UPDATE: Adecco Swings To Profit, Confirming Market Pickup

August 11 2010 - 6:01AM

Dow Jones News

Adecco SA (ADEN.VX), the world's largest temporary employment

company by sales, Wednesday said it swung to a second-quarter net

profit as demand for temporary staffing jumped and because last

year's figures had been hit by restructuring costs.

The company followed nearest rivals Randstad Holding NV

(RAND.AE) of the Netherlands and U.S.-based Manpower Inc. (MAN) in

reporting better profits. In July, Randstad said net profit in the

second quarter jumped to EUR54.0 million from EUR10 million a year

earlier, when it booked about EUR12.5 million in restructuring

charges and costs. Manpower reported a doubling of second-quarter

net profit to $32.7 million from $16.3 million.

Adecco's net profit in the second quarter was EUR97 million,

compared with a net loss of EUR147 million a year earlier, as

revenue rose sharply to EUR4.65 billion from EUR3.59 billion. Both

figures beat analysts' expectations.

Adecco reiterated its financial guidance, saying it is making

good progress in reaching its operating profit margin target of

over 5.5% in the medium term.

Staffing companies were hit hard by the credit crisis and

resulting economic downturn as companies cut staff as they tried to

reduce their costs. This year has seen a pickup in demand, although

concerns about economic growth remain. The U.S. Federal Reserve

Tuesday said it would continue stimulating the U.S. company because

the pace of recovery had slowed in recent months.

"Despite current concerns about the sustainability of the

economic recovery, developments in the staffing industry continue

to signal healthy demand and management is confident of strong

revenue development near term," Adecco said. "To date there is no

evidence of a slowdown of business in the third quarter of

2010."

The company said growth had been strong in its main markets in

France and North America, and revenues had grown more than 10% in

Germany, Italy, the Nordic countries and emerging markets. It said

demand was particularly strong from industrial customers, but its

professional staffing business also returned to growth.

"While keeping a tight grip on costs and pricing, we are very

well positioned to take advantage of the current growth

opportunities," said Chief Executive Patrick de Maeseneire.

He said Adecco may consider bolt-on acquisitions in niche or

emerging markets for a total amount of up to EUR150 million if

opportunities arise. "But don't expect anything big," he added.

Adeeco's recent takeovers were U.S.-based MPS Group and

U.K.-based Spring, two companies focusing on the placement of

employees such as engineers and IT specialists.

A year ago, the company posted impairment charges of EUR192

million in the second quarter because Germany had suffered heavily

from the economic crisis and the company had scrapped its Iberia

brand in Spain.

On the Swiss bourse at 0930 GMT, Adecco's shares were down 1.30

Swiss francs, or 2.3%, to CHF54.30 in a slightly lower general

market. The highly cyclical stock is currently driven by investor

caution regarding global economic prospects, a trader said.

-By Martin Gelnar, Dow Jones Newswires; +41 43 443 80 42;

martin.gelnar@dowjones.com

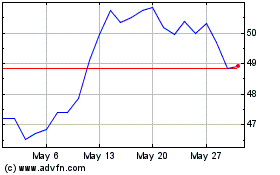

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024