Ophir Energy Forecasts 16% Rise in 1st Half Revenue

July 12 2018 - 4:46AM

Dow Jones News

By Oliver Griffin

Ophir Energy PLC (OPHR.LN) said Thursday that revenue in the

first half of 2018 is expected to be 16% higher than the

previous-year period, citing higher-than-expected commodity prices

and above-forecast production.

The oil-and-gas exploration company said revenue for the six

months ended June 30 is forecast at $102 million, up from $88.3

million last year.

The company said that average daily production during the first

half of the year was 11,400 barrels of oil equivalent a day, above

previous forecasts.

Cash flow from production in the first half of 2018 is forecast

to be $43 million. Ophir Energy said cash flow from production for

the whole year, on a proforma basis including assets it is

acquiring from Santos Ltd. (STO.AU), is forecast at $190

million.

Production for the full year is forecast at 11,500 barrels of

oil equivalent per day, rising to 25,000 barrels on a proforma

basis including the Santos acquisition, the company said.

Write to Oliver Griffin at oliver.griffin@dowjones.com

(END) Dow Jones Newswires

July 12, 2018 04:31 ET (08:31 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

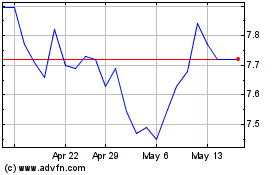

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

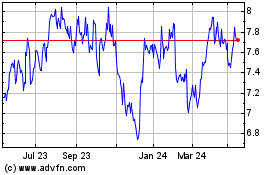

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025