Paris, February 8,

2018

Highlights

-

Net sales up 3.7% year-on-year

at €2,841m, robust organic growth of 4.8%(1)

-

In Q4, all segments contributed

to a strong 6.9% organic growth

-

Adjusted EBITDA(2) at €315m and EBITDA margin at 11.1% (versus 12.2% in FY

2016)

-

Net profit(3) up +6.5% vs. 2016 at €126m (excluding the

French Competition Authority's penalty)

-

Leverage ratio (net

debt/adjusted EBITDA) of 1.6x

-

A stable dividend of €0.60 per

share will be proposed at the AGM

-

Eric La Bonnardière will

replace Didier Deconinck as Chairman of the Supervisory Board,

confirming the long term commitment of the family to the future of

Tarkett(4)

(1) Organic growth: at constant

scope of consolidation and exchange rates (note that in the CIS

segment, price increases implemented to offset currency

fluctuations are not included in organic growth, which only

reflects changes in volumes and the product mix). See the

definition of alternative performance indicators at the end of this

press release.

(2) Adjusted EBITDA: adjustments include expenses such as

restructuring, acquisitions and share-based payment expenses. See

the definition of alternative performance indicators at the end of

this press release.

(3) Net profit attributable to owners of the Company.

(4) Subject to the renewal of their mandates as Board members at

the Annual General Meeting on April, 26th 2018.

Net sales at

constant scope of consolidation and exchange rates grew by

4.8% in 2017. Sports delivered strong growth

(+11.7%) over the full year, led by both artificial turf and

running tracks. The CIS, APAC & Latin America segment recorded

robust growth (+10.8%) thanks to good trends in all three regions.

EMEA posted a solid +3.7% rise in sales fueled by healthy trading

across the region. North America retreated slightly (-1.8%) over

the full year, although Q4 showed improvement in all product

categories (+0.8%). After an already robust Q3 revenue performance

(+6.1%) for the Group as a whole, Q4 organic growth reached a

strong +6.9% as a result of positive momentum in all segments.

Reported

sales were up 3.7% compared to 2016.

Exchange rates accounted for a negative -1.2% impact, mainly due to

the depreciation of the US dollar and the British pound against the

euro. The acquisition of the assets of AlternaScapes, a

Florida-based landscape turf distributor and installer, had a minor

scope impact (+0.1%).

Adjusted

EBITDA amounted to €315m versus €334m in

2016 and the adjusted EBITDA margin came in at

11.1% compared to 12.2% in 2016. As

anticipated, the adjusted EBITDA was penalized by the increase in

raw material prices in all segments (-€34m) and adverse currency

effects (-€12m, excluding CIS currencies). Moreover, the ruble's

depreciation in the second part of the year has led to a full year

negative "lag effect" of -€4m (net impact of CIS currencies and

selling prices evolutions). In EMEA and North America, selling

price increases implemented during the year are now starting to

show their effect (+€3m in Q4). In Russia, a 5% selling price

increase on vinyl products was announced as of December

1st 2017.

Adjusted EBITDA of the Sports segment benefited from a US$12m

settlement payment related to a patent infringement claim against

competitor AstroTurf. Productivity gains amounted to €30m.

Following a weak Q3 in North America and Sports, productivity gains

in the fourth quarter have improved.

Net profit

attributable to owners of the Company amounted to -€39m. Excluding the €165m penalty to the French

Competition Authority, the net profit attributable

to owners of the Company was up +6.5% vs.

2016 at €126m.

Commenting on these results,

Glen Morrison, CEO, stated:

"Tarkett has

delivered a robust sales performance in 2017 with all segments

growing in the fourth quarter. Over the year, the CIS countries

have steadily strengthened. Sports' growth has accelerated and EMEA

continued to grow consistently well. North America is progressively

moving back into positive territory. As expected, we are now

benefitting from our actions regarding selling prices and this

positive contribution should continue in 2018."

Key Figures

| €

million |

2017 |

2016 |

Change

(as a %) |

Revenue

of which organic growth(1) |

2,841.1

|

2,739.3

|

+3.7%

+4.8% |

Adjusted

EBITDA(2)

% of net sales |

315.1

11.1% |

334.4

12.2% |

-5.8%

|

Net

profit attributable to owners of the Company

Excluding the €165m penalty

Basic earnings per share

Excluding the €165m penalty |

(38.7)

126.3

(€0.61)

€2.00 |

118.6

-

€1.87 |

n.m.

+6.5%

|

Free cash

flow

Excluding the €165m penalty |

(65.4)

99.6 |

148.0 |

|

| Return on

invested capital (ROIC)(3) |

8.9% |

9.3% |

|

| Net debt

/ adjusted EBITDA |

1.6x |

1.1x |

|

| Dividend

per share |

€0.60(4) |

€0.60 |

|

(1) Organic growth: at constant

scope of consolidation and exchange rates (note that in the CIS

segment, price increases implemented to offset currency

fluctuations are not included in organic growth, which only

reflects changes in volumes and the product mix). See the

definition of alternative performance indicators at the end of this

press release.

(2) Adjusted EBITDA: adjustments include expenses such as

restructuring, acquisitions and share-based payment expenses. See

the definition of alternative performance indicators at the end of

this press release.

(3) Defined as Net operating profit after tax [Adjusted EBIT * (1 -

Normative tax rate of 35%)] divided by the invested capital

[Goodwill + Tangible and intangible assets + Working capital]. See

the definition of alternative performance indicators at the end of

this press release.

(4) Will be proposed at the AGM.

Net sales by segment

| €

million |

2017 |

2016 |

% Change |

o/w Organic growth(1) |

| EMEA |

926.4 |

906.5 |

+2.2% |

+3.7% |

| North

America |

783.4 |

816.7 |

-4.1% |

-1.8% |

| CIS, APAC

& Latin America |

619.0 |

549.6 |

+12.6% |

+10.8% |

|

Sports |

512.3 |

466.5 |

+9.8% |

+11.7% |

| Total Group |

2,841.1 |

2,739.3 |

+3.7% |

+4.8% |

| €

million |

Q4 2017 |

Q4 2016 |

% Change |

o/w Organic growth(1) |

| EMEA |

217.9 |

211.9 |

+2.8% |

+3.4% |

| North

America |

172.8 |

189.1 |

-8.6% |

+0.8% |

| CIS, APAC

& Latin America |

165.3 |

157.1 |

+5.2% |

+11.4% |

|

Sports |

97.6 |

88.8 |

+9.9% |

+20.6% |

| Total Group |

653.6 |

646.9 |

+1.0% |

+6.9% |

Adjusted EBITDA(2) by segment

| €

million |

2017 |

2016 |

2017

Margin

(% net

sales) |

2016

Margin

(% net

sales) |

| EMEA |

126.8 |

136.7 |

13.7% |

15.1% |

| North

America |

95.0 |

113.0 |

12.1% |

13.8% |

| CIS, APAC

& Latin America |

88.5 |

81.0 |

14.3% |

14.7% |

|

Sports |

51.5 |

54.1 |

10.1% |

11.6% |

| Central

costs not allocated |

(46.7) |

(50.4) |

- |

- |

| Total Group |

315.1 |

334.4 |

11.1% |

12.2% |

(1) Organic growth: at constant

scope of consolidation and exchange rates (note that in the CIS

segment, price increases implemented to offset currency

fluctuations are not included in organic growth, which only

reflects changes in volumes and the product mix). See the

definition of alternative performance indicators at the end of this

press release.

(2) Adjusted EBITDA: adjustments include expenses such as

restructuring, acquisitions and share-based payment expenses. See

the definition of alternative performance indicators at the end of

this press release.

Comments by reporting

segment

Europe, Middle

East, Africa (EMEA)

Net sales at

constant scope of consolidation and exchange rates grew by

3.7% in 2017. France has been positive

throughout the year after several years of market decline. Nordic

countries showed growth, though Q4 was slightly down. The UK

reported further growth despite an uncertain environment. Southern

Europe enjoyed strong level of growth. Germany, the Netherlands and

Central Europe also achieved a good performance. The Middle East

reported stable sales on a full year basis.

Luxury vinyl tiles (LVT) continued

to fuel volume growth both in the residential and commercial

segments. More than €20m will be invested is this product category

over the next three years, mainly in Poland and Luxemburg. These

investments will further enhance Tarkett's strong position in the

European LVT market and facilitate customer's access to unique and

exclusive designs.

Sales were up

2.2% on a reported basis, penalized by

unfavorable exchange rate fluctuations, mainly the British

Pound.

The adjusted

EBITDA margin was 13.7% compared to 15.1%

in 2016, affected mainly by rising raw material costs and the

adverse evolution of the British Pound. Selling price increases

have been implemented in 2017 and started to bear fruits in Q4. We

anticipate seeing the full benefit of these increases in 2018.

North

America

In North America, full year 2017

sales were down -1.8% on

2016 at constant scope of consolidation and

exchange rates but increased slightly over the fourth quarter (+0.8%).

Commercial resilient flooring and

accessories posted growth in 2017, benefiting from the last two

year investments made in terms of service, products and operational

performance.

Commercial carpet remained down in

2017, mostly owing to weaknesses in the office and healthcare

sectors, although the situation improved in the fourth quarter. We

are planning to follow 2017 products launches with continued

products and services deployment in 2018.

Luxury vinyl tiles (LVT) kept

delivering good growth in North America and remain an important

driver for Tarkett. Tarkett has enriched its tile product range and

in Q3 has launched ProGen, a semi-rigid board product that has been

very well received by our customers.

Tarkett has announced investments

totaling $60 million over a three-year period to increase LVT

production at its flooring manufacturing facilities in Florence,

Alabama, including a new distribution center. These investments

increase our local LVT production capacity, improve supply chain

efficiency and enhance customer service.

Reported

sales decreased by -4.1% on the back of

the depreciation of the US dollar against the euro over the

year.

Adjusted EBITDA

margin narrowed to 12.1% from 13.8% in

2016, penalized by higher raw material prices, a slight decrease in

sales volumes as well as lower operational performance in Q3

(although Q4 has significantly improved). The selling price

increases implemented in 2017 have started to contribute positively

in the fourth quarter and will bring full benefit in 2018.

Andrew Bonham has been appointed

President and Chief Executive Officer of Tarkett North America,

effective March 5, 2018. Andrew has extensive experience in the

construction, industrial equipment and specialty chemicals

industries and has held several global leadership positions as well

as regional leadership in North America and Europe.

CIS, APAC &

Latin America

The CIS, APAC & Latin America

segment posted a robust 10.8% organic sales

growth in 2017 (excluding selling price adjustments in the CIS

region). The CIS countries continued throughout the year on a

steady upward trend. The strengthening of real wages and improving

consumer confidence have fueled a recovery in volumes as well as an

improved product mix.

Sales in the Asia-Pacific region grew over the full year, spurred

by nice trends in China and South-East Asia. Latin America saw

further growth in 2017, thanks to vigorous LVT volumes in Brazil,

despite the difficult environment in the Brazilian construction

market.

On a reported

basis, sales rose by 12.6%, thanks to

gains in the Russian ruble and the Brazilian real on a full year

basis.

In Russia, Tarkett maintained its

focused strategy of adapting selling prices to movements in

exchange rates. In December 2017, a 5% price increase on vinyl

products has been announced to cope with the ruble devaluation in

H2 2017. As a reminder, vinyl selling prices had been reduced by 5%

to 15% in Q2 2017, depending on products following several quarters

of ruble recovery.

Adjusted EBITDA

margin remained at a healthy 14.3% from

14.7% in 2016, against a tough basis of comparison in H2 2016 when

the margin had reached 17.9% thanks to a positive "lag effect" (net

impact of currencies and selling prices evolutions) of

€11.6m.

In 2017, the full-year "lag effect" on adjusted EBITDA is -€4.5m,

as a result of the depreciation of the ruble in the second half of

the year combined with lower selling prices (leading to a negative

-€12.0m impact on adjusted EBITDA in H2 2017). However, the

segment's margin has proved resilient at 14.3% thanks to a strong

contribution of additional volumes and manufacturing

productivities.

Sports

The Sports segment put in another

very good performance reaching 11.7% organic

growth in 2017, driven by growth in all product lines. The

increased share of turnkey projects, which include billings for

civil engineering work, has also contributed to reach this high

level of sales. Several high profile projects have been completed

in the course of 2017 in hybrid turf (FC Barcelona's Camp Nou and

Liverpool FC's stadiums) as well as in running tracks (Beynon

banked hydraulic track Rise-n Run in the University of

Michigan).

Sports is pursuing its

geographical expansion and has announced the acquisition of the

assets of Grassman (sales of AUS$15m, approx. €10m in 2017), a

leading artificial turf manufacturer in Australia. In addition to

reinforcing our local presence, this move gives us access to new

market segments (hockey, tennis or landscape). Sports has also

initiated a strategic partnership with Allsports Construction &

Maintenance, the market leader in the construction and installation

of high profile synthetic turf fields in Scotland.

Reported

sales were up 9.8%, penalized by the

depreciation of the US dollar against the euro.

Adjusted EBITDA

margin stood at 10.1% versus 11.6% in

2016. In H1 2017, the adjusted EBITDA benefited from a US$ 12m

settlement in connection with a patent infringement claim against

competitor Astroturf. Full year adjusted EBITDA margin was

penalized by the large proportion of turnkey projects - the civil

engineering part of which generates a lower margin - higher raw

material prices, legal costs and lower than last year performance

in operations in Q3.

In order to further streamline its operations, the Group has closed

its artificial turf facility in Spain (17 employees). The

production has been transferred to its production site in Auchel,

France.

Net profit

attributable to owners of the Company

Central costs

decreased slightly to €46.7m from €50.4m in 2016.

Adjustments to

EBIT went from -€23.0m in 2016 to -€183.6m in 2017, mainly due

to the French Competition Authority penalty of €165m.

Financial income

and expenses amounted to -€23.4m in 2017 vs. -€21.0m in 2016,

due to higher foreign exchange losses in the CIS countries.

The effective tax

rate decreased to 19.7% compared to 31.2%

in 2016 thanks a more favorable country mix and the reassessment of

tax credits due to changes in some entities' earnings profile.

Tarkett recorded a +9m€ tax income following the decision of the

French constitutional court to cancel the 3% surtax on

dividend.

Net profit

attributable to owners of the Company amounted to -€39m. Excluding the €165m penalty to the French

Competition Authority, the net profit attributable

to owners of the Company was up +6.5% vs.

2016 at €126m.

A sound financial

structure

Ongoing capital

expenditures increased moderately in 2017, totaling €110.9m, or

3.9% of net sales vs. €91.5m 2016, owing to capacity investments in

growing product categories such as LVT and further operations

productivity enhancement.

Free cash

flow amounted to €99.6m excluding the French Competition

Authority penalty from +€148.0m in 2016. The payment of the €165m

penalty to the French Competition Authority took place at the end

of December 2017.

Net debt

increased from €378m to €492m, resulting in a leverage ratio to 1.6

times adjusted EBITDA (1.1x at year-end 2016).

The Management Board will propose

payment of a €0.60 per-share

dividend at the Annual General Meeting on April 26, 2018,

stable compared to last year.

Outlook

Most of our markets are well

positioned in 2018. The Group expects positive growth driven by a

combination of innovative new products and new services to further

enhance customer experience. At constant exchange rates, EMEA

should be well oriented and grow moderately. North America should

continue to improve. The CIS and Sports segments should continue to

grow, albeit at a lower rate than in 2017.

At current prices, we anticipate

in 2018 a negative impact from raw materials of similar magnitude

to that experienced in 2017. Against this backdrop, the Group will

pursue its efforts on selling prices with the goal of compensating

raw material costs for the full year.

Moreover, the Group will further

deploy its World Class Manufacturing program to generate savings in

line with historical performances.

As a result of the commitment of

the Group to long term growth strategy and continuous optimization

of its operations, capital expenditures in 2018 should be around 5%

of net sales. This investment effort is focused on capacity and

efficiency projects, in particular through automation and notably

on the LVT category, but also in regions with potential for faster

growth (Wood production line in Russia).

US tax reforms which came into

effect in January 2018 will positively impact the Group's after tax

earnings, principally due to the reduction of the US federal

corporate income tax rate. In addition, the Group will benefit from

the evolution of its country mix and from the cancellation of the

3% tax on dividends in France. Going forward, we estimate that the

Group's effective tax rate should be circa 30%.

In October 2016, the Group

presented a strategic plan which included 2020 financial targets

(see appendix 3 for more details).

The Group maintains the objective of achieving those targets by the

end of the plan. Given the current environment of increased

inflation in raw material prices and unfavorable currency

movements, the achievement of the profitability & return

targets (adjusted EBITDA margin > 12% and ROIC > 9%) is more

challenging in 2018.

With its healthy balance sheet,

Tarkett will continue to actively seek out opportunities for

external growth.

Supervisory

Board: Evolution of the governance of Tarkett

Tarkett's Supervisory Board has

agreed that Eric La Bonnardière, currently Vice Chairman, will

become Chairman of the Supervisory Board. He will replace Didier

Deconinck who will remain on the Board as Vice Chairman.

This decision is dependent upon

the Annual General Meeting on April 26th, 2018

approving the renewal of their mandates as Board members.

Eric La Bonnardière is a grandson

of Bernard Deconinck Senior. Eric is the co-founder, Chairman, and

CEO of Evaneos, a leading European travel marketplace. Before

creating Evaneos in 2009, Eric began his career in 2006 as a

consultant at Capgemini and at the strategic consulting firm

Advancy, where he focused on projects relating to industry and

distribution. He obtained an engineering degree from Supélec, and a

Master in Business from HEC Paris.

The audited

consolidated financial statements for the full year 2017 are

available on Tarkett's website. The analysts' conference will be

held on Friday February 9, 2018 at 11:00 am CET and an audio

webcast service (live and replay) along with the results

presentation will be available on www.tarkett.com.

Financial calendar

-

April 24, 2018: Q1 2018 financial results -

press release after close of trading on the Paris

market and conference call the following morning

-

April 26, 2018: Annual General Meeting

-

July 25, 2018: H1 2018 financial results -

press release after close of trading on the Paris

market and presentation in person the following morning

-

October 23, 2018: Q3 2018 financial Results

- press release after close of trading on the

Paris market and conference call the following morning

About

Tarkett

With net sales of more than €2.8bn in 2017, Tarkett is a worldwide

leader of innovative flooring and sports surface solutions.

Offering a wide range of products including vinyl, linoleum,

rubber, carpet, wood and laminate flooring, artificial turf and

athletics tracks, the Group serves customers in over 100 countries

across the globe. With 12,500 employees and 34 industrial sites,

Tarkett sells 1.3 million square meters of flooring every day, for

hospitals, schools, housing, hotels, offices, stores and sports

fields. Committed to sustainable development, the Group has

implemented an eco-innovation strategy and promotes a circular

economy. Tarkett is listed on Euronext Paris (compartment A, ISIN:

FR0004188670, ticker TKTT) as well as on the SBF 120 and CAC Mid 60

indexes. www.tarkett.com

Investor

Relations contact

Tarkett Alexandra Baubigeat Boucheron

alexandra.baubigeatboucheron@tarkett.com

Media Relations

contacts

Tarkett Véronique Bouchard Bienaymé

communication@tarkett.com

Brunswick tarkett@brunswickgroup.com Tél. : +33 (0) 1 53 96 83

83

Disclaimer

On February 8, 2018, Tarkett's Supervisory Board reviewed the

Group's consolidated financial statements as of and for the year

ended December 31, 2017. The audit of the financial statements has

been completed and the statutory auditors' report on the financial

statements has been issued.

This press release may contain

estimates and/or forward looking statements. Such statements do not

constitute forecasts regarding Tarkett's results or any other

performance indicator, but rather trends or targets, as the case

may be.

These statements are by their nature subject to risks and

uncertainties, many of which are outside Tarkett's control,

including, but not limited to the risks described in Tarkett's

'document de référence', registered on March 21st, 2017

available on its Internet website (www.tarkett.com). These risks

and uncertainties include those discussed or identified under

'Facteurs de Risques' in the 'document de reference'. These

statements do not warrant future performance of Tarkett, which may

materially differ. Tarkett does not undertake to provide updates of

these statements to reflect events that occur or circumstances that

arise after the publication of the press release.

Appendices

1)

Bridges

Net Sales evolution by

nature in million euros- see document attached

2/ Key figures

Net sales by segment

| €

million |

Q1 2017 |

Q1 2016 |

% Change |

o/w Organic growth(1) |

| EMEA |

243.4 |

232.4 |

+4.7% |

+7.0% |

| North

America |

190.3 |

187.2 |

+1.6% |

-2.1% |

| CIS, APAC

& Latin America |

121.3 |

103.5 |

+17.2% |

+2.0% |

|

Sports |

56.7 |

53.2 |

+6.6% |

+3.6% |

| TOTAL |

611.7 |

576.3 |

+6.1% |

+2.8% |

| €

million |

Q2 2017 |

Q2 2016 |

% Change |

o/w Organic growth(1) |

| EMEA |

237.9 |

239.3 |

-0.5% |

+1.5% |

| North

America |

222.4 |

223.9 |

-0.7% |

-1.3% |

| CIS, APAC

& Latin America |

154.4 |

131.4 |

+17.4% |

+11.3% |

|

Sports |

137.6 |

127.3 |

+8.0% |

+5.9% |

| TOTAL |

752.3 |

721.8 |

+4.2% |

+3.2% |

| €

million |

H1 2017 |

H1 2016 |

% Change |

o/w Organic growth(1) |

| EMEA |

481.3 |

471.6 |

+2.1% |

+4.2% |

| North

America |

412.7 |

411.1 |

+0.4% |

-1.6% |

| CIS, APAC

& Latin America |

275.7 |

234.9 |

+17.4% |

+7.2% |

|

Sports |

194.3 |

180.5 |

+7.6% |

+5.3% |

| TOTAL |

1,364.0 |

1,298.1 |

+5.1% |

+3.0% |

| €

million |

Q3 2017 |

Q3 2016 |

% Change |

o/w

organic(1) |

| EMEA |

227.2 |

222.9 |

+1.9% |

+2.9% |

| North

America |

197.9 |

216.6 |

-8.6% |

-4.2% |

| CIS, APAC

& LATAM |

178.0 |

157.7 |

+12.9% |

+15.5% |

|

Sports |

220.4 |

197.2 |

+11.8% |

+13.6% |

| TOTAL |

823.5 |

794.3 |

+3.7% |

+6.1% |

| €

million |

Q4 2017 |

Q4 2016 |

% Change |

o/w

organic(1) |

| EMEA |

217.9 |

211.9 |

+2.8% |

+3.4% |

| North

America |

172.8 |

189.1 |

-8.6% |

+0.8% |

| CIS, APAC

& LATAM |

165.3 |

157.1 |

+5.2% |

+11.4% |

|

Sports |

97.6 |

88.8 |

+9.9% |

+20.6% |

| TOTAL |

653.6 |

646.9 |

+1.0% |

+6.9% |

(1) Organic growth: at constant

scope of consolidation and exchange rates (note that in the CIS

segment, price increases implemented to offset currency

fluctuations are not included in organic growth, which only

reflects changes in volumes and the product mix). See the

definition of alternative performance indicators at the end of this

press release.

Quarterly Group adjusted

EBITDA(1)

| €

million |

2017 |

2016 |

2017 Margin

(% net sales) |

2016

Margin

(% net sales) |

| Q1 |

51.5 |

45.0 |

8.4% |

7.8% |

| Q2 |

108.8 |

106.5 |

14.5% |

14.8% |

| Q3 |

101.1 |

119.2 |

12.3% |

15.0% |

| Q4 |

53.7 |

63.7 |

8.2% |

9.8% |

Half-year adjusted

EBITDA(1) by segment

| €

million |

H1 2017 |

H1 2016 |

H1 2017 Margin

(% net sales) |

H1 2016

Margin

(% net sales) |

| EMEA |

68.5 |

74.8 |

14.2% |

15.9% |

| North

America |

51.7 |

59.3 |

12.5% |

14.4% |

| CIS, APAC

& Latin America |

40.2 |

24.8 |

14.6% |

10.6% |

|

Sports |

23.0 |

18.2 |

11.8% |

10.1% |

| Central

costs not allocated |

(23.1) |

(25.7) |

- |

- |

| Total |

160.3 |

151.4 |

11.8% |

11.7% |

| €

million |

H2 2017 |

H2 2016 |

H2 2017 Margin

(% net sales) |

H2 2016

Margin

(% net sales) |

| EMEA |

58.3 |

61.9 |

13.1% |

14.2% |

| North

America |

43.3 |

53.7 |

11.7% |

13.2% |

| CIS, APAC

& Latin America |

48.3 |

56.2 |

14.1% |

17.9% |

|

Sports |

28.5 |

35.9 |

9.0% |

12.6% |

| Central

costs not allocated |

(23.6) |

(24.7) |

- |

- |

| Total |

154.8 |

183.0 |

10.5% |

12.7% |

(1) Adjusted EBITDA: adjustments

include expenses such as restructuring, acquisitions and

share-based payment expenses. See the definition of alternative

performance indicators at the end of this press release.

Simplified consolidated income statement

| €

million |

2017 |

2016 |

| Net sales |

2,841.1 |

2,739.3 |

Adjusted EBITDA(1)

% net sales |

315.1

11.1% |

334.4

12.2% |

|

Depreciation and amortization |

(118.8) |

(120.7) |

|

Adjustments to EBIT |

(183.6) |

(23.0) |

Result from operations (EBIT)

% net sales |

12.7

0.4% |

190.7

7.0% |

| Financial

income and expenses |

(23.4) |

(21.0) |

| Profit

before income tax |

(7.7) |

172.3 |

Income

tax

Effective tax rate(2) |

(30.3)

19.7% |

(53.0)

31.2% |

| Net profit attributable to owners of the Company |

(38.7) |

118.6 |

| Basic

earnings per share |

€(0.61) |

€1.87 |

(1) Adjusted EBITDA: adjustments

include expenses such as restructuring, acquisitions and

share-based payment expenses. See the definition of alternative

performance indicators at the end of this press release.

(2) Excluding the effect of the €165m French Competition Authority

penalty, non tax deductible.

3/ 2017-2020

financial objectives communicated in October 2016, unless

transforming acquisition, based on relatively stable raw material

prices (as of October 2016)

-

Net Sales of €3.5bn in 2020, including

acquisitions

-

Adjusted EBITDA margin(1) >

12%

-

Return On Invested Capital (ROIC)(2) >

9%

-

Additional sales by 2020 of ~€500m through

acquisitions

-

Net debt / adjusted EBITDA(1) <

2.5x

-

Dividend: at least €0.60 per share

(1) Adjusted EBITDA: adjustments

include expenses such as restructuring, acquisitions and

share-based payment expenses. See the definition of alternative

performance indicators at the end of this press release.

(2) Defined as the Net operating profit after tax [Adjusted EBIT *

(1 - Normative tax rate of 35%)] divided by the Capital employed

[Goodwill + Tangible and intangible assets + Working capital].

4/ Definition of

alternative performance indicators

(not defined by IFRS)

The Tarkett Group uses the

following non-IFRS financial indicators:

These indicators are calculated as described below.

-

Organic growth:

-

Organic growth measures the change in net sales

as compared with the same period in the previous year, at constant

scope of consolidation and exchange rates.

-

The exchange rate effect is calculated by

applying the previous year's exchange rates to sales for the

current year and calculating the difference as compared with sales

for the current year. It also includes the impact of price

adjustments in CIS countries intended to offset movements in local

currencies against the euro.

-

The scope effect reflects:

-

current-year sales for entities not included in

the scope of consolidation in the same period in the previous year,

up to the anniversary date of their consolidation;

-

the reduction in sales relating to discontinued

operations that are not included in the scope of consolidation for

the current year but were included in sales for the same period in

the previous year, up to the anniversary date of their

disposal.

Year-on-year

net sales trends can be analyzed as follows:

| €

million |

2017 |

2016 |

%

Change |

o/w Exchange rate effect |

o/w

Scope effect |

o/w

Organic growth |

| Total Group - Q1 |

611.7 |

576.3 |

+6.1% |

+3.3% |

0.0% |

+2.8% |

| Total Group - Q2 |

752.3 |

721.8 |

+4.2% |

+0.9% |

+0.1% |

+3.2% |

| Total Group - H1 |

1,364.0 |

1,298.1 |

+5.1% |

+2.0% |

+0.1% |

+3.0% |

| Total Group - Q3 |

823.5 |

794.3 |

+3.7% |

-2.5% |

+0.1% |

+6.1% |

| Total Group - Q4 |

653.6 |

646.9 |

+1.0% |

-5.9% |

+0.1% |

+6.9% |

| Total Group - H2 |

1,477.1 |

1,441.2 |

+2.5% |

-4.0% |

+0.1% |

+6.4% |

| Total Group - FY |

2,841.1 |

2,739.3 |

+3.7% |

-1.2% |

+0.1% |

+4.8% |

-

Adjusted EBITDA:

-

Adjusted EBITDA is calculated by deducting the

following income and expenses from result from operations before

depreciation and amortization:

-

restructuring costs intended to increase the

Group's future profitability;

-

capital gains and losses recognized on

significant asset disposals;

-

provisions and provision reversals for loss in

value;

-

costs arising on corporate and legal

restructuring;

-

share-based payment expenses;

-

other one-off items considered non-recurring

owing to their nature.

-

Note 3.1 to the consolidated financial

statements includes a table that reconciles operating income with

adjusted EBITDA, as well as the effect of adjustments by

type.

|

|

|

Of which adjustments: |

|

| (in millions of euros) |

2017 |

Restructuring |

Gains/losses on asset sales/impairment |

Business combinations |

Share-based payments |

Other* |

2017 adjusted |

| |

| Net revenue |

2,841.1 |

- |

- |

- |

- |

- |

2,841.1 |

| Cost of sales |

(2,138.1) |

1.6 |

3.9 |

- |

1.0 |

0.0 |

(2,131.6) |

| Gross profit |

703.0 |

1.6 |

3.9 |

- |

1.0 |

0.0 |

709.5 |

| Other operating income |

30.1 |

0.2 |

0.1 |

(1.9) |

- |

(0.1) |

28.4 |

| Selling and distribution expenses |

(319.4) |

(1.2) |

- |

- |

0.5 |

- |

(320.1) |

| Research and development |

(36.4) |

0.4 |

- |

- |

0.3 |

- |

(35.7) |

| General and administrative expenses |

(187.5) |

0.8 |

0.6 |

0.6 |

10.3 |

0.4 |

(174.8) |

| Other operating expenses |

(177.1) |

0.3 |

- |

- |

- |

165.8 |

(11.0) |

| Result from operating activities

(EBIT) |

12.7 |

2.1 |

4.6 |

(1.3) |

12.1 |

166.1 |

196.3 |

| Depreciation and amortization |

122.3 |

1.0 |

(4.5) |

- |

- |

- |

118.8 |

| EBITDA |

135.0 |

3.1 |

0.1 |

(1.3) |

12.1 |

166.1 |

315.1 |

| *Others: includes the adjustment linked

to the €165m booked following the French Competition Authority

decision. |

Net cash flow from operations for

the year can be broken down as follows:

| €

million |

2017 |

2016 |

| Cash

generated from operations |

91.1 |

297.3 |

|

Acquisitions of property, plant and equipment and intangible

assets |

(111.1) |

(91.9) |

|

Restatement of non-recurring capital expenditure |

0.2 |

0.4 |

| Net cash flow from operations |

(19.8) |

205.8 |

Note: Cash generated from

operations decrease significantly due to the penalty paid to the

French Competition Authority.

-

Free cash flow:

-

Net cash flow from operations, as defined above,

to which the following inflows are added to (or outflows are

subtracted from) the cash flow statement:

-

Net interest received (paid);

-

Net taxes collected (paid);

-

Miscellaneous operational items deposited

(disbursed); and

-

Proceeds (losses) from disposals of fixed

assets.

-

Free cash flow may be broken down as follows:

| €

million |

2017 |

2016 |

| Net cash

flow from operations |

(19.8) |

205.8 |

| Net

interest paid |

(11.3) |

(15.3) |

| Net taxes

paid |

(37.8) |

(41.1) |

|

Miscellaneous operational items |

(1.0) |

(2.1) |

| Proceeds

from sale of property, plant and equipment |

4.5 |

0.7 |

| Free Cash Flow |

(65.4) |

148.0 |

Note 3.5 to the consolidated financial statements includes a table

showing the reconciliation of the line items in the Statement of

Cash Flows to operating cash flow and free cash flow.

Net operating profit after taxes (NOPAT) is

calculated as follows:

| € million |

2017 |

2016 |

| Result from operating activities

(EBIT) |

12.7 |

190.7 |

| Adjustments |

|

|

|

Restructuring costs |

2.1 |

5.0 |

| Gains (losses) on disposal of fixed assets/Impairment |

4.6 |

2.4 |

| Business combinations |

(1.3) |

4.6 |

| Share-based payments |

12.1 |

8.7 |

| Other |

166.1 |

2.3 |

| Adjusted EBIT |

196.3 |

213.7 |

| Normative tax rate(1) |

35% |

35% |

| Net operating profit after taxes (NOPAT) (A) |

127.6 |

138.9 |

(1) At this stage, 35% has been

kept for coherence purpose with the 2020 objective calculation

formula.

Invested capital is calculated as follows:

| € million |

2017 |

2016 |

| Property, plant and equipment |

467.4 |

488.6 |

| Intangible assets |

91.4 |

108.5 |

| Goodwill |

510.5 |

550.4 |

| Working capital(1) |

365.1 |

347.8 |

| Total invested capital (B) |

1,434.4 |

1,495.3 |

(1) Working capital includes

inventory, trade and other receivables, deferred tax assets and

liabilities, trade payables, other liabilities, and other

short-term provisions, restated for financial items (€3.3m) and for

amounts payable on fixed assets (€5.8m).

The Group's return on invested capital is as

follows:

| € million |

2017 |

2016 |

| Return on invested capital (ROIC) (A/B) |

8.9% |

9.3% |

Link to PDF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Tarkett via Globenewswire

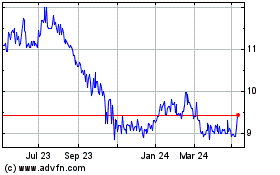

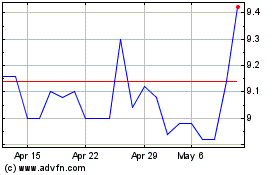

Tarkett (EU:TKTT)

Historical Stock Chart

From May 2024 to Jun 2024

Tarkett (EU:TKTT)

Historical Stock Chart

From Jun 2023 to Jun 2024