Cnova N.V.: 2019 Second Quarter Activity & First Half Financial

Results

CNOVA N.V. 2019 Second Quarter Activity & First Half

Financial Results

AMSTERDAM, July 24, 2019, 07:45 CEST Cnova N.V.

(Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova” or the

“Company”) today announced its second quarter activity and first

half unaudited financial results for 2019.

- GMV: 2Q19 +13% organic1 growth, to reach

€847mn

- Driven by marketplace (+4.4 pts) and B2C services (+4.8

pts)

- Accelerating marketplace: +3.5 pts GMV share2

in 2Q19, at 40.1%

- Fulfillment by Cdiscount: +57% GMV growth, 27% marketplace GMV

share (+7.4 pts)

- B2B marketplace services revenues almost doubled

- B2C services rapidly growing, along with extension of

the offer

- Cdiscount Voyages: +73% 2Q19 GMV vs 1Q19, launch of a holiday

package marketplace

- Cdiscount Energie: x2.1 2Q19 GMV y-o-y, x2.3 subscribers

- Launch of Cdiscount Santé: health insurance and prescription

eyeglasses

- CDAV: 2mn members benefiting from 1mn eligible

products

- 2Q19: +3.1 pts GMV share to reach 37.9%

- More than 1mn SKUs available, x3 y-o-y

- International expansion plan well on track

- 25 countries now covered (+5 vs 1Q19)

- 34 websites directly connected (+23 vs 1Q19)

- EBITDA: +€12mn increase in 1H19 to reach €18mn

- €32mn gain in gross margin

- Marketplace commissions increase: +12% in 2Q19

- Monetization growing at a fast pace: +23% in 2Q19

Emmanuel Grenier, Cnova CEO, commented:

“This second quarter showed a strong

double-digit growth, driven by our strategic plan pillars: a

dynamic marketplace and the growing success of our B2C and B2B

services.

First, we went a step further in building our

platform model. Our marketplace of products benefited from the rise

in next-day delivery eligible products thanks to the quick

expansion of Fulfillment by Cdiscount and Cdiscount Transport

services for our marketplace vendors. Our ecosystem of

services significantly widened with the launch of a marketplace of

holiday packages within Cdiscount Voyages and two new health

services (health insurance and prescription eyeglasses).

Second, our CDAV loyalty program now counts more

than 2 million members, who benefit from more than 1 million

products eligible for free next-day delivery. This great success

rewards our constant efforts in strengthening our bonds with our

customers, also reinforced by our media coverage boosting our brand

and visibility both online and offline.

Sticking to our strategic plan showed once again

its relevance, illustrated by fast-improving business and financial

results: our EBITDA is increasing and is positive for the first

semester.”

| Cnova

N.V. |

Second Quarter(1) |

Change |

|

2019 |

2018 |

Reported(1)(2) |

Organic(3) |

| GMV(4) (€

millions) |

847.2 |

759.8 |

+11.5% |

+13.0% |

| Marketplace share(5) |

40.1% |

36.6% |

+3.5

pts |

| Mobile share |

49.0% |

43.2% |

+5.8

pts |

| CDAV share |

37.9% |

34.8% |

+3.1

pts |

| Net sales(5) (€

millions) |

468.8 |

444.6 |

+5.4% |

+7.0% |

| Traffic (visits

in millions) |

235.3 |

213.5 |

+10.2% |

| Mobile share |

71.5% |

65.4% |

+ 6.1

pts |

| Active

customers(6) (millions) |

9.2 |

8.7 |

+5.3% |

| Orders(7)

(millions) |

5.9 |

5.8 |

+0.9% |

| CDAV share |

37.9% |

35.3% |

+2.6

pts |

| Number of items

sold (millions) |

11.1 |

11.0 |

+0.2% |

- All figures are unaudited.

- Reported figures show all revenue generated by Cdiscount,

including the technical goods sales realized in Casino Group’s

hypermarkets and supermarkets.

- Organic growth: figures exclude (i) sales realized in Casino

Group’s hypermarkets and supermarkets on technical goods and home

category (total exclusion impact of +2.5 pts and +3.7 pts,

respectively, on GMV [Gross Merchandise Volume] and net sales in

2Q19), and (ii) 1001Pneus & Stootie acquisitions during 4Q18

(total exclusion impact of -1.7 pt and -2.6 pts on GMV and net

sales in 2Q19) but take into account showroom sales.

- GMV is defined as: all taxes included, product sales + other

revenues + marketplace business volumes (calculated based on

approved and sent orders) + services GMV

- Marketplace GMV shares have been adjusted to take into account

coupons and warranties and exclude CDAV subscription fees. 2Q18 GMV

share has therefore been adjusted by +0.6 pt for comparison

purposes.

- Active customers at the end of June having purchased at least

once through Cdiscount sites and/or app during the previous 12

months.

- Total placed orders before cancellation due to fraud detection

and/or customer non-payment.

2nd quarter and 1st semester 2019

Highlights

|

GMV |

2Q19 |

1H19 |

|

Organic Growth |

+13.0% |

+11.0% |

Organic GMV (gross merchandise volume) posted

an increase of +13.0% in the 2nd quarter 2019 versus the same

period in 2018 (+11.0% in the first semester 2019). GMV growth in

the 2nd quarter 2019 was notably driven by the marketplace (+4.4

pts contribution to organic growth) and B2C services (+4.8 pts

contribution), in particular Cdiscount Voyages (travel).

|

Marketplace |

2Q19 |

1H19 |

|

Marketplace total GMV share |

+3.5 pts |

+3.3 pts |

|

FFM marketplace GMV share |

+7.4 pts |

+6.3 pts |

The marketplace is a key

component of the overall product platform. Marketplace GMV share

reached 40.1% in the 2nd quarter 2019, a +3.5 points increase (+3.3

points in the 1st semester 2019, at 37.8%). The GMV fulfilled by

Cdiscount again experienced a very high growth (+57%) and reached

27% of marketplace GMV (+7.4 points).

|

Net sales |

2Q19 |

1H19 |

|

Organic growth |

+7.0% |

+5.6% |

Net sales amounted to €438

million in the 2nd quarter 2019, a +7% organic growth compared to

the same period in 2018. The main drivers were the increase in

marketplace commissions, new monetization revenue streams and

showrooms revenues.

|

Traffic |

2Q19 |

1H19 |

|

Mobile traffic growth |

+20% |

+18% |

|

Mobile traffic share |

+6.1 pts |

+5.9 pts |

|

Mobile GMV share |

+5.8 pts |

+5.3 pts |

Traffic at Cdiscount totaled

235 million visits in the 2nd quarter 2019, driven by a 20% mobile

traffic growth, which accounted for 72% of total traffic share (+

6.1 points) and 49% of GMV share (+5.8 points). Regarding Unique

Monthly Visitors (UMV), Cdiscount, ranked #2, again widened the gap

by more than 2 million UMV with its nearest competitor, the largest

gap since August 20183. Over the first four months of the year, UMV

increased by +5% to 20 million, posting the highest progression

among the 10 main competitors3.

|

CDAV |

2Q19 |

1H19 |

|

GMV share |

+3.1 pts |

+2.1 pts |

Cdiscount’s loyalty program, Cdiscount à

Volonté (“CDAV”), now counts 2 million members. It

accounted for 38% of the GMV (+3 points) in the 2nd quarter

2019.

1st semester financial performance

| Cnova

N.V.(€ millions) |

First semester |

Change |

|

2019 |

2018Revised4 |

Reported |

Organic |

| GMV |

1,752.2 |

1,613.8 |

+8.6% |

+11.0% |

| Net sales |

995.8 |

968.8 |

+2.8% |

+5.6% |

| Gross

profit |

174.5 |

142.9 |

+22.1% |

|

| Gross margin |

17.5% |

14.7% |

+2.8 pts |

|

| SG&A |

(188.3) |

(162.1) |

+16.2% |

|

| Operating EBIT |

(13.9) |

(19.2) |

+5.4 |

|

| EBITDA |

18.1 |

6.3 |

+11.8 |

|

Gross profit was €175 million

in the 1st semester 2019, with an associated gross margin of 17.5%,

a +2.8 point improvement compared to 2018. It benefited from the

increased marketplace GMV share and associated commissions, a

continued growth in monetization revenues as well as other

revenues.

SG&A costs amounted to

€(188) million in the 1st semester 2019 and accounted for 18.9% of

net sales, increasing by +2.2 points. Fulfillment costs, at 8.2%

(-0.2 pt), decreased as a percentage of net sales thanks to

logistics productivity improvements with optimized processes and

the rolling-out of 3D packing machines and innovative Skypod Exotec

robots. Marketing costs rose to 3.9% of net sales (+1.1 pt) to

support both unaided brand awareness (+9 pts y-o-y5) and

Cdiscount’s traffic #2 market positioning (20 million average UMV

over the first 4 months, the highest progression among the 10 main

competitors). Technology & Content costs also progressed at

4.5% of net sales (+0.7 pt) driven by the investments supporting

the development of B2C and B2B revenues. Development of new

businesses also affected General & Administrative expenses

(2.3% of net sales, +0.5 pt) including the impact from the

integration of new entities (Stootie, 1001pneus).

As a result, EBITDA reached

€18.1 million in the 1st semester 2019, a +€11.8m significant

improvement compared to 20186. EBITDA benefited from a solid

marketplace growth and a strong expansion of monetization revenues

especially in the 2nd quarter, along with continued improvements of

the core business profitability.

Operating EBIT increased by

€5.4m compared to 2018, with depreciation and amortization

increasing by €6.5m.

Net financial

expense, mainly related to installment payment

solutions offered to customers, amounted to €(24.0)7 million,

mostly driven by business growth. It was well controlled and

slightly decreased as percentage of net sales thanks to

improvements in risk and fraud management.

Net loss from continuing

operations improved by +€12.5m y-o-y to finish at €(42.2)

million with an adjusted EPS of €(0.11) benefiting from the

profitability improvements and non-current operational expenses

decrease.

Free cash flow from continuing operating

activities8 amounted to €50 million in the last twelve

months, relying on strong fundamentals:

- Operating profitability increased at a fast pace with a

significant positive EBITDA at €35m, up by +€35m ;

- Limited other cash operating expenses of €(10)m (+€25m

variation) ;

- Positive change in working capital of +€26m driven by inventory

rationalization.

Capital expenditures were up to €(80)m and

remained stable as a percentage of GMV at 2.1%, supporting the

implementation of the strategic shift towards the platform model

and monetization initiatives. As a result, free cash flow before

interest expenses reached a negative €(8) million during the same

period.

Change in net financial debt amounted to €(87)m

during the same period.

Key Business Achievements:

Development of the marketplace and its

related services

- The marketplace is a key pillar of our product

platform and a prominent contributor to our

monetization initiatives through its associated

services to sellers.

- Marketplace activity accelerated during the 2nd quarter,

gaining +3.5 points along with a 40.1% GMV

share (+3.3 points in the 1st semester, at 37.8%).

- The Fulfillment by Cdiscount is a key

component of customer satisfaction through the increase in service

quality, and a driver for CDAV sales with the addition of SKUs

available for next-day delivery. It achieved a 57%

GMV significant growth in the 2nd quarter 2019 and a

+7.4 points increase in marketplace GMV share to

reach 27%.

- Marketplace vendor value added services

revenues doubled in the 2nd quarter compared to

the year before, thanks to the strong Premium pack growth, as well

as the acceleration of recently launched services (Cdiscount Ads,

Cdiscount Transport, Cdiscount Fintech).

B2C services rapidly growing, along with

extension of the offer

- Strong acceleration of B2C services, with a second

quarter 2019 +41% GMV growth compared to

the first quarter

- Cdiscount Voyages (travel) outpaced its

objectives and grew fast, with a 2nd quarter +73% GMV

growth compared to the previous one. Moreover, the travel

offer was significantly reinforced by the launch mid-May of a

marketplace of holiday packages (flight + accommodation) with

thousands of offers, to be tripled by end of the year. Several

strong partnerships had also been concluded to widen the offer to

car rentals and train bookings (with SNCF, the French national

railway company).

- Cdiscount Billetterie (ticketing) kept

expanding its offer during the semester. In particular, the leading

ticket booking company Ticketmaster offer is now available on

Cdiscount, giving its clients access to more than 150,000 events.

Cdiscount Billetterie GMV tripled in the 2nd quarter 2019 compared

to the previous one.

- Cdiscount Energie continued to expand with GMV

and subscriptions that both more than doubled.

- Launch of Cdiscount Santé (health), made up

with a brand-new health insurance offer in

partnership with Mutuelle Ociane Matmut and a low-priced

prescription eyeglass offer.

Cdiscount à Volonté: pillar of the

marketing strategy

- CDAV program reached 2 million members

- +2.1 pts GMV share (36.3%) in the first

semester 2019, supported by a tripling of SKUs

available to reach 1 million, thanks to

the development of the Fulfillment by Cdiscount and Cdiscount

Transport marketplace services for our marketplace vendors.

Boosting brand awareness

- Cdiscount launched several powerful marketing campaigns

boosting brand awareness, resulting in a +9.1 pts increase y-o-y in

unaided awareness9. The most noticeable event was the release in

May 2019 of a TV advertising in partnership with Disney on the

movie, Aladdin: 2 spot formats on main French channels over 17

days, leading to more than 900 spots broadcasted,

viewed by more than 29 million people.

- Complimentary to offline campaigns, Cdiscount reinforced its

online presence, leading to an extended 3 million

fan base which is increasingly committed

thanks to the development of specialized pages such as Cdiscount

Gaming, le Bazar de Zoé (Home and Decoration) and Travel.

Further enhancing the customer

journey

- Leveraging on the 2018 success of the showrooms opened inside

Géant stores, Cdiscount opened 9 new showrooms in

the first semester 2019, bringing the total network to 55 at end

June 2019.

- Through Agrikolis, part of Cdiscount’s startup

logistics incubator The Warehouse, Cdiscount opened 37 farming

pickup points, of which 30 during the 2nd quarter. This new kind of

picking point is used to deliver heavy products to remote rural

areas while adding revenue to farmers and fostering social bonds

between customers and local producers.

- Cdiscount went further on developing synergies with Casino

Group through multiple partnerships with Franprix. The most

prominent was the launch of a 30-min delivery in Paris for the

newly released Xiaomi MI9T phone. This is to be extended to a food

offer in September 2019.

Monetization initiatives well

advanced

- Monetization revenues are another key pillar

of Cdiscount profitable growth strategy. They grew by +23% in the

2nd quarter 2019 y-o-y, driven by strong B2C services (especially

travel), financial services and B2B marketplace services

growth.

International expansion plan well on

track

- Cdiscount now covers 25 European countries, 5 more than at the

end of 1Q19.

- 34 websites are directly connected as of the end June

2019, +23 compared to end of 1Q19.

At the forefront of logistics

innovation

- The Warehouse, Cdiscount’s logistics

incubator, proved to be very successful with 3 out of 5 selected

startups already implementing their solution for the 2018

promotion, and the 2019 promotion of 5 new startups started with

the early success of Agrikolis.

- Exotec, robotized picking solution, already

successfully implemented in Cestas warehouse, is now fully

operational in Réau warehouse, with a 50-robot fleet handling

50,000 bins.

Commitment to best-in-class Corporate

Social Responsibility

- For 10 years, Cdiscount has been working with the network

Envie, committed in social and solidarity economy

and specialized in giving products a second life.

In total, Cdiscount has given Envie more than 60,000 non-sold and

returned products that had been repaired then sold in the network

stores, given to charities (1.2 tons of toys donated) or disposed

into the appropriate recycling system.

- Rolling-out of a new 3D packing machine,

bringing the total to 4. These machines cut down parcel wasted

space, optimize shipping space and cardboard usage, therefore

reducing by 30% delivery truck traffic and pollution. Cdiscount now

manages to pack 85% of its orders without any empty space.

- Cdiscount adopted Facil'iti, a software

solution facilitating web navigation for disabled people,

especially those suffering from impaired vision or audition. It

adapts Cdiscount’s website by compensating for their difficulties

and helping them navigating through the website.

OutlookCdiscount’s strong

growth associated with significant EBITDA improvement confirms the

relevance of our strategy, driven by the positive orientation of

our business pillars: marketplace and monetization initiatives

through B2C and B2B services. As a result, Cdiscount is aligned

with its full year objective both in terms of growth and

profitability.

***

Cnova publishes today on its website, Wednesday July, 24th, its

2019 semi-annual report.

***

About Cnova N.V.

Cnova N.V., one of France’s leading e-Commerce

companies, serves 9.2 million active customers via its

state-of-the-art website, Cdiscount. Cnova N.V.’s product offering

provides its clients with a wide variety of very competitively

priced goods, fast and customer-convenient delivery options,

practical and innovative payment solutions as well as travel,

entertainment and domestic energy services. Cnova N.V. is part of

Groupe Casino, a global diversified retailer. Cnova N.V.'s news

releases are available at www.cnova.com. Information available on,

or accessible through, the sites referenced above is not part of

this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

***

|

Cnova Investor Relations

Contact:investor@cnovagroup.comTel: +31 20 301 22 40 |

Media

contact:directiondelacommunication@cdiscount.com Tel: +33

5 56 30 07 14 |

AppendicesCnova N.V.

Consolidated Financial

Statements(1)

| Consolidated Income

Statement |

|

First halfAdjusted for IFRS

16 |

Change |

|

First halfExcl. IFRS 16

impact |

| € in millions |

|

2019 |

2018 |

|

|

2019 |

2018 |

|

Net sales |

|

995.8 |

968.8 |

+2.8% |

|

995.8 |

968.8 |

| Cost of sales |

|

(821.4) |

(825.9) |

-0.5% |

|

(821.4) |

(825.9) |

| Gross profit |

|

174.5 |

142.9 |

+22.1% |

|

174.5 |

142.9 |

|

% of net sales (Gross margin) |

|

17.5% |

14.7% |

|

|

17.5% |

14.7% |

| SG&A(2) |

|

(188.3) |

(162.1) |

+16.2% |

|

(189.3) |

(163.0) |

|

% of net sales |

|

-18.9% |

-16.7% |

+2.2

pts |

|

-19.0% |

-16.8% |

|

Fulfillment |

|

(81.6) |

(80.9) |

+0.9% |

|

(82.3) |

(81.7) |

|

Marketing |

|

(39.0) |

(27.7) |

+40.8% |

|

(39.0) |

(27.7) |

|

Technology and content |

|

(45.2) |

(36.9) |

+22.6% |

|

(45.3) |

(36.9) |

|

General and administrative |

|

(22.5) |

(16.6) |

+35.3% |

|

(22.6) |

(16.7) |

| Operating EBIT(3) |

|

(13.9) |

(19.2) |

+27.8% |

|

(14.8) |

(20.1) |

|

% of net sales |

|

-1.4% |

-2.0% |

|

|

-1.5% |

-2.1% |

| Other

expenses |

|

(4.4) |

(11.9) |

-63.1% |

|

(4.4) |

(11.9) |

|

Operating profit/(loss) |

|

(18.3) |

(31.2) |

+41.3% |

|

(19.2) |

(32.1) |

| Net

financial income/(expense) |

|

(24.0) |

(23.5) |

+2.4% |

|

(21.3) |

(21.2) |

|

Profit/(loss) before tax |

|

(42.3) |

(54.6) |

+22.6% |

|

(40.5) |

(53.2) |

| Income tax gain/(expense) |

|

0.1 |

(0.0) |

nm |

|

0.1 |

(0.0) |

|

Net profit/(loss) from continuing operations |

|

(42.2) |

(54.6) |

+22.8% |

|

(40.4) |

(53.3) |

| Net

profit/(loss) from discontinued operations |

|

(0.3) |

(0.3) |

+14.7% |

|

(0.3) |

(0.3) |

| Net profit/(loss) for the

period |

|

(42.5) |

(54.9) |

+22.6% |

|

(40.7) |

(53.5) |

|

% of net sales |

|

-4.3% |

-5.7% |

|

|

-4.1% |

-5.5% |

|

Attributable to Cnova equity holders (incl. discontinued) |

|

(42.9) |

(54.8) |

+21.7% |

|

(41.4) |

(53.4) |

|

Attributable to non-controlling interests (incl. discontinued) |

|

0.4 |

(0.2) |

nm |

|

0.7 |

(0.2) |

|

Adjusted EPS (€)(4) |

|

(0.11) |

(0.12) |

+10.5% |

|

(0.11) |

(0.12) |

- IFRS 16, which replaces IAS 17 and the related interpretations

from January 1st, 2019, eliminates the distinction between

operating leases and finance leases: it requires recognition of an

asset (the right to use the leased item) and a financial liability

representative of discounted future rentals for virtually all lease

contracts. Operating lease expense is replaced with depreciation

expense related to the right of use and interest expense related to

the lease liability. Previously, the Group recognized mainly

operating lease expense on a straight-line basis over the term of

the lease and recognized assets and liabilities only to the extent

that there was a timing difference between actual lease payments

and the expense recognized. The Group decided to adopt the full

retrospective approach as a transition method on January 1, 2019

and IFRS 16 has been applied retrospectively for each period

presented. Detailed impacts of IFRS 16 application are included in

Note 1 of the Unaudited condensed consolidated financial statements

that will be available on our website in the coming

days.

- SG&A: selling, general and administrative expenses.

- Operating EBIT: operating profit/(loss) before other expenses

(strategic and restructuring expenses, litigation expenses and

impairment and disposal of assets expenses).

- Adjusted EPS: net profit/(loss) attributable to equity holders

of Cnova before other expenses and the related tax impacts, divided

by the weighted average number of outstanding ordinary shares of

Cnova during the applicable period.

| Consolidated

Balance Sheet |

|

Adjusted for IFRS 16 |

|

Excluding IFRS 16 impact |

|

| € in millions |

|

2019End June |

2018End Dec |

2018End June |

|

2019End June |

2018End Dec |

2018End June |

| |

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

93.6 |

35.5 |

52.3 |

|

93.6 |

35.5 |

52.3 |

| Trade receivables, net |

|

106.6 |

187.0 |

79.9 |

|

106.6 |

187.0 |

79.9 |

| Inventories, net |

|

349.0 |

355.6 |

370.8 |

|

349.0 |

355.6 |

370.8 |

| Current income tax assets |

|

3.5 |

3.0 |

2.5 |

|

3.5 |

3.0 |

2.5 |

| Other current

assets, net |

|

140.5 |

127.2 |

102.3 |

|

140.5 |

127.2 |

102.3 |

|

Total current assets |

|

693.1 |

708.4 |

607.9 |

|

693.1 |

708.4 |

607.9 |

| |

|

|

|

|

|

|

|

|

| Other non-current assets, net |

|

12.7 |

9.6 |

4.5 |

|

12.7 |

9.6 |

4.5 |

| Deferred tax assets |

|

41.2 |

38.6 |

0.5 |

|

41.2 |

38.6 |

0.5 |

| Right of use, net |

|

162.4 |

164.5 |

168.0 |

|

- |

- |

- |

| Property and equipment, net |

|

36.0 |

39.1 |

34.9 |

|

36.0 |

39.1 |

34.9 |

| Intangible assets, net |

|

158.9 |

139.6 |

113.6 |

|

158.9 |

139.6 |

113.6 |

|

Goodwill |

|

123.0 |

61.4 |

58.2 |

|

124.2 |

61.4 |

58.2 |

|

Total non-current assets |

|

534.2 |

452.9 |

379.8 |

|

373.1 |

288.3 |

211.8 |

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

1,227.4 |

1,161.3 |

987.6 |

|

1,066.2 |

996.8 |

819.7 |

| |

|

|

|

|

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current provisions |

|

8.8 |

9.5 |

10.1 |

|

8.8 |

9.5 |

10.1 |

| Trade payables |

|

507.8 |

667.9 |

502.8 |

|

507.8 |

667.9 |

502.8 |

| Current financial debt |

|

453.1 |

234.3 |

321.1 |

|

453.1 |

234.3 |

321.1 |

| Current lease liability |

|

27.4 |

22.7 |

20.7 |

|

- |

- |

- |

| Current tax liabilities |

|

63.1 |

42.3 |

37.5 |

|

63.1 |

42.3 |

37.5 |

| Other current liabilities |

|

152.1 |

192.0 |

124.1 |

|

152.7 |

192.5 |

124.6 |

|

Total current liabilities |

|

1,212.3 |

1,168.7 |

1,016.3 |

|

1,185.6 |

1,146.6 |

996.2 |

| |

|

|

|

|

|

|

|

|

| Non-current provisions |

|

13.1 |

11.8 |

12.7 |

|

13.1 |

11.8 |

12.7 |

| Non-current financial debt |

|

2.4 |

2.4 |

0.0 |

|

2.4 |

2.4 |

0.0 |

| Non-current lease liability |

|

155.4 |

158.7 |

160.9 |

|

- |

- |

- |

| Deferred tax liabilities |

|

1.7 |

1.6 |

0.3 |

|

1.7 |

1.6 |

0.3 |

| Other non-current liabilities |

|

2.0 |

1.7 |

1.9 |

|

12.2 |

10.1 |

8.5 |

|

Total non-current liabilities |

|

174.6 |

176.2 |

175.8 |

|

29.4 |

25.9 |

21.5 |

| |

|

|

|

|

|

|

|

|

| Share capital |

|

17.2 |

17.2 |

17.2 |

|

17.2 |

17.2 |

17.2 |

| Reserves, retained earnings and

additional paid-in capital |

|

(244.0) |

(200.8) |

(221.2) |

|

(234.7) |

(192.9) |

(214.9) |

| Equity attributable to equity

holders of Cnova |

|

(226.7) |

(183.5) |

(204.0) |

|

(217.4) |

(175.7) |

(197.7) |

|

Non-controlling interests |

|

67.1 |

0.0 |

(0.4) |

|

68.7 |

0.0 |

(0.4) |

|

Total equity |

|

(159.6) |

(183.6) |

(204.4) |

|

(148.7) |

(175.7) |

(198.1) |

|

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

1,227.4 |

1,161.3 |

987.6 |

|

1,066.2 |

996.8 |

819.7 |

| Consolidated Cash Flow

Statement |

|

Last Twelve Months |

|

Last Six Months |

| at June 30 (€ in millions) |

|

2019 |

2018 |

|

2019 |

2018 |

| Net profit/(loss) from continuing

operations |

|

(26.2) |

(109.0) |

|

(42.5) |

(54.5) |

| Net profit/(loss), attributable to

non-controlling interests |

|

0.5 |

(0.3) |

|

0.4 |

(0.2) |

|

Net profit (loss) for the period excl. discontinued

operations |

|

(25.7) |

(109.3) |

|

(42.2) |

(54.6) |

| Depreciation and amortization expense |

|

61.3 |

47.7 |

|

32.6 |

25.5 |

| (Income) expenses on share-based payment

plans |

|

0.0 |

0.5 |

|

0.0 |

0.1 |

| (Gains) losses on disposal of non-current

assets |

|

(0.5) |

0.4 |

|

0.1 |

(0.1) |

| Other non-cash items |

|

(0.3) |

(0.1) |

|

(0.3) |

(0.1) |

| Financial expense, net |

|

54.8 |

46.8 |

|

24.1 |

23.5 |

| Current and deferred tax (gains)

expenses |

|

(37.0) |

1.0 |

|

(0.1) |

0.0 |

| Income tax paid |

|

(3.2) |

(3.2) |

|

(1.8) |

(0.9) |

| Change in operating working

capital |

|

22.7 |

105.7 |

|

(96.5) |

10.6 |

|

Inventories of products |

|

22.3 |

(5.6) |

|

7.1 |

19.2 |

|

Accounts payable |

|

7.5 |

98.3 |

|

(158.5) |

(81.1) |

|

Accounts receivable |

|

(33.0) |

(28.8) |

|

80.9 |

75.1 |

|

Working capital non-goods |

|

25.9 |

41.8 |

|

(26.0) |

(2.7) |

| Net cash from/(used in) continuing

operating activities |

|

72.2 |

89.5 |

|

(84.1) |

4.0 |

|

Net cash from/(used in) discontinued operating

activities |

|

(0.3) |

(9.3) |

|

(1.0) |

(25.2) |

| Purchase of property, equipment &

intangible assets |

|

(84.2) |

(81.3) |

|

(38.0) |

(34.3) |

| Purchase of non-current financial

assets |

|

(2.6) |

(2.3) |

|

(2.4) |

(0.6) |

| Proceeds from disposal of prop., equip.,

intangible assets |

|

3.9 |

6.3 |

|

3.7 |

6.3 |

| Proceeds from disposal of non-current

financial assets |

|

0.0 |

2.1 |

|

0.0 |

2.1 |

| Movement of perimeter, net of cash

acquired |

|

(1.8) |

(2.2) |

|

0.0 |

0.0 |

| Investments in associates |

|

0.0 |

0.0 |

|

0.0 |

0.0 |

| Changes

in loans granted (including to related parties) |

|

(0.1) |

0.1 |

|

0.0 |

0.4 |

| Net cash from/(used in) continuing

investing activities |

|

(84.9) |

(77.3) |

|

(36.7) |

(26.1) |

|

Net cash from/(used in) discontinued investing

activities |

|

0.0 |

(0.0) |

|

0.0 |

(0.0) |

| Transaction with owners of non-controlling

interests |

|

(2.4) |

(0.0) |

|

(2.4) |

0.0 |

| Additions to financial debt |

|

2.3 |

(0.2) |

|

3.3 |

1.0 |

| Repayments of financial debt |

|

0.3 |

(3.7) |

|

(7.4) |

(10.4) |

| Repayments of lease liabilities (IFRS 16

adjustment) |

|

(21.7) |

(13.4) |

|

(11.3) |

(6.2) |

| Changes in loans received |

|

117.0 |

79.5 |

|

203.4 |

96.2 |

| Interest

paid, net |

|

(49.3) |

(43.2) |

|

(21.9) |

(20.8) |

| Net cash from/(used in) continuing

financing activities |

|

46.1 |

19.0 |

|

163.7 |

59.8 |

|

Net cash from/(used in) discontinued financing

activities |

|

0.0 |

(1.7) |

|

0.0 |

0.0 |

| Effect of

changes in foreign currency translation adjustments from

discontinued operations |

|

0.0 |

(0.1) |

|

0.0 |

0.0 |

| Change in cash and cash

equivalents from continuing operations |

|

33.4 |

31.2 |

|

42.9 |

37.8 |

|

Change in cash and cash equivalents from discontinued

operations |

|

(0.3) |

(11.0) |

|

(1.0) |

(25.3) |

|

Total change in cash and cash equivalents |

|

33.1 |

20.2 |

|

41.8 |

12.5 |

|

Cash and cash equivalents, net, at period

begin |

|

36.1 |

15.8 |

|

27.3 |

23.6 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, net, at period end |

|

69.2 |

36.1 |

|

69.2 |

36.1 |

è Adjusted for

IFRS 16 impactè Excluding IFRS 16

impact

| Consolidated Cash Flow

Statement |

|

Last Twelve Months |

|

Last Six Months |

| at June 30 (€ in millions) |

|

2019 |

2018 |

|

2019 |

2018 |

| Net profit/(loss) from continuing

operations |

|

(23.2) |

(106.6) |

|

(41.1) |

(53.1) |

| Net profit/(loss), attributable to

non-controlling interests |

|

0.8 |

(0.3) |

|

0.7 |

(0.2) |

|

Net profit (loss) for the period excl. discontinued

operations |

|

(22.4) |

(107.0) |

|

(40.4) |

(53.3) |

| Depreciation and amortization

expense |

|

37.9 |

30.3 |

|

20.5 |

15.8 |

| (Income) expenses on share-based

payment plans |

|

0.0 |

0.5 |

|

0.0 |

0.1 |

| (Gains) losses on disposal of

non-current assets |

|

(0.5) |

0.4 |

|

0.1 |

(0.1) |

| Other non-cash items |

|

(0.3) |

(0.1) |

|

(0.3) |

(0.1) |

| Financial expense, net |

|

49.7 |

43.0 |

|

21.4 |

21.2 |

| Current and deferred tax (gains)

expenses |

|

(37.0) |

1.0 |

|

(0.1) |

0.0 |

| Income tax paid |

|

(3.2) |

(3.2) |

|

(1.8) |

(0.9) |

| Change in operating working

capital |

|

26.2 |

111.2 |

|

(94.7) |

15.0 |

|

Inventories of products |

|

22.3 |

(5.6) |

|

7.1 |

19.2 |

|

Accounts payable |

|

7.5 |

98.3 |

|

(158.5) |

(81.1) |

|

Accounts receivable |

|

(33.0) |

(28.8) |

|

80.9 |

75.1 |

|

Working capital non-goods |

|

29.5 |

47.3 |

|

(24.2) |

1.7 |

| Net cash from/(used in)

continuing operating activities |

|

50.4 |

76.1 |

|

(95.3) |

(2.2) |

|

Net cash from/(used in) discontinued operating

activities |

|

(0.3) |

(9.3) |

|

(1.0) |

(25.2) |

| Purchase of property, equipment &

intangible assets |

|

(84.2) |

(81.3) |

|

(38.0) |

(34.3) |

| Purchase of non-current financial

assets |

|

(2.6) |

(2.3) |

|

(2.4) |

(0.6) |

| Proceeds from disposal of prop.,

equip., intangible assets |

|

3.9 |

6.3 |

|

3.7 |

6.3 |

| Proceeds from disposal of non-current

financial assets |

|

0.0 |

2.1 |

|

0.0 |

2.1 |

| Movement of perimeter, net of cash

acquired |

|

(1.8) |

(2.2) |

|

0.0 |

0.0 |

| Investments in associates |

|

0.0 |

0.0 |

|

0.0 |

0.0 |

|

Changes in loans granted (including to related parties) |

|

(0.1) |

0.1 |

|

0.0 |

0.4 |

| Net cash from/(used in)

continuing investing activities |

|

(84.9) |

(77.3) |

|

(36.7) |

(26.1) |

|

Net cash from/(used in) discontinued investing

activities |

|

0.0 |

(0.0) |

|

0.0 |

(0.0) |

| Transaction with owners of

non-controlling interests |

|

(2.4) |

(0.0) |

|

(2.4) |

0.0 |

| Additions to financial debt |

|

2.3 |

(0.2) |

|

3.3 |

1.0 |

| Repayments of financial debt |

|

0.3 |

(3.7) |

|

(7.4) |

(10.4) |

| Repayments of lease liabilities (IFRS

16 adjustment) |

|

0.0 |

0.0 |

|

|

|

| Changes in loans received |

|

117.0 |

79.5 |

|

203.4 |

96.2 |

|

Interest paid, net |

|

(49.3) |

(43.2) |

|

(21.9) |

(20.8) |

| Net cash from/(used in)

continuing financing activities |

|

67.9 |

32.4 |

|

174.9 |

66.1 |

|

Net cash from/(used in) discontinued financing

activities |

|

0.0 |

(1.7) |

|

0.0 |

0.0 |

| Effect

of changes in foreign currency translation adjustments from

discontinued operations |

|

0.0 |

(0.1) |

|

0.0 |

0.0 |

| Change in cash and cash

equivalents from continuing operations |

|

33.4 |

31.2 |

|

42.9 |

37.8 |

|

Change in cash and cash equivalents from discontinued

operations |

|

(0.3) |

(11.0) |

|

(1.0) |

(25.3) |

|

Total change in cash and cash equivalents |

|

33.1 |

20.2 |

|

41.8 |

12.5 |

|

Cash and cash equivalents, net, at period

begin |

|

36.1 |

15.8 |

|

27.3 |

23.6 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, net, at period end |

|

69.2 |

36.1 |

|

69.2 |

36.1 |

|

Upcoming Event |

|

|

|

Wednesday, July 24, 2019 at 16:00 CEST / 10:00 EDT |

Cnova First Half 2019 Financial ResultsConference Call &

Webcast |

|

Conference Call and Webcast connection

details |

|

|

|

Conference Call Dial-In Numbers: |

|

Toll-Free: |

|

|

France |

0 800 912 848 |

|

UK |

0 800 756 3429 |

|

USA |

1 877 407 0784 |

|

Toll: |

1 201 689 8560 |

|

|

|

|

Conference Call Replay Dial-In Numbers: |

|

Toll-Free: |

1 844 512 2921 |

|

Toll: |

1 412 317 6671 |

|

|

|

|

Available From: July 24, 2019 at |

13:00 EDT / 19:00 CEST |

|

To: July 31, 2019 at |

00:00 EDT / 06:00 CEST |

|

Replay Pin Number: |

13692256 |

|

|

|

|

Webcast: |

|

http://public.viavid.com/index.php?id=135165 |

|

|

|

|

Presentation materials to accompany the call will be available at

cnova.com on July 24, 2019. |

|

|

|

|

An archive of the conference call will be available for 1 week at

cnova.com. |

|

|

1 Organic growth: figures include showroom sales and services;

exclude technical goods and home category sales made in Casino

Group’shypermarkets and supermarkets (total exclusion impact of

+2.5 pts on GMV growth) and 1001Pneus/Stootie GMV, companies

acquired in 4Q18, (total exclusion impact of -1.7 pt on GMV

growth)

2 Marketplace GMV shares have been adjusted to take into account

coupons and warranties and exclude CDAV subscription fees. 2Q18 GMV

share has therefore been adjusted by +0.6 pt for comparison

purposes and 1H18 by +0.1 pts

3 Latest Médiamétrie studies (April & May 2019)

4 IFRS 16, which replaces IAS 17 and the related

interpretations from January 1st, 2019, eliminates the distinction

between operating leases and finance leases: it requires

recognition of an asset (the right to use the leased item) and a

financial liability representative of discounted future rentals for

virtually all lease contracts. Operating lease expense is replaced

with depreciation expense related to the right of use and interest

expense related to the lease liability. Previously, the Group

recognized mainly operating lease expense on a straight-line basis

over the term of the lease and recognized assets and liabilities

only to the extent that there was a timing difference between

actual lease payments and the expense recognized. The Group decided

to adopt the full retrospective approach as a transition method on

January 1, 2019 and IFRS 16 has been applied retrospectively for

each period presented.

5 Source: latest Respondi study

6 EBITDA was positively impacted by IFRS 16 respectively for

€13.1m in 1H19 and €10.6m in 1H18

7 Net financial expense includes €2.7m of interest on lease

liability

8 For comparison purpose, cash flow figures are presented before

IFRS 16 restatements. Adjusted for IFRS 16, FCF from continuing

activities = €72m, EBITDA = €60m (+€42m vs 2018), change in working

capital = +€23m. Considering €22m debt repayment, change in net

financial debt remains unchanged at €(87)m.

9 Source: latest Respondi study

- 2019 07 24 Cnova 1H19 Results ENG

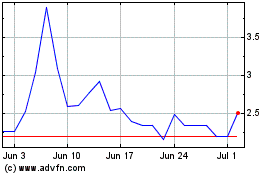

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024