2021 Annual Results: In an Extraordinary Year, Getlink is Controlling Its Costs, Innovating and Preparing for the Recovery

February 24 2022 - 1:30AM

Business Wire

- Revenues of €774 million (-6%1)

- EBITDA of €297 million (-11%)

- Positive Free Cash Flow2 (€21 million)

- Net available cash at 31/12/2021 of €718 million

(+14%)

Regulatory News:

Getlink (Paris:GET):

Yann Leriche, Group Chief Executive Officer said: “In

2021, in the difficult context of the health crisis, we managed to

preserve our fundamental values through strong financial

discipline, allowing us once again to protect our cash flow. The

development of new digital services for all our freight and

passenger customers has allowed us to strengthen our leadership

position while preparing for the future. In 2022, we shall continue

this momentum as well as our concrete actions in terms of CSR. With

the IGC approval obtained on 17 February, we are approaching the

entry into service of ElecLink which will mark the start of a new

activity for the Group.”

- 2022 financial outlook

- The Group will communicate objectives for its financial

performance in 2022 when the trends in the evolution of the

pandemic – which are currently positive – are confirmed.

- The gradual lifting of travel restrictions and the effective

management of the re-establishment of EU to UK customs controls

have led to a significant recovery in traffic during the first

weeks of 2022 compared to the same period in 2021, with a notable

return of passenger customers in line with the trends expected by

the European short-haul airline market.

- Dividend

- Payment of a dividend of €0.10 per share subject to approval at

the AGM on 27 April 2022.

ANNUAL HIGHLIGHTS

- Environment Plan

- Trajectory of greenhouse gas emission reduction by 30% in 2025,

validated by the SBTi initiative and supplemented by an ultimate

ambition to contribute to carbon neutrality in 2050.

- Reduction of greenhouse gas emissions by 6% in 2021 compared to

2020 on a like-for-like basis.

- Alignment of 86% of the Group's revenue under the European

Taxonomy.

- Group

- Reduction in operating costs of €66 million in 2021 compared to

2019 on a like-for-like basis, a performance better than the

operational objective of €55 million at end of June.

- Consolidated cash at €718 million at the end of December,

reflecting the Group's ability to continue to generate positive

Free Cash Flow.

- Successful placement of the additional “green” bond issue for

an amount of €150 million which complements the Green Bonds

maturing in 2025.

- Eurotunnel

- A year marked by travel restrictions (no unrestricted days in

2021) and the implementation of the Brexit agreement.

- Optimisation of Shuttle yield (+8.5%), linked for Le Shuttle

passenger activity to last-minute reservations and flexible and

premium tickets and the implementation of a new pricing policy,

“Next Gen Pricing”.

- The Le Shuttle and Le Shuttle Freight services confirmed their

leadership in the Short Straits market with market shares of 74%

for cars and 39.1% for trucks.

- Nearly 1.4 million trucks travelled on board Le Shuttle

Freight.

- More than 960,000 passenger vehicles crossed the Channel aboard

Passenger Shuttles, a remarkable performance compared to our

competitors.

- Great success for the Eurotunnel Border Pass (62% uptake3) and

Passenger Wallet applications (more than 80% uptake) designed for

customers and optimising their travel experience.

- Signature of several partnerships to facilitate customs

formalities for the truck business, such as the SGS TransitNet

solution, the ICS partnerships, and the launch of additional

services including a truck maintenance service in the Le Truck

Village car park.

- Launch of an innovative unaccompanied freight service.

- Launch of a voluntary departure programme in the form of a

collective contractual termination (RCC) procedure in France and an

Expression of Interest in the United Kingdom.

- Europorte

- Increase in Europorte’s annual revenues (+6%) to €130.2

million, in particular due to the launch of the Flex Express

service and strong commercial momentum to increase traffic

flows.

- Continuation of the profitable growth strategy with an EBITDA

of €27.9 million, up €0.6 million compared to 2020.

- ElecLink

- Works in the Tunnel completed and electromagnetic compatibility

tests in the Tunnel carried out successfully.

- Validation of the safety file by the IGC on 17 February 2022

guaranteeing the compatibility of the interconnector with the rail

system which allows the final phase of the electricity transfer

tests between national networks and which confirms the schedule for

entry into commercial service expected mid-2022.

FINANCIAL RESULTS

The Group’s consolidated revenue for the 2021 financial year

amounts to €774 million.

Consolidated EBITDA amounts to €297 million, impacted by the

Covid pandemic, down €38 million compared to 2020 at a constant

exchange rate.

Trading profit was €108 million, down 28% compared to 2020.

The Group's consolidated net result for the 2021 financial year

is a loss of €229 million.

The Group is now considering options for the refinancing of the

C2a tranche of Eurotunnel’s Term Loan (equivalent to the CLEF A7

notes).

€718 million of cash held at 31 December 2021, up €89 million

compared to 31 December 2020.

FINANCIAL OUTLOOK

The lack of short-term visibility does not undermine the Group's

confidence in the strength of its various activities, their growth

potential in the medium and long term, and its ability to improve

its operational and environmental performance. The Group will

communicate objectives for its financial performance in 2022 when

the trends in the evolution of the pandemic – which are currently

positive – are confirmed.

Dates for 2022:

21 April 2022: 2022 first quarter traffic and revenue 27 April

2022: Getlink SE’s AGM 21 July 2022: 2022 half-year results

Additional information:

At its meeting on Wednesday 23 February 2022, the Board of

Directors, under the chairmanship of Jacques Gounon, approved the

financial statements for the year ending 31 December 2021.

The financial analysis of the consolidated financial statements

is available on the Group’s website: www.getlinkgroup.com.

Getlink SE’s consolidated and parent company accounts for 2021

have been audited and certified by the statutory auditors.

1 All comparisons with the 2020 income statement are based on

the average exchange rate for 2021 of £1 = €1.167. 2 Defined as:

cash flow from operating activities of current activities less

capital expenditure (excluding ElecLink) and debt service. 3 Rate

observed from 10 January 2022 to 9 February 2022 on trucks carrying

goods from the UK to the EU.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220223006354/en/

Getlink: For UK media

enquiries contact John Keefe on + 44 (0) 1303 284491

Email: press@getlinkgroup.com

For other media enquiries contact Romain Dufour on

+33(0)1 4098 0464

For investor enquiries contact: Jean-Baptiste Roussille

on +33 (0)1 40 98 04 81 Email:

jean-baptiste.roussille@getlinkgroup.com

Michael Schuller on +44 (0) 1303 288749 Email:

Michael.schuller@getlinkgroup.com

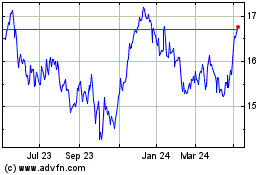

Getlink (EU:GET)

Historical Stock Chart

From Jun 2024 to Jul 2024

Getlink (EU:GET)

Historical Stock Chart

From Jul 2023 to Jul 2024