Dendreon and AEternaZentaris Look for Stronger Performance in 2012

January 05 2012 - 8:16AM

Marketwired

The always volatile biotechnology industry had its share of winners

and losers last year. Overall, the biotech space was up more than 9

percent in 2011, CNBC reports. However several firms struggled

immensely over the last year as disappointing revenues and FDA

disappointments weighed down shares of several biotech companies.

The BedfordReport examines the outlook for companies in the

biotechnology industry and provides investment research onDendreon

Corporation (NASDAQ: DNDN) and AEternaZentaris, Inc. (NASDAQ: AEZS)

(TSX: AEZ). Access to the full company reports can be found at:

www.bedfordreport.com/DNDN

www.bedfordreport.com/AEZS

AEternaZentaris Inc. operates as a late-stage drug development

company specialized in oncology and endocrine therapy. The

Company's pipeline encompasses compounds at all stages of

development, from drug discovery through to marketed products. Last

week the company announced that its Japanese partner, Yakult Honsha

initiated a Phase 1/2 trial in Japan to assess the safety and

efficacy of the Company's PI3K/Akt inhibitor, perifosine, in

combination with chemotherapeutic agent, capecitabine, in patients

with refractory advanced colorectal cancer.

Last month AEternaZentaris had reported encouraging clinical

data for an ongoing Phase 2 clinical study for Perifosine in

patients with refractory/relapsed Hodgkin Lymphoma.

The Bedford Report releases stock research on the Biotechnology

industry so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.bedfordreport.com and get exclusive

access to our numerous stock reports and industry newsletters.

Shares of Dendreon struggled last year as demand for its $93,000

prostate cancer drug, Provenge, was not as strong as expected.

Last month Dendreon agreed to sell its royalty interest related

to intellectual property licensed to Schering-Plough Ltd. and

Schering Corporation and associated with VICTRELIS (boceprevir), a

treatment for chronic hepatitis C, for $125 million in cash. "The

sale of the VICTRELIS royalty interest allows the Company to

strengthen our cash position, and enables us to further invest in

our core business initiatives," said Greg Schiffman, executive vice

president and chief financial officer

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned companies. We act as an independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

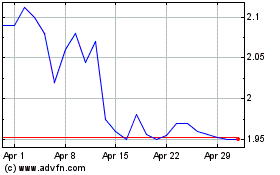

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jun 2024 to Jul 2024

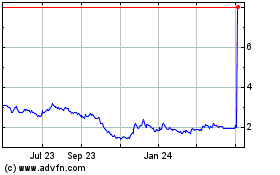

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Jul 2023 to Jul 2024