UPDATE: Randstad More Upbeat Even As Profit Misses Views

February 18 2010 - 9:23AM

Dow Jones News

Dutch staffing group Randstad Holding NV (RAND.AE) Thursday

posted lower-than-expected fourth-quarter net profit, but signaled

increased confidence in an economic recovery as markets

stabilized.

"Our markets have stabilized and classical recovery patterns are

visible," said Chief Executive Ben Noteboom. He added that "if

recovery continues we should do very well."

That recovery so far has been uneven. It is apparent in the

industrial sector in France, Germany and the U.S., Chief Financial

Officer Robert-Jan van de Kraats told Dow Jones in an interview,

but in the Netherlands, its home market, which accounts for about

23% of revenue, there was no sign of an upturn.

"The rate of decline is improving strongly," said van de Kraats.

"We've seen this trend now for two quarters."

Randstad said the recovery remains fragile, but it is facing the

coming quarters with increased confidence.

The Diemen-based company swung to a net profit of EUR46 million

in the fourth quarter of 2009 from a net loss of EUR233 million a

year earlier when it was burdened by a non-cash goodwill impairment

of EUR500 million related to its acquisition last year of Dutch

rival Vedior NV. Analysts had expected a EUR54.6 million net profit

for the period.

Revenue at the second-largest staffing agency by sales behind

Adecco SA (ADEN.VX) dropped 20% to EUR3.18 billion from EUR3.96

billion, below analysts' forecasts of EUR3.22 billion.

Organic revenue per working day fell 18% in the final quarter of

2009. During the quarter, the revenue trend improved, with the rate

of decline moving from a contraction of 21% in October to a

contraction of 13% in December. In January, revenue per working day

declined 5% organically, and the improving trend continued into the

first two weeks of February.

Global staffing markets have shrunk in the past year as

companies cut back on hiring or laid off staff in response to the

downturn. Randstad has been cutting costs since early 2008 and was

able to realize additional savings through the integration of

Vedior. Cost reductions were accelerated as the recession started

to gain pace, with Randstad cutting branches and personnel.

In the current environment, Randstad won't cut costs

further.

Operating expenses excluding restructuring and integration costs

fell 22% to EUR499.8 million. The figure was in line with the

EUR500 million Randstad had said it hoped to achieve. Earnings

before interest, tax and amortization, or Ebita excluding one-off

items, was down 39% to EUR106.1 million, below analysts'

expectations of EUR116.8 million. The company's Ebita margin was

3.3% in the fourth quarter, while Randstad targets a margin of

4%.

The company scrapped its full-year dividend for the second year

in a row, citing its leverage ratio.

Its net debt to earnings before interest, tax, depreciation and

amortization, or Ebitda, stood at 2.5 times at the end of the

fourth quarter, above its target of between zero and 2 times.

"We, therefore, aim to further reduce debt and propose that no

ordinary dividend is paid for 2009," the company said in a

statement.

Net debt stood at EUR1.01 billion at the end of 2009, compared

with EUR1.64 billion a year earlier.

"We have ample capacity to benefit from renewed growth in all

major global markets. Whether it is in staffing, in managed

services or in the placement of professionals, we have an excellent

position from which to start building again, and our new Randstad

group is ready for the future," Noteboom said.

At 1334 GMT, Randstad shares traded down EUR0.42, or 1.3%, at

EUR32.58, while the benchmark AEX index traded up 0.2%.

-By Robin van Daalen, Dow Jones Newswires; +31-20-5715200;

robin.vandaalen@dowjones.com

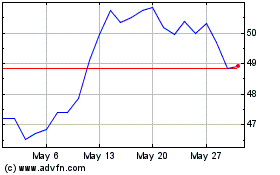

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024