Akoya Reports Record Revenue in the Third Quarter of 2023 and Reiterates Full Year 2023 Revenue Guidance

November 08 2023 - 4:00PM

Akoya Biosciences, Inc. (Nasdaq: AKYA) (“Akoya”), The Spatial

Biology Company®, today announced its financial results for the

third quarter ending September 30, 2023.

"Akoya delivered strong financial performance in the third

quarter with another record revenue quarter while maintaining

operating expenses at a steady or reduced level, solidifying the

path towards achieving positive cash flow," explained Brian

McKelligon, Chief Executive Officer of Akoya Biosciences. "We are

executing on our plan to improve workflow throughput, with the

ongoing 2.0 instrument field upgrades across the industry's largest

installed base and by expanding our menu of ready-to-use panels.

Akoya is strategically positioned to scale spatial biology by

setting the standard in the industry."

Third Quarter 2023 Financial Highlights

- Total revenue was $25.2 million

in the third quarter of 2023, compared to $18.9 million in the

prior year period; an increase of 34%.

- Product revenue (which includes

instruments, reagents, and software) was $18.0 million in the third

quarter of 2023, compared to $14.4 million in the prior year

period; an increase of 25%.

- Instrument revenue was $12.0

million, compared to $9.5 million in the prior year period; an

increase of 27%.

- Reagent revenue was $5.7 million,

compared to $4.7 million in the prior year period; an increase of

21%.

- Service and other revenue totaled

$7.2 million in the third quarter of 2023, compared to $4.4 million

in the prior year period; an increase of 62%.

- Gross profit was $15.3 million in

the third quarter of 2023, compared to $10.9 million in the prior

year period; an increase of 40%.

- Gross profit margin was 60.6% in

the third quarter of 2023, compared to 57.9% in the prior year

period.

- $78.6 million of cash and cash

equivalents as of September 30, 2023, with $11.3 million in

additional debt capacity.

Third Quarter 2023 Business Highlights

- 69 instruments were sold in the

third quarter of 2023: 27 PhenoCyclers, 42 PhenoImagers (which

includes Fusion and HT), compared to 55 instruments sold in the

prior year period (17 PhenoCyclers, 38 PhenoImagers).

- Instrument installed base of

1,132 as of September 30, 2023 (327 PhenoCyclers, 805

PhenoImagers), compared to an installed base of 863 in the prior

year period (229 PhenoCyclers, 634 PhenoImagers); an increase of

31%.

- Combined-unit PhenoCycler-Fusion

installed base of 186 as of September 30, 2023, compared to 72 in

the prior year period.

- 1,070 total publications citing

Akoya’s technology as of September 30, 2023, compared to 691 total

publications in the prior year period: an increase of 55%.

- The University of Queensland and

Akoya Biosciences have comprehensively mapped the spatial proteome

of head and neck squamous cell carcinoma (HNSCC) using

ultrahigh-plex phenotyping (100+ protein biomarkers) on the

PhenoCycler-Fusion, as published in an article in the inaugural

issue of GEN Biotechnology.

- Ongoing Fusion 2.0 and HT 2.0

field upgrades with rolling launch of new ready-to-use PhenoCode

Panels.

- Showcased Akoya’s new 2.0

solutions, data, and applications at the 2023 Society for

Immunotherapy of Cancer (SITC) conference held November 1-5 in San

Diego, CA.

YTD 2023 Financial and Business Highlights

- Total revenue was $70.1 million

YTD as of September 30, 2023, compared to $53.6 million in the

prior year period; an increase of 31%.

- Product revenue was $50.7 million

YTD as of September 30, 2023, compared to $41.9 million in the

prior year period; an increase of 21%.

- Services and other revenue

totaled $19.4 million YTD as of September 30, 2023, compared to

$11.7 million in the prior year period; an increase of 66%.

- Gross profit was $39.7 million

YTD as of September 30, 2023, compared to $31.3 million in the

prior year period and gross profit margin was 56.6% YTD as of

September 30, 2023, compared to 58.4% in the prior year

period.

- 198 instruments were sold YTD as

of September 30, 2023; 73 PhenoCyclers, 125 PhenoImagers, compared

to 166 instruments sold in the prior year period; an increase of

19%.

2023 Financial Outlook

The Company, based on its current plans and initiatives,

continues to expect full year 2023 revenue in the range of $95-98

million.

Webcast and Conference Call Details

Akoya will host a conference call today, November 8, 2023, at

5:00 p.m. Eastern Time to discuss its third quarter 2023 financial

results. Investors interested in listening to the conference call

are required to register online. A live webcast of the conference

call will be available on the “Investors” section of the Company's

website at https://investors.akoyabio.com/. The webcast will be

archived on the website following the completion of the call for

three months.

Forward-Looking Statements

This press release contains forward-looking statements that are

based on management’s beliefs and assumptions and on information

currently available to management. All statements contained in this

release other than statements of historical fact are

forward-looking statements, including expectations regarding our

ability to market and sell our PhenoCycler and PhenoImager

platforms and our other products and services, our ability to

increase awareness of spatial biology technology, our ability to

execute on our plans and expectations, our research and development

efforts and other matters regarding our business strategies, future

performance, use of capital, results of operations and financial

position and plans and objectives for future operations.

In some cases, you can identify forward-looking statements by

the words “may,” “will,” “could,” “would,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,”

“project,” “potential,” “continue,” “ongoing” or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. These statements

involve risks, uncertainties and other factors that may cause

actual results, levels of activity, performance, or achievements to

be materially different from the information expressed or implied

by these forward-looking statements. These risks, uncertainties and

other factors are described under "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of

Operations" and elsewhere in the documents we file with the

Securities and Exchange Commission from time to time. We caution

you that forward-looking statements are based on a combination of

facts and factors currently known by us and our projections of the

future, about which we cannot be certain. As a result, the

forward-looking statements may not prove to be accurate. The

forward-looking statements in this press release represent our

views as of the date hereof. We undertake no obligation to update

any forward-looking statements for any reason, except as required

by law.

About Akoya Biosciences

As The Spatial Biology Company®, Akoya Biosciences’ mission is

to bring context to the world of biology and human health through

the power of spatial phenotyping. The Company offers comprehensive

single-cell imaging solutions that allow researchers to phenotype

cells with spatial context and visualize how they organize and

interact to influence disease progression and response to therapy.

Akoya offers a full continuum of spatial phenotyping solutions to

serve the diverse needs of researchers across discovery,

translational and clinical research: PhenoCode™ Panels and

PhenoCycler®, PhenoImager® Fusion and PhenoImager HT Instruments.

To learn more about Akoya, visit www.akoyabio.com.

Investor Contact:

Priyam ShahSr. Director, Investor RelationsAkoya

Biosciencesinvestors@akoyabio.com

Media Contact:

Christine Quern617-650-8497media@akoyabio.com

|

AKOYA BIOSCIENCES, INC. AND SUBSIDIARYCondensed

Consolidated Balance Sheets (unaudited)(in

thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

September 30, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

78,595 |

|

|

$ |

74,229 |

|

|

Marketable securities |

|

|

— |

|

|

|

6,989 |

|

|

Accounts receivable, net |

|

|

16,096 |

|

|

|

9,729 |

|

|

Inventories, net |

|

|

18,752 |

|

|

|

14,486 |

|

|

Prepaid expenses and other current assets |

|

|

3,505 |

|

|

|

6,764 |

|

| Total current assets |

|

|

116,948 |

|

|

|

112,197 |

|

| Property and equipment,

net |

|

|

10,843 |

|

|

|

10,174 |

|

| Demo inventory, net |

|

|

1,305 |

|

|

|

2,084 |

|

| Intangible assets, net |

|

|

18,123 |

|

|

|

20,048 |

|

| Goodwill |

|

|

18,262 |

|

|

|

18,262 |

|

| Operating lease right of use

assets, net |

|

|

9,003 |

|

|

|

10,785 |

|

| Financing lease right of use

assets, net |

|

|

1,776 |

|

|

|

1,490 |

|

| Other non-current assets |

|

|

984 |

|

|

|

991 |

|

| Total assets |

|

$ |

177,244 |

|

|

$ |

176,031 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

25,084 |

|

|

$ |

27,147 |

|

|

Current portion of operating lease liabilities |

|

|

2,790 |

|

|

|

3,009 |

|

|

Current portion of financing lease liabilities |

|

|

799 |

|

|

|

620 |

|

| Deferred revenue |

|

|

6,850 |

|

|

|

6,279 |

|

| Total current liabilities |

|

|

35,523 |

|

|

|

37,055 |

|

| Deferred revenue, net of

current portion |

|

|

2,782 |

|

|

|

2,114 |

|

| Long-term debt, net |

|

|

63,818 |

|

|

|

63,277 |

|

| Contingent consideration

liability, net of current portion |

|

|

5,255 |

|

|

|

6,039 |

|

| Operating lease liabilities,

net of current portion |

|

|

6,752 |

|

|

|

8,203 |

|

| Financing lease liabilities,

net of current portion |

|

|

914 |

|

|

|

675 |

|

| Other long-term

liabilities |

|

|

227 |

|

|

|

87 |

|

| Total liabilities |

|

|

115,271 |

|

|

|

117,450 |

|

| Total stockholders'

equity |

|

|

61,973 |

|

|

|

58,581 |

|

| Total liabilities and

stockholders' equity |

|

$ |

177,244 |

|

|

$ |

176,031 |

|

|

AKOYA BIOSCIENCES, INC. AND SUBSIDIARYConsolidated

Statements of Operations (unaudited)(in

thousands, except share and per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 30, |

|

September 30, |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue |

|

$ |

18,048 |

|

|

$ |

14,438 |

|

|

$ |

50,719 |

|

|

$ |

41,942 |

|

|

Service and other revenue |

|

|

7,167 |

|

|

|

4,414 |

|

|

|

19,427 |

|

|

|

11,698 |

|

| Total revenue |

|

|

25,215 |

|

|

|

18,852 |

|

|

|

70,146 |

|

|

|

53,640 |

|

| Cost of goods sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product revenue |

|

|

6,208 |

|

|

|

5,455 |

|

|

|

19,747 |

|

|

|

14,733 |

|

|

Cost of service and other revenue |

|

|

3,731 |

|

|

|

2,490 |

|

|

|

10,714 |

|

|

|

7,563 |

|

| Total cost of goods sold |

|

|

9,939 |

|

|

|

7,945 |

|

|

|

30,461 |

|

|

|

22,296 |

|

| Gross profit |

|

|

15,276 |

|

|

|

10,907 |

|

|

|

39,685 |

|

|

|

31,344 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

19,017 |

|

|

|

19,922 |

|

|

|

63,483 |

|

|

|

58,705 |

|

|

Research and development |

|

|

5,173 |

|

|

|

5,466 |

|

|

|

17,219 |

|

|

|

16,778 |

|

|

Change in fair value of contingent consideration |

|

|

262 |

|

|

|

357 |

|

|

|

1,019 |

|

|

|

(599 |

) |

|

Depreciation and amortization |

|

|

2,375 |

|

|

|

1,815 |

|

|

|

6,193 |

|

|

|

4,975 |

|

|

Total operating expenses |

|

|

26,827 |

|

|

|

27,560 |

|

|

|

87,914 |

|

|

|

79,859 |

|

| Loss from operations |

|

|

(11,551 |

) |

|

|

(16,653 |

) |

|

|

(48,229 |

) |

|

|

(48,515 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,239 |

) |

|

|

(1,109 |

) |

|

|

(6,468 |

) |

|

|

(2,707 |

) |

|

Interest income |

|

|

1,074 |

|

|

|

136 |

|

|

|

2,576 |

|

|

|

212 |

|

|

Other expense, net |

|

|

(185 |

) |

|

|

(225 |

) |

|

|

(338 |

) |

|

|

(607 |

) |

| Loss before provision for

income taxes |

|

|

(12,901 |

) |

|

|

(17,851 |

) |

|

|

(52,459 |

) |

|

|

(51,617 |

) |

| Provision for income

taxes |

|

|

(15 |

) |

|

|

(21 |

) |

|

|

(62 |

) |

|

|

(149 |

) |

| Net loss |

|

$ |

(12,916 |

) |

|

$ |

(17,872 |

) |

|

$ |

(52,521 |

) |

|

$ |

(51,766 |

) |

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.26 |

) |

|

$ |

(0.47 |

) |

|

$ |

(1.23 |

) |

|

$ |

(1.37 |

) |

| Weighted-average shares

outstanding, basic and diluted |

|

|

48,975,432 |

|

|

|

37,900,821 |

|

|

|

42,686,065 |

|

|

|

37,660,814 |

|

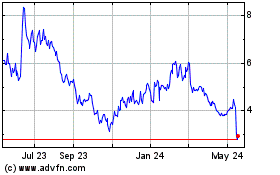

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

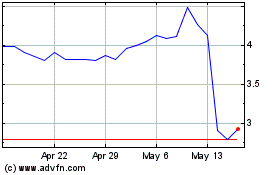

Akoya BioSciences (NASDAQ:AKYA)

Historical Stock Chart

From Feb 2024 to Feb 2025