TIDMORM

RNS Number : 4795H

Ormonde Mining PLC

27 July 2023

27 July 2023

Ormonde Mining plc

(Ormonde or the Company)

Proposed Cancellation of Admission to Trading on AIM and

Euronext Growth

As stated in the announcement of the Company's proposed

investment in TRU Precious Metals Corp (TRU) on 30 June 2023, the

Board of Ormonde proposes to seek Shareholder approval to cancel

the admission of the Company's ordinary shares (the Ordinary

Shares) to trading on AIM and Euronext Growth (the Cancellation).

The Company will be posting a circular to shareholders next week in

connection with the proposed Cancellation (the Circular).

The Circular will set out the background to and reasons for the

Cancellation and additional information on the implications of the

Cancellation for the Company and its Shareholders.

Cancellation of Admission

Reasons for the proposed Cancellation

Ormonde proposes to invest CAD$3 million in TRU (the Investment)

in return for a 36.2% interest in its current issued share capital.

This amounts to 80% of Ormonde's available current cash resources.

Subject to the exercise of the warrants Ormonde has the opportunity

to invest a further $2.25million in TRU to increase its interest in

the issued share capital of TRU to 46%.

Post completion of the Investment in TRU the Company's other

investments will be:

-- Investment in Peak Nickel Ltd (cost GBP512,500)

-- Deferred consideration receivable from sale of La Zarza property (EUR1.5million)

-- Interests in Spanish licenses (currently lapsed, in course of

renewal) (Book asset value of EUR157,000)

TRU is listed on the TSX-V in Canada and it is intended that

post completion of the Investment a substantial element of the

strategic focus of Ormonde's exploration activity will be in TRU's

future activity. Taking all this into account the Board, in

determining the future trajectory and strategic focus of activity

of the enlarged Group and the most appropriate market for listing,

has given consideration to the following factors:

i. A substantial proportion of the Company's activities will

comprise the exploration activity undertaken through TRU, which is

located in Newfoundland, Canada, a region which is experiencing

vibrant exploration and mining M&A activity;

ii. Should the Investment be approved, Ormonde will be the

largest shareholder in TRU. Under TSX-V Rules, it will be

designated as having a Controlling Interest in TRU, and shall be

entitled, under the provisions of the Subscription Agreement, to

appoint a majority of the board of TRU. The existing TRU management

team has considerable experience in mining M&A activity, while

the Ormonde technical team has extensive experience in geological

and mining activity, the combination of which will be brought to

bear on TRU's future development;

iii. TRU has a listing on the TSX-V, a Canadian market which is

considered by the Board to be more appropriate for the raising of

capital for activity in the region and the market in which the TRU

team operate; and

iv. The investment in TRU constitutes a Reverse Takeover under

AIM and Euronext Growth Rules. To retain the listings on AIM and

Euronext Growth, Ormonde would have been required to publish an

admission document for the enlarged group which would have incurred

significant time and expense. The Board determined that the scale

of the Company's activities does not justify the significant cost

burden that an admission document for AIM and Euronext Growth would

require.

This decision also enables the Investment in TRU to proceed

within the time available to execute the transaction.

On the basis of consideration of all of the factors the Board

has concluded that it is most appropriate to cancel the listing on

AIM and Euronext Growth and to pursue alternative measures to

provide liquidity for Ormonde Shareholders in the medium term.

Effects of the Cancellation

In the event that the Cancellation Resolution is passed and the

Admission of the Company's Ordinary Shares to trading on AIM and

Euronext Growth is cancelled, Shareholders will no longer be able

to buy and sell Ordinary Shares in the Company through AIM or

Euronext Growth. Accordingly, the Company would no longer be

subject to the rules and corporate governance requirements to which

companies admitted to trading on AIM and Euronext Growth are

subject (and accordingly shareholders will no longer be afforded

the protections given by the AIM Rules or the Euronext Growth

Rules). Davy will cease to be the Company's nominated adviser and

broker. There will be no formal market for shareholders to effect

transactions in the Company's shares following Cancellation unless

an alternative trading facility is put in place.

Alternative trading facility

The Board, in considering the Investment, was mindful of

providing Shareholders with a mechanism or alternative arrangement

for trading the Ordinary Shares.

Accordingly, the Board is actively pursuing the introduction of

the Ordinary Shares of the Company to an alternative share

exchange. In this regard t he Company intends to apply to have its

Ordinary Shares traded on the AQSE Growth Market, a Recognised

Growth Market, based in London, subject to approval by AQSE

Regulation. In the event that the Company's shares are admitted to

trading on the AQSE, the Company will be subject to the regulations

and corporate governance of the AQSE Exchange.

The Board believes that this initiative would result in

significant ongoing cost savings when compared to maintaining the

Company's listings on AIM and Euronext Growth, while providing

Shareholders with a platform for trading in the Ordinary

Shares.

In the event that the Cancellation is approved, and whether or

not the application for admission to the AQSE Growth Market is

successful, the Board will continue to maintain the highest

standards of corporate governance, integrity and social

responsibility, and disclosure. The Company at present applies the

Quoted Companies Alliance (QCA) Corporate Governance Code, to the

extent applicable to a company of its size, and shall continue to

do so, while continuing to publish its interim and final results

and regular announcements to keep Shareholders fully appraised of

the information available.

Cancellation Process

In accordance with the AIM Rules and the Euronext Growth Rules,

the Company has notified the London Stock Exchange plc and Euronext

of the proposed Cancellation.

Pursuant to the AIM Rules and the Euronext Growth Rules, the

Cancellation can only be effected by the Company after securing the

resolutions of shareholders in a general meeting passed by a

requisite majority, being not less than 75 per cent of the votes

cast (in person or by proxy) by shareholders (the Resolutions).

Under the AIM Rules and Euronext Growth Rules, the Cancellation

can only take place after the expiry of a period of twenty Business

Days from the date on which notice of the Cancellation is given. In

addition, a period of at least five Business Days following the

shareholder approval of the Cancellation is required before the

Cancellation may be put into effect. Accordingly, if the

Resolutions to cancel the Admission is approved, the Cancellation

will become effective at 7.00 a.m. on 5 September 2023.

Should the Cancellation Resolutions not be passed by

Shareholders then the resolution authorising completion of the

Investment will not proceed.

Ormonde became a cash shell company following the sale of its La

Zarza asset last year. In the absence of the Investment proceeding,

or an alternative transaction that would constitute a Reverse

Takeover under the AIM Rules and the Euronext Growth Rules being

executed prior to 4 October 2023, the AIM and Euronext Growth

listings will be cancelled on that date.

Extraordinary General Meeting

The Circular which will be posted to Shareholders next week,

will include a copy of the notice convening the Extraordinary

General Meeting to be held at the Maldron Hotel, located at

Bellevue Ave, Merrion Road, Dublin, D04 K5C2, Republic of Ireland

at 11.30 a.m. on 25 August 2023 at which, inter alia, the

Cancellation Resolution will be proposed.

The Directors of the Company are responsible for the release of

this announcement.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2023

Publication of the Circular 31 July

Latest time and date for receipt of Forms 11.30 a.m. on 23 August

of Proxy for the EGM

Extraordinary General Meeting 11.30 a.m. on 25 August

Expected date that admission to trading of 5 September

the ordinary shares on AIM and Euronext Growth

will be cancelled

Expected Completion of the Investment in TRU 5 September

Precious Metals

INVESTOR ENQUIRIES:

Ormonde Mining plc Brian Timmons, Chairman

Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons / Charlie Neish

Tel: 44 (0)20 7390 0230

Davy (Nomad, Euronext Growth Listing

Sponsor and Broker) Anthony Farrell Tel:

+353 (0)1 679 6363

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUQGMUPWGMM

(END) Dow Jones Newswires

July 27, 2023 13:19 ET (17:19 GMT)

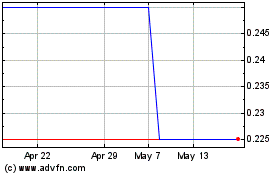

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Nov 2024 to Dec 2024

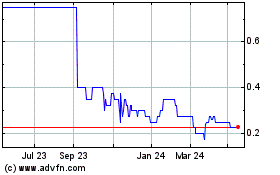

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Dec 2023 to Dec 2024