Filed by Aerovate Therapeutics, Inc.

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Aerovate Therapeutics, Inc.

Commission File No.: 001-40544

Date: October 31, 2024

This filing relates to the proposed transaction

pursuant to the terms of that certain Agreement and Plan of Merger, dated as of October 30, 2024, by and among Aerovate Therapeutics,

Inc., an Delaware corporation (“Aerovate”), Jade Biosciences, Inc., a Delaware corporation (“Jade”), Caribbean

Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of Aerovate (“Merger Sub I”), and Caribbean Merger

Sub II, LLC, a Delaware limited liability company and a wholly owned subsidiary of Aerovate (“Merger Sub II” and together

with Merger Sub I, “Merger Subs”) (the “Merger Agreement”), pursuant to which, and subject to the satisfaction

or waiver of the conditions set forth in the Merger Agreement, among other things, Merger Sub I will merge with and into Jade, with Jade

surviving the merger as the surviving corporation (the “First Merger”), and as part of the same overall transaction, Jade

will merge with and into Merger Sub II, with Merger Sub II continuing as a wholly owned subsidiary of Aerovate and the surviving corporation

of the merger (the “Second Merger” and together with the First Merger, the “Merger”).

On October 31, 2024, Jade published the following presentation:

October 2024 Corporate Presentation

2 This presentation is for informational purposes only and only a summary of certain information related to Jade Biosciences, I nc. (the “Company”). It does not purport to be complete and does not contain all information that an investor may need to consider in making an investment decision. The information contained herein does not co nstitute investment, legal, accounting, regulatory, taxation or other advice, and the information does not take into account your investment objectives or legal, accounting, regulatory, taxation or financial sit uat ion or particular needs. Investors must conduct their own investigation of the investment opportunity and evaluate the risks of acquiring the Company securities based solely upon such investor’s independent examinat ion and judgment as to the prospects of the Company as determined from information in the possession of such investor or obtained by such investor from the Company, including the merits and risks inv olved. Statements in this presentation are made as of the date hereof unless stated otherwise herein, and the delivery of this prese nta tion at any time shall not under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date. The Company is under no obligation to update or keep current the information contained in this document. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or cor rec tness of the information or opinions contained herein, and any reliance you place on them will be at your sole risk. The Company, its affiliates and advisors do not accept any liability whatsoever for any loss how soever arising, directly or indirectly, from the use of this document or its contents. Forward - looking statements and other information Certain statements contained in this presentation that are not descriptions of historical facts are “forward - looking statements. ” When we use words such as “potentially,” “could,” “will,” “projected,” “possible,” “expect,” “illustrative,” “estimated” or similar expressions that do not relate solely to historical matters, we are making f orw ard - looking statements. Forward - looking statements are not guarantees of future performance and involve risks and uncertainties that may cause our actual results to differ materially from our expectations dis cussed in the forward - looking statements. This may be a result of various factors, including, but not limited to: our management team’s expectations, hopes, beliefs, intentions or strategies regarding the fut ure including, without limitation, statements regarding: the pre - closing financing and the other transactions contemplated by the agreement and plan of merger with Aerovate Therapeutics, Inc., and the expected effect s, perceived benefits or opportunities and related timing with respect thereto, expectations regarding or plans for discovery, preclinical studies, clinical trials and research and development programs and th erapies; expectations regarding the use of proceeds and the time period over which our capital resources will be sufficient to fund our anticipated operations; and statements regarding the market and potentia l o pportunities for autoimmune therapies. All forward - looking statements, expressed or implied, included in this presentation are expressly qualified in their entirety by this cautionary statement. You are cautio ned not to place undue reliance on any forward - looking statements. Except as otherwise required by applicable law, we disclaim any duty to update any forward - looking statements, all of which are expressly qualified by this cautionary statement, to reflect events or circumstances after the date of this presentation. This presentation concerns drug candidates that are under clinical investigation, and which have not yet been a ppr oved by the U.S. Food and Drug Administration. These are currently limited by federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for wh ich they are being investigated. Market and Industry Data Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications and other data obtained from third - party sources as well as our own internal estimates and research. While we believe these third - party sources to be reliable as of the date of this presentati on, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third party sources. Forecasts and other forw ard - looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward - looking statements in this presentation. Statements as to our market and c ompetitive position data are based on market data currently available to us, as well as management’s internal analyses and assumptions regarding the Company, which involve certain assumptions and estimates. These int ernal analyses have not been verified by any independent sources and there can be no assurance that the assumptions or estimates are accurate. While we are not aware of any misstatements regarding our in dustry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors. As a result, we cannot guarantee the accuracy or completeness of such informa tio n contained in this presentation. Disclaimers

3 • Developing potential best - in - class therapies for the treatment of autoimmune diseases , including IgA nephropathy ( IgAN ). • Fourth company launched to research and develop antibody candidates licensed from Paragon Therapeutics , an antibody discovery engine founded by Fairmount. • Following in the footsteps of Apogee, Spyre, and Oruka , which have collectively raised ~$1.8B and have generated clinical data utilizing Paragon’s half - life extension technology. Jade Biosciences is developing potentially transformative therapies for high - value Inflammation and Immunology indications Jade’s mission is to deliver best - in - class therapies for patients living with autoimmune diseases. I&I – inflammation and immunology; MOA – mechanism of action; FIH – First - In - Human Planned Healthy Volunteer Data Planned Clinical FIH IND - enabling Discovery Program MOA 1H26 2H25 JADE - 001 anti - APRIL 1H26 JADE - 002 Undisclosed 1H27 JADE - 003 Undisclosed

4 Experienced Management Team with Backing from Paragon Andrew King CSO, Head of R&D Lawrence Klein Board of Directors Tomas Kiselak Board of Directors Management Board of Directors Tom Frohlich CEO Valerie Fauvelle SVP, Regulatory & Quality Hetal Kocinsky CMO Jonathan Quick SVP, Finance Eric Dobmeier Board Chair Chris Cain Board of Directors Erin Lavelle Board of Directors Amy Sullivan SVP, Development Operations Elizabeth Balta GC & Corporate Secretary Sandy Lewis SVP, Biometrics and Clinical Strategy Tom Frohlich Board of Directors

5 JADE - 001: a potential best - in - class anti - APRIL mAb for IgAN

6 Jade is developing a potential best - in - class anti - APRIL mAb designed to have disease - modifying MoA in IgAN Estimated $10B+ newly branded market Anti - APRIL mechanism is potentially disease - modifying JADE - 001 has potential best - in - class profile Efficient development path to PoC and market Designed to have superior potency and half - life for maximal efficacy & convenient dosing in young patient population requiring life - long therapy HV IgA biomarker closely correlated with efficacy in IgAN ; Potential surrogate endpoints support potential IgAN approval Current approved treatments don’t adequately address young patient population with need for long - term disease - modifying therapy Shown to reduce pathogenic IgA and proteinuria, and preserve kidney function HV – Healthy Volunteers; PoC – proof of concept

7 There is a high unmet need for disease - modifying treatments that are safe, well - tolerated, and convenient for life - long therapy in a young patient population . • IgAN is an autoimmune kidney disease , typically diagnosed in 20 - to 30 - year - olds, requiring life - long therapy . • At a prevalence of ~169K in the US, with ~60 - 75% of patients with persistent proteinuria requiring treatment per international guidelines, along with pricing of branded IgAN agents, the US TAM is estimated to exceed $10B annually . ~169K+ IgAN patients in US, majority with persistent proteinuria, representing potential $10B+ market IgAN patients with persistent proteinuria are at risk of kidney failure ~ 1M+ global patients, significant potential ex - US market potential 169 205 103 0 100 200 300 400 1,300 ’000 Patients 783 IgAN est. prevalence 1,260 US EU Japan China Notes: US prevalence estimate from FDA; EU prevalence estimate from EMA; Japan / China prevalence estimates from a Novartis p res entation. Estimated pricing of ~$120K - $150K per year based on Filspari and Tarpeyo . Sources: 2023 Pitcher (CJASN); FDA Reviews for Filspari / Tarpeyo ; EMA; Novartis; 2018 Schena (Seminars in Nephrology); Reuters

8 Ideal IgAN therapy Fabhalta Tarpeyo Filspari SGLT2i Systemic glucocorticoids ACEi / ARB Complement Factor B inhibitor GI - released systemic glucocorticoid Dual endothelin / angiotensin inhibition SGLT2 inhibition General immunosuppression Renin - angiotensin system inhibition MoA Accelerated approval Approved Approved Approved for CKD Used off - label Used off - label Status Disease - modifying (depletes Gd - IgA1, stabilizes GFR) Reduce complement - driven pathology Immunosuppression Supportive therapy Supportive therapy Immunosuppression Supportive therapy (reduce glomerular pressure) Therapeutic rationale 60%+, ideally to < 0.3 - 0.5 g per day ↓38% pbo - adj at 36W ↓32% pbo - adj at 36W ↓35% control - adj at 36W ↓26% pbo - adj (UACR) ~↓ 30 - 50% at 6M ; none at 3Y ~↓30 - 40% Proteinuria reduction ✓ No long - term data ✗ ✗ ✗ ✗ ✗ GFR stabilization No notable safety issues, minimal immunosuppression BBW + REMS (serious bacterial infections); URTI, abdominal pain Immunosuppression, edema, hypertension, weight increase, URTI BBW + REMS (liver & pregnancy); hypotension, edema, AKI, hyperkalemia UTIs, genital fungal infections, volume depletion Severe infections, edema, hypertension, bone density loss, etc. BBW (fetal tox), hyperkalemia, angioedema, AKI Safety (9 - month course) (6 to 9 - month course) Annual dosing Notes: Proteinuria reduction based on UPCR. Data from Praga & Nakamura trials ( ACEi / ARB), STOP - IgAN & TESTING (glucocorticoids), DAPA - CKD (SGLT2i), PROTECT ( Filspari ), NefIgArd ( Tarpeyo ), APPLAUSE - IgAN ( Fabhalta ). Sources: UpToDate; 2003 Praga (J Am Soc Nephrol); 2006 Li (Am J Kidney Dis); 2000 Nakamura (Am J Nephrol); 2022 Lv (JAMA); 2023 Campbell (Dove Press); Filspari Label; Tarpeyo Label; Fabhalta Label; KOL interviews. CKD – chronic kidney disease; UACR – urine albumin to creatinine ratio; BBW – black box warning; REMS – r isk evaluation and mitigation strategy; AKI – acute kidney injury; URTI – upper respiratory tract infection Current IgAN treatments leave significant unmet need, with no disease - modifying (i.e., long - term GFR - stabilizing) approved therapeutics 180 - 270 x 4 - 6 x (or fewer) 365 x (or greater) 365 x 365 x 730 x 270 x

9 Sources: KDIGO Guidelines Public Review Draft; 2023 Mathur (NEJM); Jade analysis KDIGO – Kidney Disease Improving Global Outcomes Proposed updates to KDIGO guidelines highlight the need for therapies like JADE - 001, which may reduce pathogenic IgA CONFIDENTIAL KDIGO updates are anticipated to increase IgAN diagnosis , expand the at - risk patient population requiring treatment , lower proteinuria target to clinical remission, and require use of targeted therapies that reduce pathogenic IgA Proposed guidelines expected to increase IgAN diagnosis and redefine treatment goals … Patient population • Recommends a kidney biopsy in all adults with proteinuria ≥0.5 g/d where IgAN is a possible diagnosis. • Recommends all patients be enrolled in an IgAN registry . Risk of progression • Redefines risk of progressive loss of kidney function for patients with ≥0.5 g/d of proteinuria on or off treatment (previously ≥0.75 - 1 g/d after maximal supportive care). • Recommends additional treatment should be initiated in all cases where patients have proteinuria ≥0.5 g/d. Proteinuria target • Establishes a new, ideal treatment goal: proteinuria should be maintained at <0.5 g/d, preferably <0.3 g/d . • 0.3 g/d is the highly stringent cutoff for clinical remission used in the sibeprenlimab Phase 2. … and further underscore the importance of reducing pathogenic IgA in the treatment paradigm • Proposed guidelines state, “reduction or prevention of IgA immune complex formation should incorporate treatments that have been proven to reduce pathogenic forms of IgA ”. Anti - APRILs and TACI - Fcs have shown the best clinical data to date for reducing pathogenic IgA. • Guidelines also recommend therapies that prevent immune complex - mediated injury should be used in combination with, and not as a replacement for, therapies that reduce pathogenic IgA. IgAN at risk of progressive kidney function loss Manage the IgAN - specific drivers for nephron loss Manage the generic response to IgAN - induced nephron loss Drivers for nephron loss In all patients these should be addressed simultaneously Reduce pathogenic forms of IgA and IgA immune complex formation Treatment goals Reduce glomerular inflammation Blood pressure control Reduce glomerular hyperfiltration and the impact of proteinuria on the tubulointerstitium Cardio - vascular risk reduction

10 APRIL dependency HSC Pro B cell Large pre - B cell Small pre - B cell Immature B cell Mature Naïve B cell Memory B cell Plasma cell Bone marrow Mucosa Mucosa & bone marrow CD20 expression BAFF dependency *Gradient indicates level of receptor expression Sources: 2024 Cheung (Front Nephrol); 2023 Mathur (J Clin Med) Reducing pathogenic IgA production by plasma cells is a potentially disease - modifying approach for IgAN Broad B - cell depletion is ineffective in IgAN… …while targeted plasma cell modulation is highly effective . • B - cell depletion with rituximab (anti - CD20) failed to reduce Gd - IgA1, anti - Gd - IgA1 autoantibody, or proteinuria and did not impact eGFR . • BAFF neutralization (blisibimod) did not reduce IgA or proteinuria. • APRIL and dual APRIL/BAFF neutralization result in significant and sustained depletion of Gd - IgA1, reduction in proteinuria, and eGFR stabilization. APRIL APRIL blocking therapy Plasma cell differentiation Antibody class - switching HIT 1 Production of galactose - deficient IgA1 (Gd - IgA1) HIT 2 Synthesis of anti - Gd - IgA1 autoantibodies HIT 3 Autoantibodies bind Gd - IgA1 to form pathogenic immune complexes HIT 4 Deposition of immune complexes in the mesangium and initiation of kidney injury Neutralizing APRIL depletes Gd - IgA1, reduces proteinuria, and preserves eGFR , providing a disease - modifying treatment of IgAN without impacting B - cell development and maturation.

11 Existing genomic, mechanistic, IgAN model, and clinical data support the importance of APRIL over BAFF in IgAN , and APRIL - only blockade avoids the potential for unnecessary immunosuppression . Selectively targeting APRIL potentially provides disease modification without added immunosuppression of BAFF inhibition Sources: 2024 Cheung (Front Nephrol); Chinook 2022 CKD3 Presentation; 2004 Castigli (PNAS); 2001 Schiemann (Science) BAFF APRIL ✗ ✓ Risk variant in IgAN GWAS ✓ / ✗ ✓ Elevated in IgAN patients and associated with disease severity No data ✓ Promotes excess secretion of Gd - IgA1 in IgAN patient lymphocytes ex vivo ✗ ✓ Drives IgA class switching via TACI in vivo ✓ ✓ Overexpression in mouse model leads to glomerular IgA deposition ✗ ✓ KO mouse model decreases IgA levels / IgA+ plasma cells in small intestine ✗ ✓ Selective inhibition demonstrates preclinical / clinical efficacy in IgAN APRIL is the B cell survival factor critically linked to IgAN pathogenesis and disease activity Targeting APRIL selectively modulates plasma cells , maintaining pool of mature B cells

12 Reductions in proteinuria and IgA in IgAN clinical studies indicate APRIL inhibition is the driving force behind TACI - Fc efficacy Notes: Cross - trial comparisons are inherently limited and presented for hypothesis - generating purposes only. Data digitized from graphs where publications did not provide specific values. Values only included if N > 5. Blisibimod W52 data is from W60. Sources: Anthera 2017 10 - K; 2023 Mathur (NEJM); 2023 Barratt (ERA Poster); 2024 Lafayette (KI Reports); 2024 Tumlin (WCN Presentation); 2024 Madan (ASN Presentation) 0 4 8 12 16 20 24 28 32 36 40 44 48 52 - 70 % - 60 - 50 - 40 - 30 - 20 - 10 0 10 Weeks 24h UPCR Δ from Baseline (%) Blisibimod (anti - BAFF) Sibeprenlimab (anti - APRIL, 8 mg/kg) Sibeprenlimab (anti - APRIL, 4 mg/kg) Zigakibart (anti - APRIL) Atacicept (TACI - Fc, 150 mg) Atacicept (TACI - Fc, 75 mg) Povetacicept (Eng. TACI - Fc, 240 mg) Povetacicept (Eng. TACI - Fc, 80 mg) 0 4 8 12 16 20 24 28 32 36 40 44 48 52 - 70 - 60 - 50 - 40 - 30 - 20 - 10 0 - 80 % Weeks IgA Δ from Baseline (%)

13 Povetacicept Atacicept Zigakibart Sibeprenlimab Engineered TACI - Fc TACI - Fc anti - APRIL anti - APRIL MoA P3 P3 P3 P3 Status N=9 (80 mg) N=32 (150 mg) N=35 (600 mg) N=79 (4/8 mg/kg pooled) Δ from baseline in critical disease markers (W36 timepoint*) ✓ (12 months) ✓ (24 months) ✓ (18 months) ✓ (12 months) GFR stabilization ✓ ✓ No data ✓ Hematuria resolution ✓ Well - tolerated (no pbo ) 240 mg ↑ infections ✓ Well - tolerated, slight ↑ in infections (& URTIs) vs. pbo ✓ Well tolerated (no pbo) , no drug discontinuations ✓ Well tolerated, no overall ↑ infections, slight ↑ in URTIs vs. pbo Safety 80 mg SC, Q4W 150 mg SC, QW 600 mg SC, Q2W 400 mg SC, Q4W P3 Dosing Anti - APRILs have shown evidence of disease modification and clinical activity that matches or beats TACIs, with reduced immune suppression IgA Gd - IgA1 UPCR 67% 60% 60% IgA Gd - IgA1 UPCR 64% 69% 53% IgA Gd - IgA1 UPCR 63% 64% 33% IgA Gd - IgA1 UPCR 65% 69% 59% “The goal is to reduce pathogenic IgA and get the disease under control right away . The APRIL class will be the backbone [of therapy]. This class will become first - line . ” – European KOL “These therapies may change the thinking in IgAN . Instead of first starting with a hemodynamic agent and then going to prednisone… now we would start with [anti - APRIL and anti - APRIL/BAFF]. ” – US KOL “If I biopsy a patient and they have clear inflammation, if these were available, I would use them immediately with ACEi / ARBs . ” – US KOL Notes: *Zigakibart IgA / Gd - IgA data at W40; UPCR data at W52 (only timepoint available); change from baseline is not pbo - controlled; N represents patients on dose(s) for which data is shown. Atacicept infections/URTIs placebo - (32%/0%), 25 mg (38%/0%), 75 mg (49%/9%), 150 mg (39%/6%). Povetacicept infection rates: Grade 1/2/≥3 – 80 mg 10%/5%/0%, 240 mg 18%/27%/3%. Sibe infections/URTIs placebo - (55%/0%), 2 mg/kg (39.5%/8%), 4 mg/kg (56%/12%), 8 mg /kg (53%/5% Sources: 2023 Mathur (NEJM); 2024 Barratt (ERA Presentation); VERA January 2024 R&D Day; ALPN 2024 WCN Investor Update; 2024 Mad an (ASN Presentation)

14 • ~7 - year data from belimumab in SLE shows continuous BAFF inhibition lowers B cell populations from ~50% to ~99% , with most populations decreasing >80%. Sources: 2022 Struemper (Lupus Sci Med); Barratt ASN 2024 BAFF inhibition is accompanied by the potential for significant long - term B cell depletion Long - term BAFF inhibition significantly depletes all B cell populations … … whereas chronic APRIL inhibition does not impact circulating lymphocytes Long - term BAFF suppression , in an otherwise young and healthy patient population, is unnecessary given equivalent efficacy in IgAN from anti - APRILs and TACI - Fcs observed to date. 10 9 /L

15 JADE - 001 is a potential best - in - class anti - APRIL Blocks APRIL with greater potency than clinical benchmarks • Validated mechanism of action • Binds APRIL to neutralize activity • Greater binding affinity than sibeprenlimab (≥5x) and zigakibart (≥14x) Effector - null human IgG1 Fc Half - life extension through validated YTE Fc modification • Longer exposure intended to reduce dosing frequency Paragon has filed provisional patent applications covering the subject matter of JADE - 001, which we will be entitled to under th e license agreement with respect to JADE - 001. We have exercised the Option with respect to JADE - 001, but have not yet entered the license agreement. Multiple antibody discovery strategies pursued to achieve potential best - in - class mAb Novel IP for composition of matter into 2040s

16 pH 5.5 pH 7 • Jade mAbs designed to be recycled back into circulation more readily • Drug exists at much higher levels for longer duration of effect • Fewer injections decrease patient burden and can improve compliance and penetration SOURCE: Adapted from Ko S et al BioDrugs 2021 Jade mAbs employ proven half - life extension (HLE) technology Blood Stream Antibody Degradation Antibody Recycling Endosome 1 st gen mAb FcRn Pinocytosis Antibody Degradation Antibody Recycling Endosome Jade mAb FcRn bound Jade mAbs High affinity 1 st gen mAB released back to blood stream FcRn bound mAbs Jade mAbs released back to blood stream FcRn Pinocytosis Physiological affinity

17 • JADE - 001 employs well - established HLE technology , with the potential for Q8W+ dosing . • High potency can potentially further drive lower dosing frequency – which has already been demonstrated for APRIL by sibeprenlimab’s Q4W dosing vs. zigakibart’s Q2W dosing despite near - equivalent half - life. Sources: 2019 Myette (Kidney Intl); 2022 Mathur (KI Reports); 2018 Dulos (ASN Poster); 2020 Lo (ERA Poster); Apogee Corporate Presentation *Based on single dose studies in NHPs dosed with JADE - 001 initial clone. A development candidate will be selected from a pool of clones currently in profiling. We have exercised the Option with respect to JADE - 001 under the Paragon Option Agreement but have not yet entered into the related license agreement. **Available anti - APRIL therapeutics demonstrate appreciable TMDD resulting in dose and dose frequency dependent t1/2. Jade estim ated t1/2 of benchmarks from publicly available data at the P3 dose and schedule via standard noncompartmental analysis of observed data bolstered with compartmental modelling approaches capturing clinically ob ser ved TMDD. Cross - trial comparisons are inherently limited and presented for hypothesis - generating purposes only. JADE - 001’s goal is to introduce Q8W+ dosing for IgAN patients via HLE Prior experience, including with Paragon - generated mAbs , indicates HLE c ould significantly improve dosing over anti - APRILs in development Est. Dosing Interval Human t 1/2 (days) Targeting Q8W+ JADE - 001 TPP (HLE anti - APRIL mAb ) Q4W (400 mg) Sibeprenlimab (anti - APRIL mAb ) Q2W (600 mg) Zigakibart (anti - APRIL mAb ) QW (150 mg) Atacicept (TACI - Fc APRIL/BAFF) Q4W (80 mg) Povetacicept (TACI - Fc APRIL/BAFF) ~20** ~23* 50+* HV PK expected H1 2026 6.7 3.7

18 JADE - 001 HLE strategy and profile in NHPs shows promise with early clone* ~3X increased half - life over sibeprenlimab in NHPs… … which is accompanied by prolonged IgA reduction in NHPs following a single, saturating dose PHARMACOKINETICS PHARMACODYNAMICS Note: *Data shown is from an initial clone. A development candidate will be selected from a pool of clones currently in profiling. We have exercised the Option with respect to JADE - 001 under the Paragon Option Agreement but have not yet entered into the related license agreement. Sibeprenlimab and JADE - 001 lead clone dosed at 30 mg/kg (single dose), N=4 per group. Manufactured based on available sequences from patents / company releases. Studies are ongoing. Sources: Internal data

19 JADE - 001 has potential to demonstrate superior clinical activity by maximizing remission rates in significantly more patients than other anti - APRIL programs in development. • The highest rates of clinical remission (<0.3 g/day urinary protein excretion) for sibeprenlimab were accompanied by the deepest levels of APRIL suppression. • Safety profile was consistent across dose levels. • Significant opportunity to drive increased systemic exposure with HLE and maximize clinical remission . • JADE - 001’s affinity could further contribute to potential best - in - class efficacy . Note: clinical remission definition of <0.3g/day urinary protein excretion. Source: 2023 Mathur (NEJM) Deeper APRIL suppression could drive superior efficacy 3 7 12 26 Clinical Remission (% at 12 months) Placebo 2 mg/kg 4 mg/kg 8 mg/kg

20 • Sibeprenlimab is being dosed as a single 400mg SC injection Q4W in ongoing global Phase 3 VISIONARY trial. • 400 mg SC Q4W is equivalent to ~3.5 mg/kg IV for average IgAN patient (range 2.5 - 6 mg/kg). • The estimated Phase 3 equivalent dose range demonstrated lower efficacy on key endpoints in Phase 2 ENVISION trial (as seen on right). • ~50% of healthy volunteers in P1 SAD demonstrated positive antidrug antibody activity following a single SC dose which may further impact PK, efficacy, and safety profile in Phase 3. Notes: Estimated sibeprenlimab P3 dose based on average 85 kg IgAN patient (95% CI ~50 - 120 kg) and 75% bioavailability. Sources: 2023 Mathur (NEJM); 2023 Zhang (Clin Pharm) HV – healthy volunteers; ADA+ - antidrug antibody positive Sibeprenlimab is potentially under - dosed in ongoing Phase 3 trial Potential under - dosing of sibeprenlimab creates additional opportunity for JADE - 001 to demonstrate potential best - in - class clinical activity for patients. 13 50 57 63 UPCR Δ from baseline (%, W36) Placebo 2 mg/kg IV 4 mg/kg IV 8 mg/kg IV - 5.9 - 4.1 0.1 - 0.8 Est. P3 equivalent dose Est. P3 equivalent dose 2 mg/kg lower dose did not stabilize eGFR at 1 year, while higher doses did Annualized eGFR slope (mL/min/1.73m 2 , baseline to W52)

21 Potential path to early clinical proof - of - concept and accelerated approval • NHP and Phase 1 PK/PD could provide early signals of clinical activity; IgA reduction in HVs has been observed to be highly correlated with clinical activity . • 9 - month proteinuria data, which we believe is highly predictive of kidney function preservation , provides support for US submission for accelerated approval and potentially offers a faster path to market prior to eGFR confirmatory data. Proof - of - concept IgA healthy volunteer data expected in 1H 2026 Potential Indications Potential Healthy Volunteer Data Phase 1 Initiation Discovery Program MOA IgAN 1H26 2H25 Ongoing JADE - 001 anti - APRIL

22 Notes: Sibeprenlimab IgAN IgA reductions (LHS) are average of 4 mg/kg and 8 mg/kg cohorts (HV data is from 6 mg/kg cohort); the two cohorts saw effecti ve ly equivalent IgA reduction at W4 and W8. Zigakibart UPCR data is at 52W. Atacicept IgAN W8 is average of W4 and W12 datapoints. Trend lines are best linear fit. Sources: 2022 Mathur (KI Reports); 2023 Mathur (NEJM); 2020 Lo (ASN Presentation); 2023 Barratt (ERA Poster); 2024 Barratt (E RA Presentation); 2022 Dillon (ASN Poster); 2024 Tumlin (WCN Presentation); Anthera 2017 10 - K; 2024 Lafayette (KI Reports); 2024 Madan (ASN Presentation) IgA reduction in healthy volunteers is the critical inflection point for clinical development in IgAN IgA reduction in HVs has been observed to be highly correlated with IgA reduction in IgAN patients …and IgA reduction was observed to correlate with W36 UPCR reduction, the endpoint for accelerated approval - 60 % - 50 - 40 - 30 - 20 - 10 0 - 60 % - 50 - 40 - 30 - 20 - 10 0 HV IgA Δ from baseline (%) IgAN IgA Δ from baseline (%) W4 W8 W2 W4 W6 W8 240 mg / W4 80 mg / W4 Sibeprenlimab Zigakibart Povetacicept R 2 = 0.86 - 70 % - 60 - 50 - 40 - 30 - 20 - 10 0 - 60 % - 50 - 40 - 30 - 20 - 10 0 IgAN UPCR Δ from baseline (%, W36) IgAN IgA Δ from baseline (%, W8) 8 mg/kg 4 mg/kg 150 mg 75 mg 240 mg 80 mg Blisibimod Sibeprenlimab Zigakibart Atacicept Povetacicept R 2 = 0.78

23 Potential of JADE - 001 in IgAN Potential to deplete pathogenic IgA and avoids broad B - cell inhibition Enabled by half - life extension technology Designed for superior potency and half - life with potential to maximize clinical remission Potential Disease - modifying MoA More convenient dosing Potential best - in - class clinical activity

24 Pipeline opportunities beyond IgAN

25 Additional Jade pipeline programs are expected to focus on best - in - class product profiles in high - value I&I indications I&I indications with significant market opportunity Potential Best - in - class and best - in - indication product profile Potential Rapid path to clinical PoC Expected minimal competition Jade team expertise Team is evaluating additional opportunities to build pipeline of potentially best - in - class I&I therapies.

26 Jade Biosciences is developing transformative therapies for high - value I&I indications • Approximately $300 million raised to date, including anticipated proceeds from an oversubscribed pre - closing private financing, from syndicate of top tier healthcare investors, including: Planned Healthy Volunteer Data Planned Clinical FIH IND - enabling Discovery Program MOA 1H26 2H25 JADE - 001 anti - APRIL 1H26 JADE - 002 Undisclosed 1H27 JADE - 003 Undisclosed

27 CONFIDENTIAL Estimated total shares of common stock of the combined company post - closing 2 1,855,835,012 Shares on an as - converted basis 28,867,711 • Shares of common stock outstanding Aerovate • Shares of common stock outstanding (including shares underlying option grants) 202,760,666 Jade Biosciences • Series A shares 428,776,000 Pre - closing financing 932,531,887 • Shares of common stock • Pre - funded warrants 262,898,748 Expecte d ownership of the combined company 1.6% 98.4% Estimated capitalization following close of transactions with Aerovate and pre - closing private placement 1 Prior to closing, Aerovate expects to declare a cash dividend to pre - merger Aerovate stockholders, distributing excess net cash estimated to be approximately $65 million. 2 Please refer to AVTE’s SEC filings for additional information, including the Registration Statement on Form S - 4 that AVTE intend s to file in connection with the transaction. Estimated dividend per share $2.25 1 N/A

28 Thank you

29 JADE - 001 HLE strategy and profile in NHPs shows promise* ~3X increased half - life over sibeprenlimab in NHPs… … which is accompanied by prolonged IgA reduction in NHPs following a single, saturating dose PHARMACOKINETICS PHARMACODYNAMICS Note: *Data shown is from an initial clone. A development candidate will be selected from a pool of clones currently in profiling. We have exercised the Option with respect to JADE - 001 under the Paragon Option Agreement but have not yet entered into the related license agreement. Sibeprenlimab (n=12) and JADE - 001 (n=5) lead clone dosed at 30 mg/kg (single dose), Pove (n=4) dosed at 13 mg/kg (equimolar, single dose). Manufactured based on available sequences from patents / company releases. Studies are ongoing. Sources: Internal data

Forward-Looking

Statements

Certain

statements in this communication, other than purely historical information, may constitute “forward-looking statements” within

the meaning of the federal securities laws, including for purposes of the “safe harbor” provisions under the Private Securities

Litigation Reform Act of 1995, concerning Aerovate, Jade, the proposed concurrent investment and the proposed Merger (collectively, the

“Proposed Transactions”) and other matters. These forward-looking statements include, but are not limited to, express or implied

statements relating to Aerovate’s and Jade’s management teams’ expectations, hopes, beliefs, intentions or strategies

regarding the future including, without limitation, statements regarding: the Proposed Transactions and the expected effects, perceived

benefits or opportunities of the Proposed Transactions, including investment amounts from investors and expected proceeds, and related

timing with respect thereto; expectations related to Aerovate’s contribution and payment of the cash dividends in connection with

the proposed Merger, including the anticipated timing of the Closing of the proposed transactions (the “Closing”); the expectations

regarding the ownership structure of the combined company; and the expected trading of the combined company’s stock on Nasdaq under

the ticker symbol “JBIO” after the Closing. In addition, any statements that refer to projections, forecasts or other characterizations

of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “opportunity,”

“potential,” “milestones,” “pipeline,” “can,” “goal,” “strategy,”

“target,” “anticipate,” “achieve,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “plan,” “possible,”

“project,” “should,” “will,” “would” and similar expressions (including the negatives

of these terms or variations of them) may identify forward-looking statements, but the absence of these words does not mean that a statement

is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future developments

and their potential effects. There can be no assurance that future developments affecting Aerovate, Jade or the Proposed Transactions

will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are

beyond Aerovate’s control) or other assumptions that may cause actual results or performance to be materially different from those

expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that

the conditions to the Closing or consummation of the Proposed Transactions are not satisfied, including Aerovate’s failure to obtain

stockholder approval for the proposed Merger; the risk that the proposed concurrent investment is not completed in a timely manner or

at all; uncertainties as to the timing of the consummation of the Proposed Transactions and the ability of each of Aerovate and Jade to

consummate the transactions contemplated by the Proposed Transactions; risks related to Aerovate’s continued listing on Nasdaq until

closing of the Proposed Transactions and the combined company’s ability to remain listed following the Proposed Transactions; risks

related to Aerovate’s and Jade’s ability to correctly estimate their respective operating expenses and expenses associated

with the Proposed Transactions, as applicable, as well as uncertainties regarding the impact any delay in the closing of any of the Proposed

Transactions would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated

spending and costs that could reduce the combined company’s cash resources; the failure or delay in obtaining required approvals

from any governmental or quasi-governmental entity necessary to consummate the Proposed Transactions; the occurrence of any event, change

or other circumstance or condition that could give rise to the termination of the business combination between Aerovate and Jade; the

effect of the announcement or pendency of the Merger on Aerovate’s or Jade’s business relationships, operating results and

business generally; costs related to the Merger; the risk that as a result of adjustments to the exchange ratio, Jade stockholders and

Aerovate stockholders could own more or less of the combined company than is currently anticipated; the outcome of any legal proceedings

that may be instituted against Aerovate, Jade or any of their respective directors or officers related to the Merger Agreement or the

transactions contemplated thereby; the ability of Aerovate and Jade to protect their respective intellectual property rights; competitive

responses to the Proposed Transactions; unexpected costs, charges or expenses resulting from the Proposed Transactions; potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the Proposed Transactions; failure to

realize certain anticipated benefits of the Proposed Transactions, including with respect to future financial and operating results; the

risk that Aerovate stockholders receive more or less of the cash dividend than is currently anticipated; legislative, regulatory, political

and economic developments; and those uncertainties and factors more fully described in periodic filings with the SEC, including under

the heading “Risk Factors” and “Business” in Aerovate’s most recent Annual Report on Form 10-K for the year

ended December 31, 2023, filed with the SEC on March 25, 2024, subsequent Quarterly Reports on Form 10-Q filed with the SEC, as well as

discussions of potential risks, uncertainties, and other important factors included in other filings by Aerovate from time to time, any

risk factors related to Aerovate or Jade made available to you in connection with the Proposed Transactions, as well as risk factors associated

with companies, such as Jade, that operate in the biopharma industry. Should one or more of these risks or uncertainties materialize,

or should any of Aerovate’s or Jade’s assumptions prove incorrect, actual results may vary in material respects from those

projected in these forward-looking statements. Nothing in this communication should be regarded as a representation by any person that

the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements

will be achieved. You should not place undue reliance on forward-looking statements in this communication, which speak only as of the

date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither Aerovate nor Jade undertakes

or accepts any duty to release publicly any updates or revisions to any forward-looking statements. This communication does not purport

to summarize all of the conditions, risks and other attributes of an investment in Aerovate or Jade.

No Offer or Solicitation

This

communication and the information contained herein is not intended to and does not constitute (i) a solicitation of a proxy, consent or

approval with respect to any securities or in respect of the Proposed Transactions or (ii) an offer to sell or the solicitation of an

offer to subscribe for or buy or an invitation to purchase or subscribe for any securities pursuant to the Proposed Transactions or otherwise,

nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not

be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction,

or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet)

of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

NEITHER

THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS COMMUNICATION IS TRUTHFUL

OR COMPLETE.

Important Additional Information

about the Proposed Transaction Will be Filed with the SEC

This

communication is not a substitute for the registration statement or for any other document that Aerovate may file with the SEC in connection

with the Proposed Transactions. In connection with the Proposed Transactions, Aerovate intends to file relevant materials with the SEC,

including a registration statement on Form S-4 that will contain a proxy statement/prospectus of Aerovate. AEROVATE URGES INVESTORS AND

STOCKHOLDERS TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AEROVATE, JADE, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and stockholders

will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Aerovate with the SEC (when they become

available) through the website maintained by the SEC at www.sec.gov. Stockholders are urged to read the proxy statement/prospectus and

the other relevant materials when they become available before making any voting or investment decision with respect to the Proposed Transactions.

In addition, investors and stockholders should note that Aerovate communicates with investors and the public using its website (https://ir.aerovatetx.com/).

Participants in the Solicitation

Aerovate,

Jade and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders

in connection with the Proposed Transactions. Information about Aerovate’s directors and executive officers, including a description

of their interests in Aerovate, is included in Aerovate’s most recent Annual Report on Form 10-K for the year ended December 31,

2023, filed with the SEC on March 25, 2024, subsequent Quarterly Reports on Form 10-Q filed with the SEC, including any information incorporated

therein by reference, as filed with the SEC, and other documents that may be filed from time to time with the SEC. Additional information

regarding these persons and their interests in the transaction will be included in the proxy statement/prospectus relating to the Proposed

Transactions when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

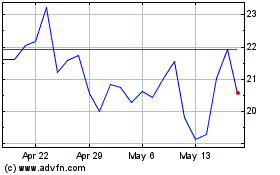

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aerovate Therapeutics (NASDAQ:AVTE)

Historical Stock Chart

From Feb 2024 to Feb 2025