Edge Makes Oil-Focused Acquisition and Increases Production

February 01 2012 - 7:45AM

Marketwired Canada

Edge Resources Inc. ("Edge" or the "Company") (TSX VENTURE:EDE) is pleased to

announce that it has completed the acquisition of certain oil and gas assets

located in West Central Saskatchewan (the "Acquisition") from an Alberta-based

public oil and gas producer for aggregate consideration of $8.8 million.

The Acquisition consists of the following:

-- Current production of approximately 350 boe/day (65% oil)

-- 100% working interest in 19 sections of Crown land plus 2 sections of

land upon which the Company has acquired Gross Overriding Royalty

("GOR") interests

-- Over 25 sections of proprietary 3D seismic

-- Over 125km of proprietary 2D seismic lines

-- 30km of natural gas pipeline and associated infrastructure

Brad Nichol, President & CEO of Edge commented, "We have acquired an amazing

asset in a highly sought-after area, which can act as an immediate platform for

near-term growth. We can utilize our existing operational expertise to hit the

ground running."

Highlights of the Acquisition include:

-- Acquisition price of $25,142 per flowing boe/day versus 2011 averages of

$42,171 and $114,448 for heavy and light oil-weighted transactions,

respectively1

-- The acquired properties produced net cash flow of approximately $3.1

million in 2011 and the Company anticipates a similar level of net cash

flow in 2012, excluding the drilling of any additional wells

-- The identification of several promising drilling locations, based on

review of the proprietary 3D seismic

-- Near-term opportunities to work-over existing wellbores and increase

production

-- Opportunities to improve recoverable reserves, which the Company

estimates to currently be only a small percentage of original oil in

place, through field optimization and secondary recovery methods

-- Multi-zone exploration and development potential from several horizons

Nichol added, "The Acquisition brings our total current production to over 900

boe/day and increases our oil weighting and immediate cash flow. We are very

pleased to have taken 100% ownership of this asset, as controlling our own

destiny has always been important to controlling our own success. We look

forward to developing this asset and the multiple promising horizons it

encompasses, to its fullest potential, which we feel can be largely accomplished

through relatively shallow, conventional, vertical, low-cost wells."

The Acquisition was financed 100% though debt and no new equity was issued to

close this transaction. To finance a portion of the Acquisition, the Company

entered into a secured loan facility in the amount of $7.5 million with the

remaining $1.3 million of the consideration from the Company's operating line.

The secured loan was provided by non-insider, Alberta resident shareholders of

the Company.

About Edge Resources Inc.

Edge Resources is focused on developing a balanced portfolio of oil and natural

gas assets from properties in Alberta and Saskatchewan, Canada. The management

team's success rate is based on the safe, efficient deployment of capital and a

proven ability to efficiently execute in shallow formations, which gives Edge

Resources a sustainable, low-cost, competitive advantage.

1Average 2011 transaction metrics sourced from ATB Corporate Financial Services

"Key Statistics Summary" published January 31, 2012.

This release includes certain statements that may be deemed "forward-looking

statements". All statements in this release, other than statements of historical

facts, that address future production, reserve potential, exploration drilling,

exploitation activities and events or developments that the Company expects are

forward-looking statements. Although the Company believes the expectations

expressed in such forward looking statements are based on reasonable

assumptions, such statements are not guarantees of future performance and actual

results or developments may differ materially from those in the forward-looking

statements. Factors that could cause actual results to differ materially from

those in forward looking statements include market prices, exploitation and

exploration successes, continued availability of capital and financing, and

general economic, market or business conditions. Investors are cautioned that

any such statements are not guarantees of future performance and those actual

results or developments may differ materially from those projected in the

forward-looking statements. For more information on the Company, Investors

should review the Company's registered filings which are available at

www.sedar.com.

This news release shall not constitute an offer to sell or the solicitation of

any offer to buy, nor shall there be any sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful. The

securities offered have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States absent registration or applicable exemption from the registration

requirements of the U.S. Securities Act and applicable state securities laws.

Barrel ("bbl") of oil equivalent ("boe") amounts may be misleading particularly

if used in isolation. All boe conversions in this report are calculated using a

conversion of six thousand cubic feet of natural gas to one equivalent barrel of

oil (6 mcf=1 bbl) and is based on an energy conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

well head.

Trading in the securities of Edge Resources Inc. should be considered highly

speculative.

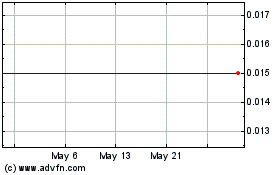

Goldrea Resources (CSE:GOR)

Historical Stock Chart

From Oct 2024 to Nov 2024

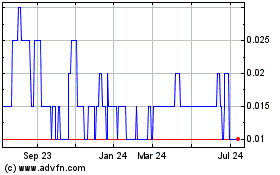

Goldrea Resources (CSE:GOR)

Historical Stock Chart

From Nov 2023 to Nov 2024