TIDMORM

RNS Number : 0781O

Ormonde Mining PLC

29 September 2023

29 September 2023

Ormonde Mi n i ng p lc

("Or m onde" or the "C o m pany ")

Interim Results for the six months ended 30 June 2023

Ormonde Mining plc (AQSE: ORM), a natural resource company

providing exposure to quality and diverse assets across a range of

strategic minerals, announces its unaudited interim results for the

six months ended 30 June 2023.

Key points:

-- Acquisition of an initial 36.2% interest in Toronto-listed

exploration company, TRU Precious Metals Corp ("TRU"), which is

exploring for gold and copper in the highly prospective Central

Newfoundland Gold Belt in Canada

-- Acquisition of a 20% interest in Peak Nickel Limited ("PNL")

which is advancing exploration on a potentially significant battery

metals project

-- Transfer of the Company's shares to trading on the Aquis Growth Market

Brendan McMorrow, Chief Executive Officer, commented:

"I am very pleased with the progress achieved during the first

six months of 2023. During the period we identified and negotiated

two highly attractive investment opportunities to advance the

Board's stated goal of generating shareholder value by leveraging

the Company's balance sheet and resources whilst carefully managing

its operating costs.

"The Company now has exposure to two compelling, diverse and

complementary exploration opportunities. These opportunities

position the Company and its shareholders for future capital

growth, while retaining a stock market listing on the Aquis Growth

Market."

Operational Review

TRU Investment

On 30 June 2023, just prior to the end of the reporting period,

Ormonde announced its intention to acquire an initial 36.2%

interest in TRU's share capital through a private subscription for

60 million new common shares of TRU at CAD $0.05 per share for a

total consideration of CAD $3,000,000. Ormonde has the potential to

increase its shareholding up to 46.0% through the exercise of

warrants. This investment was approved by Ormonde's shareholders

after the period end, on 25 August 2023, and completed on 5

September 2023.

TRU's flagship Golden Rose Project ("Golden Rose") is in the

highly prospective Cape Ray - Valentine Lake gold-bearing

structural corridor in Southern Central Newfoundland. Golden Rose

is a regional-scale 273.5 km(2) land package, of which 240.25km(2)

is fully owned by TRU, with the additional 33.25 km(2) held under

an option to acquire a 65% interest.

This coherent land package straddles a 45km strike length along

the deposit-bearing Cape Ray -Valentine Lake shear zone and is

located between Marathon Gold's Valentine Gold Project (4 million

oz Measured and Indicated) and Matador Mining's Cape Ray Gold

Project (0.6 million oz Indicated and Inferred - exploration

continuing).

Following recent significant discoveries, Newfoundland has

become one of the world's most attractive gold exploration regions.

The prospective geology, ease of access, a supportive local

government and moderate weather all combine to give Newfoundland a

top 10 global ranking for mining investment attractiveness by the

Fraser Institute.

Within the TRU landholding, various mineralisation styles have

already been recognised, including a structural domain potentially

similar to the Curraghinalt gold deposit in Northern Ireland (6

million oz). Golden Rose has had limited historical exploration,

but the prospectivity of the area has been confirmed. TRU has

capitalised on previous work and is already turning up new

high-grade gold and copper mineralised targets on the property with

high grades similar to those that other Newfoundland explorers have

been reporting in recent years.

With the help of Ormonde, TRU intends to fast-track the

advancement of Golden Rose, as well as the evaluation of other

mineral property transaction opportunities, leveraging our teams'

complementary experience.

PNL Investment

PNL, in which Ormonde acquired a 20% interest on 7 February

2023, is a private UK-based company, which is advancing exploration

on a promising battery metals project. Ormonde's investment (

GBP512,500) was designed to support a fast-track initial drilling

programme aimed at identifying a modern, code-compliant resource in

those minerals. The Board is continuing to closely follow the

progress of this exploration programme with a view to supporting,

if and as appropriate and commensurate with Ormonde's shareholding,

the further development of this very attractive project, as the

opportunities unfold.

Financial Review

Interim Results

The Company reports a loss after tax for the six months ended 30

June 2023 of EUR454,000 (H1 2022: EUR363,000 Loss), with the

increased loss for the period reflecting additional costs incurred

on the two transactions set out in the Operational Review

above.

As at 30 June 2023, the Company held EUR2.5 million of cash

(EUR3.4 million at 31 Dec 2022).

Deferred Consideration

The Company has, after the period end, received the second

instalment of consideration (EUR500,000) due in respect of the

disposal of the La Zarza assets, which completed on 3 October 2022.

A further two instalments of EUR500,000 each are due on the second

and third anniversaries of the completion of the sale of the La

Zarza assets.

Admission to the Aquis Growth Market

As of 5 September 2023, the Company's Ordinary Shares have been

admitted to trading on the Access Segment of the Aquis Growth

Market, a Multi-lateral Trading Facility (MTF) and a Recognised

Stock Exchange under S1005 (1)(b) United Kingdom Income Tax Act

2007.

Concurrently, admission of the Company's Ordinary Shares to the

AIM and Euronext Growth markets, from which they had been suspended

from trading since 7 February 2023 pending the publication of an

Admission Document, was cancelled on the same day following

shareholder approval.

Enquiries:

Ormonde Mining plc

Brian Timmons, Chairman Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons / Fiona Hetherington Tel: +44 (0)20 7390 0230

Peterhouse Capital (Aquis Corporate

Adviser)

Narisha Ragoonanthun / Brefo Gyasi Tel: +44 (0)20 7469 0930

About Ormonde Mining

Ormonde is a natural resource company which provides its

shareholders with exposure to quality and diverse assets across a

range of strategic minerals. Ormonde's portfolio includes an

initial 36.2% interest in TRU Precious Metals (TSXV: TRU), which is

exploring for gold and copper in the highly prospective Central

Newfoundland Gold Belt in Canada, and a 20% interest in Peak

Nickel, which is advancing exploration on a potentially significant

battery metals project.

Ormonde's shares are listed on the Aquis Growth Market under the

symbol AQSE: ORM.

For more information, visit the Company's website at

www.ormondemining.com .

Ormonde Mining plc

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2023

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-23 30-Jun-22 31-Dec-22

EUR000s EUR000s EUR000s

Turnover - - -

Administration expenses (536) (350) (881)

Impairment of asset classified as held for sale - - (167)

______ ______ ______

Loss on ordinary activities (536) (350) (1,048)

Finance costs (2) (13) (17)

Finance income (non cash) 84 - -

______ ______ ______

Loss for the period from continuing activities (454) (363) (1,065)

Taxation on loss - - -

______ ______ ______

Total comprehensive loss for the period (454) (363) (1,065)

Earnings per share

from continuing operations

Basic & diluted loss per share (in cent) (0.10) (0.08) (0.23)

Total earnings per share

Basic & diluted loss per share (in cent) (0.10) (0.08) (0.23)

Ormonde Mining plc

Consolidated Statement of Financial Position

As at 30 June 2023

unaudited unaudited audited

30-Jun-23 30-Jun-22 31-Dec-22

Note EUR000s EUR000s EUR000s

Assets

Non-current assets

Intangible assets 157 315 157

Trade and other receivables 5 784 - 700

Financial assets 4 656 - -

_______ _______ _______

Total Non-Current Assets 1,597 315 857

Current assets

Trade and other receivables 5 540 49 613

Cash and cash equivalents 2,524 3,385 3,564

Asset classified as held for sale - 2,000 -

_______ _______ _______

Total current assets 3,064 5,434 4,177

_______ _______ _______

Total assets 4,661 5,749 5,034

_______ _______ _______

Equity & liabilities

Equity

Issued share capital 6 4,725 4,725 4,725

Share premium account 6 29,932 29,932 29,932

Share based payment reserve 281 281 281

Capital conversion reserve fund 29 29 29

Capital redemption reserve fund 7 7 7

Retained losses (30,532) (29,376) (30,078)

_______ _______ _______

Total equity - attributable to the owners of the Company 4,442 5,598 4,896

Current liabilities

Trade & other payables 219 151 138

_______ _______ _______

Total liabilities 219 151 138

_______ _______ _______

Total equity & liabilities 4,661 5,749 5,034

_______ _______ _______

Ormonde Mining plc

Consolidated Statement of Cashflows

Six months ended 30 June 2023

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-23 30-Jun-22 31-Dec-22

EUR000s EUR000s EUR000s

Cashflows from operating activities

Loss for period before taxation (454) (363) (1,065)

________ ________ ________

(454) (363) (1,065)

Adjustments for non-cash items:

Impairment of intangible assets - - 167

Finance income (84) - -

________ ________ ________

(538) (363) (898)

Movement in Working Capital

Movement in receivables 74 44 (20)

Movement in liabilities 80 (36) (49)

________ ________ ________

Net Cash used in operations (384) (355) (967)

Investing activities

Expenditure on intangible assets - (6) (15)

Expenditure on financial assets (656) - -

Proceeds from disposal of assets held for resale - - 800

________ ________ ________

Net cash generated by / (used in) investing activities (656) (6) 785

Net decrease in cash and cash equivalents (1,040) (361) (182)

Cash and cash equivalents at beginning of period 3,564 3,746 3,746

________ ________ ________

Cash and cash equivalents at end of period 2,524 3,385 3,564

________ ________ ________

Ormonde Mining plc

Consolidated Statement of Changes in Equity

Six months ended 30 June 2023

Share Based

Payment Reserve

Share Capital Share Premium Other Reserves Retained Losses Total

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

At 1 January 2022 4,725 29,932 281 36 (29,013) 5,961

Loss for the period - - - - (363) (363)

______ ______ ______ ______ ______ ______

Total comprehensive

income for the

period - - - - (363) (363)

______ ______ ______ ______ ______ ______

At 30 June 2022 4,725 29,932 281 36 (29,376) 5,598

Loss for the period - - - - (702) (702)

______ ______ ______ ______ ______ ______

Total comprehensive

income for the

period - - - - (702) (702)

______ ______ ______ ______ ______ ______

At 31 December 2022 4,725 29,932 281 36 (30,078) 4,896

Loss for the period - - - - (454) (454)

______ ______ ______ ______ ______ ______

Total comprehensive

income for the

period - - - - (454) (454)

______ ______ ______ ______ ______ ______

At 30 June 2023 4,725 29,932 281 36 (30,532) 4,442

______ ______ ______ ______ ______ ______

Notes to the Interim Consolidated Financial Statements

1. Accounting policies and basis of preparation

Ormonde Mining plc is a company incorporated and domiciled in

the Republic of Ireland. The Interim Consolidated Financial

Statements for the six months ended 30 June 2023 comprise the

Company and its subsidiaries (together referred to as the "Group"),

and have not been audited or reviewed by the Company's

auditors.

The Interim Consolidated Financial Statements do not include all

of the information required for full annual financial statements

and should be read in conjunction with the audited consolidated

financial statements of the Group as at and for the year ended 31

December 2022, which are available on the Company's website at

https://ormondemining.com/ . The audit opinion on the statutory

financial statements for the year ended 31 December 2022 was

unqualified.

The financial information in this report has been prepared using

accounting policies consistent with International Financial

Reporting Standards (" IFRS") as adopted by the European Union.

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board ("IASB") and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the European Commission. These policies are

consistent with those to be adopted in the Group's consolidated

financial statements for the year ending 31 December 2023. The

accounting policies applied by the Group in the Interim

Consolidated Financial Statements are the same as those applied by

the Group in the consolidated financial statements for the year

ended 31 December 2022.

The Directors have prepared the Interim Consolidated Financial

Statements on the going concern basis which assumes that the Group

and Company will have sufficient resources to continue in operation

for the foreseeable future, being a period of not less than 12

months from the date of signing of these statements. The Directors

have prepared cashflow forecasts for the twelve-month period to

September 2024 and on that basis consider it appropriate to prepare

the Interim Consolidated Financial Statements on the going concern

basis. These statements do not include any adjustments that would

result from the going concern basis of preparation not being

adopted.

The unaudited Interim Consolidated Financial Statements were

approved by the Board of Directors on 28 September 2023.

2. Segmental analysis

An analysis by geographical segments is presented below. The

Group has geographical segments in Ireland and Spain.

The segment results for the period ended 30 June 2023 are as

follows:

Ireland Spain Total

Total comprehensive loss for 6 months

to 30 June 2023 EUR000s EUR000s EUR000s

Segment loss for period (431) (23) (454)

______ ______ ______

(431) (23) (454)

______ ______ ______

Total comprehensive loss for year

to 31 December 2022 EUR000s EUR000s EUR000s

Segment loss for period (933) (132) (1,065)

______ ______ ______

(933) (132) (1,065)

______ ______ ______

Total comprehensive loss for 6 months

to 30 June 2022 EUR000s EUR000s EUR000s

Segment loss for period (207) (156) (363)

______ ______ ______

(207) (156) (363)

______ ______ ______

3. Basic earnings per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

Earnings per share 30-Jun-23 30-Jun-22 31-Dec-22

EUR000s EUR000s EUR000s

Loss for the period attributable to

equity holders of the parent:

From continuing business (454) (363) (1,065)

______ ______ ______

Total Loss for period (454) (363) (1,065)

Weighted average number of ordinary

shares

for the purpose of basic earnings per

share 472,507,482 472,507,482 472,507,482

______ ______ ______

Basic loss per ordinary shares (in

cent) from continuing operations (0.10) (0.08) (0.23)

______ ______ ______

Basic loss per ordinary shares (in

cent) Total (0.10) (0.08) (0.23)

______ ______ ______

Diluted earnings per share

For the six months to 30 June 2023, the share options are

anti-dilutive and therefore diluted earnings per share is the same

as the basic earnings per share.

For the six months to 30 June 2022 and the year ended 31

December 2022 the basic and diluted earnings per share are the

same.

4. Financial assets

Financial assets of EUR656,000 is comprised of EUR588,000

relating to the Company's 20% equity investment in Peak Nickel

Limited which is advancing exploration on a potentially significant

battery metals project and EUR68,000 which represents a first

payment relating to the equity investment in TRU Precious Metals

Corporation (a TSX V listed company) which transaction closed on 5

September 2023. See Post balance sheet events note for more

details.

5. Trade and other receivables

Trade receivables include the amount of EUR500,000 (current) and

EUR784,000 (non-current) (total of EUR1.284 Million) representing

the fair value of the EUR1.5 Million deferred consideration

receivable at 30 June 2023 following the disposal in September 2022

of certain land and data assets associated with the La Zarza

project.

6. Share capital

30-Jun-23 30-Jun-22 31-Dec-22

EUR000s EUR000s EUR000s

Authorised Equity

650,000,000 ordinary shares of EUR0.01 each 6,500 6,500 6,500

______ ______ ______

6,500 6,500 6,500

______ ______ ______

Issued Capital

Share Capital 4,725 4,725 4,725

Share Premium 29,932 29,932 29,932

______ ______ ______

34,657 34,657 34,657

______ ______ ______

Issued Capital comprises

472,507,483 ordinary shares of EUR0.01 each 4,725 4,725 4,725

______ ______ ______

4,725 4,725 4,725

______ ______ ______

7. Dividends

No dividends were paid or proposed in respect of the six months

ended 30 June 2023.

8. Post balance sheet events

At an extraordinary general meeting on 25 August 2023,

shareholders passed a resolution to cancel the listing of the

Company's shares from both the AIM Market and the Euronext Growth

Market. At the same extraordinary general meeting the Company was

authorised by shareholders to enter into and complete the TRU

investment.

On 5 September 2023 the Company announced that its ordinary

shares were admitted to trading on the Access Segment of the Aquis

Growth Market. It was then noted that the Company's shares would be

de-listed from trading on both the AIM and Euronext markets with

effect from 7.00 a.m. on the same day.

On 6 September 2023 the Company announced the closing of the

investment in TRU Precious Metals Corporation (TRU - a TSX V listed

company) whereby it acquired a 36.2% equity interest in TRU for a

consideration of CAD$3 Million.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXSEDFAAEDSEEU

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

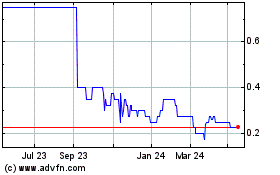

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Nov 2024 to Dec 2024

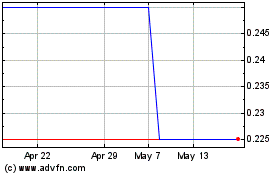

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Dec 2023 to Dec 2024