TIDMMSI

RNS Number : 4063W

MS International PLC

12 December 2023

MS INTERNATIONAL plc

Unaudited Interim Condensed

Group Financial Statements

31st October, 2023

EXECUTIVE DIRECTORS

Michael Bell

Michael O'Connell

Nicholas Bell

NON-EXECUTIVE DIRECTORS

Roger Lane-Smith

David Hansell

COMPANY SECRETARY

Shelley Ashcroft

REGISTERED OFFICE

Balby Carr Bank

Doncaster

DN4 8DH

England

PRINCIPAL OPERATING DIVISIONS

'Defence and Security'

'Forgings'

'Petrol Station Superstructures'

'Corporate Branding'

Chairman's Statement

Introduction

In last June's annual Statement, I highlighted that we anticipated a significant upward step

change in the development of the business that would bring additional rewards and success.

I am now delighted to confirm we have been awarded the first production order contracts with

the US Navy to supply our 30mm naval gun. This significant development is complemented by

a further contract to maintain and support those systems.

I first reported on our efforts to break into the US Navy market in my Chairman's Statement

of 25th July 1988, when I stated, "The first unit built to suit the US Navy specific requirements

awaits ships trials in the United States". It has been a long haul, but vision; persistence;

determination and capability has resulted in success.

We have also delivered a significant contract relating to the first sales of our 'VSHORAD'

land-based mobile counter-drone weapon system. This was the contract where the customer's

delay in taking delivery - because of the war in Europe - negatively impacted last year's

results.

Results

For the half year ended 31st October 2023 profit before tax increased substantially to GBP7.72m

(2022 - GBP3.46m) on revenue of GBP57.02m (2022 - GBP42.03m).

Basic earnings per share were 35.9p (2022 - 17.4p).

The balance sheet is again much stronger with net cash at GBP50.05m (2022 - GBP23.88m), reflecting

the valuable upturn in activity in our 'Defence and Security' businesses.

Prospects

'Defence and security'

We believe that the strong start to 2023/4 looks set to continue, with deliveries gaining

pace against contracts to overseas customers, for both our naval gun and land-based counter-drone

defence systems.

Also, deliveries against our US Navy contracts will commence later in the new year.

Moreover, we are particularly pleased and encouraged by the level of military 'land market'

interest in 'VSHORAD' and the number of enquiries we are receiving from multiple sources as

to its availability and potential supply. Our existing production facilities are capable of

fulfilling our current firm orders. Additionally, the refurbishment and reorganisation of

parts of our, once under-utilised, production facilities in Norwich continues. This programme,

when complete, will better accommodate our prospective production requirements.

'Forgings'

The Forgings division remains a very efficient business and well positioned to continue serving

its broad international customer base. We remain committed to assisting our customers through

our multi continent contemporary fork-arm manufacturing facilities.

'Petrol Station Superstructures'

In September the UK Government announced a revised set of green policies including delaying

the ban on the sale of new petrol and diesel vehicles by five years to 2035. The news reinvigorated

many of our fuel dispensing UK customers, encouraging them to consider expanding and enhancing

the quality of their stations to ensure they remain competitive. In the meantime, we look

forward to an improvement in our eastern Europe market which is reviving after some hesitancy

caused by the region's continuing war.

'Corporate Branding'

We perceive that we remain well placed in our focused market of providing installation, repair

and maintenance within the specialist area of the branding for petrol stations.

Outlook

We believe that we have continued to enhance the performance of the Group's businesses and

with considerable confidence, we look forward to delivering further progress across the Group.

In the light of these positive developments and new commercial relationships, all matters

considered, the Board has declared an increased interim dividend per share of 3p (2022 - 2p)

payable on 19th January 2024 to those shareholders on the register at close of business on

22nd December 2023, with the ex-dividend date being 21st December 2023.

Michael Bell 11(th) December 2023

MS INTERNATIONAL plc

Michael Bell Tel: 01302 322133

Shore Capital (Nominated Adviser and Broker)

Patrick Castle/Daniel Bush/Lucy Bowden Tel: 020 7408 4090

Independent auditor's review report on Interim Financial Information to MS INTERNATIONAL

Plc

Conclusion

We have reviewed the condensed set of financial statements in the half-yearly financial report

MS INTERNATIONAL plc (the 'group') for the six months ended 31 October 2023 which comprises

of Interim condensed consolidated income statement, Interim condensed consolidated statement

of comprehensive income statement, Interim condensed consolidated statement of financial position,

Interim consolidated statement of changes in equity, Interim consolidated cash flow statement

and notes to the interim consolidated financial statements.

Based on our review, nothing has come to our attention that causes us to believe that the

condensed set of financial statements in the half-yearly financial report for the six months

ended 31 October 2023 is not prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'.

Basis for conclusion

We conducted our review in accordance with International Standard on Review Engagements (UK)

(ISRE (UK)) 2410, "Review of Interim Financial Information Performed by the Independent Auditor

of the Entity" (ISRE (UK) 2410). A review of interim financial information consists of making

inquiries, primarily of persons responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing (UK) and consequently does

not enable us to obtain assurance that we would become aware of all significant matters that

might be identified in an audit. Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the group are prepared in accordance

with UK adopted IFRSs. The condensed set of financial statements included in this half yearly

financial report has been prepared in accordance with UK adopted International Accounting

Standard 34, "Interim Financial Reporting".

We have read the other information contained in the half-yearly financial report which comprises

only the Chairman's Statement and considered whether it contains any apparent misstatements

or material inconsistencies with the information in the condensed set of financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than those performed in an audit

as described in the Basis of conclusion section of this report, nothing has come to our attention

to suggest that management have inappropriately adopted the going concern basis of accounting

or that management have identified material uncertainties relating to going concern that are

not appropriately disclosed.

This conclusion is based on the review procedures performed in accordance with this ISRE UK,

however future events or conditions may cause the entity to cease to continue as a going concern.

In our evaluation of the directors' conclusions, we considered the inherent risks associated

with the group's business model including effects arising from macro-economic uncertainties

such as high interest rates and the cost of living crisis, we assessed and challenged the

reasonableness of estimates made by the directors and the related disclosures and analysed

how those risks might affect the group's financial resources or ability to continue operations

over the going concern period.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved by, the directors.

In preparing the half-yearly financial report, the directors are responsible for assessing

the company's ability to continue as a going concern, disclosing, as applicable, matters related

to going concern and using the going concern basis of accounting unless the directors either

intend to liquidate the company or to cease operations, or have no realistic alternative but

to do so.

Auditor's Responsibilities for the review of the financial information

Our responsibility is to express a conclusion to the company on the condensed set of financial

statements in the half-yearly financial report based on our review.

Our conclusion, including our Conclusions relating to going concern, are based on procedures

that are less extensive than audit procedures, as described in the Basis for conclusion paragraph

of this report.

Use of our report

This report is made solely to the company, as a body, in accordance with ISRE (UK) 2410. Our

review work has been undertaken so that we might state to the company those matters we are

required to state to it in an independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility to anyone other than the

company as a body, for our review work, for this report, or for the conclusion we have formed.

Grant Thornton UK LLP

Statutory Auditor, Chartered Accountants

Sheffield

11(th) December 2023

Interim condensed consolidated income

statement

Half-year to 31st October, 2023 Half-year to 31st October, 2022

unaudited unaudited

Notes GBP'000 GBP'000

Revenue 5/6 57,023 42,025

Cost of sales (38,943) (30,095)

-------------------------------------------

Gross profit 18,080 11,930

Distribution costs (2,303) (1,815)

Administrative expenses (7,441) (6,522)

Derivative losses 15 (731) -

-------------------------------------------

Operating profit 6 7,605 3,593

Finance income/(costs) 204 (70)

Other finance costs - pension (90) (63)

------------------------------------------- ------------------------------- -------------------------------

Profit before taxation 7,719 3,460

Tax expense 7 (1,917) (689)

------------------------------------------- ------------------------------- -------------------------------

Profit for the period attributable to

equity holders of the parent 5,802 2,771

------------------------------------------- ------------------------------- -------------------------------

Basic earnings per share 8 35.9p 17.4p

Diluted earnings per share 8 34.3p 16.8p

------------------------------------------- ------------------------------- -------------------------------

Interim condensed consolidated statement of comprehensive income

Half-year to 31st October, 2023 Half-year to 31st October, 2022

unaudited unaudited

Notes GBP'000 GBP'000

Profit for the period attributable to

equity holders of the parent 5,802 2,771

------------------------------------------- ------------------------------- -------------------------------

Exchange differences on retranslation of

foreign operations (43) 57

------------------------------------------- ------------------------------- -------------------------------

Net other comprehensive (loss)/income to be

reclassified to profit or loss in

subsequent

periods (43) 57

------------------------------------------- ------------------------------- -------------------------------

Remeasurement gains/(losses) on defined

benefit pension scheme 13 54 (8)

Deferred taxation on remeasurement of

defined benefit pension scheme (14) 2

Net other comprehensive income/(loss) not

being reclassified to profit or loss in

subsequent

periods 40 (6)

------------------------------------------- ------------------------------- -------------------------------

Total comprehensive income for the period

attributable to equity holders of the

parent 5,799 2,822

------------------------------------------- ------------------------------- -------------------------------

Interim condensed consolidated statement of financial position

Notes 31st 31st October, 2022 30th April, 2023

October,

2023

unaudited unaudited audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 10 25,415 25,076 24,886

Right-of-use assets 11 968 1,328 1,162

Intangible assets 2,365 2,896 2,396

Investment in joint venture - 35 -

Deferred income tax asset 1,716 1,373 1,677

---------------------------------------- ------------- --------------------- -----------------

30,464 30,708 30,121

---------------------------------------- ------------- --------------------- -----------------

Current assets

Inventories 16,940 17,003 24,764

Trade and other receivables 27,578 11,095 9,031

Contract assets 3,374 1,450 144

Cash and cash equivalents 12 42,627 23,363 12,336

Restricted cash held in Escrow 12 7,426 519 2,917

---------------------------------------- ------------- --------------------- -----------------

97,945 53,430 49,192

---------------------------------------- ------------- --------------------- -----------------

TOTAL ASSETS 128,409 84,138 79,313

---------------------------------------- ------------- --------------------- -----------------

EQUITY AND LIABILITIES

Equity

Share capital 1,784 1,784 1,784

Capital redemption reserve 957 957 957

Other reserve 2,815 2,815 2,815

Revaluation reserve 9,923 9,923 9,923

Special reserve 1,629 1,629 1,629

Currency translation reserve (363) (360) (320)

Treasury shares (3,703) (2,789) (2,381)

Retained earnings 30,362 26,242 26,668

---------------------------------------- ------------- --------------------- -----------------

TOTAL EQUITY SHAREHOLDERS' FUNDS 43,404 40,201 41,075

---------------------------------------- ------------- --------------------- -----------------

Non-current liabilities

Defined benefit pension liability 13 3,577 4,341 4,216

Deferred income tax liability 2,941 2,547 2,943

Contract liabilities 19,148 - -

Derivative financial instruments 15 218 - -

Lease liabilities 630 1,003 829

---------------------------------------- ------------- --------------------- -----------------

26,514 7,891 7,988

---------------------------------------- ------------- --------------------- -----------------

Current liabilities

Trade and other payables 19,291 15,070 15,286

Contract liabilities 38,303 20,610 14,585

Derivative financial instruments 15 513 - -

Lease liabilities 384 366 379

---------------------------------------- ------------- --------------------- -----------------

58,491 36,046 30,250

---------------------------------------- ------------- --------------------- -----------------

TOTAL EQUITY AND LIABILITIES 128,409 84,138 79,313

---------------------------------------- ------------- --------------------- -----------------

The interim condensed consolidated financial statements of the Group for the six months ended

31st October, 2023 were authorised for issue in accordance with a resolution of the directors

on 11th December, 2023 and signed on their behalf by:

Michael O'Connell

Finance Director

Interim consolidated statement of changes in equity

Share Capital Other Revaluation Special Currency Treasury Retained Total

capital redemption reserve reserve reserve translation shares earnings unaudited/

reserve reserve audited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30th April,

2022 1,784 957 2,815 9,923 1,629 (417) (2,789) 24,673 38,575

Profit for the

period - - - - - - - 2,771 2,771

Other

comprehensive

income/(loss) - - - - - 57 - (6) 51

Dividend paid - - - - - - - (1,196) (1,196)

At 31st

October, 2022 1,784 957 2,815 9,923 1,629 (360) (2,789) 26,242 40,201

--------------- ------- ---------- ------- ------------ ------- ----------- -------- -------- ----------

Profit for the

period - - - - - - - 1,344 1,344

Other

comprehensive

income/(loss) - - - - - 40 - (272) (232)

Share option

expense - - - - - - - 86 86

Exercise of

share options - - - - - - 408 (408) -

Dividend paid - - - - - - - (324) (324)

At 30th April,

2023 1,784 957 2,815 9,923 1,629 (320) (2,381) 26,668 41,075

--------------- ------- ---------- ------- ------------ ------- ----------- -------- -------- ----------

Profit for the

period - - - - - - - 5,802 5,802

Other

comprehensive

(loss)/income - - - - - (43) - 40 (3)

Dividend paid

(note 9) - - - - - - - (2,123) (2,123)

Share option

expense - - - - - - - 19 19

Purchase of own

shares - - - - - - (1,676) - (1,676)

Exercise of

share options - - - - - - 354 (44) 310

At 31st

October, 2023 1,784 957 2,815 9,923 1,629 (363) (3,703) 30,362 43,404

------- ---------- ------- ------------ ------- ----------- -------- -------- ----------

Interim consolidated cash flow statement

Half-year to 31st October, 2023 Half-year to 31st October, 2022

unaudited unaudited

GBP'000 GBP'000

Profit before taxation 7,719 3,460

Adjustments to reconcile profit before

taxation to cash generated from operating

activates:

Depreciation charge of owned and right-of-use

assets 1,024 968

Amortisation charge 31 119

Profit on disposal of property, plant and

equipment (148) (37)

Net finance (income)/costs (114) 133

Share option expense 19 -

Foreign exchange gains/(losses) 202 (111)

Decrease/(increase) in inventories 7,853 (491)

(Increase)/decrease in receivables (21,598) 2,219

Increase/(decrease) in payables 4,257 (606)

Increase in derivatives 731 -

Increase in contract liabilities 42,255 1,543

Pension fund deficit reduction payments (675) (450)

---------------------------------------------- -------------------------------- --------------------------------

Cash generated from operating activities 41,556 6,747

Net interest received/(paid) 224 (43)

Taxation paid (2,279) (78)

---------------------------------------------- -------------------------------- --------------------------------

Net cash inflow from operating activities 39,501 6,626

---------------------------------------------- -------------------------------- --------------------------------

Investing activities

Purchase of property, plant and equipment (1,168) (879)

Proceeds on disposal of property, plant and

equipment 149 91

(Increase)/decrease in restricted cash held

in Escrow maturing in more than 90 days (4,509) 639

---------------------------------------------- -------------------------------- --------------------------------

Net cash outflow from investing activities (5,528) (149)

---------------------------------------------- -------------------------------- --------------------------------

Financing activities

Buy back of own shares (1,676) -

Proceeds from exercise of employee share 310 -

options

Lease payments (206) (207)

Dividend paid (2,123) (1,196)

---------------------------------------------- -------------------------------- --------------------------------

Net cash outflow from financing activities (3,695) (1,403)

---------------------------------------------- -------------------------------- --------------------------------

Increase in cash and cash equivalents 30,278 5,074

Opening cash and cash equivalents 12,336 18,092

Exchange differences on cash and cash

equivalents 13 197

---------------------------------------------- -------------------------------- --------------------------------

Closing cash and cash equivalents 42,627 23,363

---------------------------------------------- -------------------------------- --------------------------------

Notes to the interim consolidated financial statements

1. Corporate information

MS INTERNATIONAL plc is a public limited company incorporated and domiciled in England and

Wales. The Company's ordinary shares are traded on the Alternative Investment Market (AIM)

market of the London Stock Exchange. The principal activities of the Company and its subsidiaries

("the Group") are the design, manufacture, construction, and servicing of a range of engineering

products and structures. These activities are grouped into the following divisions:

'Defence and Security' - design, manufacture, and service of defence equipment.

'Forging' - manufacture of fork-arms and open die forgings.

'Petrol Station Superstructures' - design, manufacture, construction, and maintenance of petrol

station superstructures.

'Corporate Branding' - design, manufacture, installation, and service of corporate brandings,

including media facades, way-

finding signage, public illumination, creative lighting solutions, and the complete appearance

of petrol station superstructures

and forecourts.

2. Basis of preparation and accounting policies

The consolidated condensed interim financial statements included in this half-yearly financial

report have been prepared in accordance with International Accounting Standard 34, "Interim

Financial Reporting" in conformity with the requirements of the Companies Act 2006. They do

not include all the information and disclosures required in annual financial statements in

accordance with UK adopted International Accounting Standards, and should therefore be read

in conjunction with the Group's Annual Report for the year ended 30th April, 2023 and any

public announcements made by MS INTERNATIONAL plc during the interim reporting period. The

financial statements for the year ended 30th April, 2023 have been filed with the Registrar

of Companies. The auditor's report on these financial statements was unmodified and did not

contain statements under sections 498 (2) or (3) of the Companies Act 2006.

The interim financial information has been reviewed but not audited by the Group's auditor,

Grant Thornton UK LLP. The interim financial information does not constitute full financial

information within the meaning of section 434 of the Companies Act 2006. The auditor's report

is included on page 4.

The accounting policies are consistent with those applied in the financial statements of the

Annual Report for year ended 30th April, 2023, with the exception of a new policy for Derivative

Financial Instruments, as detailed below. The Group has not early adopted any standard, interpretation,

or amendment that has been issued but is not yet effective.

Derivative financial instruments are initially recognised at fair value on the date the derivative

contract is entered into and are subsequently remeasured at their fair value including remeasurement

at the reporting date. The Group has decided not to apply hedge accounting with respect to

forward exchange contracts and as a result changes in the fair values are recognised immediately

within the Consolidated income statement within the Derivative gains or losses line.

The assets and liabilities of the overseas subsidiaries are translated into the presentational

currency of the Group at the rate of exchange ruling at the statement of financial position

date and their income statements are translated at the weighted average exchange rates for

the year. The exchange differences arising on the translation are taken directly to a separate

component of equity.

3. Principal risks and uncertainties

The principal risks and uncertainties facing the Group for the remaining six months of the

financial year are discussed below. Further details of the Group's risks and uncertainties

can be found on page 8 of the Annual Report for the year ended 30th April, 2023, which is

available from MS INTERNATIONAL plc's website: www.msiplc.com

One of the Group's principal risks and uncertainties continues to be the impact of inflationary

pressures upon both trading and profitability. Rising raw material and energy prices have

increased the cost base of all divisions. Where possible cost increases are passed to the

customer, however, in doing so there is uncertainty with regards to any potential impact on

the level of customer demand.

During the interim period, the risk that foreign exchange fluctuations will impact the Group's

performance has increased significantly. A number of international contracts in the 'Defence

and Security' division are denominated in USD, which created a large unhedged currency exposure

within the Group. As a result, management have taken steps to mitigate this risk by taking

out various forward contracts (note 15).

4. Going concern

The condensed interim financial statements included in this report have been prepared on a

going concern basis. Forecasts have been made up to 31(st) December, 2024, which the Directors

believe to be a reasonable expectation based on the information available at the time of signing

these accounts. The forecasts have been assessed for the impact of potential sensitivities,

including a 10% fall in the forecasted Group revenue and a 10% increase in materials prices.

In all scenarios, the Group has sufficient headroom to meet its liabilities as they fall due.

In addition, management have carried out reverse stress tests to 31st December, 2024 under

various scenarios, all of which are considered implausible by management. In all tested scenarios,

the Group would continue as a going concern for at least 12 months from the date of signing.

As a result, in making the going concern assessment the Directors believe there to be no material

uncertainties that could cast significant doubt on the Group's ability to continue operating

as a going concern. The Group has sufficient financial resources with a healthy orderbook

to continue operating for the foreseeable future, being at least to 31(st) December, 2024.

As a result, the Directors continue to adopt the going concern basis of accounting in preparation

of this report.

5. Revenue

The Group's revenue disaggregated by pattern of revenue recognition is as follows:

Half-year Half-year to

to 31st October, 31st October,

2023 2022

unaudited unaudited

GBP'000 GBP'000

Revenue recognised at a point in time 55,780 40,940

Revenue recognised over time 1,243 1,085

---------------------------------------- ------------------ ---------------

Total revenue 57,023 42,025

---------------------------------------- ------------------ ---------------

6. Segment

information

The following table presents segmental revenue and operating profit/(loss) as well as segmental

assets and liabilities of the Group's divisions for the half-year periods ended 31st October,

2023 and 31st October, 2022. The reporting format is determined by the differences in manufacture

and services provided by the divisional segments within the Group.

'Defence and 'Forgings' 'Petrol Station 'Corporate Total

Security' Superstructures' Branding'

2023 2022 2023 2022 2023 2022 2023 2022 2023 2022

unaudited unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue

Segment revenue 33,508 13,956 9,454 12,516 8,555 9,057 5,584 6,835 57,101 42,364

Intercompany

revenue from

other segments - - - - (8) (275) (70) (64) (78) (339)

------------------ ------- --------- ------- ------- -------- -------- ------- ------- --------- ---------

External revenue 33,508 13,956 9,454 12,516 8,547 8,782 5,514 6,771 57,023 42,025

------------------ ------- --------- ------- ------- -------- -------- ------- ------- --------- ---------

Segment result

Operating

profit/(loss) 5,741 (188) 681 2,759 1,285 1,339 (102) (317) 7,605 3,593

Net finance

income/(expense) 114 (133)

------------------ --------- ---------

Profit before

taxation 7,719 3,460

Tax expense (1,917) (689)

------------------ --------- ---------

Profit for the

period 5,802 2,771

------------------ --------- ---------

Segmental assets

Assets

attributable to

segments 79,724 33,088 7,357 8,186 12,586 11,226 5,261 7,941 104,928 60,441

Unallocated

assets* 23,481 23,697

------------------ --------- ---------

Total assets 128,409 84,138

------------------ --------- ---------

Segmental

liabilities

Liabilities

attributable to

segments 68,203 24,913 2,212 2,762 4,683 4,313 2,167 3,510 77,265 35,498

Unallocated

liabilities* 7,740 8,439

Total liabilities 85,005 43,937

Other segmental

information

Capital

expenditure 780 452 194 116 131 109 63 202 1,168 879

Depreciation 210 141 317 319 370 368 127 140 1,024 968

Amortisation 9 9 - - 22 22 - 88 31 119

------------------ ------- --------- ------- ------- -------- -------- ------- ------- --------- ---------

* Unallocated assets include certain fixed assets (including all UK properties), current assets,

and deferred income tax assets. Unallocated liabilities include the defined benefit pension

scheme liability, the deferred income tax liability, and certain current liabilities.

Assets and liabilities attributable to segments comprise the

assets and liabilities of each segment adjusted to reflect the

elimination of the cost of investment in subsidiaries and the

provision of financing loans provided by MS INTERNATIONAL plc.

Revenue between segments is determined on an arm's length basis.

Segment results, assets, and liabilities include items directly

attributable to the segment as well as those that can be allocated

on a reasonable basis.

7. Tax expense

The major components of the tax expense in the consolidated income statement are:

Half-year to

31st October, Half-year to 31st

2023 October, 2022

unaudited unaudited

GBP'000 GBP'000

Current tax expense 1,979 660

Deferred tax (income)/expense (62) 29

------------------------------------------------------------------------------ --------------- -----------------------

Total tax expense reported in the Interim condensed consolidated income

statement 1,917 689

------------------------------------------------------------------------------ --------------- -----------------------

Tax relating to items charged/(credited) to other comprehensive income:

Half-year Half-year

to 31st to 31st

October, October,

2023 2022

unaudited unaudited

GBP'000 GBP'000

Deferred tax on measurement of defined benefit pension

scheme 14 (2)

--------------------------------------------------------- ---------- ----------

Deferred tax in the Interim condensed consolidated

statement of comprehensive income 14 (2)

--------------------------------------------------------- ---------- ----------

8. Earnings per share

The calculation of basic earnings per share of 35.9p (2022 - 17.4p) is based on the profit

for the period attributable to equity holders of the parent of GBP5,802,000 (2022 - GBP2,771,000)

and on a weighted average number of ordinary shares in issue of 16,141,981 (2022 - 15,949,691).

At 31st October, 2023 there were 1,072,693 (2022 - 1,055,000) potentially dilutive shares

on option with a weighted average effect of 789,551 (2022 - 587,217) giving a diluted earnings

per share of 34.3p (2022 - 16.8p).

Half-year

Half-year to 31st

to 31st October, October,

2023 2022

unaudited unaudited

Weighted average number of shares in issue 17,841,073 17,841,073

Less weighted average number of shared held in

the

ESOT (231,387) (245,048)

Less weighted average number of shares purchased

by the Company (1,467,705) (1,646,334)

-------------------------------------------------- ------------------ ------------

Weighted average number of shares to be used in

basic

EPS calculation 16,141,981 15,949,691

Weighted average number of the 1,072,693 (2022 -

1,055,000) potentially dilutive shares 789,551 587,217

-------------------------------------------------- ------------------ ------------

Weighted average diluted shares 16,931,532 16,536,908

-------------------------------------------------- ------------------ ------------

Profit for the period attributable to equity

holders

to the parent in GBP 5,802,000 2,771,000

Basic earnings per share 35.9p 17.4p

Diluted earnings per share 34.3p 16.8p

9. Dividends paid and proposed

Half-year to

31st October, Half-year to 31st

2022 October, 2021

unaudited unaudited

GBP'000 GBP'000

Declared and paid during the six month period

Final dividend on ordinary shares for 2023 - 15p (2022 - 7.5p) 2,123 1,196

------------------------------------------------------------------------------ --------------- -----------------------

Proposed for approval

Interim dividend on ordinary shares for 2024 - 3p (2023 - 2p) 487 319

------------------------------------------------------------------------------ --------------- -----------------------

The interim dividend will be payable on 19th January, 2024 to those shareholders on the register

at the close of business on 22nd December, 2023, with the ex-dividend date being 21(st) December,

2023.

10. Property, plant and equipment

At 31st October, 2023

Freehold Plant and

property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2023 21,930 17,298 39,228

Additions 517 651 1,168

Disposals - (316) (316)

Exchange differences 194 63 257

--------------------------------------- --------- ---------- --------

At 31st October, 2023 22,641 17,696 40,337

--------------------------------------- --------- ---------- --------

Accumulated depreciation

At 30th April, 2023 395 13,947 14,342

Depreciation charge for the period 202 636 838

Disposals - (315) (315)

Exchange differences 7 50 57

--------------------------------------- --------- ---------- --------

At 31st October, 2023 604 14,318 14,922

--------------------------------------- --------- ---------- --------

Net book value at 31st October, 2023 22,037 3,378 25,415

--------------------------------------- --------- ---------- --------

Analysis of cost or valuation

At professional valuation 21,681 - 21,681

At cost 960 17,696 18,656

--------------------------------------- --------- ---------- --------

At 31st October, 2023 22,641 17,696 40,337

--------------------------------------- --------- ---------- --------

At 31st October, 2022

Freehold Plant and

property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2022 21,368 16,106 37,474

Additions 185 694 879

Disposals - (182) (182)

Exchange differences 419 147 566

At 31st October, 2022 21,972 16,765 38,737

--------------------------------------- --------- ---------- --------

Accumulated depreciation

At 30th April, 2022 - 12,937 12,937

Depreciation charge for the period 198 582 780

Disposals - (128) (128)

Exchange differences 2 70 72

--------------------------------------- --------- ---------- --------

At 31st October, 2022 200 13,461 13,661

--------- ---------- --------

Net book value at 31st October, 2022 21,772 3,304 25,076

--------------------------------------- --------- ---------- --------

Analysis of cost or valuation

At professional valuation 21,787 - 21,787

At cost 185 16,765 16,950

--------------------------------------- --------- ---------- --------

At 31st October, 2022 21,972 16,765 38,737

--------------------------------------- --------- ---------- --------

At 30th April, 2023

Freehold Plant and

property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2022 21,368 16,106 37,474

Additions 421 1,550 1,971

Disposals - (488) (488)

Exchange differences 141 130 271

---------------------------------------------------------- --------------- ---------------- ------------

At 30th April, 2023 21,930 17,298 39,228

---------------------------------------------------------- --------------- ---------------- ------------

Accumulated depreciation

At 30th April, 2022 - 12,937 12,937

Depreciation charge for the year 400 1,268 1,668

Disposals - (358) (358)

Exchange differences (5) 100 95

---------------------------------------------------------- --------------- ---------------- ------------

At 30th April, 2023 395 13,947 14,342

---------------------------------------------------------- --------------- ---------------- ------------

Net book value at 30th April, 2023 21,535 3,351 24,886

---------------------------------------------------------- --------------- ---------------- ------------

Analysis of cost or valuation

At professional valuation 21,930 - 21,930

At cost - 17,298 17,298

---------------------------------------------------------- --------------- ---------------- ------------

At 30th April, 2023 21,930 17,298 39,228

---------------------------------------------------------- --------------- ---------------- ------------

At 30th April, 2022 the Group's land and buildings, which consist of manufacturing and office

facilities in the USA, Poland, and UK were valued by Real Estate & Appraisal Services Inc

(USA), KonSolid-Nieruchomosci (Poland) and Dove Haigh Phillips (UK). Management determined

that these constitute one class of asset under IFRS 13 (designated as level 3 fair value assets),

based on the nature, characteristics and risks of the properties.

The properties in the UK were valued on the basis of an existing use value in accordance with

the Appraisal and Valuation Standards (5th Edition) published by the Royal Institution of

Chartered Surveyors. The Polish property was valued based on the income approach, converting

anticipated future benefits in the form of rental income into present value. The US property

was valued on an income and market value basis. For all properties, there is no difference

between current use and highest and best use.

11. Right-of-use assets

At 31st October, 2023 Plant and

Property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2023 2,312 - 2,312

Exchange differences (12) - (12)

----------------------------------------------- ------------------- ------------------- -----------------

At 31st October, 2023 2,300 - 2,300

----------------------------------------------- ------------------- ------------------- -----------------

Accumulated depreciation

At 30th April, 2023 1,150 - 1,150

Depreciation charge for the period 186 - 186

Exchange differences (4) - (4)

----------------------------------------------- ------------------- ------------------- -----------------

At 31st October, 2023 1,332 - 1,332

----------------------------------------------- ------------------- ------------------- -----------------

Net book value at 31st October, 2023 968 - 968

----------------------------------------------- ------------------- ------------------- -----------------

At 31st October, 2022 Plant and

Property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2022 2,218 10 2,228

Exchange differences 56 - 56

----------------------------------------------- ------------------- ------------------- -----------------

At 31st October, 2022 2,274 10 2,284

----------------------------------------------- ------------------- ------------------- -----------------

Accumulated depreciation

At 30th April, 2022 741 8 749

Depreciation charge for the period 186 2 188

Exchange differences 19 - 19

----------------------------------------------- ------------------- ------------------- -----------------

At 31st October, 2022 946 10 956

----------------------------------------------- ------------------- ------------------- -----------------

Net book value at 31st October, 2022 1,328 - 1,328

----------------------------------------------- ------------------- ------------------- -----------------

At 30th April, 2023 Plant and

Property equipment Total

GBP'000 GBP'000 GBP'000

Cost or valuation

At 30th April, 2022 2,218 10 2,228

Disposals - (10) (10)

Exchange differences 94 - 94

----------------------------------------------- ------------------- ------------------- -----------------

At 30th April, 2023 2,312 - 2,312

----------------------------------------------- ------------------- ------------------- -----------------

Accumulated depreciation

At 30th April, 2022 741 8 749

Depreciation charge for the year 374 2 376

Disposals - (10) (10)

Exchange differences 35 - 35

----------------------------------------------- ------------------- ------------------- -----------------

At 30th April, 2023 1,150 - 1,150

----------------------------------------------- ------------------- ------------------- -----------------

Net book value at 30th April, 2023 1,162 - 1,162

----------------------------------------------- ------------------- ------------------- -----------------

12. Cash and cash equivalents

For the purpose of the interim consolidated cash flow statement, cash and cash equivalents

are comprised of the following:

31st October, 2023 31st October, 2022 30th April, 2023

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 42,627 23,363 12,336

Restricted cash held in Escrow - maturing in

more than 90 days 7,426 519 2,917

Total cash 50,053 23,882 15,253

----------------------------------------------- ------------------- ------------------- -----------------

The restricted cash balance held in Escrow provides security to Lloyds Bank plc in respect

of certain guarantees, indemnities, and performance bonds given by the Group in the ordinary

course of business.

13. Pension liability

The Company operates an employee pension scheme called the MS INTERNATIONAL plc Retirement

and Death Benefits Scheme ("the Scheme"). IAS 19 requires disclosure of certain information

about the Scheme as follows:

* Until 5th April, 1997, the Scheme provided defined

benefits and these liabilities remain in respect of

service prior to 6th April, 1997. From 6th April,

1997 until 31st May, 2007 the Scheme provided future

service benefits on a defined contribution basis.

* The last formal valuation of the Scheme was performed

at 7th May, 2021 by a professionally qualified

actuary.

* From 6th April, 2016 the Company directly pays the

expenses of the Scheme. The total pension scheme

expenses incurred by the Company during the period

were GBP221,000 (2022: GBP137,000).

* Deficit reduction contributions paid into the Scheme

by the Company are GBP900,000 per annum. The deficit

reduction contributions are paid on a quarterly basis

with the first having been paid on or after 1st July,

2021 and the last being due for payment on or before

1st April, 2028. The total deficit reduction payments

made in the period were GBP675,000 (2022 -

GBP450,000).

* From 1st June, 2007 the Company has operated a

defined contribution scheme for its UK employees

which is administered by a UK pension provider.

Member contributions are paid in line with this

Scheme's documentation over the accounting period and

the Company has no further obligations once the

contributions have been made. At 30th April, 2023 the

present value of the contracted future deficit

reduction contributions was GBP3,577,000 (2022 -

GBP4,341,000), which was greater than the net scheme

asset of GBP48,000 (2022 - GBP2,337,000 liability).

As the Company does not have an unconditional right

to the economic benefits arising from this surplus,

an additional liability of GBP3,625,000 (2022 -

GBP2,004,000) has been recognised in the financial

statements in accordance with IFRIC 14.

* The pension scheme liability has reduced by

GBP639,000 from GBP4,216,000 at 30th April, 2023 to

GBP3,577,000 at 31st October, 2023. A total actuarial

gain of GBP54,000 (2022 - GBP8,000 loss) has been

recognised through other comprehensive income. It

comprises of a GBP671,000 remeasurement loss (2022 -

GBP3,493,000) compared to the interest income on the

plan assets, a GBP1,413,000 actuarial gain (2022 -

GBP4,346,000 gain) due to changes in financial

assumptions and a loss relating to IFRIC 14 of

GBP688,000 (2022 - GBP861,000). The interest cost on

the net defined benefit liability of GBP90,000 (2022

- GBP63,000) has been recognised through the income

statement. The Scheme's liabilities have been reduced

by pension fund deficit payments in the period of

GBP675,000 (2022 - GBP450,000).

14. Commitments and contingencies

The Company is contingently liable in respect of guarantees, indemnities and performance bonds

given in the ordinary course of business amounting to GBP7,416,000 at 31st October, 2023 (2022

- GBP1,566,000).

In the opinion of the Directors, no material loss will arise in connection with the above

matters.

The Group and certain of its subsidiary undertakings are parties to legal actions and claims

which have arisen in the normal course of business. The results of actions and claims cannot

be forecast with certainty, but the directors believe that they will be concluded without

any material effect on the net assets of the Group.

15. Derivative financial instruments

During the period, the Group has entered into a number of forward currency contracts in respect

of USD denominated cash inflows in the 'Defence and Security' division.

The Group has chosen not to adopt hedge accounting with respect to forward exchange contracts

and as a result the loss of GBP731,000 arising from the change in the fair value during the

period has been included within operating profit.

Change in

US Dollar Sterling Average Fair Value

$'000 GBP'000 forward rate GBP'000

Current derivative

liability 41,500 33,615 1.2346 513

Non-current derivative

liability 57,500 46,680 1.2318 218

--------------------------- ---------- --------- -------------- ------------

Total 99,000 80,295 1.2330 731

--------------------------- ---------- --------- -------------- ------------

16. Share-based payments

During the period, a total of 122,700 share options have been granted to executive directors,

non-executive directors, and employees under the MS INTERNATIONAL plc Company Share Option

Plan. These options are exercisable in three equal amounts at three, four and five years after

the date of grant and are not subject to any share price performance conditions. Of the options,

4,800 have been granted at an exercise price of GBP6.24 and the remaining 117,900 have been

granted at an exercise price of GBP7.20 per share.

Share options totalling 320,007 have been exercised during the period. This includes 100,000

options exercised under the MS INTERNATIONAL plc Long Term Incentive Plan at an exercise price

of GBP0 per share, and a further 220,007 options exercised under the MS INTERNATIONAL Plc

Company Share Option Scheme at an exercise price of GBP1.41 per share.

170,007 of the options were satisfied by transferring shares from treasury and the remaining

150,000 options were satisfied by transferring shares from The Employee Share Ownership Trust

("ESOT").

The following tables illustrate the number and weighted average exercise prices (WAEP) of

share options during the year:

Long-term Company Share Total

Incentive Option Plan

Plan

Number WAEP Number WAEP Number WAEP

Outstanding

at 30th

April, 2022 500,000 - 1,000,000 GBP1.41 1,500,000 GBP0.94

Granted in

year - - 20,000 GBP3.00 20,000 GBP3.00

Exercised in

year (250,000) - - - (250,000) -

-------------- ---------- ------ ---------- -------- ---------- --------

Outstanding

at 30th

April, 2023 250,000 - 1,020,000 GBP1.44 1,270,000 GBP1.16

Granted in

year - - 122,700 GBP7.16 122,700 GBP7.16

Exercised in

year (100,000) - (220,007) GBP1.41 (320,007) GBP0.97

-------------- ---------- ------ ---------- -------- ---------- --------

Outstanding

at 31st

October,

2023 150,000 - 922,693 GBP2.21 1,072,693 GBP1.90

--------------

The Group recognised a total charge during the period of GBP19,000 (2022 - GBP15,000) in relation

to equity-settled share-based payment transactions. At 31st October, 2023 there were 150,000

(2022 - nil) and 113,337 (2022 - nil) share options exercisable in the LTIP and CSOP share

option schemes respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCBDDSUBDGXB

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

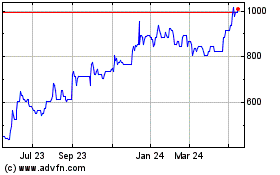

MS (AQSE:MSI.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

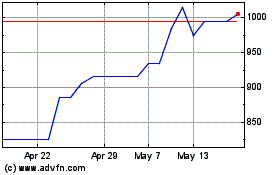

MS (AQSE:MSI.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025