ArcelorMittal reports fourth quarter 2021 results

Luxembourg, February 10, 2022 - ArcelorMittal

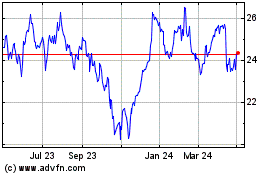

(referred to as “ArcelorMittal” or the “Company”) (MT (New York,

Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading

integrated steel and mining company, today announced results1,2 for

the three-months and twelve-months period ended December 31,

2021.

2021 Key highlights:

- Health and safety focus: Protecting the health

and wellbeing of employees remains the Company’s overarching

priority; LTIF rate of 0.79x in FY 2021 vs. 0.61x in FY 20203

- Robust financial performance: FY 2021

operating income of $17.0bn4 (vs. $2.1bn4,5 in FY 2020) and EBITDA

of $19.4bn (vs. $4.3bn in FY 2020)

- Enhanced share value: Basic EPS of $13.53/sh.

Equity book value per share22 increased to $51/sh (from $32/sh in

FY 2020)

- Financial strength: The Company ended 2021

with gross debt of $8.4bn (vs. $12.3bn at the end of 2020), net

debt of $4.0bn (vs. $6.4bn at the end of 2020) and returned to

investment grade; pension/OPEB declined 20% to $3.7bn in Dec'21 vs.

$4.6bn in Dec'20

- Healthy net income: $15.0bn6 in FY 2021

includes share of JV and associates net income of $2.2bn (vs.

$0.2bn in FY 2020) largely reflecting performance at AMNS India,

AMNS Calvert and other investees

- Strong FCF generation: 9.2% higher steel

shipments YoY on scope adjusted basis21 led to a working capital

investment of $6.4bn in FY 2021; despite this the Group generated

$6.6bn free cash flow (FCF)17 in FY 2021 ($9.9bn net cash provided

by operating activities less capex of $3.0bn less minority

dividends of $0.3bn)

- Significant returns to shareholders: The

Company returned $6.7bn of capital to shareholders in FY 2021,

reducing the fully diluted shares outstanding by 19%; 165m shares

cancelled (120m shares in 2021 and 45m shares in Jan 2022)

Priorities & Outlook:

- Global leadership on addressing climate

change:

- The Company is progressing its plans to reduce the CO2e

intensity of its global production by 25% by 2030 (including a 35%

reduction in CO2e intensity in Europe) with a net investment of

$0.3bn forecast in 2022

- 1st Smart Carbon projects to be commissioned in Ghent (Belgium)

by end 2022

- 1st Hydrogen reduction project in Hamburg to start production

2024-2025; Further decarbonization projects announced during the

year in Spain, Canada, Belgium and France

- New €1.7bn investment in Fos-sur-Mer & Dunkirk (France),

enabling a reduction of ~40% or 7.8Mtpa CO2 emissions in France by

2030

- XCarbTM Innovation Fund investments12 in five technology

partnerships during 2021 totaling $180m

- Sales of XCarb® green steel certificates

targeted to increase to 0.6Mt run rate by end 2022

- New 3 year $1.5bn Value plan to deliver commercial and

business improvements

- Delivering strategic growth in support of higher

sustainable returns

- New $0.3bn pellet plant investment at Kryvyi Rih (Ukraine) to

ensure sustainability, environmental compliance and improve

productivity; new $0.2bn section mill in Barra Mansa (Brazil) to

produce higher value added products and enhance the product

mix

- $3.1bn strategic capex envelope to be spent between 2021-2024

(of which $0.2bn has been spent to date)23 is estimated to add

$1.1bn to future EBITDA24

- 1st coils from the Mexico HSM produced in December 2021;

strategic capex to increase in 2022 as growth projects in Brazil

(Monlevade, Vega and Barra Mansa) and Ukraine, as well as Iron Ore

mining (Liberia, Las Truchas, Serra Azul) advance

- Building a track record of consistently returning

capital to shareholders:

- $7.2bn of capital returned to shareholders since September

2020

- The Board proposes to increase the annual base dividend to

shareholders to $0.38/sh (to be paid in June 2022, subject to the

approval of shareholders at the AGM in May 2022)

- The Company has announced a new $1.0bn capital return for

1H'22. Further authorization to repurchase shares will be sought

from shareholders at the 2022 AGM

- Market outlook is favorable

- World ex-China apparent steel consumption ("ASC") in 2022 vs.

2021 is expected to grow 2.5-3%; the Company expects its steel

shipments in 2022 to grow by 3% vs. 202121

- The Company expects strong EBITDA and FCF generation in

2022

Financial highlights (on the basis of

IFRS1,2):

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

20,806 |

20,229 |

14,184 |

76,571 |

53,270 |

|

Operating income |

4,558 |

5,345 |

1,998 |

16,976 |

2,110 |

|

Net income / (loss) attributable to equity holders of the

parent |

4,045 |

4,621 |

1,207 |

14,956 |

(733) |

|

Basic earnings / (loss) per common share (US$) |

3.93 |

4.17 |

1.01 |

13.53 |

(0.64) |

|

|

|

|

|

|

|

|

Operating income/ tonne (US$/t) |

289 |

366 |

116 |

270 |

31 |

|

EBITDA |

5,052 |

6,058 |

1,726 |

19,404 |

4,301 |

|

EBITDA/ tonne (US$/t) |

320 |

414 |

100 |

308 |

62 |

|

|

|

|

|

|

|

|

Crude steel production (Mt) |

16.5 |

17.2 |

18.8 |

69.1 |

71.5 |

|

Steel shipments (Mt) |

15.8 |

14.6 |

17.3 |

62.9 |

69.1 |

|

Total group iron ore production (Mt) |

13.4 |

13.0 |

15.3 |

50.9 |

58.0 |

|

Iron ore production (Mt) (AMMC and Liberia only) |

7.2 |

6.8 |

7.6 |

26.2 |

28.3 |

|

Iron ore shipment (Mt) (AMMC and Liberia only) |

7.1 |

6.9 |

7.9 |

26.0 |

28.4 |

|

|

|

|

|

|

|

|

Number of shares outstanding (issued shares less treasury shares)

(millions) |

911 |

971 |

1,081 |

911 |

1,081 |

Note: As previously announced, effective 2Q 2021, ArcelorMittal

has amended its presentation of reportable segments to report the

operations of AMMC and Liberia within the Mining segment. The

results of each other mine are accounted for within the steel

segments that it primarily supplies; as from 2Q 2021 onwards,

ArcelorMittal Italia is deconsolidated and accounted for as a joint

venture.

Commenting, Aditya Mittal, ArcelorMittal Chief Executive

Officer, said:

“2021 was a strong year in which we accelerated progress on many

fronts. The global economic rebound post initial COVID-19

restrictions being lifted supported buoyant demand in all markets

delivering very high levels of profitability. This further

strengthened our balance sheet and enabled the delivery of

consistent returns for shareholders as well as targeted investment

in our business. Recent investments, both organic and acquisitive,

have long-term strategic value – with the Mexico hot strip mill set

to ramp up this year, the construction of the Calvert EAF underway,

and the AM/NS India joint venture performing well and poised to

capture further opportunity in this fast-growing market.

The one area where we are not satisfied is safety. We want to do

better and we have to do better. Across the organization all our

efforts are focused on this most important outcome.

Perhaps most critically we intensified our commitments to

decarbonize, recognizing that steel can and must make a significant

contribution to achieving net zero. We stated an ambition to reduce

our CO2e intensity by 25% by 2030 and continue to invest in

multiple technology routes that will help us succeed. We launched

our XCarb vision which includes an investment fund into the clean

energy technologies that support this transformation. Working in

collaboration with stakeholders, we were able to accelerate

progress at a number of our plants in Europe and also in Canada.

Our aim is to demonstrate what is possible by having the world’s

first near zero-emissions steel plant.

We start 2022 ready to build on the progress already achieved

for long-term sustainability and success. Industry fundamentals

remain positive, supported by re-negotiated automotive contracts.

Our balance sheet strength enables us to invest in the most

compelling organic growth opportunities and continue our transition

towards low emissions steelmaking. We see increasing evidence of

stakeholder understanding and support for the transition to

zero-carbon steel-making. We look forward to further building on

this progress achieved, in 2022.”

Sustainable development and safety

performance

Health and safety - Own personnel and

contractors lost time injury frequency rate

Protecting the health and wellbeing of employees remains the

Company’s overarching priority with ongoing strict adherence to

World Health Organization guidelines (in respect of COVID-19), and

specific government guidelines have been followed and

implemented.

Health and safety performance based on own personnel and

contractors lost time injury frequency ("LTIF") rate was 0.74x in

the fourth quarter of 2021 ("4Q 2021") as compared to 0.76x for the

third quarter of 2021 ("3Q 2021"). Prior period figures have not

been recast for the ArcelorMittal USA disposal which took place in

December 2020 and exclude ArcelorMittal Italia (which is now

accounted for under the equity method) for all periods.

Health and safety performance in the twelve months of 2021 (“12M

2021”) was 0.79x as compared to 0.61x in the twelve months of 2020

(“12M 2020”).

The Company’s efforts to improve its health and safety record

aim to strengthen the safety of its workforce with an absolute

focus on eliminating fatalities. A change to the Company’s

executive remuneration policy has been made to reflect this

focus.

Own personnel and contractors - Frequency

rate

|

Lost time injury frequency rate |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

NAFTA |

0.25 |

0.48 |

0.49 |

0.40 |

0.57 |

|

Brazil |

0.30 |

0.10 |

0.16 |

0.22 |

0.28 |

|

Europe |

1.09 |

1.38 |

1.35 |

1.19 |

1.07 |

|

ACIS |

0.92 |

0.80 |

0.64 |

0.94 |

0.64 |

|

Mining |

— |

— |

0.34 |

0.32 |

0.27 |

|

Total |

0.74 |

0.76 |

0.65 |

0.79 |

0.61 |

Key sustainable development

highlights:

- On November 3, 2021, ArcelorMittal and the government of Quebec

announced a CAD$205 million investment by ArcelorMittal Mining

Canada (‘AMMC’) in its Port-Cartier pellet plant, enabling this

facility to convert its entire 10 million tonne annual pellet

production to direct reduced iron ("DRI") pellets by the end of

2025. The investment, in which the Quebec government will

contribute through an electricity rebate of up to CAD$80 million,

will enable the Port-Cartier plant to become one of the world’s

largest producers of DRI pellets, the raw material feedstock for

ironmaking in a DRI furnace and reduce the plant's CO2e by ~20% per

annum. The project includes the implementation of a flotation

system that will enable a significant reduction of silica in the

iron ore pellets, facilitating the production of a very

high-quality pellet.

- ArcelorMittal announced on December 9, 2021 a US$30 million

investment in carbon recycling company, LanzaTech through its

XCarb™ innovation fund, the fourth investment the Company has made

through the fund since its launch in March 2021. The investment

further expands ArcelorMittal’s relationship with LanzaTech, which

commenced in 2015 when the Company first announced plans to utilise

LanzaTech’s carbon capture and re-use technology at its plant in

Ghent, Belgium. The €180 million Carbalyst® plant – ArcelorMittal’s

flagship carbon capture and re-use technology project - is

currently under construction, with commissioning expected before

the end of 2022.

- ArcelorMittal announced on January 25, 2022 a $5 million

investment in H2Pro through its XCarb™ innovation fund, bringing

the fund’s total investment commitments to $180 million since its

launch. H2Pro is developing a disruptive way of producing hydrogen

from water, which offers superior energy efficiency to traditional

water electrolysis technologies.

- ArcelorMittal was announced as a Supplier Sustainability Award

winner by Ford Motor Company in their World Excellence Awards. The

awards recognise companies that exceed expectations and achieve the

highest levels of excellence in quality, cost, performance and

delivery. ArcelorMittal’s commitment to IRMA (Initiative for

Responsible Mining Assurance) was particularly acknowledged by Ford

in making this award.

- On January 27, 2022, ArcelorMittal published its second Climate

Advocacy Alignment Report which maps the policy positions of the 61

associations of which the Company is a member, against the

objectives of the Paris agreement and the five policy priorities

ArcelorMittal outlined in its second Climate Action Report.

Analysis of results for the twelve months ended December

31, 2021 versus results for the twelve months ended December 31,

2020Adjusted for the change in scope (i.e. excluding the

shipments of ArcelorMittal USA, sold on December 9, 2020, and

ArcelorMittal Italia13, deconsolidated as from April 14, 2021),

steel shipments in 12M 2021 were 61.9 million metric tonnes (Mt),

9.2% higher as compared to 56.7Mt in 12M 2020 driven by the broad

based recovery in demand following the impacts of COVID-19 in 2020.

Adjusted for the change in scope, all segments experienced year on

year shipment growth: Europe +8.9%, Brazil +24.3%, ACIS +4.8% and

NAFTA +8.0%.

Sales for 12M 2021 increased by 43.7% to $76.6 billion as

compared with $53.3 billion for 12M 2020, primarily due to higher

average steel selling prices (+54.2%) and higher iron ore prices

which more than offset the changes in scope.

Depreciation of $2.5 billion for 12M 2021 was lower as compared

with $3.0 billion in 12M 2020 largely due to the change of scope.

The FY 2022 depreciation expense is expected to be approximately

$2.7 billion (based on current exchange rates) primarily driven by

changes in the useful lives estimates for certain assets in Europe

and Canada due to decarbonization projects.

Impairment gain for 12M 2021 amounted to $218 million following

improved cash flow projections in the context of decarbonization

plans in Sestao (Spain) (partially reversing the impairment

recognized in 2015). Whilst 12M 2020 included a net impairment gain

of $133 million4.

Exceptional items for 12M 2021 of $123 million relate to

expected costs for the decommissioning of the dam at the Serra Azul

mine in Brazil. Exceptional items for 12M 2020 were net gains of

$636 million related to the gain on disposal of ArcelorMittal USA

($1.5 billion) partially offset by site restoration and termination

charges following the permanent closure of a blast furnace and

steel plant in Krakow (Poland) totaling $146 million and inventory

related charges in NAFTA and Europe ($0.7 billion).

Operating income for 12M 2021 of $17.0 billion was primarily

driven by positive steel price-cost effects and higher iron ore

reference prices. Operating income for 12M 2020 of $2.1 billion was

positively impacted by impairment and exceptional net gains

totaling $0.8 billion as discussed above and negatively impacted in

particular by the effects of the COVID-19 pandemic.

Income from associates, joint ventures and other investments14

for 12M 2021 was $2.2 billion as compared to $234 million for 12M

2020. 12M 2021 income is significantly higher on account of

improved contribution from AMNS India7 and AMNS Calvert (Calvert)8

and other equity and joint-ventures investments as well as the

annual dividend received from Erdemir of $89 million. 12M 2020

income from associates included a $211 million impairment of the

Company's investment in DHS (Germany).

Net interest expense in 12M 2021 was lower at $278 million as

compared to $421 million in 12M 2020 following debt repayments and

liability management.

Foreign exchange and other net financing losses were $877

million for 12M 2021 as compared to losses of $835 million for 12M

2020.

ArcelorMittal recorded an income tax expense of $2.5 billion for

12M 2021 (including $493 million deferred tax benefit) as compared

to $1.7 billion for 12M 2020 (which included $827 million deferred

tax expense).

ArcelorMittal’s net income for 12M 2021 was $14,956 million, or

$13.53 basic earnings per common share, as compared to a net loss

in 12M 2020 of $733 million, or $0.64 basic loss per common

share.

Analysis of results for 4Q 2021 versus 3Q 2021 and 4Q

2020Total steel shipments in 4Q 2021 were 15.8Mt, 7.9%

higher as compared with 14.6Mt in 3Q 2021 following the reversal of

the production constraints and order shipment delays which impacted

3Q 2021: Europe +10.3%, Brazil +7.2% and ACIS +9.7%, although NAFTA

was down -3.3%.

Adjusted for the change in scope (i.e. excluding the shipments

of ArcelorMittal USA and ArcelorMittal Italia21), steel shipments

in 4Q 2021 increased 8.5% as compared to 4Q 2020: Europe +9.4%,

Brazil +17.8% and ACIS +9.4% offset in part by NAFTA (-5.8%).

Sales in 4Q 2021 were $20.8 billion as compared to $20.2 billion

for 3Q 2021 and $14.2 billion for 4Q 2020. As compared to 3Q 2021,

the 2.8% increase in sales was primarily due to higher steel

shipment volumes (+7.9%) offset in part by lower average steel

selling prices (-2.4%), and lower mining revenue primarily due to

lower iron ore reference prices (-32.3%). Sales in 4Q 2021 were

+46.7% higher as compared to 4Q 2020 primarily due to significantly

higher average steel selling prices (+60.1%) offset in part by

lower iron ore reference prices (-17.1%) and the impacts of scope

changes.

Depreciation for 4Q 2021 was $712 million as compared to $590

million for 3Q 2021 primarily driven by changes in the useful lives

estimates for certain assets in Europe and Canada due to

decarbonization projects, and stable as compared to $711 million in

4Q 2020.

Impairment gain for 4Q 2021 amounted to $218 million following

improved cash flow projections in the context of decarbonization

plans in Sestao (Spain) (partially reversing the impairment

recognized in 2015). There were no impairment items for 3Q 2021.

Impairment expenses in 4Q 2020 were $331 million related to the

revised future cashflow expectations of plate assets in Europe.

Exceptional items for 4Q 2021 were nil. Exceptional charges for

3Q 2021 of $123 million related to expected costs for the

decommissioning of the dam at the Serra Azul mine in Brazil.

Exceptional items in 4Q 2020 of $1.3 billion related to gain on the

sale of ArcelorMittal USA5 offset by site restoration and

termination charges related to the closure of the steel shop and

blast furnace at Krakow (Poland).

Operating income for 4Q 2021 was $4.6 billion as compared to

$5.3 billion in 3Q 2021 and $2.0 billion in 4Q 2020 (impacted by

the exceptional and impairment items as discussed above). The

decreased operating income for 4Q 2021 as compared to 3Q 2021

reflects a negative price-cost effect which more than offset higher

shipments in steel segments and the impacts of lower iron ore

reference prices which more than offset higher iron ore shipments

in the Mining segment.

Income from associates, joint ventures and other investments for

4Q 2021 was $383 million as compared to $778 million for 3Q 2021

and $7 million in 4Q 2020. 4Q 2021 is significantly lower on

account of weaker results from AMNS India7, AMNS Calvert8, and

Chinese investees14.

Net interest expense in 4Q 2021 was lower at $49 million as

compared to $62 million in 3Q 2021 and $88 million in 4Q 2020,

mainly due to savings following the repayment of bonds.

Foreign exchange and other net financing losses in 4Q 2021 were

$111 million as compared to losses of $339 million in 3Q 2021 and

$270 million in 4Q 2020. 4Q 2021 includes foreign exchange loss of

$30 million (compared to $22 million gain in 3Q 2021) and $13

million non-cash mark-to-market loss related to the mandatory

convertible bonds call option (loss of $68 million in 3Q 2021 and

gain of $59 million in 4Q 2020). 4Q 2021 also includes a charge of

$61 million related to the repurchase of approximately $395 million

in aggregate principal amount of the Mandatorily Convertible

Subordinated Notes ("MCN") on December 23, 2021. 3Q 2021 included

an $82 million charge in connection with a revised valuation of the

put option granted to Votorantim20 and a $153 million loss

(primarily consisting of interest and indexation charges) relating

to a legal claim (for which the Company is exploring its legal

options, including an action to set aside the decision) at

ArcelorMittal Brasil from the Votorantim acquisition20.

ArcelorMittal recorded an income tax expense of $632 million in

4Q 2021 as compared to $882 million in 3Q 2021 and $358 million for

4Q 2020.

ArcelorMittal recorded net income for 4Q 2021 of $4,045 million

($3.93 basic earnings per common share), as compared to net income

of $4,621 million for 3Q 2021 ($4.17 basic earnings per common

share), and a net income of $1,207 million for 4Q 2020 ($1.01 basic

earnings per common share).

Analysis of segment

operations2, 18

NAFTA

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Sales |

3,329 |

3,423 |

3,204 |

12,530 |

13,668 |

|

Operating income |

939 |

925 |

1,507 |

2,800 |

1,684 |

|

Depreciation |

(113) |

(70) |

(102) |

(325) |

(537) |

|

Impairment items |

— |

— |

— |

— |

660 |

|

Exceptional items |

— |

— |

1,460 |

— |

998 |

|

EBITDA |

1,052 |

995 |

149 |

3,125 |

563 |

|

Crude steel production (kt) |

2,046 |

1,994 |

4,180 |

8,487 |

17,813 |

|

Steel shipments (kt) |

2,205 |

2,280 |

4,134 |

9,586 |

17,902 |

|

Average steel selling price (US$/t) |

1,341 |

1,303 |

714 |

1,128 |

702 |

NAFTA segment crude steel production increased by 2.6% to 2.0Mt

in 4Q 2021, as compared to 3Q 2021 primarily due to recovery post

operational disruptions (including the impact of hurricane Ida) in

Mexico during 3Q 2021. Adjusted for scope (excluding the impact of

ArcelorMittal USA which was sold in December 2020), crude steel

production declined 0.7% year on year.

Steel shipments in 4Q 2021 decreased by 3.3% to 2.2Mt, as

compared to 2.3Mt in 3Q 2021 primarily due to weaker demand in

North America. Adjusted for scope, steel shipments were 5.8% lower

year on year.

Sales in 4Q 2021 decreased by 2.8% to $3.3 billion, as compared

to $3.4 billion in 3Q 2021, primarily due a decrease in steel

shipments (as discussed above) offset in part by a 2.9% increase in

average steel selling prices. Sales increased in 4Q 2021 compared

to $3.2 billion in 4Q 2020.

Operating income in 4Q 2021 was $939 million as compared to $925

million in 3Q 2021 and $1,507 million in 4Q 2020 which was

positively impacted by the $1.5 billion exceptional gain5 on the

sale of ArcelorMittal USA.

EBITDA in 4Q 2021 of $1,052 million was 5.8% higher as compared

to $995 million in 3Q 2021, primarily due to a positive price-cost

effect offset in part by lower shipment volumes as noted above.

EBITDA in 4Q 2021 was higher as compared to $149 million in 4Q 2020

mainly due to a significant positive price-cost effect.

Brazil

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Sales |

3,452 |

3,606 |

1,905 |

12,856 |

6,336 |

|

Operating income |

892 |

1,164 |

296 |

3,798 |

777 |

|

Depreciation |

(60) |

(59) |

(51) |

(228) |

(228) |

|

Exceptional items |

— |

(123) |

— |

(123) |

— |

|

EBITDA |

952 |

1,346 |

347 |

4,149 |

1,005 |

|

Crude steel production (kt) |

3,117 |

3,112 |

2,868 |

12,413 |

9,539 |

|

Steel shipments (kt) |

3,034 |

2,829 |

2,575 |

11,695 |

9,410 |

|

Average steel selling price (US$/t) |

1,049 |

1,196 |

702 |

1,030 |

634 |

Brazil segment crude steel production was stable at 3.1Mt in 4Q

2021 and in 3Q 2021, and higher as compared to 2.9Mt in 4Q

2020. Steel shipments in 4Q 2021 increased by 7.2% to 3.0Mt as

compared to 2.8Mt in 3Q 2021, primarily due to delivery of

shipments that had been delayed at the end of the previous quarter.

Steel shipments were 17.8% higher in 4Q 2021 as compared to 2.6Mt

in 4Q 2020.

Sales in 4Q 2021 decreased by 4.3% to $3.5 billion as compared

to $3.6 billion in 3Q 2021, following a 12.3% decrease in average

steel selling prices offset in part by higher steel shipments.

Sales in 4Q 2020 were $1.9 billion impacted by the COVID-19

pandemic.

Operating income in 4Q 2021 of $892 million was lower as

compared to $1,164 million in 3Q 2021 and higher as compared to

$296 million in 4Q 2020. Operating income in 3Q 2021 was impacted

by exceptional items of $123 million related to expected costs for

the decommissioning of the dam at the Serra Azul mine in

Brazil.

EBITDA in 4Q 2021 decreased by 29.3% to $952 million as compared

to $1,346 million in 3Q 2021, primarily due to a negative

price-cost effect and a negative currency translation effect offset

in part by higher steel shipments. EBITDA in 4Q 2021 was

significantly higher as compared to $347 million in 4Q 2020

primarily due to a positive price-cost effect and higher steel

shipments.

Europe

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Sales |

12,079 |

11,228 |

7,604 |

43,334 |

28,071 |

|

Operating income /(loss) |

1,886 |

1,925 |

(444) |

5,672 |

(1,439) |

|

Depreciation |

(353) |

(284) |

(356) |

(1,252) |

(1,418) |

|

Impairment items |

218 |

— |

(331) |

218 |

(527) |

|

Exceptional items |

— |

— |

(146) |

— |

(337) |

|

EBITDA |

2,021 |

2,209 |

389 |

6,706 |

843 |

|

Crude steel production (kt) |

8,621 |

9,091 |

9,110 |

36,795 |

34,004 |

|

Steel shipments (kt) |

8,325 |

7,551 |

8,569 |

33,182 |

32,873 |

|

Average steel selling price (US$/t) |

1,110 |

1,098 |

695 |

986 |

655 |

Europe segment crude steel production was 5.2% lower at 8.6Mt in

4Q 2021 as compared to 9.1Mt in 3Q 2021 (due to planned

maintenance) and was lower by 5.4% compared to 4Q 2020. Following

the formation of a public-private partnership between Invitalia and

AM InvestCo Italy renamed Acciaierie d’Italia Holding

(ArcelorMittal’s subsidiary party to the lease and purchase

agreement for the ILVA business), ArcelorMittal has deconsolidated

the assets and liabilities as from mid-April 2021. Adjusted for

this change of scope, crude steel production increased by 5.1% in

4Q 2021 as compared to 4Q 2020.

Steel shipments in 4Q 2021 increased by 10.3% to 8.3Mt as

compared to 7.6Mt in 3Q 2021 and were lower as compared to 8.6Mt in

4Q 2020 (+9.4% on a scope adjusted basis). Steel shipments in 4Q

2021 include delivery of orders delayed last quarter and logistic

constraints partly linked to the severe floods in Europe in July

2021.

Sales in 4Q 2021 increased 7.6% to $12.1 billion, as compared to

$11.2 billion in 3Q 2021, primarily due higher shipments and 1.1%

higher average selling prices. Sales in 4Q 2020 were $7.6 billion

impacted by the COVID-19 pandemic.

Impairment gain for 4Q 2021 amounted to $218 million following

improved cash flow projections in the context of decarbonization

plans in Sestao (Spain) (partially reversing the impairment

recognized in 2015). Impairment charges for 3Q 2021 were nil.

Impairment charges for 4Q 2020 were $331 million following the

revised future cashflow expectations of plate assets.

Exceptional items for 4Q 2021 and 3Q 2021 were nil. Exceptional

items for 4Q 2020 were $146 million related to site restoration and

termination charges following the closure of the blast furnace and

the steel plant in Krakow (Poland).

Operating income in 4Q 2021 was $1,886 million as compared to

$1,925 million in 3Q 2021 and an operating loss of $444 million in

4Q 2020 (impacted by impairments/exceptional items as discussed

above).

EBITDA in 4Q 2021 of $2,021 million decreased 8.5%, as compared

to $2,209 million in 3Q 2021, primarily due to a negative

price-cost effect including higher energy prices and one-time $55

million provision related to an early retirement scheme in Spain,

offset in part by higher steel shipments. EBITDA in 4Q 2021

increased significantly as compared to $389 million in 4Q 2020

primarily due to a positive price-cost effect.

ACIS

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Sales |

2,539 |

2,419 |

1,553 |

9,854 |

5,737 |

|

Operating income |

439 |

808 |

233 |

2,705 |

209 |

|

Depreciation |

(118) |

(112) |

(133) |

(450) |

(492) |

|

Exceptional items |

— |

— |

— |

— |

(21) |

|

EBITDA |

557 |

920 |

366 |

3,155 |

722 |

|

Crude steel production (kt) |

2,694 |

3,014 |

2,673 |

11,366 |

10,171 |

|

Steel shipments (kt) |

2,597 |

2,367 |

2,373 |

10,360 |

9,881 |

|

Average steel selling price (US$/t) |

810 |

864 |

511 |

780 |

464 |

ACIS segment crude steel production in 4Q 2021 was 10.6% lower

at 2.7Mt as compared to 3.0Mt in 3Q 2021 due to planned and

unplanned maintenance in Ukraine and South Africa. Crude steel

production in 4Q 2021 was broadly stable at 2.7Mt as compared to 4Q

2020.

Steel shipments in 4Q 2021 increased by 9.7% to 2.6Mt as

compared to 2.4Mt as at 3Q 2021, mainly due to delivery of exports

delayed at the end of the previous quarter. 4Q 2020 steel shipments

were 2.4Mt.

Sales in 4Q 2021 increased by 5.0% to $2.5 billion as compared

to $2.4 billion in 3Q 2021, primarily due to higher steel shipments

offset in part by 6.3% lower average steel selling prices. Sales in

4Q 2020 were $1.6 billion impacted by the COVID-19 pandemic.

Operating income in 4Q 2021 was $439 million as compared to $808

million in 3Q 2021 and $233 million in 4Q 2020.

EBITDA of $557 million in 4Q 2021 was 39.5% lower as compared to

$920 million in 3Q 2021, primarily due to a negative price-cost

effect, including higher energy prices and maintenance costs,

offset in part by higher steel shipments. EBITDA in 4Q 2021 was

higher as compared to $366 million in 4Q 2020, primarily due to

positive price-cost effects and higher steel shipments.

Mining

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Sales |

824 |

1,153 |

937 |

4,045 |

2,785 |

|

Operating income |

343 |

741 |

502 |

2,371 |

1,247 |

|

Depreciation |

(57) |

(56) |

(60) |

(228) |

(243) |

|

EBITDA |

400 |

797 |

562 |

2,599 |

1,490 |

|

|

|

|

|

|

|

|

Iron ore production (Mt) |

7.2 |

6.8 |

7.6 |

26.2 |

28.3 |

|

Iron ore shipment (Mt) |

7.1 |

6.9 |

7.9 |

26.0 |

28.4 |

Given the sale of ArcelorMittal USA in December 2020, the

Company is no longer presenting coal production and shipments in

its earnings releases.

Iron ore production (AMMC and Liberia only) increased in 4Q 2021

by 4.3% to 7.2Mt as compared to 6.8Mt in 3Q 2021 and was 6.1% lower

as compared to 4Q 2020. Higher production in 4Q 2021 was primarily

due to higher Liberia production following recovery due to the

impact of locomotive incidents and heavy seasonal monsoon rains in

the prior quarter.

Iron ore shipments increased in 4Q 2021 by 2.8% as compared to

3Q 2021, primarily driven by improvement in Liberia offset in part

by lower shipments at AMMC, and decreased by 10.2% as compared to

4Q 2020 (due to lower shipments in both AMMC and Liberia).

Operating income in 4Q 2021 decreased to $343 million as

compared to $741 million in 3Q 2021 and $502 million in 4Q

2020.

EBITDA in 4Q 2021 decreased by 49.8% to $400 million as compared

to $797 million in 3Q 2021, largely reflecting the negative impact

of lower iron ore reference prices (-32.3%) offset in part by

higher iron ore shipments (+2.8%). EBITDA in 4Q 2021 was lower as

compared to $562 million in 4Q 2020, primarily due to lower iron

ore reference prices (-17.1%) and lower shipments.

Joint venturesArcelorMittal has

investments in various joint ventures and associate entities

globally. The Company considers the Calvert (50% equity interest)

and AMNS India (60% equity interest) joint ventures to be of

particular strategic importance, warranting more detailed

disclosures to improve the understanding of their operational

performance and value to the Company.

Calvert8

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Production (100% basis) (kt)* |

1,068 |

1,239 |

1,057 |

4,802 |

4,038 |

|

Steel shipments (100% basis) (kt)** |

1,052 |

1,203 |

1,005 |

4,547 |

3,912 |

|

EBITDA (100% basis)*** |

270 |

397 |

62 |

1,091 |

197 |

* Production: all production of the hot strip mill including

processing of slabs on a hire work basis for ArcelorMittal group

entities and third parties, including stainless steel slabs.

** Shipments: including shipments of finished products processed

on a hire work basis for ArcelorMittal group entities and third

parties, including stainless steel products.

*** EBITDA of Calvert presented here on a 100% basis as a

stand-alone business and in accordance with the Company's policy,

applying the weighted average method of accounting for

inventory.

Calvert’s hot strip mill ("HSM") production during 4Q 2021

totaled 1.1Mt as compared to 1.2Mt in 3Q 2021. 4Q 2021 HSM

production was 13.8% lower than 3Q 2021 mainly driven by a planned

maintenance outage in November.

Steel shipments in 4Q 2021 were 12.6% below 3Q 2021 due to HSM

maintenance outage and weak demand.

EBITDA*** during 4Q 2021 of $270 million (100% basis) was lower

as compared to $397 million in 3Q 2021, largely due to lower steel

shipments, unfavorable sales mix and higher slab weighted average

cost partially offset by higher sales prices.

AMNS India7

|

(USDm) unless otherwise shown |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

Crude steel production (100% basis) (Kt) |

1,847 |

1,891 |

1,888 |

7,393 |

6,616 |

|

Steel shipments (100% basis) (Kt) |

1,731 |

1,765 |

1,779 |

6,914 |

6,261 |

|

EBITDA (100% basis) |

435 |

551 |

274 |

1,996 |

697 |

Crude steel production in 4Q 2021 decreased by 2.3% to 1.8Mt as

compared to 1.9Mt in 3Q 2021. Steel shipment in 4Q 2021 decreased

1.9% to 1.7Mt as compared to 1.8Mt in 3Q 2021.

AMNS India EBITDA of $435 million (100% basis) was 21% lower as

compared to $551 million in 3Q 2021 primarily due lower steel

selling prices and higher costs (including coking coal and power

costs).

Liquidity and Capital

Resources

Net cash provided by operating activities for 4Q 2021 was $4,154

million as compared to $2,442 million in 3Q 2021 and $1,416 million

in 4Q 2020. Net cash provided by operating activities in 4Q 2021

includes a working capital release of $22 million as compared to a

working capital investment of $2,896 million in 3Q 2021 and a

working capital release of $925 million in 4Q 2020. 4Q 2021 did not

see anticipated working capital release due to relatively robust

finished steel prices, elevated raw material prices and lower than

anticipated inventory reduction. Based on current market conditions

together with impacts from higher automotive contract price resets,

the Company expects a further working capital investment in 1Q

2022. The 2022 full year working capital requirements will be

determined by market dynamics and are expected to be consistent

with EBITDA evolution (with the aim to return working capital

rotation days to targeted levels by year-end).

Capex of $1,145 million in 4Q 2021 compares to $675 million in

3Q 2021 and $668 million in 4Q 2020. Capex of $3.0 billion19 in FY

2021 is below the previous guidance of $3.2 billion.

Net cash used in other investing activities in 4Q 2021 was $90

million as compared to net cash provided by other investing

activities of $1,184 million in 3Q 2021 and $262 million in 4Q

2020. 4Q 2021 cash outflow primarily relates to the $45 million

investment through the XCarb™ innovation fund (including carbon

recycling company, LanzaTech). 3Q 2021 cash inflow primarily

relates to $1.3 billion cash received from the redemption of

preferred shares (the equivalent of 58.3 million common shares) of

Cleveland Cliffs following a final review of the notice of the

redemption, partially offset by other investments including those

as part of the XCarbTM Innovation fund. 4Q 2020 cash inflow relates

to $0.5 billion proceeds from the sale of ArcelorMittal USA offset

in part by an investment in short term deposits related to such

sale.

Net cash used in financing activities in 4Q 2021 was $2,990

million as compared to $2,740 million in 3Q 2021 and $2,227 million

in 4Q 2020. In 4Q 2021, net cash used in financing activities

includes an inflow of $0.1 billion from commercial paper portfolio.

Net cash used in financing activities includes an outflow of $0.8

billion in 3Q 2021 and $1.5 billion in 4Q 2020 mainly due to bond

repayments.

During 4Q 2021, ArcelorMittal repurchased 59.2 million shares

for a total value of $1.8 billion. In addition, the Company

repurchased $395 million in aggregate principal amount of its 5.50%

Mandatorily Convertible Subordinated Notes ("MCN") due 2023 for an

aggregate repurchase price of $1,196 million. The MCN repurchase

was equivalent to repurchasing approximately 36.6 million shares

(based on the minimum conversion ratio).

During 4Q 2021 and 4Q 2020, the Company paid dividends of $21

million and $16 million, respectively, to minority shareholders.

During 3Q 2021, the Company paid total dividends of $185 million of

which $28 million was withholding taxes paid on dividends to

ArcelorMittal shareholders in 2Q 2021 and $157 million mainly paid

to the minority shareholders of ArcelorMittal Mines Canada9 (AMMC)

and ArcelorMittal Kryvyi Rih.

Outflows from lease payments and other financing activities were

$53 million in 4Q 2021 and $46 million in 3Q 2021. Outflows from

lease payments and other financing activities were $218 million for

4Q 2020 and included $135 million paid to Banca Intesa15.

Gross debt increased by $152 million to $8.4 billion as of

December 31, 2021, as compared to $8.2 billion as of September 30,

2021 and $12.3 billion as of December 31, 2020. As of December 31,

2021, net debt increased to $4.0 billion as compared to $3.9

billion as of September 30, 2021, primarily driven by returns to

shareholders offset by free cash flows.

As of December 31, 2021 and September 30, 2021, the Company had

liquidity of $9.9 billion, consisting of cash and cash equivalents

of $4.4 billion and $5.5 billion of available credit lines10. As of

December 31, 2021, the average debt maturity was 5.8 years.

Key recent developments

- On February 4, 2022, ArcelorMittal announced plans for the

acceleration of its decarbonization plan with a €1.7 billion

investment in its Fos-sur-Mer and Dunkirk sites in France (while

maintaining equivalent production capacities), supported by the

Government. This investment will enable a transformation of

steelmaking in France and a total reduction of close to 40% or

7.8Mtpa in ArcelorMittal’s CO2 emissions in France by 2030.

Specifically, in Fos-sur-Mer, ArcelorMittal will build an Electric

Arc Furnace (EAF). This new unit will complement the ladle furnace

announced last March and supported by France’s recovery plan,

‘France Relance’. In Dunkirk, ArcelorMittal will build a 2.5Mt

Direct Reduction of Iron (DRI) unit to transform iron ore using

hydrogen instead of coal. This DRI will be coupled with an

innovative technology electric furnace and complemented by an

additional Electric Arc Furnace (EAF). Other investments are

already under way to continue to increase the proportion of scrap

steel used. The new industrial facilities will be operational

starting in 2027 and will gradually replace 3 out of 5 of

ArcelorMittal’s blast furnaces in France by 2030 (2 out of 3 in

Dunkirk, 1 out of 2 in Fos-sur-Mer).

- On January 14, 2022, ArcelorMittal announced that 45 million

treasury shares had been cancelled to keep the number of treasury

shares within appropriate levels. As a result of this cancellation,

ArcelorMittal now has 937,809,772 shares in issue (compared to

982,809,772 before the cancellation). Details on share buyback

programs can be found at:

https://corporate.arcelormittal.com/investors/equity-investors/share-buyback-program.

- On December 29, 2021, ArcelorMittal announced that it had

completed the fifth share buyback program announced on November 17,

2021 under the authorization given by the annual general meeting of

shareholders of June 8, 2021 (the "2021 AGM Authorization"). By

market close on December 28, 2021, ArcelorMittal had repurchased

34,080,049 shares for a total value of €885,729,034.96 (equivalent

to $999,999,819.63) at an approximate average price per share of

€25.99. This brought the total advance as part of its prospective

2022 capital return to shareholders (to be funded from 2021 surplus

cash flow under the capital return policy announced February 2021)

to $3.2 billion including $2 billion of share buy backs completed

and $1.2 billion payments related to the MCN as described

below.

- On December 22, 2021, ArcelorMittal announced that it had

determined the final repurchase price for its previously announced

repurchases of $395 million of its 5.50% Mandatorily Convertible

Subordinated Notes due 2023 (the "Notes"). The aggregate repurchase

price that ArcelorMittal paid for those Notes was $1,196 million.

The transactions closed on December 23, 2021. The repurchase of

this aggregate principal amount of Notes is equivalent to

repurchasing approximately 36.6 million shares of ArcelorMittal

common stock that would otherwise be issuable at maturity under the

Notes (at the minimum conversion ratio). Pursuant to the purchase

agreements the repurchased Notes have been cancelled and therefore

will not convert into common shares of the Company. Following

completion of the repurchases, approximately $608 million aggregate

principal amount of the Notes remain outstanding.

- On December 9, 2021, the Company announced it had made a $30

million investment in carbon recycling company, LanzaTech through

its XCarb™ innovation fund, the fourth investment the Company has

made through the fund since its launch in March 2021. The

investment further expands ArcelorMittal’s relationship with

LanzaTech, which commenced in 2015 when the Company first announced

plans to utilise LanzaTech’s carbon capture and re-use technology

at its plant in Ghent, Belgium.

- On November 17, 2021, ArcelorMittal announced that it had

completed the fourth share buyback program announced on July 29,

2021 under the 2021 AGM Authorization. By market close on November

16, 2021, ArcelorMittal had repurchased 67,404,066 shares for a

total value of €1,881,270,528.80 (equivalent to

US$2,199,999,614.74) at an approximate average price per share of

€27.91. On the same day, the Company commenced a new share buyback

program in the amount of $1 billion under the 2021 AGM

Authorization.

Cost improvement

In 2021, the Company achieved $0.6 billion of fixed cost savings

relating to its previously announced $1 billion structural

improvement plan. Savings were achieved through productivity gains

and footprint optimization (following closures at Krakow, coke

plant in Florange, and Saldanha); and SGA savings including a 20%

reduction in corporate office costs including headcount reduction.

The Company did not make progress against its plan related to

repairs and maintenance ("R&M") spend following the decision

taken to maintain R&M spend at higher levels to ensure

operational reliability.

The Company is now announcing a new 3-year $1.5 billion value

plan focused on creating value through well-defined commercial and

operational initiatives. This plan does not include the impact of

strategic projects (which will be followed separately). The plan

includes commercial initiatives, including volume/mix improvements

and operational improvements (primarily in variable costs). The

plan aims at protecting the EBITDA potential of the business from

rising inflationary pressures; improving its relative competitive

position vis-a-vis its peers and supporting sustainably higher

profits.

Capital return

In line with the Company's capital return

policy, the Board recommends an increase of the base annual

dividend to $0.38/share (from $0.30/share paid in 2021) to be paid

in June 2022, subject to the approval of shareholders at the AGM in

May 2022.

Given the favorable outlook for free cashflow in 2022, the

Company has initiated a new $1 billion share buy-back program for

1H 2022. This is the maximum based on the authorization provided by

shareholders at the AGM in June 2021. Additional authorization to

repurchase shares will be sought from shareholders at the 2022 AGM

(subject to cash generation).

The remaining surplus cash has accrued to the balance sheet in

2021. This headroom to our balance sheet targets provides strategic

optionality to consider M&A in support of our strategic targets

or further additional returns to shareholders in the future.

Financial calendar for 2022

- General meeting of shareholders: May 4, 2022: ArcelorMittal

Annual General Meeting ("AGM")

- Earnings results announcements: May 5, 2022: Earnings release

1Q 2022; July 28, 2022: Earnings release 2Q and half year 2022;

November 10, 2022: Earnings release 3Q and nine-months 2022

OutlookBased on the current

economic outlook, ArcelorMittal expects global apparent steel

consumption (“ASC”) in 2022 to grow between +0% to +1.0% (versus

growth of +4% in 2021).

Economic activity improved in 2021 as lockdown measures eased

and the global steel industry benefiting from a favorable supply

demand balance, supporting increasing utilization and improve

demand. Although there is some moderation of the tight market

conditions (and subject to pandemic-related macroeconomic

uncertainties), the Company expects overall ASC to grow in 2022

versus 2021 with regional differences highlighted below:

- In the US, ASC is expected to grow within a range of +1.0% to

+3.0% in 2022 (versus an estimated +20% growth in 2021). Automotive

is expected to grow strongly as semi-conductor shortages ease and

manufacturing sectors are supported by strong order backlogs and

low inventory of finished goods. Infrastructure expected to grow

due to beginnings of support from the $1.2 trillion infrastructure

plan.

- In Europe, ASC is expected to grow within a range of +0% to +2%

in 2022 (versus an estimated +14% growth in 2021), automotive

expected to grow strongly, with moderate growth in infrastructure

and construction to support underlying demand.

- In Brazil, ASC is expected to decline in 2022 in the range of

-8 to -10% (versus a healthy +23.0% estimated growth in 2021).

While ASC is expected to decline due to destocking, real demand is

expected to increase moderately in 2022 with a recovery in

automotive output offset by weakness in other steel-consuming

sectors.

- In the CIS, ASC in 2022 is expected to grow within a range of

+0% to +2% (versus a +3.0% estimated growth in 2021).

- In India, ASC in 2022 is expected to grow within a range of +6%

to +8% (versus +17.0% estimated growth in 2021).

- As a result, overall World ex-China ASC in 2022 is expected to

grow within the range of +2.5 to +3.0% (versus +11% in 2021)

supported by mild growth in our core developed markets and stronger

growth in India offset by weakness in Brazil.

- In China, overall demand is expected to continue to decline in

2022 to -2% to +0% (versus an estimated decline of -2% in 2021)

weak real estate is partially offset by a mild pick-up in

infrastructure.

Given the mild growth anticipated in ex-China ASC in 2022 vs.

2021 (+2.5 to +3.0% as described above), the Company expects steel

shipments in 2022 to grow by approximately +3% vs. 2021 levels

(including some mix benefits and recovery post logistics issues in

2021).

In addition, capex is expected to increase from $3.0 billion in

2021 to $4.5 billion in 2022. Including $0.2 billion of carry-over

from 2021, capex outside of strategic capex is expected to be $3.1

billion in 2022. Decarbonization capex is expected to be $0.3

billion in 2022 (net of government support). Capex on strategic

envelope projects is expected to be $1.1 billion, including: the

mix/growth investments at Vega and Monlevade in Brazil; iron ore

projects at Liberia, Serra Azul and Las Truchas; and the pellet

plant project in Ukraine and new section mill in Barra Mansa

(Brazil).

Based on current market conditions (including support from

automotive contract resets that have already occurred) the Company

expects strong cash flow generation in 2022 and has announced a

proposed increase in the base annual dividend to $0.38/share from

$0.30/share to be paid in June 2022, (subject to the approved of

shareholders at the AGM in May 2022) and a new $1.0 billion capital

return program by 1H 2022.

ArcelorMittal Condensed Consolidated Statement of

Financial Position1

|

In millions of U.S. dollars |

Dec 31,2021 |

Sept 30,2021 |

Dec 31,2020 |

|

ASSETS |

|

|

|

| Cash and

cash equivalents and restricted funds |

4,371 |

4,381 |

5,963 |

| Trade

accounts receivable and other |

5,143 |

5,572 |

3,072 |

|

Inventories |

19,858 |

18,806 |

12,328 |

| Prepaid

expenses and other current assets |

5,567 |

4,421 |

2,281 |

| Asset

held for sale11 |

— |

— |

4,329 |

|

Total Current Assets |

34,939 |

33,180 |

27,973 |

|

|

|

|

|

| Goodwill

and intangible assets |

4,425 |

4,309 |

4,312 |

| Property,

plant and equipment |

30,075 |

29,599 |

30,622 |

|

Investments in associates and joint ventures |

10,319 |

10,134 |

6,817 |

| Deferred

tax assets |

8,147 |

7,787 |

7,866 |

| Other

assets16 |

2,607 |

3,082 |

4,462 |

|

Total Assets |

90,512 |

88,091 |

82,052 |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Short-term debt and current portion of long-term debt |

1,913 |

1,796 |

2,507 |

| Trade

accounts payable and other |

15,093 |

14,108 |

11,525 |

| Accrued

expenses and other current liabilities |

7,161 |

7,527 |

5,596 |

|

Liabilities held for sale11 |

— |

— |

3,039 |

|

Total Current Liabilities |

24,167 |

23,431 |

22,667 |

|

|

|

|

|

| Long-term

debt, net of current portion |

6,488 |

6,453 |

9,815 |

| Deferred

tax liabilities |

2,369 |

1,953 |

1,832 |

| Other

long-term liabilities |

6,144 |

6,933 |

7,501 |

|

Total Liabilities |

39,168 |

38,770 |

41,815 |

|

|

|

|

|

| Equity

attributable to the equity holders of the parent |

49,106 |

47,116 |

38,280 |

|

Non-controlling interests |

2,238 |

2,205 |

1,957 |

|

Total Equity |

51,344 |

49,321 |

40,237 |

|

Total Liabilities and Shareholders’ Equity |

90,512 |

88,091 |

82,052 |

ArcelorMittal Condensed Consolidated Statement of

Operations1

|

|

Three months ended |

Twelve months ended |

|

In millions of U.S. dollars unless otherwise

shown |

Dec 31, 2021 |

Sept 30, 2021 |

Dec 31, 2020 |

Dec 31, 2021 |

Dec 31, 2020 |

|

Sales |

20,806 |

20,229 |

14,184 |

76,571 |

53,270 |

|

Depreciation (B) |

(712) |

(590) |

(711) |

(2,523) |

(2,960) |

|

Impairment items (B) |

218 |

— |

(331) |

218 |

133 |

|

Exceptional items (B) |

— |

(123) |

1,314 |

(123) |

636 |

|

Operating income (A) |

4,558 |

5,345 |

1,998 |

16,976 |

2,110 |

| Operating

margin % |

21.9 % |

26.4 % |

14.1 % |

22.2 % |

4.0 % |

|

|

|

|

|

|

|

| Income

from associates, joint ventures and other investments |

383 |

778 |

7 |

2,204 |

234 |

| Net

interest expense |

(49) |

(62) |

(88) |

(278) |

(421) |

| Foreign

exchange and other net financing loss |

(111) |

(339) |

(270) |

(877) |

(835) |

|

Income before taxes and non-controlling

interests |

4,781 |

5,722 |

1,647 |

18,025 |

1,088 |

|

Current tax expense |

(678) |

(938) |

(373) |

(2,953) |

(839) |

|

Deferred tax benefit / (expense) |

46 |

56 |

15 |

493 |

(827) |

| Income

tax expense |

(632) |

(882) |

(358) |

(2,460) |

(1,666) |

|

Income / (loss) including non-controlling

interests |

4,149 |

4,840 |

1,289 |

15,565 |

(578) |

|

Non-controlling interests income |

(104) |

(219) |

(82) |

(609) |

(155) |

|

Net income / (loss) attributable to equity holders of the

parent |

4,045 |

4,621 |

1,207 |

14,956 |

(733) |

|

|

|

|

|

|

|

|

Basic earnings / (loss) per common share ($) |

3.93 |

4.17 |

1.01 |

13.53 |

(0.64) |

|

Diluted earnings / (loss) per common share ($) |

3.92 |

4.16 |

1.00 |

13.49 |

(0.64) |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

1,030 |

1,109 |

1,199 |

1,105 |

1,140 |

|

Diluted weighted average common shares outstanding (in

millions) |

1,033 |

1,112 |

1,204 |

1,108 |

1,140 |

|

|

|

|

|

|

|

|

OTHER INFORMATION |

|

|

|

|

|

|

EBITDA (C = A-B) |

5,052 |

6,058 |

1,726 |

19,404 |

4,301 |

| EBITDA

Margin % |

24.3 % |

29.9 % |

12.2 % |

25.3 % |

8.1 % |

|

|

|

|

|

|

|

| Total

group iron ore production (Mt) |

13.4 |

13.0 |

15.3 |

50.9 |

58.0 |

| Crude

steel production (Mt) |

16.5 |

17.2 |

18.8 |

69.1 |

71.5 |

| Steel

shipments (Mt) |

15.8 |

14.6 |

17.3 |

62.9 |

69.1 |

ArcelorMittal Condensed Consolidated Statement of Cash

flows1

|

|

Three months ended |

Twelve months ended |

|

In millions of U.S. dollars |

Dec 31, 2021 |

Sept 30, 2021 |

Dec 31, 2020 |

Dec 31, 2021 |

Dec 31, 2020 |

|

Operating activities: |

|

|

|

|

|

|

Income /(loss) attributable to equity holders of the

parent |

4,045 |

4,621 |

1,207 |

14,956 |

(733) |

|

Adjustments to reconcile net income/ (loss) to net cash provided by

operations: |

|

|

|

|

|

|

Non-controlling interests income |

104 |

219 |

82 |

609 |

155 |

|

Depreciation and impairment items |

494 |

590 |

1,042 |

2,305 |

2,827 |

|

Exceptional items |

— |

123 |

(1,314) |

123 |

(636) |

| Income

from associates, joint ventures and other investments |

(383) |

(778) |

(7) |

(2,204) |

(234) |

| Deferred

tax (benefit) / expense |

(46) |

(56) |

(15) |

(493) |

827 |

| Change in

working capital |

22 |

(2,896) |

925 |

(6,409) |

1,496 |

| Other

operating activities (net) |

(82) |

619 |

(504) |

1,018 |

380 |

|

Net cash provided by operating activities (A) |

4,154 |

2,442 |

1,416 |

9,905 |

4,082 |

|

Investing activities: |

|

|

|

|

|

| Purchase

of property, plant and equipment and intangibles (B) |

(1,145) |

(675) |

(668) |

(3,008) |

(2,439) |

| Other

investing activities (net) |

(90) |

1,184 |

262 |

2,668 |

428 |

|

Net cash (used in) / provided by investing

activities |

(1,235) |

509 |

(406) |

(340) |

(2,011) |

|

Financing activities: |

|

|

|

|

|

| Net

proceeds / (payments) relating to payable to banks and long-term

debt |

100 |

(806) |

(1,506) |

(3,562) |

(2,395) |

| Dividends

paid to ArcelorMittal shareholders |

— |

(28) |

— |

(312) |

— |

| Dividends

paid to minorities (C) |

(21) |

(157) |

(16) |

(260) |

(181) |

| Share

buyback |

(1,820) |

(1,703) |

(487) |

(5,170) |

(500) |

|

Common share offering |

— |

— |

— |

— |

740 |

|

(Payments) / proceeds from Mandatorily Convertible Notes |

(1,196) |

— |

— |

(1,196) |

1,237 |

| Lease

payments and other financing activities (net) |

(53) |

(46) |

(218) |

(398) |

(399) |

|

Net cash used in financing activities |

(2,990) |

(2,740) |

(2,227) |

(10,898) |

(1,498) |

| Net

(decrease) / increase in cash and cash equivalents |

(71) |

211 |

(1,217) |

(1,333) |

573 |

| Cash and

cash equivalents transferred from / (to) assets held for sale |

— |

— |

67 |

3 |

(3) |

| Effect of

exchange rate changes on cash |

13 |

(9) |

234 |

(55) |

163 |

|

Change in cash and cash equivalents |

(58) |

202 |

(916) |

(1,385) |

733 |

|

|

|

|

|

|

|

|

Free cash flow (D=A+B+C)17 |

2,988 |

1,610 |

732 |

6,637 |

1,462 |

Appendix 1: Product shipments by

region(1)

|

(000'kt) |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

| Flat |

1,548 |

1,613 |

3,462 |

6,879 |

15,422 |

| Long |

739 |

770 |

807 |

3,088 |

2,884 |

|

NAFTA |

2,205 |

2,280 |

4,134 |

9,586 |

17,902 |

| Flat |

1,790 |

1,523 |

1,324 |

6,425 |

4,722 |

| Long |

1,256 |

1,325 |

1,268 |

5,332 |

4,740 |

|

Brazil |

3,034 |

2,829 |

2,575 |

11,695 |

9,410 |

| Flat |

5,788 |

5,333 |

6,210 |

23,485 |

23,907 |

| Long |

2,421 |

2,121 |

2,246 |

9,236 |

8,550 |

|

Europe |

8,325 |

7,551 |

8,569 |

33,182 |

32,873 |

| CIS |

2,067 |

1,684 |

1,912 |

7,883 |

7,685 |

|

Africa |

531 |

679 |

458 |

2,473 |

2,190 |

|

ACIS |

2,597 |

2,367 |

2,373 |

10,360 |

9,881 |

Note: “Others and eliminations” are not presented in the

table

Appendix 2a: Capital

expenditures(1,2)

|

(USDm) |

4Q 21 |

3Q 21 |

4Q 20 |

12M 21 |

12M 20 |

|

NAFTA |

104 |

118 |

82 |

369 |

527 |

|

Brazil |

171 |

102 |

67 |

412 |

216 |

|

Europe |

473 |

231 |

326 |

1,282 |

1,040 |

|

ACIS |

266 |

139 |

134 |

619 |

476 |

|

Mining |

127 |

78 |

46 |

302 |

140 |

|

Total |

1,145 |

675 |

668 |

3,008 |

2,439 |

Note: “Others” are not presented in the table

Appendix 2b: Capital expenditure projects

The following tables summarize the Company’s principal growth

and optimization projects involving significant capex.

For projects in which the targeted addition to EBITDA is

indicated, such amount is based on numerous assumptions as to

selling prices and input costs in particular, and for projects

relating to Mining / iron ore mines, conservative long term iron

ore prices.

Completed projects

|

Segment |

Site / unit |

Project |

Capacity / details |

Key date / forecast completion |

|

NAFTA |

Mexico |

New hot strip mill |

Production capacity of 2.5Mt/year |

2021 (a) |

Ongoing projects

|

Segment |

Site / unit |

Project |

Capacity / details |

Key date / forecast completion |

|

NAFTA |

ArcelorMittal Dofasco (Canada) |

Hot strip mill modernization |

Replace existing three end of life coilers with two state of the

art coilers and new runout tables |

1H 2022 (b) |

|

NAFTA |

ArcelorMittal Dofasco (Canada) |

#5 CGL conversion to AluSi® |

Addition of up to 160kt/year Aluminum Silicon (AluSi®) coating

capability to #5 Hot-Dip Galvanizing Line for the production of

Usibor® steels |

2H 2022 (c) |

|

Brazil |

ArcelorMittal Vega Do Sul |

Expansion project |

Increase hot dipped / cold rolled coil capacity and construction of

a new 700kt continuous annealing line (CAL) and continuous

galvanising line (CGL) combiline |

4Q 2023 (d) |

|

Mining |

Liberia mine |

Phase 2 premium product expansion project |

Increase production capacity to 15Mt/year |

4Q 2023 (e) |

|

NAFTA |

Las Truchas mine (Mexico) |

Revamping and capacity increase to 2.3MT |

Revamping project with 1Mtpa pellet feed capacity increase (to 2.3

Mt/year) with DRI concentrate grade capability |

2H 2023 (f) |

|

Brazil |

Serra Azul mine |

4.5Mtpa direct reduction pellet feed plant |

Facilities to produce 4.5Mt/year DRI quality pellet feed by

exploiting compact itabirite iron ore |

2H 2023 (g) |

|

Brazil |

Monlevade |

Sinter plant, blast furnace and melt shop |

Increase in liquid steel capacity by 1.0Mt/year; Sinter feed

capacity of 2.3Mt/year |

2H 2024 (h) |

|

ACIS |

ArcelorMittal Kryvyi Rih(Ukraine) |

New Pellet Plant |

Facilities to produce 5.0 Mtpa pellets, replacing two existing

sinter plants ensuring environmental compliance and improving

productivity |

4Q 2023 (i) |

|

Brazil |

Barra Mansa |

New section mill |

Increase capacity of HAV bars and sections by 0.4Mt/pa |

1Q 2024 (j) |

a) On September 28, 2017, ArcelorMittal announced a major $1.0

billion investment programme at its Mexican operations, which is

focused on building ArcelorMittal Mexico’s downstream capabilities,

sustaining the competitiveness of its mining operations and

modernizing its existing asset base. The programme is designed to

enable ArcelorMittal Mexico to meet the anticipated increased

demand requirements from domestic customers, realize in full

ArcelorMittal Mexico’s production capacity of 5.3Mt and

significantly enhance the proportion of higher added-value products

in its product mix. The main investment will be the construction of

a new hot strip mill. Upon completion, the project will enable

ArcelorMittal Mexico to produce c.2.5Mt of flat rolled steel, long

steel c.1.5Mt and the remainder made up of semi-finished slabs.

Coils from the new hot strip mill will be supplied to domestic,

non-auto, general industry customers. The hot strip mill project

commenced late 4Q 2017, and the first coils were produced at the

end of 2021 with ramp up expected to full capacity during 2022. The

hot skin pass mill (HSPM) is expected to be completed in 2H 2022.

In addition to the HSM project, a push pull pickling line (PPPL) is

to be constructed to capture additional domestic volume through hot

rolled pickled and oiled products. The PPPL has a capacity of up to

0.75Mtpa, and the first pickled and oiled coils are expected to be

produced by 2H 2024.

b) Investment in ArcelorMittal Dofasco (Canada) to modernize the

hot strip mill. The project is to install two new state of the art

coilers and runout tables to replace three end of life coilers. The

strip cooling system will be upgraded and include innovative power

cooling technology to improve product capability. The project is

estimated to be completed in 1H 2022. The project is estimated to

add >$25 million in EBITDA on full completion and post ramp

up.

c) Investment to replace #5 Hot-Dip Galvanizing Line Galvanneal

coating capability with 160kt/year Aluminum Silicon (AluSi®)

capability for the production of ArcelorMittal’s patented Usibor®

Press Hardenable Steel for automotive structural and safety

components. With the investment, ArcelorMittal Dofasco will become

the only Canadian producer of AluSi® coated Usibor®. This

investment complements additional strategic North America

developments, including a new EAF and caster at Calvert in the US

and a new hot strip mill in Mexico, and will allow to capitalize on

increasing Auto Aluminized PHS demand in North America. The project

is expected to be completed in 2022, with the first coil planned

for 2H 2022. The project is estimated to add >$40 million in

EBITDA on full completion and post ramp up.

d) In February 2021, ArcelorMittal announced the resumption of

the Vega Do Sul expansion to provide an additional 700kt of

cold-rolled annealed and galvanized capacity to serve the growing

domestic market. The ~$0.35 billion investment programme to

increase rolling capacity with construction of a new continuous

annealing line and CGL combiline (and the option to add a ca. 100kt

organic coating line to serve construction and appliance segments),

and upon completion, will strengthen ArcelorMittal’s position in

the fast growing automotive and industry markets through Advanced

High Strength Steel products. The investments will look to

facilitate a wide range of products and applications whilst further

optimizing current ArcelorMittal Vega facilities to maximize site

capacity and its competitiveness, considering comprehensive digital

and automation technology. Equipment delivery is progressing in

accordance with plan. Civil works and erection of acid regeneration

plant and repair and inspection line is well advanced. The project

is estimated to be completed in 4Q 2023 and potentially add

>$0.1 billion in EBITDA on full completion and post ramp up.

e) ArcelorMittal Liberia has been operating a 5Mt direct

shipping ore (DSO) since 2011 (Phase 1). In 2013, the Company had

started construction of a Phase 2 project that envisaged the

construction of 15Mtpa of concentrate sinter fines capacity and

associated infrastructure; this project was then suspended due to

the onset of Ebola in West Africa and the subsequent force-majeure

declaration by the onsite contracting companies. On September 10,

2021, ArcelorMittal signed with the Government of the Republic of

Liberia an amendment to its Mineral Development Agreement which is

currently under the legislative ratification process. Final

detailed engineering is in progress, whilst site preparation and

tenders for key construction contracts and remaining equipment are

underway. Under this project, first concentrate product is expected

in late 2023, ramping up to 15Mtpa thereafter. The capex required

to conclude the project, estimated at approximately $0.8 billion,

is under review given impacts of inflation and enlarged scope.

Under the agreement, the Company has further expansion

opportunities up to 30Mtpa. Other users may be allowed to invest

for additional rail capacity. The project is estimated to add

approximately $250 million in EBITDA on full completion and post

ramp up.

f) ArcelorMittal Mexico is investing ~$150 million to increase

pellet feed production by 1Mtpa to 2.3Mtpa and improve concentrate

grade in Las Truchas. This project will enable concentrate

production to the blast furnace (BF) route (2.0Mtpa) and direct

reduced iron (DRI) route (0.3Mtpa) for a total of 2.3Mtpa. Primary

target is to supply ArcelorMittal Mexico steel operations with high

quality feed. Procurement of long lead time items (mills and pumps)

and early works have started. Detailed engineering is ongoing. Road

works are in progress. Production start-up is estimated in 2H 2023

and estimated to add approximately $50 million in EBITDA on full

completion and post ramp up.

g) Approximately $350 million investment at Serra Azul (Brazil)

to construct facilities to produce 4.5Mtpa of DRI quality pellet

feed to primarily supply ArcelorMittal Mexico steel operation. The

project will allow to mine the compact itabirite iron ore.

Environmental and operations licenses have been cleared. Detailed

engineering is ongoing, hiring of drilling companies and

procurement of main equipment is initiated. Project start-up is

estimated in 2H 2023. The project is estimated to add ~$100 million

in EBITDA on full completion and post ramp up.

h) The Monlevade upstream expansion project consisting of the

sinter plant, blast furnace and meltshop has recommenced in late

2021, following the anticipated improvement in Brazil domestic

market. Basic engineering is being finalized and hiring of civil

works and piling companies has started. The project is estimated to

be completed in 2H 2024 with a capex requirement of approximately

$0.5 billion. The project is estimated to add >$0.2 billion in

EBITDA on full completion and post ramp up.

i) Investment in ArcelorMittal Kryvyi Rih to build a new 5.0Mtpa

pellet plant which, together with the ongoing modernization of

Sinter Plant 2, will ensure that all sinter operations in Kryvyi

Rih are compliant with dust emissions environmental regulations and

will enable cost reduction, quality and productivity improvement.

In addition, the project will enable a CO2 footprint improvement by