Swiss Franc Weakens Against Majors

December 05 2023 - 4:25AM

RTTF2

The Swiss franc dropped against its major counterparts in the

European session on Tuesday, as encouraging comments by European

Central Bank official lifted sentiment.

In an interview with Reuters, ECB board member Isabel Schnabel

said that the slowdown in inflation raised the prospect of no more

rate hikes by the central bank.

Schnabel's comments strengthened expectations for a 25 basis

point cut by the ECB in March.

U.S. job openings data is due later in the day, and non-farm

payrolls data will be published on Friday.

On the economic front, the HCOB services PMI for the euro area

also increased to 48.7, from 47.8 in the previous month. Economists

were expecting a rise to 48.2.

The franc dropped to 0.8748 against the greenback, 1.1043

against the pound and 0.9469 against the euro, from its early highs

of 0.8714, 1.1007 and 0.9438, respectively. The franc is seen

finding support around 0.92 against the greenback, 1.15 against the

pound and 1.00 against the euro.

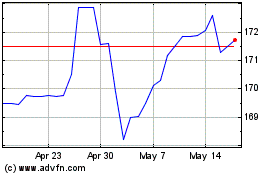

The franc touched 167.71 against the yen, setting a 6-day low.

The next possible support for the franc is seen around the 128.00

level.

U.S. ISM services PMI for November will be out in the New York

session.

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024