IDOX PLC Year End Trading Update (2040U)

November 22 2023 - 2:00AM

UK Regulatory

TIDMIDOX

RNS Number : 2040U

IDOX PLC

22 November 2023

22 November 2023

Idox plc

( 'Idox', the 'Group' or the 'Company')

Year End Trading Update

A resilient performance in line with expectations

Idox plc (AIM: IDOX), a leading supplier of specialist

information management software and Geospatial data solutions to

the public and asset intensive sectors, today issues a trading

update for its financial year ended 31 October 2023 ('FY23').

Group trading performance

Building on the significant progress the Group has made over the

past few years, we are pleased to report Idox has again delivered a

resilient performance in line with expectations for FY23 despite

the backdrop of continued geo-political and economic uncertainty.

We have continued to make good progress towards a number of our

medium-term strategic goals, placing the Group on a firm footing

for FY24 and beyond.

The Group delivered a record order intake of over GBP82m in

FY23, an increase of c.11% on the prior year, reflecting our

high-quality customer base and strong market positions.

The Board expects to report (subject to external audit) revenue

and profit in line with expectations; revenue is expected to be up

c.11% to c.GBP73m, with recurring revenue up c.8% over the period

to c.GBP44m, delivering a c.9% increase in full year adjusted

EBITDA to c.GBP24.5m and a robust adjusted EBITDA margin of c.34%

(FY22: 34%).

Net debt at 31 October 2023 was GBP14.7m, including the initial

cash consideration of GBP14.8m paid for Emapsite.com Limited

('Emapsite') as announced on 21 August 2023 (FY22: net debt of

GBP6.7m). In September 2023 the Group completed the refinancing of

its lending facilities to a new GBP75m revolving credit facility

and a GBP45m accordion, a significant increase on the previous

facilities which consisted of a revolving credit facility of GBP35m

and GBP10m accordion, respectively. The new facilities, which are

on improved terms, are for a three-year period with two extension

options of one year each. The new facilities are provided by the

Group's existing syndicate of banks: HSBC Innovation, NatWest and

Santander.

The integration of Emapsite is underway and will enhance the

Group's data capabilities whilst adding significant scale to our

Geospatial offering. The Group continues to evaluate a number of

further acquisition opportunities, remaining focussed on ensuring

strategic alignment at appropriate valuations.

We have started FY24 with good levels of visibility - strong

recurring revenue, a solid order book and a healthy order pipeline

supported by a strengthened financial platform. As a result, our

expectations for FY24 remain unchanged, notwithstanding the current

macro-environment.

David Meaden, Chief Executive Officer of Idox commented:

"We are pleased to deliver another solid performance including

double-digit revenue growth despite a challenging geo-political and

economic backdrop. Our recurring revenue and order intake are both

up on the prior year and this provides a solid foundation as we

start the new financial year.

We are very pleased with the acquisition of Emapsite which adds

significant scale and expertise to our existing Geospatial data

capabilities. We are excited by the growth opportunities available

in this sector, adding to our existing market leading public

software capabilities.

We were delighted to complete a refinancing in the period. The

new and increased facilities, which are on improved terms, support

our strategic M&A ambitions supplementing our organic growth

strategy. Despite the challenging headwinds, our resilient business

model allows us to look forward with confidence."

Notice of results

The Group expects to report its FY23 results in late January

2024. Management intends to host a results webinar on the day.

Please contact MHP to register your interest.

Definitions

Adjusted EBITDA is defined as earnings before amortisation,

depreciation, restructuring, acquisition costs, impairment,

financing costs and share option costs.

Net debt is defined as the aggregation of cash, bank borrowings

and long-term bond.

For further information please contact:

Idox plc +44 (0) 870 333 7101

Chris Stone, Non-Executive Chairman investorrelations@idoxgroup.com

David Meaden, Chief Executive

Officer

Anoop Kang, Chief Financial

Officer

Peel Hunt LLP (NOMAD and Broker)

Paul Gillam

Michael Burke

James Smith +44 (0) 20 7418 8900

MHP + 44 (0) 20 3128 8100

Reg Hoare idox@mhpgroup.com

Ollie Hoare

Matthew Taylor

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUARRROSUAUUA

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

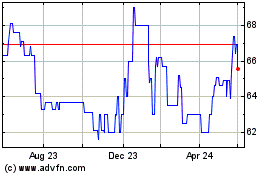

IDOX (AQSE:IDOX.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

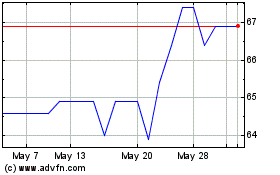

IDOX (AQSE:IDOX.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025