UPDATE: Adecco 1Q Net Profit Up On US, France Recovery

May 06 2010 - 2:29AM

Dow Jones News

Adecco SA (ADEN.VX) Thursday said it more than doubled

first-quarter net profit on the back of improved job markets in the

U.S. and France as well as cost cutting, expecting staffing markets

to continue their recovery during the second quarter.

The world's largest staffing company in terms of sales ahead of

Netherlands-based Randstand Holding NV (RAND.AE) and Manpower Inc

(MAN) of the U.S. said first-quarter net profit jumped to EUR57

million from EUR23 million in the year-earlier period, beating

analyst forecasts of EUR50 million.

Revenues, which fell constantly during the downturn, also

improved 7% to EUR3.96 billion from EUR3.70 billion a year earlier,

partly helped by acquisitions.

While Japan, Germany, the U.K. and Ireland and Switzerland still

suffered from revenue declines, France and the U.S., the company's

two key markets, showed clear signs of improvement.

"The figures show that the job markets are improving, especially

in the U.S., where Adecco showed a 2% organic increase," said Marco

Strittmatter, analysts at Zuercher Kantonalbank.

"Although some markets are still in the red, the improvement

from last year is substantial," Strittmatter said, noting that

Adecco's cost discipline also helped the company improve its

operating margin by 30 basis points to 2.8%.

Adecco, like most of its competitors, faced severe headwinds

during the crisis as companies worldwide cut jobs and introduced

short-time work, reducing the need for temporary employment.

Many companies such as Adecco lost more than 30% of their annual

revenue and analysts expect it may take at least two to three years

before employment firms can reach their pre-crisis size as firms

will continue to curb costs.

Chief Executive Officer Patrick de Maeseneire said trading

conditions in the market for placing blue-collar workers had

improved in the first quarter. He cautioned, however, that pricing

pressure remained acute, forcing Adecco to continue to slash costs

by reducing its own staff and cutting its branch network.

"Looking into the second quarter, we continue to see good

revenue developments in the majority of our markets," de Maeseneire

said, adding that "we will continue our strong cost control, which

together with our disciplined pricing, position us very well to

take full advantage of the improving economic conditions."

Company website: www.adecco.com

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

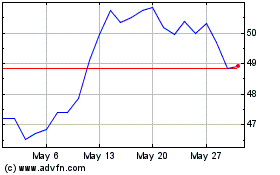

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024