Adobe's Purchase of Figma Could Harm Innovation, UK Regulator Says -- Update

June 30 2023 - 8:15AM

Dow Jones News

By Ian Walker

The U.K. Competition and Markets Authority said Friday that

Adobe's planned $20 billion acquisition of collaboration-software

company Figma could reduce innovation, and has given the company

five working days to offer a proposal to address its concerns.

The regulator said that if no proposal is submitted by the

deadline it will start an in-depth review into the deal.

The CMA said it has identified concerns into the supply of

screen design and provision of creative design software.

"We're worried this deal could stifle innovation and lead to

higher costs for companies that rely on Figma and Adobe's digital

tools, as they cease to compete to provide customers with new and

better products," senior mergers director at the CMA, Sorcha

O'Carroll, said.

"Unless Adobe can put forward viable solutions to our concerns

in the coming days, we will move to a more in-depth

investigation."

Responding, Adobe said Figma's product design is an adjacency to

Adobe's core creative products and that it has no meaningful plans

to compete in the product design space.

"The combination of Adobe and Figma will deliver significant

value to customers by making product design more accessible and

efficient, re-imagining creative capabilities on the web and

creating new categories of creativity and productivity," Adobe

said.

It said the company looks forward to establishing these facts in

the next phase of the process and successfully completing the

transaction.

Adobe said in September that it planned to buy Figma.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

June 30, 2023 08:00 ET (12:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

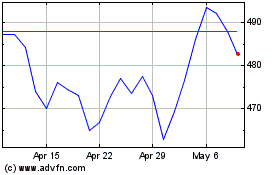

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Sep 2024 to Oct 2024

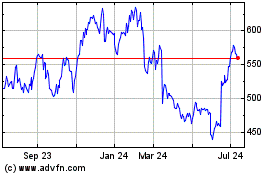

Adobe (NASDAQ:ADBE)

Historical Stock Chart

From Oct 2023 to Oct 2024