Adecco Net Profit Soars, Plans Buy-back

March 03 2011 - 2:29AM

Dow Jones News

Swiss recruitment company Adecco SA (ADEN.VX) Thursday reported

a steep increase in fourth quarter net profit and said it had

enjoyed a strong start to 2011 despite tougher comparisons.

The Zurich-based company also said it wanted to buy up to 2% of

its shares "if and when opportune" and said revenues in January had

risen 17% compared with the previous year.

At the beginning of 2010, "demand continued to be very healthy

in France and North America", Adecco's two main markets, where the

pick up already started in the second half of 2009, the company

said in a statement.

Growth also remained strong in Germany, Italy, Benelux,

Switzerland and the Nordic countries, while Japan returned to

positive growth in January 2011.

"Based on these developments, management is confident on strong

top line growth in the months ahead, albeit measured against higher

comparables," Adecco said.

The outlook was given as the company reported a 32% increase in

fourth quarter revenue to EUR4.99 billion, beating expectations of

EUR4.92 billion.

Net income increased to EUR141 million from EUR42 million a year

earlier, beating a forecast of EUR110.8 million in an poll of

analysts by Dow Jones Newswires.

For the whole year, Adecco increased net profit to EUR423

million from EUR8 million, on sales of EUR18.66 billion, up from

EUR14.79 billion.

The company said it expects the environment to remain favorable

for flexible labor in 2011, with most economic growth and activity

being covered by temporary staff.

Permanent jobs will be created, but just enough to cover the new

entrants into the labor market. Unemployment is likely to remain at

high levels in most developed economies, it said.

The company currently holds 14.6 million treasury shares, which

represent 7.7% of total shares issued.

Speaking about the full year, Patrick De Maeseneire, Chief

Executive of the Adecco Group said: "2010 was a good year for

Adecco.

"Most markets returned to strong double-digit revenue growth

during the year."

The growth was mainly driven by the industrial staffing segment,

and also the later cyclical office and professional staffing

segments returned to growth, he said.

"Coming out of the downturn, our customers clearly value

flexibility more than in the past and see it as a strategic

component of their labour force.

"We therefore strongly believe that penetration rates of

flexible labour will surpass the previous peaks of 2007 and

2008."

The company's operating margin had improved 110 basis point to

4.5%, and Adecco is now in "good shape" to achieve its mid-term

EBITA margin target of over 5.5%, De Maeseneire said.

The performance follows positive results by rival staffing

companies Randstad Holding NV (RAND.AE) and Manpower Inc (MAN).

Adecco shares closed Wednesday at CHF61.7, and have gained so

far in 2011.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

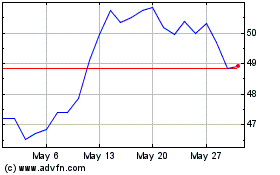

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024