TIDMSEE

RNS Number : 5552G

Seeing Machines Limited

30 March 2022

Seeing Machines Limited

30 March 2022

Half year results and financial report

Seeing Machines Limited (AIM: SEE, "Seeing Machines" or the

"Company"), the advanced computer vision technology company that

designs AI-powered operator monitoring systems to improve transport

safety, today publishes its unaudited results and financial report

for the six months to 31 December 2021 ("H1 2021").

Financial Highlights:

- Total operational revenue of A$21.7m (H1 2021: A$18.1m),

reflecting comparative growth of c.19.4% on previous period.

o Underlying revenue growth[1] using constant currency is 24.6%

year on year (exchange rate as at 31 December 2021)

o OEM (Automotive and Aviation) revenue of A$5.2m, representing

a 69% increase on the previous period (H1 2021: A$3.1m)

-- Includes a 170% increase in royalty revenue derived from the

installation of the Group's DMS technology of $2.1m (H1 2021:

A$0.78m)

o Annual Recurring Revenue including royalties increased by 9.3%

since 30 June 2021 to A$18.8m (FY2021: A$17.2m)

o Aftermarket (Fleet and Off-Road) revenue grew by 9% to A$16.4m

(H1 2021: A$15m)

o Aftermarket Monitoring Service Revenues including royalties

grew by 16% to A$6.7m (H1 2021: A$5.8m)

- Net loss reduced by 17.8% to A$13.8m (H1 2021: A$16.8m)

- Cash at 31 December 2021 of A$79.3m (31 December 2020: A$52.4m)

OEM (Automotive and Aviation) Highlights:

- Global momentum calling for Driver Monitoring System (DMS)

technology for enhanced safety continues and saw the USA introduce

legislation that would require DMS to reduce risks of distracted

and drunk driving.

- Seeing Machines announced the largest driver and occupant

monitoring system technology award to date and was appointed by a

new Tier 1 partner for a leading German automaker, with an initial

lifetime value of A$125m. This brings total cumulative initial

lifetime value of all Company won automotive programs to more than

A$325m.

- With over nine vehicle models now past start of production,

there are more than 250,000 cars on roads featuring Seeing Machines

technology, representing an increase of 108% since 30 June 2021. A

further 30 distinct vehicle models, featuring Seeing Machines

technology, are expected to launch by early 2023.

- Key commercial traction in Aviation, as Airservices Australia

announced that it will collaborate with Seeing Machines Aviation to

enhance safety in Air Traffic Management, and Air Ambulance

Victoria announced its use of Seeing Machines in the world-first

pilot fatigue detection system.

- Seeing Machines and Collins Aerospace, the world's largest

Tier 1 Avionics company, have signed a collaboration agreement to

jointly market co-developed solutions across the Aviation

industry.

Aftermarket Highlights:

- Guardian, the Company's Aftermarket driver distraction and

fatigue technology, is now fitted to 36,933 individual vehicles, a

16.2% increase of 5,000 connections over the six month period (FY

2021: 31,771 units).

- The Company signed a Global Framework Agreement with Shell

Global Solutions International B.V. for the provision of Guardian,

to enhance safety across its worldwide operations.

- EROAD Limited, a leading transportation technology company

that offers fleet management software and products, has integrated

Seeing Machines Guardian technology into its fleet management

software to help combat driver fatigue and make roads safer.

- Seeing Machines established a European sales team,

headquartered in Amsterdam, the Netherlands, to lead the next phase

of its business development and focus on growing demand in Europe

for the Company's Aftermarket driver safety technology,

Guardian.

Investment Highlights:

- On 23 November 2021, Seeing Machines issued 277,123,492 new

ordinary shares of no par value each (the "New Ordinary Shares") at

a price of 11 pence per New Ordinary Share, raising gross proceeds

of approximately US$41,000,000 (the "Placing"). The net proceeds of

the Placing are being used to accelerate a range of features to

meet technology demands and for general working capital and

corporate purposes, as well as to strengthen the Company's balance

sheet.

Outlook:

- Seeing Machines continues to trade within the range of consensus expectations for FY2022.[2]

There is considerable accelerating momentum for the business,

with current market conditions presenting a significant opportunity

to capture an even greater market share as a number of structural

tailwinds continue to support application of the Company's

technology. The current 'active RFQ' pipeline, with program

opportunities exceeding a cumulative total of A$1bn, underpins the

board's view that Seeing Machines will have an increased market

share by 2025.

Paul McGlone, CEO of Seeing Machines commented: "These results

demonstrate positive momentum across the company. Our Automotive

business continues to grow with more cars starting production,

generating high-margin royalty revenue. This is underpinned by our

increasing confidence in ongoing RFQ processes as we focus on

feature development and integration options to support OEM demands,

in partnership with our Tier 1 customers. Aftermarket is

experiencing similar positive momentum with growth in our direct

business resulting in a more profitable business model and a

growing sales pipeline through our expanding global team.

"There are obviously challenges with the current geopolitical

and global inflationary environment and supply chain that affect

the market as a whole. We are focused on mitigating these risks as

they are identified and are confident in our ability to continue to

grow the business."

Enquiries:

Seeing Machines Limited +61 2 6103 4700

Paul McGlone - CEO

Sophie Nicoll - Corporate Communications

Stifel Nicolaus Europe Limited (Nominated

Adviser and Broker) +44 20 7710 7600

Alex Price

Nick Adams

Ross Poulley

Lionsgate Communications (Media Enquiries)

Jonathan Charles +44 07791 892509

Seeing Machines (LSE: SEE), a global company founded in 2000 and

headquartered in Australia, is an industry leader in vision-based

monitoring technology that enable machines to see, understand and

assist people. Seeing Machines' technology portfolio of AI

algorithms, embedded processing and optics, power products that

need to deliver reliable real-time understanding of vehicle

operators. The technology spans the critical measurement of where a

driver is looking, through to classification of their cognitive

state as it applies to accident risk. Reliable "driver state"

measurement is the end-goal of Driver Monitoring Systems (DMS)

technology. Seeing Machines develops DMS technology to drive safety

for Automotive, Commercial Fleet, Off-road and Aviation. The

company has offices in Australia, USA, Europe and Asia, and

supplies technology solutions and services to industry leaders in

each market vertical.

Review of Operations

Financial Results

The Company's total sales revenue for H1 FY2022 (excluding

foreign exchange gains and finance income) increased by 19.4% to

A$21.7m (H1 FY2021: A$18.1m).

Business unit 31 Dec 2021 31 Dec 2020 Variance

$'000 $'000 %

OEM 5,243 3,103 69

Aftermarket 16,421 15,040 9

Sales Revenue 21,664 18,143 19

Royalty revenue, derived from installation of Seeing Machines'

Driver Monitoring System (DMS) technology, increased by 170% to

A$2.1m compared to the same period last year (H1 FY2021: A$0.78m)

as vehicles start production across a number of Automotive OEM

programs. This demonstrates the significant ramp up of royalty

revenues, earned at a substantial margin, that is set to continue

as more of these programs are delivered.

Monitoring services revenue in Aftermarket grew by 16% to A$6.7m

for the half-year, compared to A$5.8m for the same period last

year. Installed Guardian units increased by over 5,000 to 36,933

connected units representing a 16.2% growth in connections over the

six-month period (FY21: 31,771 units), demonstrating ongoing

momentum for the Aftermarket business, despite ongoing challenges

posed by COVID-19 and supply chain pressures.

The Company continued to invest in its core technology

development to further strengthen our competitive moat, rapidly

expand features and leverage systems approach across global OEM and

Aftermarket industries. As a result, Seeing Machines incurred total

research and development expenses of A$18.1m during the six-months

ended 31 December 2021 (2020: A$8.9m), of which A$11.8m (2020: nil)

was capitalised.

Customer support and operations cost categories increased to

A$4.3m (2020: A$3.2m) and A$5.8m (2020: A$3.5m) respectively in

line with strengthening of business pursuit and emerging markets

activities to support increased pipeline and channel market

expansion.

On 23 November 2021, Seeing Machines issued 277,123,492 new

ordinary shares of no par value each (the "New Ordinary Shares") at

a price of 11 pence per New Ordinary Share, raising gross proceeds

of approximately US$41,000,000 (the "Placing"). The net proceeds of

the Placing are being used to accelerate a range of features to

meet technology demands and for general working capital and

corporate purposes, as well as to strengthen the Company's balance

sheet.

Cash and cash equivalents at 31 December totaled A$79.3m (2020:

A$52.4m).

We highlight this report is unaudited. There is no requirement

for the interim financial statements to be subject to review by the

external auditor.

Interim Consolidated Statement of Financial Position -

Unaudited

Consolidated

31 Dec 30 Jun

AS AT Notes 2021 2021

Unaudited Audited

A$000 A$000

---------------------------------- -------------------- ---------- ---------

ASSETS

CURRENT ASSETS

Cash and cash equivalents 5 79,261 47,393

Other short-term deposits 472 472

Trade and other receivables 6 17,633 19,851

Inventories 7 7,039 2,627

Other current assets 5,348 5,438

---------- ---------

TOTAL CURRENT ASSETS 109,753 75,781

---------- ---------

NON-CURRENT ASSETS

Property, plant & equipment 8 3,347 3,361

Intangible assets 9 21,477 9,540

Right-of-use assets 3,847 4,252

---------- ---------

TOTAL NON-CURRENT ASSETS 28,671 17,153

---------- ---------

TOTAL ASSETS 138,424 92,934

---------- ---------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 1 0 9,218 8,839

Lease liabilities 1 1 998 918

Provisions 5,579 4,893

Contract liabilities 1,733 772

---------- ---------

TOTAL CURRENT LIABILITIES 17,528 15,422

---------- ---------

NON-CURRENT LIABILITIES

Provisions 261 192

Lease liabilities 1 1 4,772 5,272

---------- ---------

TOTAL NON-CURRENT LIABILITIES 5,033 5,464

---------- ---------

TOTAL LIABILITIES 22,561 20,886

---------- ---------

NET ASSETS 115,863 72,048

========== =========

EQUITY

Contributed equity 1 4 312,822 257,382

Accumulated losses (215,821) (202,046)

Other reserves 18,862 16,712

---------- ---------

Equity attributable to the owners

of the parent 115,863 72,048

---------- ---------

TOTAL EQUITY 115,863 72,048

========== =========

The above interim consolidated statement of financial position

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Comprehensive Income -

Unaudited

Consolidated

2021 2020

FOR THE SIX-MONTH PERIODED 31 Notes Unaudited Unaudited

DECEMBER A$000 A$000

---------------------------------------- ----------------- ---------- ------------------

Sale of goods and licence fees 11,480 9,159

Rendering of services 10,184 8,981

Research revenue - 3

---------- ----------------

Revenue 3 21,664 18,143

---------- ----------------

Cost of sales (11,528) (11,804)

---------- ----------------

Gross profit 10,136 6,339

---------- ----------------

Net gain/(loss) in foreign exchange 164 (2,002)

Finance income 219 196

Other (expense) / income (9) 1,672

Expenses

Research and development expenses 4 (6,286) (8,853)

Customer support and marketing expenses (4,327) (3,194)

Operations expenses (5,790) (3,476)

General and administration expenses (7,530) (7,186)

Finance costs (239) (267)

---------- ----------------

Loss before tax (13,662) (16,771)

Income tax expense (113) -

---------- ----------------

Loss after income tax (13,775) (16,771)

========== ================

Loss for the period attributable to:

Equity holders of the parent (13,775) (16,771)

---------- ----------------

Other comprehensive income/(loss)

Exchange differences on translation

of foreign operations 172 (22)

---------- ----------------

Other comprehensive income/(loss)

net of tax 172 (22)

---------- ----------------

Total comprehensive loss (13,603) (16,793)

---------- ----------------

Total comprehensive loss attributable

to:

Equity holders of the parent (13,603) (16,793)

========== ================

Total comprehensive loss for the period (13,603) (16,793)

========== ================

Loss per share for loss attributable to the ordinary equity

holders of

the parent:

Basic loss per share 13 (0.01) (0.01)

Diluted loss per share 13 (0.01) (0.01)

The above interim consolidated statement of comprehensive income

should be read in conjunction with the accompanying notes.

Interim Consolidated Statement of Changes in Equity -

Unaudited

FOR THE Employee

SIX-MONTH Foreign Equity

PERIOD Currency BenefitsED 31 Contributed Accumulated Translation & Other

DECEMBER Equity Losses Reserve Reserve Total Equity

A$000 A$000 A$000 A$000 A$000

--------------- -------------------- -------------------- -------------------- -------------------- -------------------

As at 1 July

2020 217,204 (184.626) (1,516) 15,147 46,209

Loss for the

period - (16,771) - - (16,771)

Other

comprehensive

loss - - (22) - (22)

Total

comprehensive

loss - (16.771) (22) - (16,793)

Transactions

with owners

in their

capacity as

owners:

Issue of new

shares 27,526 - - - 27,526

Share-based

payments - - - 1,943 1,943

At 31 December

2020 -

Unaudited 244,730 (201,397) (1,538) 17,090 58,885

As at 1 July

2021 257,382 (202,046) (1,685) 18,397 72,048

Loss for the

period - (13,775) - - (13,775)

Other

comprehensive

income - - 172 - 172

Total

comprehensive

loss - (13,775) 172 - (13,603)

Transactions

with owners

in their

capacity as

owners:

Issue of new

shares 56,855 - - - 56,855

Capital

raising costs (1,415) - - - (1,415)

Share-based

payments - - - 1,978 1,978

At 31 December

2021 -

Unaudited 312,822 (215,821) (1,513) 20,375 115,863

The above consolidated statement of changes in equity should be

read in conjunction with the accompanying notes.

Interim Consolidated Statement of Cash Flows - Unaudited

FOR THE SIX-MONTH PERIODED 2021 2020

31 DECEMBER Notes Unaudited Unaudited

A$000 A$000

-------------------------------------------- ------- ----------- --------------

Operating activities

Receipts from customers 25,919 18,519

Payments to suppliers (36,641) (32,556)

Receipt of government grants - 1,565

Interest received 219 45

Interest paid (239) (267)

Income tax paid (113) -

----------- --------------

Net cash flows used in operating activities (10,855) (12,694)

----------- --------------

Investing activities

Purchase of property, plant and equipment 8 (304) (92)

Payments for intangible assets (patents,

licences and trademarks) 9 (181) (190)

Payments for intangible assets (capitalised

development costs) 4, 9 (11,783) -

Maturity of term deposits - 180

----------- --------------

Net cash flows (used in)/from investing

activities (12,268) 102

----------- --------------

Financing activities

Proceeds from issue of new shares 56,855 28,160

Cost of capital raising (1,415) (634)

Principal repayment of lease liabilities (421) -

Repayment of borrowings - (700)

----------- --------------

Net cash flows from financing activities 55,019 26,826

----------- --------------

Net increase in cash and cash equivalents 31,896 14,030

Net (decrease)/increase due to foreign

exchange difference (28) 193

Cash and cash equivalents at 1 July 47,393 38,138

Cash and cash equivalents at 31 December 5 79,261 52,361

=========== ==============

The above interim consolidated statement of cash flows should be

read in conjunction with the accompanying notes.

Notes to the Interim Consolidated Financial Statements -

Unaudited

1 Corporate information

Seeing Machines Limited (the "Company") is a limited liability

company incorporated and domiciled in Australia and listed on the

AIM market of the London Stock Exchange. The address of the

Company's registered office is 80 Mildura Street, Fyshwick,

Australian Capital Territory, Australia.

Seeing Machines Limited and its subsidiaries (the "Group")

provide operator monitoring and intervention sensing technologies

and services for the automotive, mining, transport and aviation

industries.

The interim consolidated financial report of the Group (the

"interim financial report") for the six-month period ended 31

December 2021 was authorised for issue in accordance with a

resolution of the Directors on 30 March 2022.

2 Basis of preparation and changes to the Group's accounting policies

(a) Basis of preparation

The interim financial report for the six-month period ended 31

December 2021 has been prepared in accordance with AASB 134 Interim

Financial Reporting in order to fulfil the reporting requirements

of Rule 18 of the London Stock Exchange's AIM Rules for Companies

issued July 2016.

The interim financial report does not include all the

information and disclosures required in the annual financial report

and should be read in conjunction with the Group's annual

consolidated financial statements as at 30 June 2021.

There is no requirement for the interim financial report to be

subject to audit or review by the external auditor and accordingly

no audit or review has been conducted.

(b) New standards, interpretations and amendments adopted by the Group

The accounting policies applied are consistent with those of the

consolidated financial statements for the year ended 31 June 2021,

except for the adoption of new amendments to the existing standards

as set out below.

The Group has adopted all of the new and revised Standards and

Interpretations issued by the AASB that are relevant to its

operations and effective for an accounting period that begins on or

after 1 July 2021.

(i) Amendments to existing standards effective and adopted with

no significant impact to the Group

There has been no significant impact due to the adoption of any

of the following standards or amendments thereto.

AASB 2020-8 Amendments to Australian Accounting Standards - Interest

Rate Benchmark Reform - Phase 2

----------- ----------------------------------------------------------------

AASB 2021-3 Amendments to Australian Accounting Standards - Covid-19-Related

Rent Concessions beyond 30 June 2021

----------- ----------------------------------------------------------------

(ii) New and amended standards and interpretations that have

been issued but not yet effective or early adopted by the Group

At the date of authorisation of the interim financial report,

the Group has not applied the following new and revised Australian

Accounting Standards, Interpretations and amendments that have been

issued but are not yet effective.

Effective for annual

reporting periods

beginning on or

Standard / Amendment after

-------------------------------------------------------------- -------------------------

AASB 17 and Insurance Contracts and Amendments 1 January 2023

AASB 2020-5 to Australian Accounting Standards

- Insurance Contracts

-------------- ---------------------------------------------- -------------------------

AASB 2014-10; Amendments to Australian Accounting 1 January 2022

AASB 2015-10; Standards - Sale or Contribution of (Editorial corrections

and AASB Assets between an Investor and its in AASB 2017-5

2017-5 Associate or Joint Venture; Amendments applied from 1

to Australian Accounting Standards January 2018)

- Effective Date of Amendments to AASB

10 and AASB 128; and Amendments to

Australian Accounting Standards - Effective

Date of Amendments to AASB 10 and AASB

128 and Editorial Corrections

-------------- ---------------------------------------------- -------------------------

Notes to the Interim Consolidated Financial Statements -

Unaudited

2 Basis of preparation and changes to the Group's accounting policies (continued)

(b) New standards, interpretations and amendments adopted by the Group (continued)

(ii) New and amended standards and interpretations that have

been issued but not yet effective or early adopted by the Group

(continued)

Effective for annual

reporting periods

beginning on or

Standard / Amendment after

--------------------------------------------------------- --------------------

AASB 2020-1 Amendments to Australian Accounting 1 January 2022

and AASB Standards - Classification of Liabilities

2020-6 as Current or Non-Current and Amendments

to Australian Accounting Standards

- Classification of Liabilities as

Current or Non-current - Deferral of

Effective Date

----------- -------------------------------------------- --------------------

AASB 2020-3 Amendments to Australian Accounting 1 January 2022

Standards - Annual Improvements 2018-2020

and Other Amendments

----------- -------------------------------------------- --------------------

AASB 2021-2 Amendments to Australian Accounting 1 January 2023

Standards - Disclosure of Accounting

Policies and Definition of Accounting

Estimates

----------- -------------------------------------------- --------------------

In addition, at the date of authorisation of the interim

financial report the following IASB Standards and IFRS

Interpretations Committee Interpretations were on issue but not yet

effective, but for which Australian equivalent Standards and

Interpretations have not yet been issued:

Effective for

annual reporting

periods beginning

Standard / Amendment on or after

----------------------------------------------- --------------------

Deferred Tax related to Assets and Liabilities 1 January 2023

arising from a Single Transaction - Amendments

to IAS 12

----------------------------------------------- --------------------

The Group is currently in the process of assessing the impact of

the above standards or amendments.

3 Segment information

a. Segment revenue based on operating segment

The following table presents revenue and net profit/(loss)

information for the Group's operating segments for the six-month

periods ended 31 December 2021 and 2020, respectively:

Segment Revenue Segment Profit/(Loss)

FOR THE SIX-MONTH PERIODED 2021 2020 2021 2020

31 DECEMBER A$000 A$000 A$000 A$000

Unaudited

---------------------------------------- ------------------------ ------------------ ------------------

OEM 5,243 3,103 (6,495) (7,515)

Aftermarket 16,421 15,040 844 (267)

Other - - (8,124) (8,989)

Total 21,664 18,143 (13,775) (16,771)

Notes to the Interim Consolidated Financial Statements -

Unaudited

3 Segment information (continued)

b. Revenue from contracts with customers

In the following tables, revenue segments have been

disaggregated by type of goods or services which also reflects the

timing of revenue recognition.

FOR THE SIX-MONTH PERIODED OEM A$000 Aftermarket Total A$000

31 DECEMBER 2021 A$000

Unaudited

------------------------------- ------------------------ ------------------ --------------------

Revenue Types

Sales at a point in time

Consulting - 839 839

Hardware and Installations 519 6,869 7,388

Royalties 2,099 - 2,099

Sales over time

Driver Monitoring - 6,726 6,726

Non-recurring Engineering 2,625 - 2,625

Licencing and royalties - 1,987 1,987

Total revenue 5,243 16,421 21,664

FOR THE SIX-MONTH PERIODED OEM A$000 Aftermarket Total A$000

31 DECEMBER 2020 A$000

Unaudited

------------------------------- ------------------------ ------------------ --------------------

Revenue Types

Sales at a point in time

Paid Research 3 - 3

Consulting - 544 544

Hardware and Installations 221 6,679 6,900

Royalties 778 - 778

Sales over time

Driver Monitoring - 5,811 5,811

Non-recurring Engineering 2,101 253 2,354

Licencing and royalties - 1,753 1,753

Total revenue 3,103 15,040 18,143

c. Geographic information

FOR THE SIX-MONTH PERIODED 2021 2020

31 DECEMBER A$000 A$000

Unaudited

-------------------------------------------------------------------- ------------------

Revenues from external customers

Australia 7,943 6,882

North America 10,038 5,420

Asia-Pacific (excluding Australia) 1,832 2,010

Europe 1,042 3,202

Other 809 629

Total revenue from external customers 21,664 18,143

The revenue information above is based on

the locations of the customers.

Notes to the Interim Consolidated Financial Statements -

Unaudited

4 Research and development expenses

Research and development expense relates to ongoing investment

in the Group's core technology.

The Group incurred total research and development expenses of

A$18,069,000 during the six-months ended 31 December 2021 (2020:

A$8,853,000), of which A$11,783,000 (2020: nil) were

capitalised.

As part of the assessment of research and development expenses

at 30 June 2021, total costs of A$8,311,000 were capitalised for

the year ended 30 June 2021, of which A$3,134,000 pertained to the

six-month period ended 31 December 2020.

5 Cash and cash equivalents

For the purpose of the interim consolidated statement of cash

flows, cash and cash equivalents are comprised of the

following:

31 Dec 30 June

2021 2021

Unaudited Audited

A$000 A$000

---------- --------

Cash at bank 29,307 47,393

Cash held for enhanced yield deposit (maturing

on 10 January 2022) 49,954 -

---------- --------

Total cash and cash equivalents 79,261 47,393

========== ========

On 10 December 2021 the Group entered into an enhanced yield

deposit with HSBC for principal amount of GBP 27,000,000. This is

classified as short-term, maturing on 10 January 2022 with an

interest rate of 4.75%.

6 Trade and other receivables

Current 31 Dec 30 June

2021 2021

Unaudited Audited

A$000 A$000

--------------------------------------- ---------------------- ---------------------

Trade receivables (net of provisions) 16,673 19,427

Deferred finance income (237) (302)

16,436 19,125

Other receivables 1,197 726

Total trade and other receivables -

current 17,633 19,851

The Group recognised nil impairment losses on receivables and

contract assets arising from contracts with customers for the

six-month period ended 31 December 2021 (2020: A$27,000).

7 Inventories

31 Dec 30 Jun

2021 2021

Unaudited Audited

A$000 A$000

---------- --------

Finished goods (at lower of cost and net realisable

value) 7,052 2,640

Provision for obsolescence (13) (13)

---------- --------

Total inventories at the lower of cost and

net realisable value 7,039 2,627

========== ========

Notes to the Interim Consolidated Financial Statements -

Unaudited

8 Property, plant and equipment

Acquisitions and disposals

During the six-month period ended 31 December 2021, the Group

acquired assets with a cost of A$304,000 (2020: A$92,000).

No assets were disposed by the Group during the six-month period

ended 31 December 2021.

9 Intangible assets

During the six-month period ended 31 December 2021, the Group

incurred expenditure of A$11,964,000 (2020: A$190,000) related to

intangibles. A$181,000 (2020: A$190,000) of this expenditure

related to patent and trademark applications and licences.

A$11,783,000 (2020: nil) related to capitalised development

costs.

A$1,000 (2020: nil) of intangibles relating to trademark

applications were disposed by the Group during the six-month period

ended 31 December 2021.

10 Trade payables

At 31 December 2021, the balance of the trade payables was

A$2,372,000 (30 June 2021: A$2,186,000), of which an amount of

A$2,123,000 (30 June 2021: A$2,043,000) was aged less than 60 days;

and an amount of A$249,000 (30 June 2021: A$144,000) was aged over

60 days.

11 Lease liabilities

31 Dec 30 June

2021 2021

Unaudited Audited

A$000 A$000

---------- --------

Current

Lease liabilities 998 918

Non-current

Lease liabilities 4,772 5,272

---------- --------

Total lease liabilities 5,770 6,190

========== ========

The table below summarises the maturity profile of the Group's

liabilities based on contractual undiscounted payments:

<=6 6-12 >1

AT 31 DEC 2021 months A$000 months A$000 year A$000 Total A$000 Carrying

Value A$000

------------------- ---------------------- ------------------ ----------------- ------------------- -------------

Lease liabilities 697 712 5,638 7,047 5,770

====================== ================== ================= =================== =============

<=6 6-12 >1

AT 30 JUN 2021 months A$000 months A$000 year A$000 Total A$000 Carrying

Value A$000

------------------- ---------------------- ------------------ ----------------- ------------------- -------------

Lease liabilities 685 694 6,345 7,724 6,190

====================== ================== ================= =================== =============

12 Dividends paid

No interim dividends or distributions have been made to members

during the six-month period ended 31 December 2021 (2020: nil) and

no interim dividends or distributions have been recommended or

declared by the directors in respect of the six-month period ended

31 December 2021 (2020: nil).

Notes to the Interim Consolidated Financial Statements -

Unaudited

13 Earnings per share

The following table reflects the income and share data used in

the basic and diluted earnings per share computations:

Earnings used in calculating earnings per share

Consolidated

2021 2020

FOR THE SIX-MONTH PERIODED 31 DECEMBER A$000 A$000

-------------------------------------------- ------------------- ------------------

For basic and diluted earnings per share:

Net loss (13,775) (16,771)

Net loss attributable to ordinary equity

holders of the Company (13,775) (16,771)

Weighted average number of shares

2021 2020

AT 31 DECEMBER Thousands Thousands

-------------------------------------------- ------------------- ------------------

Weighted average number of ordinary shares

for basic earnings per share 3,931,717 3,506,736

Weighted average number of ordinary shares

adjusted for the effect of

dilution

3,931,717 3,506,736

14 Share capital

Consolidated

31 Dec 30 June

2021 2021

Unaudited Audited

A$000 A$000

------------------------------------------------ ------------------------ --------------------

Ordinary shares 312,822 257,382

Total contributed equity 312,822 257,382

Number of ordinary shares

Consolidated

31 Dec 30 June

2021 2021

Unaudited Audited

Thousands Thousands

------------------------------------------------- ------------------------ --------------------

Issued and fully paid 4,155,419 3,875,618

Fully paid shares carry one vote per share

and carry the right to dividends.

The Company has no set authorised share capital

and shares have no par value.

Movement in ordinary shares:

Shares

Thousands A$000

------------------------------------------------- ------------------------ --------------------

As at 1 July 2021 3,875,618 257,382

Shares issued 279,801 56,855

Transaction costs - (1,415)

As at 31 December 2021 4,155,419 312,822

Notes to the Interim Consolidated Financial Statements -

Unaudited

15 Share-based payments

LTI 2021 - Performance rights or share options offers -

Executive and key staff

From 1 July 2015, senior staff and other key staff are offered

long term incentive (LTI) performance rights or share options.

Under this structure, the staff are only able to exercise the

rights, and have new ordinary shares issued to them, if any

performance, market and vesting conditions are met. These

conditions typically include a performance condition requiring the

staff member to achieve a minimum "meets expectations" rating and

some rights have included a market condition in the form of a

minimum Target Share Price (TSP). The vesting period ranges from 9

months to 5 years from the end of the relevant financial year or

grant date. Performance rights or options are often offered as part

of the annual remuneration review and may be offered at other

times. Any offer of performance rights or options requires Board

approval and, when granted, is announced to the market.

In November 2021 the Company awarded a total of 64,996,414

performance rights in respect of ordinary shares to Executive and

key staff to be issued at nil cost.

14,845,702 of the performance rights under the LTI have been

awarded in recognition of the past achievement of the Company's

objectives in FY2021. The rights were valued at the spot rate of

the shares at grant date, and the value is amortised over the

vesting period. The rights vest annually over 3 years in equal

tranches with the first vesting date being 1 July 2022 and require

the employee to remain continuously employed by the Company until

each relevant vesting date. If an employee leaves before the rights

vest and the service condition is therefore not met, the rights

lapse.

In some cases, for 'good leavers', determined on a discretionary

basis by management, options are prorated for service in the

current period and that portion are vested on termination, and the

remaining rights are cancelled.

The remaining 50,150,712 performance rights have been granted

under Key Person Agreements in respect of a total of 27 nominated

key people. These people have been identified as having key roles

directly related to the Company's long-term success and the

allocation of accelerated performance rights has been implemented

by the Board to successfully retain these employees and affirm

successful delivery on a range of projects and customer

commitments. These awards have an accelerated grant with delayed

vesting taking place on 1 July 2024 and require the employee to

remain continuously employed by the Company until the vesting date.

If an employee leaves before the rights vest and the service

condition is therefore not met, the rights lapse.

There is no cash settlement of the rights.

16 Related party disclosures

The following table provides the total amount of transactions

that have been entered into with related parties during the

six-month period ended 31 December 2021 and 2020:

Balance Granted as Acquired Balance

1-Jul Remuneration or sold for 31-Dec

cash

A$000 A$000 A$000 A$000

------- ------------------ -------------- ----------

Director shares:

Directors' securities 2021 5,714 - 238 5,952

Directors' securities 2020 6,837 1,604 - 8,441

17 Commitments

As at 31 December 2021, the group had commitments of

A$32,598,000 (31 December 2020: A$23,674,000) relating to the

manufacturing contract for the Group's Guardian 2.1 product for the

period January 2022 to March 2023 (31 December 2020: January 2021

to January 2022).

Notes to the Interim Consolidated Financial Statements -

Unaudited

18 Events after the reporting period

Other than the matters outlined below, there have been no

matters that have occurred subsequent to the reporting date, which

have significantly affected, or may significantly affect, the

Group's operations, results or state of affairs in future

periods.

-- As noted in cash and cash equivalents (refer Note 5), the

enhanced yield deposit matured on 10 January 2022. The strike rate

of the transaction was 0.5365 GBP/AUD, resulting in a principal

amount of A$50,326,000 and interest of A$203,000.

[1] This refers to underlying growth rates at constant currency

or adjusting for currency so business results can be viewed without

the impact of fluctuations in foreign currency exchange rates,

thereby facilitating period-to-period comparisons of Seeing

Machines business performance. To present this information, current

period results and comparative period results are converted into

Australian dollars at the 31 December 2021 exchange rate.

[2] Market expectations for FY2022 are for revenue of A$55.6m

and EBITDA of A$(32.7m)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGFFFGKGZZG

(END) Dow Jones Newswires

March 30, 2022 02:00 ET (06:00 GMT)

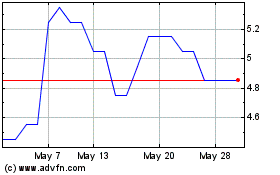

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Seeing Machines (AQSE:SEE.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024