MARKET COMMENT: S&P/ASX 200 Down 0.4%; NAB Leads Bank Selloff

March 12 2013 - 8:24PM

Dow Jones News

2354 GMT [Dow Jones] Australia's S&P/ASX 200 is down 0.4% at

5102.09, on track for a second-consecutive daily decline, after

hitting a 4 1/2 year high of 5163.5 Tuesday. NAB (NAB.AU) falls

2.8%, leading declines among banks, after its strategy update

failed to give fresh bullish catalysts, and its cost-cutting plan

undershot expectations. Overnight weakness in the S&P 500

Financials sector is also a negative factor for the sector.

Investors are partially rotating to resources, with BHP (BHP.AU),

Rio Tinto (RIO.AU), Newcrest (NCM.AU) and Fortescue (FMG.AU) up

0.7%-3.2% after a better night for most commodity prices. "There

does appear to be a bit of rotation from banks to resources today,

but it's not a dollar for dollar switch," says CMC Markets' chief

market strategist, Michael McCarthy. "That failure yesterday by the

index--surpassing the previous high, then closing below it--is

adding some downward pressure to the market." The market is

ignoring positive economic data, with Westpac's Consumer Sentiment

Index rising 2% in March from February, to its highest since

September 2010. McCarthy expects a test of uptrend line and 20-day

moving average support at 5070. (david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

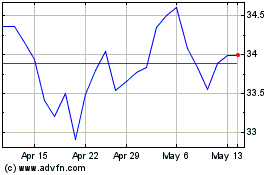

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jun 2024 to Jul 2024

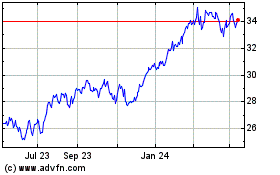

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Jul 2023 to Jul 2024