Monte dei Paschi Board Approves Plan to Shed Bad Loans

July 29 2016 - 4:00PM

Dow Jones News

MILAN—The board of Banca Monte dei Paschi di Siena SpA on Friday

approved a plan to unload a large chunk of its nonperforming loans

and raise fresh capital to try to resolve longstanding troubles at

Italy's No. 3 lender and stave off a government bailout.

According to slides published ahead of a conference call Friday

evening, the bank plans to unload €9.2 billion ($10.3 billion) in

sour loans to a new vehicle.

Monte dei Paschi will also raise up to €5 billion in fresh

capital—or nearly six times its market capitalization—to rebuild

its capital cushion. According to the slides, the bank has lined up

underwriting agreements with a number of Italian and foreign banks

to support the capital increase.

The bank also published first-half results, showing that its net

profit stood at €302 million, 8% lower than the same period last

year.

The bank will hold a conference call later Friday scheduled to

discuss its first-half results.

Write to Deborah Ball at deborah.ball@wsj.com

(END) Dow Jones Newswires

July 29, 2016 15:45 ET (19:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

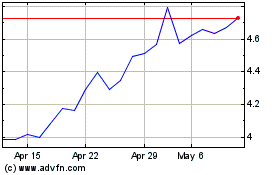

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Jul 2024 to Aug 2024

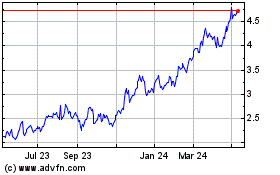

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Aug 2023 to Aug 2024