indemnification of Indemnitee is proper in the circumstances, nor an actual determination by the Company or an Independent

Counsel that such indemnification is improper, shall be a defense to the action or create a presumption that Indemnitee is not entitled

to indemnification under this Agreement or otherwise. In making any determination concerning Indemnitee’s right to indemnification,

there shall be a presumption that Indemnitee has satisfied the applicable standard of conduct. Any determination by the Company concerning

Indemnitee’s right to indemnification that is adverse to Indemnitee may be challenged by the Indemnitee in the Court of Chancery

of the State of Delaware.

12. Subrogation.

Subject to the limitations of Section 13, in the event the Company is obligated to make a payment under this Agreement,

the Company shall be subrogated to the extent of such payment to all of the rights of recovery of Indemnitee, who shall execute all documents

reasonably required and take all action that may be necessary to secure such rights and to enable the Company effectively to bring suit

to enforce such rights (provided that the Company pays Indemnitee’s costs and expenses of doing so), including without limitation

by assigning all such rights to the Company or its designee to the extent of such indemnification or advancement of Expenses. Subject

to the limitations of Section 13, the Company’s obligation to indemnify or advance expenses under this Agreement

shall be reduced by any amount Indemnitee has collected from such other source, and in the event that Company has fully paid such indemnity

or expenses, Indemnitee shall return to the Company any amounts subsequently received from such other source of indemnification.

13. Primacy

of Indemnification. The Company acknowledges that Indemnitee may have certain rights to indemnification, advancement of expenses,

or liability insurance, neither procured or provided by the Company (including for this section any parent, affiliate, subsidiary, investment

vehicle, or joint venture of the Company) nor any entity Indemnitee served or is serving at the direction of the Company, from a third

party (collectively, the “Third Party Indemnitors”). The Company agrees that (i) it is the indemnitor of

first resort, i.e., its obligations to Indemnitee under this Agreement and any indemnity provisions set forth in its Certificate

of Incorporation, Bylaws or elsewhere (collectively, “Indemnity Arrangements”) are primary, and any obligation

of the Third Party Indemnitors to advance expenses or to provide indemnification for the same expenses or liabilities incurred by Indemnitee

is secondary and excess, (ii) it shall advance the full amount of expenses incurred by Indemnitee and shall be liable for the full

amount of all expenses, judgments, penalties, fines and amounts paid in settlement by or on behalf of Indemnitee, to the extent legally

permitted and as required by any Indemnity Arrangement, without regard to any rights Indemnitee may have against the Third Party Indemnitors,

and (iii) it irrevocably waives, relinquishes and releases the Third Party Indemnitors from any claims against the Third Party Indemnitors

for contribution, subrogation or any other recovery of any kind arising out of or relating to any Indemnity Arrangement. The Company further

agrees that no advancement or indemnification payment by any Third Party Indemnitor on behalf of Indemnitee shall affect the foregoing,

and the Third Party Indemnitors shall be subrogated to the extent of such advancement or payment to all of the rights of recovery of Indemnitee

against the Company. The Company and Indemnitee agree that the Third Party Indemnitors are express third party beneficiaries of the terms

of this Section 13. The Company, on its own behalf and on behalf of its insurers to the extent allowed by its insurance

policies, waives subrogation rights against Indemnitee and Third Party Indemnitors.

14. No

Imputation. The knowledge or actions, or failure to act, of any director, officer, employee, or agent of the Company, or the Company

itself shall not be imputed to Indemnitee for the purpose of determining Indemnitee’s rights hereunder.

15. Survival

of Rights.

(a) All

agreements and obligations of the Company contained herein shall continue during the period Indemnitee is an Agent of the Company and

shall continue thereafter so long as Indemnitee shall be subject to any possible claim or threatened, pending or completed Proceeding

by reason of the fact that Indemnitee was serving in the capacity referred to herein.

(b) The

Company shall require any successor to the Company (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all

or substantially all of the business or assets of the Company, expressly to assume and agree to perform this Agreement in the same manner

and to the same extent that the Company would be required to perform if no such succession had taken place.

16. Severability.

If any provision or provisions of this Agreement shall be held to be invalid, illegal or unenforceable for any reason whatsoever, (i) the

validity, legality and enforceability of the remaining provisions of the Agreement (including, without limitation, all portions of any

paragraphs of this Agreement containing any such provision held to be invalid, illegal or unenforceable, that are not themselves invalid,

illegal, or unenforceable) shall not in any way be affected or impaired thereby, and (ii) to the fullest extent possible, such remaining

provisions shall be construed so as to give effect to the intent manifested by the provision held invalid, illegal, or unenforceable.

17. Modification

and Waiver. No supplement, modification, or amendment of this Agreement shall be binding unless it is in a writing signed by both

of the parties hereto. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of any other

provisions (even if similar) nor shall such waiver constitute a continuing waiver.

18. Notice.

All notices, requests, demands and other communications under this Agreement shall be in writing and shall be deemed to have been duly

given (a) upon delivery if delivered by hand to the party to whom such notice or other communication shall have been directed, (b) if

mailed by certified or registered mail with postage prepaid, return receipt requested, on the third business day after the date on which

it is so mailed, (c) one (1) business day after the business day of deposit with a nationally recognized overnight delivery

service, specifying next day delivery, with written verification of receipt, or (d) on the same day as delivered by electronic

transmission if delivered during business hours or on the next successive business day if delivered by electronic transmission after business

hours. Addresses for notice to either party shall be as shown on the signature page of this Agreement, or to such other address as

may have been furnished by either party in the manner set forth above.

19. Governing

Law. This Agreement shall be governed exclusively by and construed according to the laws of the State of Delaware as applied to contracts

between Delaware residents entered into and to be performed entirely within Delaware. This Agreement is intended to be an agreement of

the type contemplated by Section 145(f) of the DGCL.

20. Counterparts.

This Agreement may be executed in one or more counterparts, each of which shall for all purposes be deemed to be an original but all of

which together shall constitute one and the same Agreement, and electronically transmitted signatures shall be valid.

(Signature page follows)

The parties hereto have entered

into this Indemnification Agreement, including the undertaking contained herein, effective as of the date first above written.

| Company: |

|

| |

|

| AKOYA BIOSCIENCES, INC. |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

v3.24.3

Cover

|

Dec. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 11, 2024

|

| Entity File Number |

001-40344

|

| Entity Registrant Name |

Akoya

Biosciences, Inc.

|

| Entity Central Index Key |

0001711933

|

| Entity Tax Identification Number |

47-5586242

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

Campus Drive

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, City or Town |

Marlborough

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01752

|

| City Area Code |

855

|

| Local Phone Number |

896-8401

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.00001 per share

|

| Trading Symbol |

AKYA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

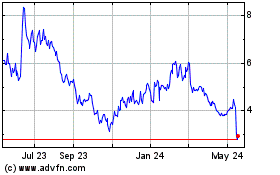

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Nov 2024 to Dec 2024

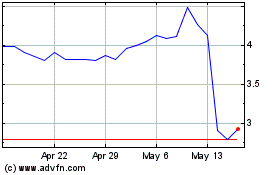

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Dec 2023 to Dec 2024