Yen Advances Against Majors

December 03 2023 - 9:53PM

RTTF2

The safe-haven yen strengthened against other major currencies

in the Asian session on Monday, as the major currencies failed to

sustain their strength due to profit taking.

Meanwhile, the Asian shares showed mixed trading on concerns

about China as well as hopes of rate cuts by the Fed, both weighing

on sentiment.

Encouraging inflation data from the region as well as growing

rate cut expectations and Fed Chair Jerome Powell's comments that

inflation was moving in the right direction, upturned the demand

for the safe-haven currency.

In the Asian trading today, the yen rose to a 1-month high of

159.11 against the euro and a 4-day high of 168.32 against the

Swiss franc, from last week's closing quotes of 159.76 and 168.86,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 157.00 against the euro and 164.00 against the

franc.

The yen advanced to a 2-week high of 185.53 against the pound

and nearly a 3-month high of 146.24 against the U.S. dollar, from

Friday's closing quotes of 186.57 and 146.81, respectively. The yen

may test resistance around 180.00 against the pound and 143.00

against the greenback.

Against the Australia, the New Zealand and the Canadian dollars,

the yen rose to 4-day highs of 97.65, 90.89 and 108.39 from last

week's closing quotes of 97.98, 91.14 and 108.76, respectively. On

the upside, 94.00 against the aussie, 87.00 against the kiwi and

105.00 against the loonie are seen as the next resistance level for

the yen.

Looking ahead, U.S. factory orders for October is due to be

released in the New York session.

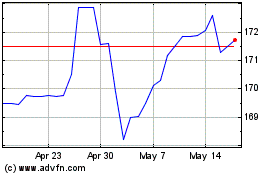

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024