By Vipal Monga and Nina Trentmann

French construction-materials company Cie. de Saint-Gobain SA,

is finding it harder to take its money out of China.

The conglomerate--like all multinationals operating there--faces

new delays in recent weeks as Chinese regulators impose tougher

restrictions on the movement of capital out of the country to slow

the yuan's decline.

"The process of authorization is going to become longer now,"

said Javier Gimeno, who heads Saint-Gobain's China operations. "The

procedures will be controlled more strictly."

Nearly 7% of Saint-Gobain's world-wide group sales come from

Asia and Oceania, a large part of that from China. The new rules

are adding confusion and anxiety to a process that had been getting

much easier over the past year, he said. The shift could cause some

multinationals to rethink future investments in a country where

once-sure payoffs are suddenly facing an uncertain return, analysts

say.

As of late November, firms that want to exchange yuan into

dollars in China now need approval for any transaction greater than

$5 million. They also face tighter limits on amounts they can

transfer in and out of bank accounts in China to affiliates in

other countries, in a practice known as "cross-border

sweeping."

"We hear a lot questions from corporates about whether they will

be able to repatriate their money in the future," said Alexander

Tietze, managing director at Acon Actienbank AG, a German bank that

advises companies on Chinese investments. He expects foreign

investments in China to slow, and cautioned that foreign takeovers

or plans for new joint ventures could fail because of the

controls.

With the Chinese economy struggling, multinationals have fewer

opportunities to reinvest there, which makes it more difficult for

them to do much with money trapped in China.

"A majority of clients are currently consolidating and

restructuring their China business," said Bernd-Uwe Stucken, a

lawyer with Pinsent Masons LLP in Shanghai. Some clients are

closing down their business, with new investments being the

exception to the rule, Mr. Stucken said.

Adding to the confusion: it is unclear where the limits are,

because regulators haven't published official rule changes, but

instead have given only informal guidance to banks, according to

Daniel Blumen, partner at Treasury Alliance Group, a consulting

firm.

Calls to the People's Bank of China weren't returned.

One official at a large multinational said that companies can

now only sweep amounts out of the country equal to 30% of their

Chinese assets. That is down from 100% under previous guidance, but

those figures couldn't be independently confirmed.

One banker at a large European bank said transfers that once

took between one to three days can now take more than a week to

complete.

The European Chamber of Commerce in China, which represents more

than 1,600 European companies, is aware of several cases in which

payments by multinational firms are stuck in China awaiting new

approvals, said Joerg Wuttke, president of the chamber. The new

regulatory scrutiny is disruptive to company operations, and

"exacerbates uncertainties regarding the predictability of China's

investment environment," he said.

China's State Administration of Foreign Exchange, known as SAFE,

and the People's Bank of China, are reacting to worrisome

indicators for investment in the economy. In 2015, foreign firms

and individuals poured roughly $250 billion into China, according

to the World Bank. While that is almost double the amount in 2009,

the recent trends have been negative. Last year marked a

second-consecutive foreign-investment decline, and a 14% drop from

2013.

Meanwhile, the yuan has been weakening, and many multinationals

have decided they would rather convert their funds to dollars and

transfer them out in anticipation of further weakening, said Ker

Gibbs, chairman of the American Chamber of Commerce in

Shanghai.

China's currency is down roughly 7% so far this year and the

capital flight has diminished the country's stockpile of foreign

currency to $3.05 trillion at the end of November, from $3.23

trillion in January, according to the People's Bank of China.

The new measures affect small and medium-size firms more

severely, as they usually operate with limited amounts of cash.

Nevertheless, the new regulation is also hurting bigger firms, said

Mikko Huotari, head of the China foreign relations research program

at Mercator Institute for China Studies, a German think-tank.

The recent clampdown has whipsawed corporate expectations, said

Caroline Owen, founder of RMB Global Advisors, a firm that advises

companies on using the yuan.

"China said it is making all these changes to open up the

border, but the message companies are now getting is that it's

conditional," she said "When things get tough, China will just roll

things back."

Write to Vipal Monga at vipal.monga@wsj.com and Nina Trentmann

at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

December 19, 2016 10:43 ET (15:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

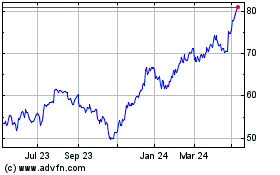

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

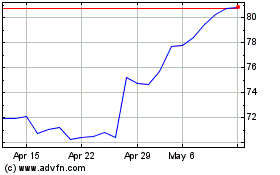

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Jul 2023 to Jul 2024