TIDMKIBO

RNS Number : 1302R

Kibo Energy PLC

27 February 2023

Kibo Energy PLC (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

('Kibo' or 'the Company')

Dated: 27 February 2023

Kibo Energy PLC

('Kibo' or the 'Company')

MED's Pyebridge Has Significant Enhancement of Income Following

Capacity Market Auction Results and Update of Trading Results for

2022

Kibo Energy PLC (AIM: KIBO; AltX: KBO), the renewable

energy-focused development company, is pleased to note the positive

announcement by its subsidiary, Mast Energy Developments ('MED'),

with regards to its current flagship and producing asset, the 9 MW

Pyebridge synchronous gas-powered flexible generation facility (the

'Site' or 'Pyebridge'). The update specifically refers to the

Site's Capacity Market ('CM') contract and the outcome of the

recent Capacity Market Auction results as well as an overview of

the key highlights with regards to the Site's actual performance

for 2022, both operationally and economically. The full

announcement can be viewed at

https://polaris.brighterir.com/public/mast_energy_developments/news/rns/story/r77nkjr

and as set out below.

Louis Coetzee, CEO of Kibo Energy said: "The Pyebridge site's

performance during 2022 has exceeded our expectations,

outperforming the average market price by 88% and highlighting

MED's ability to provide significantly better returns compared to

the market. Furthermore, MED is on track to bringing its next

project, Bordesley, into production later this year along with

advancing the development of the rest of the projects within its

portfolio".

Full MED announcement:

Mast Energy Developments PLC

Pyebridge Has Significant Enhancement of Income Following

Capacity Market Auction Results and Update of Trading Results for

2022

Mast Energy Developments PLC ('MED' or the 'Company'), the

UK-based multi-asset owner and operator in the rapidly growing

Flexible Energy market is pleased to announce an update with

regards to its current flagship producing asset, the 9 MW Pyebridge

Synchronous Gas-powered Flexible Generation Facility (the 'Site' or

'Pyebridge'). The update specifically refers to the Site's Capacity

Market ('CM') contract and the outcome of the recent Capacity

Market Auction results, as well as an overview of the key

highlights with regards to the Site's actual performance for 2022,

both operationally and economically.

Capacity Market

Upon acquisition of the Site by MED, it had a pre-existing T-4

CM contract at a tariff of GBP8/kW/pa with a contract value of c.

GBP60k per annum. Due to the UK energy market having moved

significantly since the Site previously obtained the aforementioned

contract, MED took a strategic decision to forego the contract in

favour of applying for new replacement CM contracts in the

2022/2023 CM bid window. Consequently, MED applied for and was

successful in pre-qualification to bid for two new CM contracts,

being a T-1 and a T-4 CM contract. Following the preparation of a

robust CM Auction bid strategy, MED is pleased to announce that

pursuant to the recent Capacity Market Auctions and subsequent

results, its T-1 bid cleared at GBP60/kW/pa and, its T-4 bid

cleared at an unprecedented historic record price of

GBP63/kW/pa.

The Directors are pleased at the success of MED's strategy to

replace the Site's previous low-value CM contract with new

replacement contracts at significantly higher tariffs. The Site's

new replacement T-4 contract at GBP63/kW/pa compared to its

previous T-4 CM contract at GBP8/kW/pa results in a c. 7.5x (or

750%) uplift in income. The new additional T-1 CM contract, which

the Site did not have before and is a new additional contract, will

further enhance the Site's revenue significantly.

The Site's new T-1 CM contract has a revenue value of c. GBP308k

per annum and its new T-4 CM contract has a revenue value of c.

GBP324k per annum (the latter up from the previous T-4 contract's

c. GBP60k per annum). Both contract values will increase the Site's

revenue profile accordingly.

Pyebridge Trading Update

Following the period of the Site's post-acquisition optimisation

(see RNS dated 5 July 2022), and since starting full-scale

production during March 2022, the Site generated the following

actual performance figures for the c. 10-month period March to

December 2022 (the 'Period'):

* Electricity Generation Sales Revenue for the Period: c.

GBP1.054m,

* Total Electricity Generation Output for the Period: c. 2,738

MWh, and

* Average Electricity Generation Sales Price achieved per MWh

sold for the Period: c. GBP385.

Both the achieved generation production and sales price

outperformed the market, with the market's average wholesale price

in 2022 coming to only c. GBP204 per MWh, resulting in an 88%

performance above the market and validating MED's strategy and

ability to outperform the market. MED's success in this regard is

mostly related to the astute utilisation of Artificial Intelligence

('AI') and Machine Learning ('ML') techniques related to its

trading algorithm, in conjunction with its PPA Route-to-Market

partner, Statkraft.

The Site's previous financial performance led the Company to

increase its expectations of Pyebridge, which were set out in the

Pyebridge Trading Update RNS announcement dated 19 October 2022.

The Company confirms that due to unexpected variables during the

period under review, including the generation of unprecedented

record levels of electricity generation from renewables, most

notably wind (which is a hedge to reserve power) from September to

December 2022 in the UK, and which went beyond those considered

possible by the Company when issuing its expectations, the

previously stated expectations are no longer valid. This is a

consequence of the increase in electricity generation from

renewables reducing the reserve power required across the UK during

this period and consequently impacting the electricity generation

sales at Pyebridge.

Pyebridge Asset Value

Following the Pyebridge SPA deferred consideration settlement

(see RNS dated 16 December 2022), the total effective acquisition

purchase price for the Site was reduced to c. GBP2.1m.

During the Site's recent annual insurance cover policy review,

the Site's asset value was independently confirmed at c. GBP6.3m

(on a conservative replacement cost basis). The Site's fair asset

value compared to its purchase price therefore highlights the

significant upside that MED's investment in Pyebridge has

established.

Pieter Krügel, MED CEO, commented: "We are pleased to report

that Pyebridge obtained new Capacity Market contracts at

considerably higher values, which will significantly enhance the

Site's revenue profile and profitability. Moreover, we are pleased

with the Site's actual performance during 2022, with specific

reference to the 88% outperformance of the average market price,

highlighting our ability to provide significantly better returns

compared to the market. We are confident in our ability and

strategy to keep delivering outperformance during 2023. Finally,

the Site's fair asset value compared to its acquisition price

furthermore highlights MED's ability to identify and acquire sites

at an attractive discount in order to enhance value for its

shareholders.

Further, we are advancing the development of the rest of our

projects in the portfolio and looking forward to bringing our next

project, Bordesley into production later this year.

"MED has a very exciting year ahead, being well established and

positioned to fast-track production and growth. We look forward to

updating investors with further key developments during the year

ahead."

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014.

**ENDS**

For further information please visit www.kibo.energy or

contact:

Louis Coetzee info@kibo.energy Kibo Energy PLC Chief Executive

Officer

James Biddle +44 207 628 3396 Beaumont Cornish Nominated Adviser

Roland Cormish Limited

------------------------------ -------------------- ------------------

Claire Noyce +44 20 3764 2341 Hybridan LLP Joint Broker

------------------------------ -------------------- ------------------

Damon Heath +44 207 186 9952 Shard Capital Joint Broker

Partners LLP

------------------------------ -------------------- ------------------

Zainab Slemang zainab@lifacommunications.com Lifa Communications Investor and

van Rijmenant Media Relations

Consultant

------------------------------ -------------------- ------------------

Johannesburg

27 February 2023

Corporate and Designated Adviser

River Group

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKDLBLXLLFBBF

(END) Dow Jones Newswires

February 27, 2023 04:20 ET (09:20 GMT)

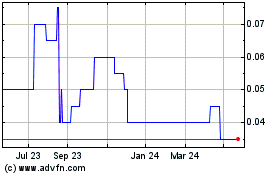

Kibo Energy (AQSE:KIBO.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kibo Energy (AQSE:KIBO.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025