Treehouse Real Estate Investment Trust

raises $133 million, will use funds to acquire properties from

MedMen Enterprises Inc. along with other cannabis real

estate

MedMen Enterprises Inc. (“MedMen” or the “Company”) (CSE: MMEN)

(OTCQX: MMNFF) (FSE: A2JM6N) today announced that Treehouse Real

Estate Investment Trust (“Treehouse”) has completed its first round

of capital raise at $133 million and will partially use the funds

to purchase properties from the Company.

The newly formed real estate investment vehicle looks to

capitalize on the fast-growing cannabis industry in the U.S. that

is projected to grow to $75 billion in gross sales by 2030,

according to Wall Street research firm Cowen & Co.

“This capital raise further proves the U.S. cannabis industry

today is more investable than ever,” said MedMen CEO and Co-founder

Adam Bierman. “MedMen’s relationship with Treehouse will allow us

to unlock significant value for MedMen shareholders by spinning out

our real estate holdings and deploying the proceeds into accretive

growth opportunities for the Company.”

Treehouse is a collaboration between MedMen and Stable Road

Capital, a Venice, California-based investment firm with successful

track records in real estate and cannabis. Treehouse is governed by

an independent board. Treehouse has a management contract with

MedMen to oversee day-to-day operations until Treehouse goes

public, at which point management will be internalized.

It is expected that Treehouse’s initial sale-leaseback

transactions will occur with MedMen. These potential

transactions include real estate related to retail stores, and

cultivation and production facilities. The Company intends to

use the proceeds from the prospective transactions to assist in

funding the buildout of its national footprint that includes 76

retail licenses and 16 cultivation and manufacturing licenses in 12

states. The Company currently operates 16 stores and 3 cultivation

and manufacturing facilities.

Subsequent to the initial transaction, Treehouse will have a

three-year right of first offer on additional MedMen-owned

facilities and development projects. With the launch of Treehouse,

MedMen has the opportunity to significantly reduce future capital

expenditures related to its retail and cultivation licenses.

To provide further details regarding the transaction and

strategy behind Treehouse, MedMen will host an analyst call with

Treehouse and Company officials on Tuesday, January 8, 2019 at 8:00

a.m. Eastern.

Webcast Information:A live audio webcast of the call will

be available on the Events and Presentations section of MedMen’s

website

at: https://investors.medmen.com/events-and-presentations/default.aspx and

will be archived for replay.

Calling Information:Toll Free Dial-In Number: (844)

559-7829International Dial-In Number: (647) 689-5387Conference ID:

3585847

ABOUT MEDMEN:MedMen Enterprises is a leading cannabis

company in the U.S. with assets and operations across the country.

Based in Los Angeles, MedMen brings expertise and capital to the

cannabis industry and is one of the nation’s largest financial

supporters of progressive marijuana laws. Visit

http://www.medmen.com

ABOUT TREEHOUSE:Treehouse Real Estate Investment Trust,

Inc. is a newly-organized, externally managed real estate

investment company focused on the acquisition, ownership and

management of specialized retail and industrial properties leased

to experienced, state-licensed operators for their regulated

adult-use and medical-use cannabis facilities. Treehouse will

initially be externally managed and advised by an affiliate of

MedMen Enterprises Inc. Visit http://www.treehousereit.com

ABOUT STABLE ROAD CAPITAL:Stable Road Capital is a family

office employing an opportunistic approach to fundamental value

investing. The Firm focuses on acquiring and investing in high

quality operating businesses, assets and funds. While the Firm is

generally industry agnostic, Stable Road Capital has dedicated

considerable resources to advising and investing in the cannabis

sector, focusing on large vertically integrated players, individual

brands, and industry specific private equity funds.

Visit https://www.stableroadcapital.com/

SOURCE: MedMen Enterprises

Cautionary Note Regarding Forward-Looking Information and

Statements

This press release contains certain “forward-looking

information” within the meaning of applicable Canadian securities

legislation and may also contain statements that may constitute

“forward-looking statements” within the meaning of the safe harbor

provisions of the United States Private Securities Litigation

Reform Act of 1995. Such forward-looking information and

forward-looking statements are not representative of historical

facts or information or current condition, but instead represent

only MedMen’s beliefs regarding future events, plans or objectives,

many of which, by their nature, are inherently uncertain and

outside of MedMen’s control. Generally, such forward-looking

information or forward-looking statements can be identified by the

use of forward-looking terminology such as “plans”, “expects” or

“does not expect”, “is expected”, “budget”, “scheduled”,

estimates”, “forecasts”, “intends”,“anticipates” or “does not

anticipate”, or “believes”, or variations of such words and phrases

or may contain statements that certain actions, events or results

“may”, “could”,“would”, “might” or “will be taken”, “will

continue”, “will occur” or “will be achieved”. The forward-looking

information and forward-looking statements contained herein may

include, but is not limited to, information concerning the proposed

sale and leaseback of certain MedMen properties, including the

contemplated timing and terms thereof and the contemplated impact

of the same on the financial position of MedMen.

By identifying such information and statements in this manner,

MedMen is alerting the reader that such information and statements

are subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, level of activity,

performance or achievements of MedMen to be materially different

from those expressed or implied by such information and statements.

In addition, in connection with the forward-looking information and

forward-looking statements contained in this press release, MedMen

has made certain assumptions.

Among others, the key factors that could cause actual results to

differ materially from those projected in the forward-looking

information and statements are the following: inability to locate

suitable acquisition targets; adverse changes in the public

perception of cannabis; changes in consumer demand for cannabis;

decreases in the prevailing prices for cannabis and cannabis

products in the markets in which the Company operates; adverse

changes in applicable laws; adverse changes in the application or

enforcement of current laws, including those related to taxation;

increasing costs of compliance with extensive government

regulation; changes in general economic, business and political

conditions, including changes in the financial markets; risks

related to licensing, including the ability to obtain the requisite

licenses or renew existing licenses for the Company’s operations;

dependence upon third party service providers, skilled labor and

other key inputs; risks inherent in the agricultural and retail

business; intellectual property risks; risks related to litigation;

dependence upon senior management; and the other risks disclosed in

the Company’s public filings. Should one or more of these risks,

uncertainties or other factors materialize, or should assumptions

underlying the forward-looking information or statements prove

incorrect, actual results may vary materially from those described

herein as intended, planned, anticipated, believed, estimated or

expected.

Although MedMen believes that the assumptions and factors used

in preparing, and the expectations contained in, the

forward-looking information and statements are reasonable, undue

reliance should not be placed on such information and statements,

and no assurance or guarantee can be given that such

forward-looking information and statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information and

statements.

Key assumptions used herein are that the proposed sale and

leaseback of the applicable MedMen properties will be completed,

including on the current terms and anticipated timing. The

forward-looking information and forward-looking statements

contained in this press release are made as of the date of this

press release, and MedMen does not undertake to update any

forward-looking information and/or forward-looking statements that

are contained or referenced herein, except in accordance with

applicable securities laws. All subsequent written and oral

forward-looking information and statements attributable to MedMen

or persons acting on its behalf is expressly qualified in its

entirety by this notice.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190107006058/en/

MEDIA CONTACT:Briana ChesterSenior

PublicistBriana.chester@medmen.com

INVESTOR RELATIONS CONTACT:Stéphanie Van HasselHead of

Investor Relationsinvestors@medmen.com(323) 705-3025

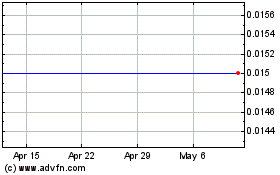

MedMen Enterprises (CSE:MMEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

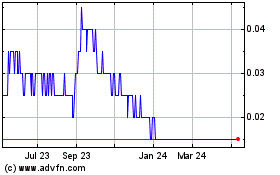

MedMen Enterprises (CSE:MMEN)

Historical Stock Chart

From Feb 2024 to Feb 2025