UPDATE: Adecco Expands Into China As Long-Term Play

December 03 2010 - 7:26AM

Dow Jones News

Swiss staffing company Adecco SA's (ADEN.VX) new Chinese joint

venture is part of the company's increased focus on emerging

markets and shows how personnel firms are expanding into the

country's giant labor market.

Adecco announced Friday it will expand its presence in China

through a joint venture with staffing company Foreign Enterprise

Human Resources Service Co. Ltd., or Fesco.

Adecco will hold 49% of the business, which will be based in

Shanghai and named Fesco Adecco, while Fesco will hold the

remaining 51%. The business starts operations on Jan. 1, 2011.

Adecco has been present in China since 1995, but until now has

had a minor presence in the country, a spokesman told Dow Jones

Newswires. He declined to reveal how much Adecco paid for its

stake.

"This is an important step forward for Adecco in China and

underlines our strategic focus on the rapidly growing emerging

markets," said Patrick De Maeseneire, Adecco chief executive, in a

statement.

Only 6% of Adecco's third-quarter revenue came from emerging

markets, which include China.

At EUR330 million, revenue from emerging markets in the third

quarter grew 26% compared with a year earlier.

Key to Adecco's decision is the growth potential of China by

offering services to multinational companies expanding into the

country and for Chinese customers, De Maeseneire added.

The Chinese economy grew at a rate of 9.6% in the third quarter,

while the country created 9.31 million new jobs in urban areas in

the January to September period, surpassing the country's full-year

target of 9 million jobs.

Although earnings potential is limited at present by low wages,

costs are also lower in the country than in Europe, analysts

said.

Earnings could also increase as multinational companies

operating in China increase their efforts to attract and retain

in-demand skills as the country's rapid economic growth fuels a

talent war between foreign and Chinese companies.

Other staffing companies also are increasing their exposure to

China. Randstad Holding NV (RAND.AE) said in October that its China

business showed solid growth in its third quarter, while revenue in

its rest of the world area increasing by 72%.

Board member of Randstad Holding Brian Wilkinson, responsible

for Asia, among others, stated in a recent interview with Dow Jones

that "the biggest challenge facing Randstad Holding in Asia is

keeping up with the region's economic growth."

Fesco already has over 100,000 associates on assignment, and has

access to a network of more than 100 branches throughout China with

a large and established local and multinational client base, Adecco

said.

Fesco Adecco mainly will provide clients with general staffing,

professional staffing and outsourcing services including the

management of payroll and benefits administration, with scope to

expand its offering.

The joint venture is the first cooperation between these two

companies and could lead to further cooperation, the companies

said.

President of Fesco Shanghai, Ni Ying, said: "The joint venture

will not only introduce the latest managerial concepts and exchange

platforms for Fesco, but also help Fesco attract and expand its

international client base within China."

Analysts welcomed the move by Adecco, saying it was a long-term

move for the company.

"It is, strategically, a sound move. this is a move for the

future," said Helvea analyst Chris Burger.

At 1030 GMT, Adecco's shares traded up 1.85 Swiss francs, or

3.1% at CHF61.45, while the benchmark SMI index traded down 0.16%.

The shares have gained 2% this year.

-By John Revill, Dow Jones Newswires; +41 43 443 8042;

john.revill@dowjones.com

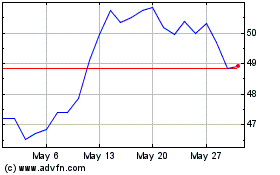

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024