TIDMSML

RNS Number : 4362Y

Strategic Minerals PLC

06 September 2022

Strategic Minerals plc

("Strategic Minerals" or the "Company")

Holdings in Company

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company announces that it has been notified by

Philip Richards of RAB Capital that he holds a beneficial interest

in 81,000,000 ordinary shares of 0.1 pence in the Company

representing 4.02% of the Company's issued share capital.

TR-1: Standard form for notification of major holdings

1. Issuer Details

ISIN

GB00B4W8PD74

Issuer Name

STRATEGIC MINERALS PLC

UK or Non-UK Issuer

UK

2. Reason for Notification

An acquisition or disposal of voting rights

3. Details of person subject to the notification obligation

Name

RAB Capital Holdings Limited

City of registered office (if applicable)

Brentwood

Country of registered office (if applicable)

United Kingdom

Name City of registered office Country of registered office

Eagles Trust Limited St Helier Jersey

=========================== ==============================

William Philip Richards St Brelade Jersey

=========================== ==============================

4. Details of the shareholder

Name City of registered office Country of registered office

Pershing Securities Limited London United Kingdom

=========================== ==============================

5. Date on which the threshold was crossed or reached

06-Sep-2022

6. Date on which Issuer notified

06-Sep-2022

7. Total positions of person(s) subject to the notification

obligation

% of voting rights % of voting rights Total of both in % Total number of

attached to shares through financial (8.A + 8.B) voting rights held

(total of 8.A) instruments (total in issuer

of 8.B 1 + 8.B 2)

Resulting situation

on the date on

which threshold

was crossed or

reached 4.020000 0.000000 4.020000 81000000

====================== ====================== ====================== ======================

Position of

previous

notification (if

applicable)

====================== ====================== ====================== ======================

8. Notified details of the resulting situation on the date on

which the threshold was crossed or reached

8A. Voting rights attached to shares

Class/Type of shares Number of direct Number of indirect % of direct voting % of indirect voting

ISIN code(if possible) voting rights (DTR5.1) voting rights rights (DTR5.1) rights (DTR5.2.1)

(DTR5.2.1)

GB00B4W8PD74 81000000 0 4.020000 0.000000

====================== ====================== ====================== ======================

Sub Total 8.A 81000000 4.020000%

============================================== ==============================================

8B1. Financial Instruments according to (DTR5.3.1R.(1) (a))

Type of financial Expiration date Exercise/conversion period Number of voting rights % of voting rights

instrument that may be acquired if

the instrument is

exercised/converted

Sub Total 8.B1

=========================================== ========================= ==================

8B2. Financial Instruments with similar economic effect

according to (DTR5.3.1R.(1) (b))

Type of financial Expiration date Exercise/conversion Physical or cash Number of voting % of voting rights

instrument period settlement rights

Sub Total 8.B2

========================================================= =================== ==================

9. Information in relation to the person subject to the

notification obligation

2. Full chain of controlled undertakings through which the

voting rights and/or the financial instruments are effectively held

starting with the ultimate controlling natural person or legal

entities (please add additional rows as necessary)

Ultimate controlling Name of controlled % of voting rights if % of voting rights Total of both if it

person undertaking it equals or is higher through financial equals or is higher

than the notifiable instruments if it than the notifiable

threshold equals or is higher threshold

than the notifiable

threshold

William Philip

Richards

====================== ====================== ====================== ======================

William Philip Eagles Trust

Richards Limited

====================== ====================== ====================== ======================

10. In case of proxy voting

Name of the proxy holder

The number and % of voting rights held

The date until which the voting rights will be held

11. Additional Information

12. Date of Completion

06/09/2022

13. Place Of Completion

United Kingdom

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects aimed at supplying the

metals and minerals likely to be highly demanded in the future.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26 June

2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Australia and brought the project temporarily into production in

April 2019. In July 2021, the project was granted a conditional

approval by the South Australian Government for a Program for

Environmental Protection and Rehabilitation (PEPR) in relation to

mining of its Paltridge North deposit and processing at the

Mountain of Light installation. In late June 2022, an updated PEPR,

addressing the conditions associated with the July 2021 approval,

was approved.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

HOLEANNKEANAEEA

(END) Dow Jones Newswires

September 06, 2022 05:31 ET (09:31 GMT)

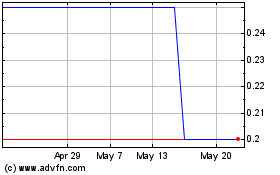

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

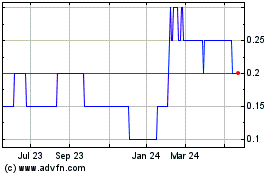

Strategic Minerals (AQSE:SML.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024