Commodity Currencies Slide On Weak Asian Shares

November 26 2023 - 10:23PM

RTTF2

Commodity currencies such as the Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Monday, as investor sentiment remained cautious

amid concerns about interest rates and the impact of higher

borrowing costs on global economic growth.

Traders are reluctant to make significant moves as they await

key economic data from the U.S., China and Europe for additional

clues about the outlook for interest rates.

Traders also cautiously await domestic inflation data later in

the week that will provide cues on the outlook for interest

rates.

Crude oil prices fell sharply, with traders waiting on a crucial

OPEC meeting this week as oil producers struggling to come to a

consensus on production levels. West Texas Intermediate Crude oil

futures for January ended lower by $1.56 or 2 percent at $75.54 a

barrel.

In the Asian trading today, the Australian dollar fell to a

4-day low of 97.81 against the yen, from last week's closing value

of 98.36. The aussie may test support near the 95.00 region.

Against the euro, the aussie dropped to a 5-day low of 1.6667

from a recent near 3-week high of 1.6593. On the downside, 1.69 is

seen as the next support level for the aussie.

Moving away from a recent near 4-month high of 0.6595 against

the U.S. dollar, the aussie edged down to 0.6566. If the aussie

extends its downtrend, it is likely to find support around the 0.63

area.

The NZ dollar fell to 4-day lows of 90.28 against the yen and

1.8055 against the euro, from last week's closing quotes of 90.73

and 1.8004, respectively. If the kiwi extends its downtrend, it is

likely to find support around 87.00 against the yen and 1.82

against the euro.

Against the U.S. and the Australian dollars, the kiwi edged down

to 0.6061 and 1.0844 from Friday's closing quotes of 0.6071 and

1.0833, respectively. The kiwi may test support near 0.58 against

the greenback and 1.09 against the aussie.

The Canadian dollar fell to 109.00 against the yen and 1.4952

against the euro, from Friday's closing quotes of 109.57 and

1.4915, respectively. If the loonie extends its downtrend, it is

likely to find support around 107.00 against the yen and 1.50

against the euro.

Against the U.S. and the Australian dollars, the loonnie dropped

to 1.3662 and 0.8990 from last week's closing quotes of 1.3635 and

0.8975, respectively. The loonie may test support near the 1.38

against the greenback and 0.90 against the aussie.

Meanwhile, the safe-haven currency, the yen rose against other

major currencies amid risk aversion.

The yen rose to 4-day highs of 148.90 against the U.S. dollar

and 168.76 against the Swiss franc, from last week's closing quotes

of 149.44 and 169.28, respectively. The yen may test resistance

around 147.00 against the greenback and 166.00 against the

franc.

Against the euro and the pound, the yen climbed to 162.94 and

187.61 from Friday's closing quotes of 163.47 and 188.34,

respectively. If the yen extends its uptrend, it is likely to find

resistance around 160.00 against the euro and 184.00 against the

pound.

Looking ahead, U.S. final building permits and new home sales

data, both for October and U.S. Dallas Fed manufacturing index for

November, are due to be released in the New York session.

At 9:00 am ET, European Central Bank President Christine Lagarde

is set to speak at a conference in Brussels, Belgium.

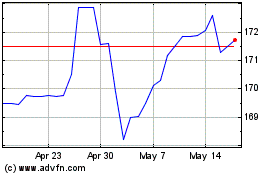

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024