Santos Inks Strategic Relationship with ENN, Hony

June 26 2017 - 9:08PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Chinese natural-gas distributor ENN Group

Co. and private-equity firm Hony Capital will leverage their joint

stake in Santos Ltd. (STO.AU) to invest in gas reserves and

production in Australia and Papua New Guinea.

The companies signed a strategic partnership aimed at assisting

Santos and using the mid-sized Australian energy company to invest

in gas fields and exports of liquefied natural gas, they said in a

statement Tuesday.

ENN and Hony snapped up more shares in Santos in May, lifting

their collective stake to 15.1%, and agreed to act in concert as

shareholders when it came to voting and other decisions. That built

on ENN's position as the largest single shareholder in a company

with a basket of natural-gas assets that supply customers in

Australia and Asia.

The formalized relationship will effectively link the upstream

exploration and production abilities of Santos with China's

fast-growing downstream market for natural gas, ENN Chairman Wang

Yusuo said.

ENN and Hony intend to use Santos as their primary investment

vehicle for material investment in Australia and Papua New Guinea,

while Santos would seek to include the pair in investment

opportunities where it was in the interest of all its shareholders,

the companies said.

As part of the agreement, Eugene Shi, vice president of ENN

Ecological Holdings Ltd. (600803.SH) will join Santos's board as a

nonexecutive director and would accept the secondment of one or two

ENN employees a year into its upstream LNG production operations as

part of a training program.

ENN and Hony would in turn support Santos, agreeing to consider

future capital raisings, opportunities for co-investment in

acquisitions and expansion, and also by proposing opportunities for

Santos to increase its access to China, according to a copy of the

agreement released by Santos.

Santos rode Australia's oil-and-gas investment boom

aggressively, pouring billions of dollars in new projects from

Australia's east coast to new developments in Papua New Guinea. But

it was hit hard by the slump in oil prices, forcing it to offer

assets for sale as it sought to shore up a stretched balance sheet.

In late 2015, it rejected as too low a takeover offer from a

private-equity firm backed by sovereign investors and wealthy

members of Asian and Gulf-based ruling families.

Kevin Gallagher, who took over as managing director and chief

executive in early 2016, has tied Santos's future to the GLNG

gas-export operation in east Australia that counts Total SA (TOT)

among its partners, the Exxon Mobil Corp.-led (XOM) PNG LNG

operation in Papua New Guinea and projects in northern Australia,

Western Australia, and the Cooper Basin straddling South Australia

and Queensland states. Last December, he moved to bundle noncore

operations to be run as a separate business and targeted a further

US$1.5 billion drop in debt to less than US$3 billion by the end of

2019.

In November, Hony bought the equivalent of an about 2.25% stake

in Santos, roughly eight months after it sold an 11.7% stake that

it had built up to ENN's ENN Ecological Holdings.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

June 26, 2017 20:53 ET (00:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

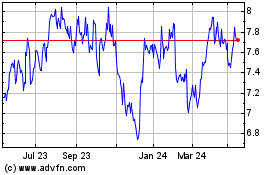

Santos (ASX:STO)

Historical Stock Chart

From Dec 2024 to Jan 2025

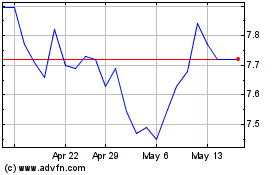

Santos (ASX:STO)

Historical Stock Chart

From Jan 2024 to Jan 2025