Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS)

today reported its financial and operating results for the fourth

quarter and year ended December 31, 2018.

All Amounts are in U.S. Dollars

Highlights

- Total revenue for fiscal 2018 was $26.9 million, compared to

$0.9 million for fiscal 2017

- Income from operations for fiscal 2018 was $9.8 million,

compared to a loss from operations of $23.1 million for fiscal

2017

- Net income for fiscal 2018 was $4.2 million, compared to a net

loss of $16.8 million for fiscal 2017

- Total revenue for Q4 2018 was $1.4 million, compared to $0.2

million for Q4 2017

- After our year-end, in January 2019, European Medicines Agency

(EMA) granted marketing authorization for macimorelin for diagnosis

of adult growth hormone deficiency

- As of December 31, 2018, we had $14.5 million of unrestricted

cash and cash equivalents

Summary of Full-Year

Results

For the year ended December 31, 2018, we

reported a consolidated net income of $4.2 million, or $0.25 per

common share, as compared with a consolidated net loss of $16.8

million, or $1.12 loss per common share, for the year ended

December 31, 2017. The $21 million improvement in results

arose primarily from a $23.9 million increase in gross profit

(which resulted primarily from the $24 million royalty payment

received from Strongbridge Biopharma) and a $9.1 million reduction

in operating expenses. These improvements were offset in part

by the $5.55 million in tax expense in 2018 (compared to a tax

recovery in 2017 of $3.5 million) and $1.6 million decrease in net

finance income.

Revenues

Our total revenue for the year ended December

31, 2018 was $26.9 million as compared with $0.9 million for the

same period in 2017, representing an increase of $26.0 million. The

2018 revenue comprised $24.3 million in license revenue, $2.2

million in product sales, $0.2 million in royalty income and $0.2

million in sales commissions as compared with $0.4 million in

license fee and $0.5 million in license fees in 2017. The increase

in total revenue in 2018 relates to license fees, royalty income

and product sales associated with executing the License and

Assignment Agreement for Macrilen™ (macimorelin) in January

2018.

Cost of sales

Our total cost of goods sold for the year ended

December 31, 2018 was $2.1 million as compared with nil for the

same period in 2017, reflecting the costs of our sales of Macrilen™

(macimorelin) inventory pursuant to an interim supply agreement

under the License and Assignment Agreement.

Operating Expenses

Our total operating expenses for the year ended

December 31, 2018 was $14.9 million as compared with $24.0 million

for the same period in 2017, representing a decline of $9.1

million. This was primarily due to a $7.8 million decline in

research and development costs, while the $2.0 million decrease in

selling expenses was offset by $0.1 million increase in general and

administrative expenses.

In 2018, our focus was on our PIP study for

Macrilen™ (macimorelin), for which we received $0.4 million from

our licensee for its share of such costs.

Our general and administrative expenses were

higher in 2018 than expected as we incurred significant legal costs

in the course of reaching settlement agreements for $1.4

million.

Our selling expenses are in-line with

expectations and lower in 2018 than in 2017 due to the Q1 2018

termination of our North American sales team and our co-promotion

activities as we shifted our focus to licensing Macrilen™

(macimorelin).

Net Finance Income

Our net finance income for the year ended

December 31, 2018 was $1.2 million, as compared to $2.8 million for

the same period in 2017, representing a decrease of $1.6 million.

The decline in net finance income is primarily due to the change in

fair value of our warrant liability. Such change in fair value

results from the periodic "mark-to-market" revaluation via the

application of pricing models to our outstanding share purchase

warrants.

Summary of Fourth Quarter

Results

For the three-month period ended December 31,

2018, we reported a consolidated net loss of $5.1 million, or $0.31

loss per common share, as compared with a consolidated net loss of

$0.5 million, or $0.03 loss per common share, for the three-month

period ended December 31, 2017. The $4.6 million increase in net

loss in 2018, as compared with 2017, results primarily from $2.8

million in tax expense movement, $1.4 million increase in cost of

goods, $0.9 million increase in finance costs and $0.8 million

increase in settlements, offset by $1.2 million increase in total

revenues. In the fourth quarter of 2018, unlike in 2017, we earned

$0.2 million in royalty income from our licensee and expensed $0.8

million in one-time settlement costs to settle a lawsuit against

the Company from two of our former executives. In the fourth

quarter of 2018 we also actively began the EMA and FDA pediatric

study for Macrilen™ (macimorelin).

Consolidated Financial Statements and

Management’s Discussion and Analysis

For reference, the Management’s Discussion and

Analysis of Financial Condition and Results of Operations for the

fourth quarter and fiscal 2018, as well as the Company’s audited

consolidated financial statements as at December 31, 2018, 2017 and

for the years ended December 31, 2018, 2017 and 2016 will be

available at www.zentaris.com in the "Investors" section or at

the Company’s profile at www.sedar.com and www.sec.gov.

Annual and Special Meeting of

Shareholders

The Company has scheduled its annual

shareholders meeting for 10:00 am (Eastern time) on May 8, 2019 at

1155 René-Lévesque Blvd. West, 41st Floor, Montreal, Quebec. At

that meeting, in addition to the presentation of the Company’s

annual financial statements, the election of directors and the

appointment of the Company’s auditors, shareholders will also

consider resolutions to move the Company’s registered address from

Quebec to Ontario, and to renew and amend the Company’s existing

shareholders rights plan. These matters are described in

detail in the Company’s 2019 Management Proxy Circular. This

proxy circular and a copy of the proposed amended and restated

shareholders rights plan will be available at www.sedar.com and

www.sec.gov.

At the Company’s 2019 annual and special

meeting, the Company will be proposing that the size of its board

of directors be reduced from seven to five, with Mr. Mike Cardiff

having resigned from the board of directors for personal reasons in

March 2019 and Mr. Juergen Ernst having indicated to the Company

his desire not to be nominated for re-election. The Company

thanks both of them for their service to the Company.

About Aeterna Zentaris Inc.

Aeterna Zentaris Inc. is a specialty

biopharmaceutical company focused on commercializing novel

pharmaceutical therapies, principally through out-licensing

arrangements. Aeterna Zentaris is a party to a license and

assignment agreement with a subsidiary of Novo Nordisk A/S to carry

out development, manufacturing, registration and commercialization

of Macrilen™ (macimorelin) in the United States and Canada.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined by applicable securities legislation) made

pursuant to the safe-harbor provision of the U.S. Securities

Litigation Reform Act of 1995, which reflect our current

expectations regarding future events. Forward-looking statements

may include, but are not limited to statements preceded by,

followed by, or that include the words "will," "expects,"

"believes," "intends," "would," "could," "may," "anticipates," and

similar terms that relate to future events, performance, or our

results. Forward-looking statements involve known and unknown risks

and uncertainties, including those discussed in this press release

and in our Annual Report on Form 20-F, under the caption "Key

Information -Risk Factors" filed with the relevant Canadian

securities regulatory authorities in lieu of an annual information

form and with the U.S. Securities and Exchange Commission. Known

and unknown risks and uncertainties could cause our actual results

to differ materially from those in forward-looking statements. Such

risks and uncertainties include, among others, our now heavy

dependence on the success of Macrilen™ (macimorelin) and related

out-licensing arrangements and the continued availability of funds

and resources to successfully launch the product, our strategic

review process, the ability of the Special Committee to carry out

its mandate, the ability of Aeterna Zentaris to enter into

out-licensing, development, manufacturing and marketing and

distribution agreements with other pharmaceutical companies and

keep such agreements in effect, reliance on third parties for the

manufacturing and commercialization of our product candidates,

potential disputes with third parties, leading to delays in or

termination of the manufacturing, development, out-licensing or

commercialization of our product candidates, or resulting in

significant litigation or arbitration, and, more generally,

uncertainties related to the regulatory process, our ability to

efficiently commercialize or out-license Macrilen™ (macimorelin),

the degree of market acceptance of Macrilen™ (macimorelin), our

ability to obtain necessary approvals from the relevant regulatory

authorities to enable us to use the desired brand names for our

products, the impact of securities class action litigation or other

litigation on our cash flow, results of operations and financial

position, our ability to take advantage of business opportunities

in the pharmaceutical industry, our ability to protect our

intellectual property, the potential of liability arising from

shareholder lawsuits and general changes in economic conditions.

Investors should consult our quarterly and annual filings with the

Canadian and U.S. securities commissions for additional information

on risks and uncertainties. Given these uncertainties and risk

factors, readers are cautioned not to place undue reliance on these

forward-looking statements. We disclaim any obligation to update

any such factors or to publicly announce any revisions to any of

the forward-looking statements contained herein to reflect future

results, events or developments, unless required to do so by a

governmental authority or applicable law.

Contact:

Leslie Auld

Chief Financial Officer

Aeterna Zentaris Inc.

IR@aezsinc.com

(843) 900-3211

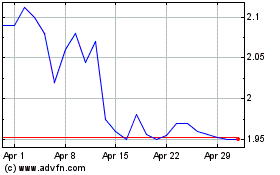

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

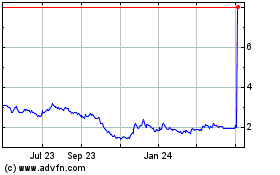

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024