Cnova N.V. : Third Quarter 2019 Activity

CNOVA

N.V. CNOVA N.V. Third Quarter 2019

Activity

AMSTERDAM – October 11, 2019, 07:45 CEST

— Cnova N.V. (Euronext Paris: CNV; ISIN: NL0010949392)

(“Cnova”) today announced unaudited operating data for the quarter

ended September 30, 2019.

- GMV: 940 million euros, +9.0% organic

growth1, +10.3% YTD

- Driven by marketplace (+4.0 pts), B2C services (+3.2

pts) and showrooms (+2.3 pts)

- Marketplace growth driven by Fulfillment by

Cdiscount

- 3Q19 marketplace GMV share2: 39.4% (+3.2

pts)

- Fulfillment by Cdiscount: +78% GMV growth; 33%

marketplace GMV share (+14 pts)

- Marketplace B2B services: +23% revenues

- CDAV loyalty program increasing

success

- Membership: +19% y-o-y (>2 million

subscribers)

- Express delivery covers +1.1m SKUs (x3

y-o-y)

- Travel offer driving fast-expanding B2C

services

- Cdiscount Voyages (Travel) high-growth sustained by

holiday packages (x2.3 GMV vs 2Q19)

- Cdiscount Energie growing fast: +31% GMV vs

3Q18

- Cdiscount Mobile: x2 clients vs 3Q18

- Launch of Cdiscount Beauté (Beauty)

- International expansion driven by new

initiatives

- Delivering to more European countries: 45 websites

connected (+11 vs 2Q19)

- Launch of IMN, an international network of shared

vendors among 4 European marketplaces

- Responsible logistics innovation

leader

- Agrikolis: 55 rural farm pick-up points (+18 vs 2Q19)

bringing great customer satisfaction

- Roll-out of new generation 3D packing machine, x2

faster than the previous ones

Emmanuel Grenier, Cnova CEO, commented:

“Our quarterly performance was again

marked by several developments, driving our profitable growth

strategy.

First, looking at our core business this

year, Fulfillment by Cdiscount has created a virtuous circle for

both our clients and sellers: more marketplace orders fulfilled by

Cdiscount translate into more overall SKUs eligible for express

delivery. This in turn generates more value and quality for our

loyal customers and is an underlying growth driver of our

constantly expanding CDAV customer loyalty program. Last but not

least, it acts as a strong lever for marketplace

growth.

Second, the success of Cdiscount’s

travel sales led to a strong B2C services growth. In fact, our

holiday packages offer quadrupled compared to the previous

quarter.

Third, we are pursuing our efforts to

grow beyond our borders. We launched a unique European marketplaces

alliance, International Marketplace Network, or IMN, that is

significantly scaling up our number of sellers and product

offer.”

3rd Quarter 2019

Highlights

|

GMV |

3Q19 |

YTD 19 |

|

Organic Growth |

+9.0% |

+10.3% |

Organic GMV (gross

merchandise volume) posted a +9.0% increase in the 3rd

quarter 2019 versus the same period in 2018. For the first nine

months of the year, GMV has experienced a steady +10.3% organic

growth. Main contributors to the GMV organic growth were: the

marketplace (+4.0 pts contribution), B2C services such as travel

and energy (+3.2 pts) and Géant showrooms (+2.3 pts contribution).

The end of the 3rd quarter was marked by a new edition of French

Days, which confirmed its success exceeding last year

performance.

|

Marketplace |

3Q19 |

|

Marketplace total GMV share |

+3.2 pts |

|

FFM marketplace GMV share |

+14 pts |

The marketplace

development remains at the heart of Cdiscount’s profitable growth

strategy. Marketplace GMV share increased to 39.4% in the 3rd

quarter 2019, +3.2 points year-on-year. The marketplace GMV

fulfilled by Cdiscount, a driving force of both marketplace

expansion and customer satisfaction, experienced a very strong +78%

growth. It now represents a third of our marketplace GMV, +14

points compared to the previous year.

|

Net sales |

3Q19 |

|

Organic growth |

+5.1% |

Net sales amounted to

€522 million in the 3rd quarter 2019, a 5.1% organic growth

compared to the same period in 2018. This sustained top line growth

reaffirms three strong pillars: growing marketplace commissions,

new B2B and B2C monetization revenue streams as well as showroom

revenues.

|

Traffic |

3Q19 |

|

Mobile traffic growth |

+21% |

|

Mobile traffic share |

+8.0 pts |

|

Mobile GMV share |

+4.8 pts |

Traffic at Cdiscount

totaled 245 million visits in the 3rd quarter 2019. Mobile traffic

grew by +21%, representing 73% share of total traffic (+ 8.0

points) and 50.4% of the GMV (+4.8 points). In terms of Unique

Monthly Visitors (UMV), Cdiscount experienced the second strongest

mobile growth among the top 5 players3, consolidating its overall

2nd ranking with more than 20 million UMV per month.

|

CDAV |

3Q19 |

|

CDAV subscriber base growth |

+19% |

|

CDAV GMV share |

+2.5 pts |

Cdiscount à Volonté

(“CDAV”)’s subscriber base grew by 19% and reached 35.3% of GMV,

driven by the constant expansion of SKUs eligible for express

delivery. Our more than 2-million-member base has now access to

more than 1.1 million express delivery eligible SKUs, a tripling of

the offer compared to last year.

Key Business Highlights

Marketplace and associated

services development

- The marketplace gained +3.2 points in total GMV

share to reach 39.4% in the 3rd quarter

2019.

- The number of available SKUs was up 46% to reach 65

million at the end of September 2019.

- Expansion of express delivery eligible

marketplace SKUs remained a key focus in the 3rd quarter

2019: Fulfillment by Cdiscount kept growing fast

with a 78% GMV increase, now accounting for a third of marketplace

GMV, +14 points compared to last year. In addition,

a new service was launched, Express Seller, for

sellers able to offer express delivery to access CDAV customers.

This initiative will increase the attractiveness of those product

offerings and enhance both our loyalty program and marketplace

sales.

- Marketplace vendor value-added

services revenues rose by 23%, driven by Premium Packs and

the success of the recent turnkey Marketing services offer, that

more than doubled compared to last year.

B2C services: growing and

expanding quickly

- Cdiscount Voyages (travel) again

exceeded expectations, supported by holiday packages GMV, 2.3 times

higher than the 2nd quarter 2019. Marketplace holiday packages

quadrupled compared to the previous quarter thanks to the

integration of more than 20 forefront tour operators such as NG

Travel and Center Parcs, to bring the assortment up to 10,000

offers.

- Cdiscount Billetterie (ticketing),

kept expanding its offer, with a new strong partnership with Disney

to offer holiday packages.

- Cdiscount Mobile (cell phone plans)

subscriptions reached a record-high, doubling compared to last

year.

- Cdiscount Energie (home energy)

remains very dynamic in the 3rd quarter 2019, experiencing a +31%

GMV growth.

- Launch of Cdiscount Beauté (Beauty), gathering

Beauty products and a new hairdresser booking service, to be

followed by other similar initiatives.

Enhanced customer experience and multichannel

strategy

- CDAV customer loyalty program experienced a 19% growth

to reach more than 2 million members and focused on expanding its

CDAV-eligible products, now encompassing more than 1.1 million

SKUs, driven by several fast delivery options proposed to our

marketplace sellers: Fulfillment by Cdiscount, Cdiscount Transport

and the newly launched Express Seller program.

- Cnova continues to develop synergies with Casino Group,

with the opening of 5 showrooms in Franprix stores around Paris.

Franprix started to display in stores monthly discounts on a

selective Cdiscount non-food and wine offers.

Monetization initiatives well

advanced

·Monetization

revenues increased by +33%, driven by the a strong B2C services

growth (especially travel) as well as financial services and

marketplace B2B services.

International platform acceleration driven by

new initiatives

- 40 million SKUs are now available for delivery to

neighboring countries.

- 45 websites are directly connected as of the end

September 2019, +11 compared to end of 2Q19, still delivering 25

countries with an offer of more than 150 thousand

SKUs.

- Creation of the International Marketplace

Network (IMN), a groundbreaking alliance of 4 marketplaces leaders

in Europe (Cdiscount, real.de, eMAG and ePrice). Addressing a

potential +230 million consumers, IMN offers sellers a single,

simplified European seller interface and will contribute to

significantly increase SKUs available for Cdiscount customers with

the potential of doubling the number of sellers registered on its

marketplace. The technology behind IMN was developed by Beezup, a

startup acquired by Cdiscount in 2018.

Commitment to responsible logistics

innovation

- Agrikolis, a Cdiscount’s rural farming

pickup points exclusive partnership, extended its network by 18

farms compared to the previous quarter to reach 55, with more to

come in the 4th quarter. In addition to better deliver isolated

areas, Agrikolis generates complementary revenues for farmers and

strongly contributes to improve customer satisfaction by fostering

genuine social bonds.

- Cdiscount is the first player in France to roll-out a

new generation 3D packing machine, twice as fast than the

previous one. It brings to 5 the number of 3D packing machine used

by Cdiscount.

- Cdiscount’s supply chain won the LSA magazine

award in the category “development of the distributor

environmental responsibility” for its actions aiming at reducing

carbon emissions.

Third Quarter

Activity

| Cnova

N.V. |

Third Quarter(1) |

Change |

|

2019 |

2018 |

Reported(1)(2) |

Organic(3) |

| GMV(4) (€

millions) |

940.3 |

871.7 |

+7.9% |

+9.0% |

| Marketplace share(5) |

39.4% |

36.3% |

+3.2

pts |

| Mobile share |

50.4% |

45.6% |

+4.8

pts |

| CDAV share |

35.3% |

32.8% |

+2.5

pts |

| Net sales (€

millions) |

521.9 |

503.0 |

+3.8% |

+5.1% |

| Traffic (visits

in millions) |

245.4 |

227.0 |

+8.1% |

| Mobile share |

73.1% |

65.1% |

+8.0

pts |

| Active

customers(6) (millions) |

9.2 |

8.8 |

+5.0% |

| Orders(7)

(millions) |

6.3 |

6.4 |

-2.3% |

| Number of items

sold (millions) |

11.5 |

12.0 |

-4.8% |

- All figures are unaudited.

- Reported figures present all revenue generated by

Cdiscount, including the technical goods sales realized in Casino

Group’s hypermarkets and supermarkets.

- Organic growth: figures exclude (i) sales realized in

Casino Group’s hypermarkets and supermarkets on technical goods and

home category (total exclusion impact of +2.4 pts and +3.6 pts,

respectively, on GMV and net sales in 3Q19), and (ii) 1001Pneus

acquisition during 4Q18 (total exclusion impact of -1.7 pt and -2.5

pt on GMV and net sales in 3Q19) but take into account showroom

sales.

- GMV (gross merchandise volume) is defined as: all taxes

included, product sales + other revenue + marketplace business

volumes (calculated based on approved and sent orders) + GMV

services

- Marketplace GMV shares have been adjusted to take into

account coupons and warranties and exclude CDAV subscription fee.

3Q18 GMV share has therefore been adjusted by +0.3pt for comparison

purposes.

- Active customers at the end of December having

purchased at least once through Cdiscount sites and app during the

previous 12 months.

- Total placed orders before cancellation due to fraud

detection and/or customer non-payment.

***About Cnova

N.V.

Cnova N.V., one of the leading

e-Commerce companies in France, serves 9.2 million active customers

via its state-of-the-art website, Cdiscount. Cnova N.V.’s product

offering provides its clients with a wide variety of very

competitively priced goods, fast and customer-convenient delivery

options, practical and innovative payment solutions as well as

travel, entertainment and domestic energy services. Cnova N.V. is

part of Groupe Casino, a global diversified retailer. Cnova N.V.'s

news releases are available at www.cnova.com. Information available

on, or accessible through, the sites referenced above is not part

of this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

***

|

Cnova Investor Relations

Contact:investor@cnovagroup.com |

Media

contact:directiondelacommunication@cdiscount.comTel: +33 5

56 30 07 14 |

1 Organic growth: figures include showroom sales

and services; exclude i) technical goods and home category sales

made in Casino Group’s hypermarkets and supermarkets (total

exclusion impact of +2.4 pts on GMV growth) and ii) 1001Pneus GMV,

company acquired in 4Q18, (total exclusion impact of -1.7 pt on GMV

growth)

2 Marketplace GMV shares have been

adjusted to take into account coupons and warranties and exclude

CDAV subscription fees. 3Q18 GMV share has therefore been adjusted

by +0.3pt for comparison purposes.

3 Latest Médiamétrie study (July 2019)

AMSTERDAM – October 11, 2019, 07:45 CEST — Cnova

N.V. (Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova”) today

announced unaudited operating data for the quarter ended September

30, 2019.

- GMV: 940 million euros, +9.0% organic

growth1, +10.3% YTD

- Driven by marketplace (+4.0 pts), B2C services (+3.2 pts) and

showrooms (+2.3 pts)

- Marketplace growth driven by Fulfillment by

Cdiscount

- 3Q19 marketplace GMV share2: 39.4% (+3.2 pts)

- Fulfillment by Cdiscount: +78% GMV growth; 33% marketplace GMV

share (+14 pts)

- Marketplace B2B services: +23% revenues

- CDAV loyalty program increasing success

- Membership: +19% y-o-y (>2 million subscribers)

- Express delivery covers +1.1m SKUs (x3 y-o-y)

- Travel offer driving fast-expanding B2C

services

- Cdiscount Voyages (Travel) high-growth sustained by holiday

packages (x2.3 GMV vs 2Q19)

- Cdiscount Energie growing fast: +31% GMV vs 3Q18

- Cdiscount Mobile: x2 clients vs 3Q18

- Launch of Cdiscount Beauté (Beauty)

- International expansion driven by new

initiatives

- Delivering to more European countries: 45 websites connected

(+11 vs 2Q19)

- Launch of IMN, an international network of shared vendors among

4 European marketplaces

- Responsible logistics innovation leader

- Agrikolis: 55 rural farm pick-up points (+18 vs 2Q19) bringing

great customer satisfaction

- Roll-out of new generation 3D packing machine, x2 faster than

the previous ones

Emmanuel Grenier, Cnova CEO, commented:

“Our quarterly performance was again marked by

several developments, driving our profitable growth strategy.

First, looking at our core business this year,

Fulfillment by Cdiscount has created a virtuous circle for both our

clients and sellers: more marketplace orders fulfilled by Cdiscount

translate into more overall SKUs eligible for express delivery.

This in turn generates more value and quality for our loyal

customers and is an underlying growth driver of our constantly

expanding CDAV customer loyalty program. Last but not least, it

acts as a strong lever for marketplace growth.

Second, the success of Cdiscount’s travel sales

led to a strong B2C services growth. In fact, our holiday packages

offer quadrupled compared to the previous quarter.

Third, we are pursuing our efforts to grow

beyond our borders. We launched a unique European marketplaces

alliance, International Marketplace Network, or IMN, that is

significantly scaling up our number of sellers and product

offer.”

3rd Quarter 2019 Highlights

|

GMV |

3Q19 |

YTD 19 |

|

Organic Growth |

+9.0% |

+10.3% |

Organic GMV (gross merchandise

volume) posted a +9.0% increase in the 3rd quarter 2019

versus the same period in 2018. For the first nine months of the

year, GMV has experienced a steady +10.3% organic growth. Main

contributors to the GMV organic growth were: the marketplace (+4.0

pts contribution), B2C services such as travel and energy (+3.2

pts) and Géant showrooms (+2.3 pts contribution). The end of the

3rd quarter was marked by a new edition of French Days, which

confirmed its success exceeding last year performance.

|

Marketplace |

3Q19 |

|

Marketplace total GMV share |

+3.2 pts |

|

FFM marketplace GMV share |

+14 pts |

The marketplace development

remains at the heart of Cdiscount’s profitable growth strategy.

Marketplace GMV share increased to 39.4% in the 3rd quarter 2019,

+3.2 points year-on-year. The marketplace GMV fulfilled by

Cdiscount, a driving force of both marketplace expansion and

customer satisfaction, experienced a very strong +78% growth. It

now represents a third of our marketplace GMV, +14 points compared

to the previous year.

|

Net sales |

3Q19 |

|

Organic growth |

+5.1% |

Net sales amounted to €522

million in the 3rd quarter 2019, a 5.1% organic growth compared to

the same period in 2018. This sustained top line growth reaffirms

three strong pillars: growing marketplace commissions, new B2B and

B2C monetization revenue streams as well as showroom revenues.

|

Traffic |

3Q19 |

|

Mobile traffic growth |

+21% |

|

Mobile traffic share |

+8.0 pts |

|

Mobile GMV share |

+4.8 pts |

Traffic at Cdiscount totaled

245 million visits in the 3rd quarter 2019. Mobile traffic grew by

+21%, representing 73% share of total traffic (+ 8.0 points) and

50.4% of the GMV (+4.8 points). In terms of Unique Monthly Visitors

(UMV), Cdiscount experienced the second strongest mobile growth

among the top 5 players3, consolidating its overall 2nd ranking

with more than 20 million UMV per month.

|

CDAV |

3Q19 |

|

CDAV subscriber base growth |

+19% |

|

CDAV GMV share |

+2.5 pts |

Cdiscount à Volonté (“CDAV”)’s

subscriber base grew by 19% and reached 35.3% of GMV, driven by the

constant expansion of SKUs eligible for express delivery. Our more

than 2-million-member base has now access to more than 1.1 million

express delivery eligible SKUs, a tripling of the offer compared to

last year.

Key Business Highlights

Marketplace and associated services

development

- The marketplace gained +3.2 points in total GMV

share to reach 39.4% in the 3rd quarter 2019.

- The number of available SKUs was up 46% to reach 65 million at

the end of September 2019.

- Expansion of express delivery eligible marketplace

SKUs remained a key focus in the 3rd quarter 2019:

- Fulfillment by Cdiscount kept growing fast

with a 78% GMV increase, now accounting for a third of marketplace

GMV, +14 points compared to last year.

- In addition, a new service was launched, Express

Seller, for sellers able to offer express delivery to

access CDAV customers. This initiative will increase the

attractiveness of those product offerings and enhance both our

loyalty program and marketplace sales.

- Marketplace vendor value-added services

revenues rose by 23%, driven by Premium Packs and the success of

the recent turnkey Marketing services offer, that more than doubled

compared to last year.

B2C services: growing and expanding

quickly

- Cdiscount Voyages (travel) again exceeded

expectations, supported by holiday packages GMV, 2.3 times higher

than the 2nd quarter 2019. Marketplace holiday packages quadrupled

compared to the previous quarter thanks to the integration of more

than 20 forefront tour operators such as NG Travel and Center

Parcs, to bring the assortment up to 10,000 offers.

- Cdiscount Billetterie (ticketing), kept

expanding its offer, with a new strong partnership with Disney to

offer holiday packages.

- Cdiscount Mobile (cell phone plans)

subscriptions reached a record-high, doubling compared to last

year.

- Cdiscount Energie (home energy) remains very

dynamic in the 3rd quarter 2019, experiencing a +31% GMV

growth.

- Launch of Cdiscount Beauté (Beauty), gathering

Beauty products and a new hairdresser booking service, to be

followed by other similar initiatives.

Enhanced customer experience and multichannel

strategy

- CDAV customer loyalty program experienced a 19% growth to reach

more than 2 million members and focused on expanding its

CDAV-eligible products, now encompassing more than 1.1 million

SKUs, driven by several fast delivery options proposed to our

marketplace sellers: Fulfillment by Cdiscount, Cdiscount Transport

and the newly launched Express Seller program.

- Cnova continues to develop synergies with Casino Group, with

the opening of 5 showrooms in Franprix stores around Paris.

Franprix started to display in stores monthly discounts on a

selective Cdiscount non-food and wine offers.

Monetization initiatives well

advanced

·Monetization

revenues increased by +33%, driven by the a strong B2C

services growth (especially travel) as well as financial services

and marketplace B2B services.

International platform acceleration driven by new

initiatives

- 40 million SKUs are now available for delivery to neighboring

countries.

- 45 websites are directly connected as of the end September

2019, +11 compared to end of 2Q19, still delivering 25 countries

with an offer of more than 150 thousand SKUs.

- Creation of the International Marketplace

Network (IMN), a groundbreaking alliance of 4 marketplaces

leaders in Europe (Cdiscount, real.de, eMAG and ePrice). Addressing

a potential +230 million consumers, IMN offers sellers a single,

simplified European seller interface and will contribute to

significantly increase SKUs available for Cdiscount customers with

the potential of doubling the number of sellers registered on its

marketplace. The technology behind IMN was developed by Beezup, a

startup acquired by Cdiscount in 2018.

Commitment to responsible logistics

innovation

- Agrikolis, a Cdiscount’s rural farming pickup

points exclusive partnership, extended its network by 18 farms

compared to the previous quarter to reach 55, with more to come in

the 4th quarter. In addition to better deliver isolated areas,

Agrikolis generates complementary revenues for farmers and strongly

contributes to improve customer satisfaction by fostering genuine

social bonds.

- Cdiscount is the first player in France to roll-out a new

generation 3D packing machine, twice as fast than

the previous one. It brings to 5 the number of 3D packing machine

used by Cdiscount.

- Cdiscount’s supply chain won the LSA magazine

award in the category “development of the distributor

environmental responsibility” for its actions aiming at reducing

carbon emissions.

Third Quarter Activity

| Cnova

N.V. |

Third Quarter(1) |

Change |

|

2019 |

2018 |

Reported(1)(2) |

Organic(3) |

| GMV(4) (€

millions) |

940.3 |

871.7 |

+7.9% |

+9.0% |

| Marketplace share(5) |

39.4% |

36.3% |

+3.2

pts |

| Mobile share |

50.4% |

45.6% |

+4.8

pts |

| CDAV share |

35.3% |

32.8% |

+2.5

pts |

| Net sales (€

millions) |

521.9 |

503.0 |

+3.8% |

+5.1% |

| Traffic (visits

in millions) |

245.4 |

227.0 |

+8.1% |

| Mobile share |

73.1% |

65.1% |

+8.0

pts |

| Active

customers(6) (millions) |

9.2 |

8.8 |

+5.0% |

| Orders(7)

(millions) |

6.3 |

6.4 |

-2.3% |

| Number of items

sold (millions) |

11.5 |

12.0 |

-4.8% |

- All figures are unaudited.

- Reported figures present all revenue generated by Cdiscount,

including the technical goods sales realized in Casino Group’s

hypermarkets and supermarkets.

- Organic growth: figures exclude (i) sales realized in Casino

Group’s hypermarkets and supermarkets on technical goods and home

category (total exclusion impact of +2.4 pts and +3.6 pts,

respectively, on GMV and net sales in 3Q19), and (ii) 1001Pneus

acquisition during 4Q18 (total exclusion impact of -1.7 pt and -2.5

pt on GMV and net sales in 3Q19) but take into account showroom

sales.

- GMV (gross merchandise volume) is defined as: all taxes

included, product sales + other revenue + marketplace business

volumes (calculated based on approved and sent orders) + GMV

services

- Marketplace GMV shares have been adjusted to take into account

coupons and warranties and exclude CDAV subscription fee. 3Q18 GMV

share has therefore been adjusted by +0.3pt for comparison

purposes.

- Active customers at the end of December having purchased at

least once through Cdiscount sites and app during the previous 12

months.

- Total placed orders before cancellation due to fraud detection

and/or customer non-payment.

***About Cnova N.V.

Cnova N.V., one of the leading e-Commerce

companies in France, serves 9.2 million active customers via its

state-of-the-art website, Cdiscount. Cnova N.V.’s product offering

provides its clients with a wide variety of very competitively

priced goods, fast and customer-convenient delivery options,

practical and innovative payment solutions as well as travel,

entertainment and domestic energy services. Cnova N.V. is part of

Groupe Casino, a global diversified retailer. Cnova N.V.'s news

releases are available at www.cnova.com. Information available on,

or accessible through, the sites referenced above is not part of

this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

***

|

Cnova Investor Relations

Contact:investor@cnovagroup.com |

Media

contact:directiondelacommunication@cdiscount.comTel: +33 5

56 30 07 14 |

1 Organic growth: figures include showroom sales and

services; exclude i) technical goods and home category sales made

in Casino Group’s hypermarkets and supermarkets (total exclusion

impact of +2.4 pts on GMV growth) and ii) 1001Pneus GMV, company

acquired in 4Q18, (total exclusion impact of -1.7 pt on GMV

growth)

2 Marketplace GMV shares have been adjusted to

take into account coupons and warranties and exclude CDAV

subscription fees. 3Q18 GMV share has therefore been adjusted by

+0.3pt for comparison purposes.

3 Latest Médiamétrie study (July 2019)

- 2019 10 10_Cnova 3Q19 PR Sales VF

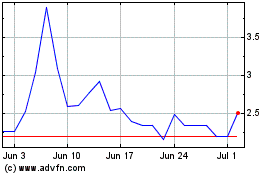

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024