UPDATE: Randstad Earnings Improve As Recovery Gains Momentum

April 28 2010 - 5:22AM

Dow Jones News

Dutch staffing group Randstad Holding NV (RAND.AE) Wednesday

reported its first-quarter earnings swung back into the black as

revenue showed signs of improvement and it said that it sees a

broad-based recovery in all of its markets.

Randstad, the second-largest staffing agency by sales behind

Switzerland's Adecco SA (ADEN.VX), said that "prospects for the

near future are better than they have been for quite some time" and

that it sees an uptick in all of its regions and segments.

In the first quarter, Randstad's revenue trend improved, with

the rate swinging from a contraction of 5% in January to an

increase of 4% in March. Although these trends continued into

April, Randstad warned that they don't guarantee sustainable growth

even though "they do provide confidence."

The upbeat outlook echoed comments by U.S. peer Manpower Inc.

(MAN), which said last week that the recovery will continue into

the second quarter as companies need more temporary staff to

respond to increased demand.

It indicates that global staffing markets may have put the worst

behind them after suffering a deep slump in the past year as

companies cut back on hiring or laid off staff in response to the

downturn.

"Staffing activity is picking up and the recovery is gaining

momentum," said KBC Securities analyst Margo Joris in a note to

investors. Joris added that Randstad's top-line was a positive

surprise and noted that, for the first time since the beginning of

the downturn, the company recorded sales growth in North America,

Germany and France, which is "psychologically important." Joris

upgraded the stock to buy from hold.

Investors welcomed the news. At 0806 GMT, Randstad shares traded

up 1.2% at EUR40.74, the biggest riser in the AEX market in

Amsterdam, which traded down 1.2%. The stock has gained about 15%

in value this year compared to a 4% rise in the AEX, as investors

hope that the early-cycle staffing sector will be the first to

benefit from an economic recovery.

Diemen-based Randstad Wednesday posted net profit of EUR20

million in the first quarter of 2010 from a net loss of EUR54.2

million. The bottom line benefited from a 20% drop in operating

expenses to EUR499.6 million. Revenue fell 1% to EUR3.04 billion

from EUR3.1 billion.

Earnings before interest tax and amortization, or Ebita

excluding one-off items, rose 53% to EUR75.4 million, beating

analyst expectations of EUR71.5 million.

In an effort to cope with the slump, Randstad has been cutting

costs since early 2008 and was able to realize additional savings

through the integration of Vedior, a Dutch rival it acquired that

year. Cost reductions were accelerated as the recession started to

gain pace, with Randstad cutting branches and personnel.

-By Maarten van Tartwijk, Dow Jones Newswires; +31 20 571 5201;

maarten.vantartwijk@dowjones.com

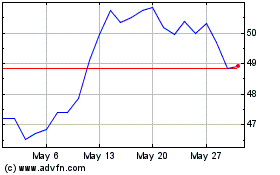

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024