CNOVA

N.V.

SIMPLIFIED TENDER OFFER TARGETING THE SHARES OF CNOVA INITIATED BY

CASINO, GUICHARD-PERRACHON

Press release

informing of the availability of the memorandum in response and the

"Other information" document relating to the legal, financial and

accounting characteristics of Cnova N.V.

FRENCH OFFER PRICE: an amount in euros equivalent to

U.S. $ 5.50 per ordinary share of Cnova N.V.

Tendering shareholders will receive an amount in

euros per tendered ordinary share equivalent to U.S. $5.50 per

ordinary share, calculated by using the WM/Reuters index spot

exchange rate for euros per U.S. $ at 5:00 p.m. (Paris time) on the

business day following the closing of the French offer, rounded

down to the nearest thousandth euro (this

offer being referred hereafter as the "Offer"), provided that the global

amount paid under each tender order will be rounded down to the

nearest lesser euro cent

(see section 3.4 of the offeror's Offer document). |

| This press

release has been prepared by Cnova N.V. and is published pursuant

to the provisions of articles 231-27 paragraph 3 and 231-28 of the

General Regulations of the French market Authority (the Autorité des marchés financiers, the "AMF"). |

IMPORTANT NOTICE

The attention of shareholders' of Cnova N.V. ("Cnova") is drawn to the fact that those who decide to

tender their ordinary shares in the Offer will remain exposed to

the EUR / U.S. $ exchange rate fluctuation until the setting of

this rate the trading day following the closing of the Offer around

5:00 pm (Paris time) (see section 3.4 of the offeror's AMF offer

document), and consequently, the amount in euros they will receive

for each ordinary share tendered to the Offer, on the settlement of

the Offer, will not be known before that date and in particular,

will not be known on the date on which they decide to tender their

shares to the Offer.

Casino, Guichard-Perrachon ("Casino") is also

making a concurrent, separate offer to purchase any and all

ordinary share held by persons resident in the United States

("U.S. Holders") at a price of U.S. $5.50 per

ordinary share to all holders of shares resident in the United

States of America (the "U.S. Offer" and

together with the Offer, the "Offers"). U.S.

Holders may only tender their ordinary shares to the U.S.

Offer. Casino expects to file the offer to purchase in

connection with the U.S. Offer on December 27, 2016, upon

commencement of the U.S. Offer.

If, following the completion of the Offers, Casino and its group

companies own 95% or more of Cnova's issued and outstanding

ordinary share capital (geplaatst en uitstaand

gewoon kapitaal), then Casino, acting on its own or with its

group companies, would have the right, but not the obligation, to

initiate a buy-out procedure (uitkoopprocedure) in accordance with Article 2:92a or

2:201a of the Dutch Civil Code and/or a takeover buyout procedure

in accordance with Article 2:359c of the Dutch Civil Code. |

Pursuant to articles L.621-8 of

the French Monetary and Financial Code and 231-26 of its General

Regulations, the AMF has delivered the visa number 16-601 on the

memorandum in response prepared by Cnova, pursuant to its

conformity decision dated December 22, 2016, regarding the Casino

tender offer targeting Cnova's shares.

Prior to the opening of the offer,

the AMF and Euronext will respectively issue a notice of opening

and a notice announcing the terms and timing of the offer.

The memorandum in response is

available on the websites of the AMF (www.amf-france.org) and Cnova

(www.cnova.com). Copies of the memorandum in response can also be

obtained free of charge from:

Cnova N.V.

Schiphol Boulevard 273

Tower D, 7th Floor

1118 BH Schiphol

The Netherlands |

The document presenting the other

information relating to Cnova's legal, financial and accounting

characteristics, filed with the AMF on December 22, 2016, and

available to the public on December 23, 2016, in accordance with

the provisions of article 231-28 of the General Regulations of the

AMF, is available under the same conditions.

Shareholders' attention is also

drawn to the publication of Cnova's position statement as referred

to in Article 18 of the Dutch Takeover Decree (Besluit Openbare Biedingen), which addresses, amongst

others, the background of the Offers, their merits and the

considerations of the Cnova Transaction Committee for supporting

the Offers recommending the Offers to its shareholders for

acceptance. The position statement is available on Cnova's website

(www.cnova.com).

***

Access to this document and to any document relating to the

tender offer can be subject to legal restrictions in certain

jurisdictions. The breach of such legal restrictions can constitute

a violation of applicable securities laws and regulations in

certain jurisdictions. Cnova N.V. declines any responsibility in

the event a violation of applicable regulations by any person shall

occur.

***

Cnova Investor Relations Contact:

Cnova N.V.

Head of Investor Relations

+31 20 795 06 71

investor@cnova.com |

Media Contact:

Cnova N.V.

Head of Communications

+ 31 20 795 06 76

directiondelacommunication@cnovagroup.com |

About Cnova

N.V.

Cnova N.V., one of the leading e-Commerce

companies in France, serves 7.9 million active customers via its

state-of-the-art website, Cdiscount. Cnova N.V.'s product offering

of more than 19 million items provides its clients with a wide variety of very

competitively priced goods, several fast and customer-convenient delivery options as well as practical

payment solutions. Cnova N.V. is part of Groupe Casino, a global

diversified retailer. Cnova N.V.'s news releases are available at

www.cnova.com. Information available on, or accessible through, the

sites referenced above is not part of this press release.

This press

release contains regulated information (gereglementeerde

informatie) within the meaning of the Dutch Financial Supervision

Act (Wet op het financieel toezicht) which must be made publicly

available pursuant to Dutch and French law. This press release is

intended for information purposes only.

Forward-Looking

Statements

This press

release contains forward-looking statements. Such forward-looking

statements may generally be identified by words like "anticipate,"

"assume," "believe," "continue," "could," "estimate," "expect,"

"intend," "may," "plan," "potential," "predict," "project,"

"future," "will," "seek" and similar terms or phrases.

Examples of forward-looking statements include, but are not limited

to, statements made regarding the possibility, timing and other

terms and conditions of the proposed transaction and the related

offer by Cnova's controlling shareholder Casino for the outstanding

shares of Cnova. The forward-looking statements contained in

this press release are based on management's current expectations,

which are subject to uncertainty, risks and changes in

circumstances that are difficult to predict and many of which are

outside of Cnova's control. Important factors that could cause

Cnova's actual results to differ materially from those indicated in

the forward-looking statements include, among others: the effect of

the announcement of the Reorganization on the ability of Cnova to

retain and hire key personnel, maintain relationships with its

customers and suppliers, and maintain its operating results and

business generally; the outcome of any legal proceedings that may

be instituted against Cnova and others relating to the

reorganization agreement, dated as of August 8, 2016, between Cnova

Brazil, Via Varejo and Cnova; changes in global, national, regional

or local economic, business, competitive, market or regulatory

conditions; and other factors discussed under the heading "Risk

Factors" in the U.S. Annual Report on Form 20-F for the year

ended December 31, 2015, filed with the SEC on

July 22, 2016, and other documents filed with or furnished to

the SEC. Any forward-looking statements made in this press release

speak only as of the date hereof. Factors or events that could

cause Cnova's actual results to differ from the statements

contained herein may emerge from time to time, and it is not

possible for Cnova to predict all of them. Except as required by

law, Cnova undertakes no obligation to publicly update any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

Important

Information for Investors and Security Holders

THIS PRESS RELEASE IS NEITHER AN OFFER TO PURCHASE NOR

SOLICITATION OF AN OFFER TO SELL SECURITIES. INVESTORS ARE

ADVISED TO READ CASINO'S TENDER OFFER STATEMENT IF AND WHEN IT

BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT

INFORMATION.

The Offers for

Cnova's outstanding ordinary shares described in this press release

have not commenced. When the Offers are commenced, Casino will file

a tender offer statement on Schedule TO with the SEC, and Cnova

will timely file a solicitation/recommendation statement on

Schedule 14D-9, with respect to the U.S. Offer. Casino and Cnova

intend to mail these documents to the shareholders of Cnova.

The tender offer statement (including the offer to purchase, the

related letter of transmittal and other offer documents) and the

solicitation/recommendation statement will contain important

information that should be read carefully before any decision is

made with respect to the tender offer. Those materials, as amended

from time to time, will be made available to Cnova's shareholders

at no expense to them at www.cnova.com. In addition, the

tender offer materials and other documents that Casino may file

with the SEC will be made available to all shareholders of Casino

free of charge at www.groupe-casino.fr. All of those

materials (and all other offer documents filed with the SEC) will

be available at no charge on the SEC's website: www.sec.gov.

Documents may also be obtained from Cnova upon written request to

the Investor Relations Department, WTC Schiphol Airport, Tower D,

7th Floor, Schiphol Boulevard 273, 1118 BH Schiphol, The

Netherlands, telephone number +31 20 795 06 71.

Cnova CGP TO ENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cnova N.V. via Globenewswire

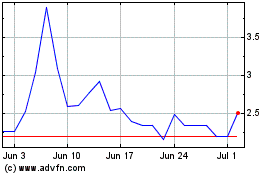

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024