2nd UPDATE: Adecco Swings To Profit As US, France Job Markets Grow

March 03 2010 - 5:02AM

Dow Jones News

Adecco SA (ADEN.VX) Wednesday said it swung to a fourth quarter

net profit on cost cutting and pricing discipline amid a gradual

improvement of job markets in the U.S. and France, which registered

growth for the first time in months during the first few weeks in

2010.

Given the improvement in two of the world's largest economies as

well as continued strength in emerging economies such as India, the

Zurich-based firm was confident for the months ahead, expecting a

broader recovery in the employment sector which was among the

hardest hit during the downturn, prompting companies such as Adecco

to slash costs as sales fell by more than 30%.

"The year 2009 has been exceptionally tough" said Chief

Executive Patrick De Maeseneire, adding, though, that, "we made the

necessary cost reductions". Thanks to these revamp efforts--which

also include a renewed focus on the placement of highly educated or

professional staff, Adecco will "profit from the upturn", he

said.

The world's largest employment firm in terms of sales ahead of

Netherlands-based Randstad Holding NV (RAND.AE) and Manpower Inc

(MAN) of the U.S., said net profit for the three months to the end

of December rose to EUR42 million, after a year-earlier net loss of

EUR22 million. That beat forecasts for a EUR35 million profit.

While fourth quarter sales still fell another 18% to EUR3.79

billion from EUR4.63 billion a year-earlier, Adecco said that

markets in the U.S., France, as well as in Italy, the Nordics and

Iberia have improved in the "recent weeks", boding well for the

months ahead. Also, business is thriving in South America, Eastern

Europe and India, areas on which Adecco wants to focus in future.

"In France and the U.S., the markets are improving and growing

again", said Chief Financial Officer Dominik de Daniel. "We've seen

improvement in the U.S. automotive sector and in France we have

seen more demand in the chemical and IT consulting sector." Adecco

generates about half of its revenue in the U.S. and France.

On the back of this market improvement and the recent takeovers

of professional staffing firms MPS Group and Spring, Adecco now

aims to achieve an operating margin of more than 5.5% in the

mid-term, up from 2.9% in the fourth quarter, CFO de Daniel

said.

"The visibility is still low given the fact that we come out of

the strongest downturn our industry has faced", de Daniel said.

"But the direction is clear and with our new business mix, we

expect to achieve this goal over the next few years".

Including its recent takeovers, Adecco generates--on a pro-forma

2009 basis--about 28% of its overall sales through the placement of

highly-educated staff such as lawyers, consultants and engineers, a

business that promises higher margins than the mass placement of

blue-collar workers.

Meanwhile, Adecco's CEO De Maeseneire said the company will

focus on organic growth after its recent takeover spree. "We will

now focus on the integration of MPS Group and Spring to achieve the

planned synergies. Therefore we will focus on organic growth over

the next few years", he said.

Shares of Adecco, which have gained more than 65% over the past

year on recovery hopes, continued to gain ground as analysts

welcomed the company's confident outlook. At 0903 GMT the shares

were up 3%, or CHF1.65, at CHF56.15 while the overall Swiss stock

market was lower.

Company Web Site: www.adecco.com

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

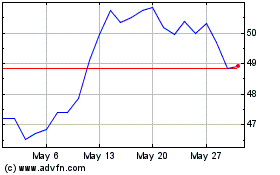

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024