U.K. Data Point to Economic Slowdown

April 21 2016 - 5:40AM

Dow Jones News

LONDON—U.K. retail sales fell in March, while Treasury chief

George Osborne missed a key borrowing goal, adding to signs the

economy slowed in the first quarter of 2016.

The data may intensify concerns that growth in the British

economy is easing off ahead of a referendum on membership of the

European Union scheduled for June.

The Office for National Statistics said Thursday that British

retail sales fell 1.3% in March compared with February, a much

larger fall than expected. Analysts polled by The Wall Street

Journal were expecting sales to be flat on the month.

The decline was felt across the sector, with sales falling at

clothing stores, food stores, department stores as well as through

mail-order and online outlets, the ONS said.

The figures are the latest in a series of disappointing data in

the U.K., coming after weak industrial production numbers and the

first rise in unemployment in almost a year. Thursday's retail

sales figures suggest that consumer spending, the engine of recent

economic growth, weakened in March amid subdued pay growth and a

gloomier economic outlook.

Among the clouds darkening the horizon: Uncertainty over the

outcome of a referendum on the U.K.'s EU membership scheduled for

June 23, which Bank of England officials say risks slowing the

economy by prompting consumers and businesses to delay

spending.

Proponents of exiting the bloc say that leaving the EU would

boost the economy by freeing businesses of burdensome regulation

and allowing the U.K. to focus trade on faster-growing parts of the

world.

Also Thursday, the ONS confirmed that George Osborne has missed

his borrowing goal for the 12 months through March, an early

setback in his latest five-year push to close the U.K.'s budget

deficit.

Data showed the government borrowed £ 74 billion ($106 billion)

over the fiscal year, £ 1.8 billion more than Britain's Office for

Budget Responsibility, the nation's fiscal watchdog, predicted.

Recent monthly borrowing figures had suggested the target was

likely to be missed.

The overshoot means Mr. Osborne will have to find fresh savings

in government spending, raise taxes or hope for faster growth in

the economy to meet his goal of balancing the government books by

2020.

Write to Jason Douglas at jason.douglas@wsj.com

(END) Dow Jones Newswires

April 21, 2016 05:25 ET (09:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

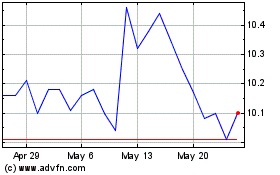

Pacific Current (ASX:PAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pacific Current (ASX:PAC)

Historical Stock Chart

From Nov 2023 to Nov 2024