TIDMGKP

RNS Number : 9311T

Gulf Keystone Petroleum Ltd.

23 March 2023

23 March 2023

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP", "the Group" or "the Company")

2022 Full Year Results Announcement and Competent Person's

Report Update

Strong 2023 production, recently exceeding 55,000 bopd

2022 CPR confirms 817 MMstb of gross 2P reserves + 2C resources,

with 100% replacement of production

Record 2022 free cash flow and profitability drove sector

leading dividend yield

Gulf Keystone, a leading independent operator and producer in

the Kurdistan Region of Iraq, today announces its results for the

full year ended 31 December 2022 and the 2022 Competent Person's

Report.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"We delivered strong operational and financial performance in

2022 in line with our clear strategy of balancing investment in

profitable production growth with sustainable shareholder returns,

while maintaining a robust balance sheet and prudent liquidity

levels. Higher oil prices and production, combined with continued

capital discipline and cost control, enabled us to generate record

profitability and cash flow, funding increased investment in future

production growth, record dividends of $215 million and the

repayment of our $100 million bond resulting in a debt-free balance

sheet.

The benefits of our 2022 investment programme and progress on

executing the Jurassic scope of the Shaikan Field Development Plan

contributed to a material increase in gross average production to

around 53,500 bopd in March 2023, hitting a new record of over

55,000 bopd in the last few days, an important milestone for GKP.

In addition, we are pleased that the 2022 CPR has confirmed the

Shaikan Field's significant growth potential and gross 2P + 2C

reserves and resources of 817 MMstb, with 100% reserves replacement

since the 2020 CPR.

Looking ahead we are reviewing our forward capital programme in

light of continued delays to KRG payments to ensure that we

maintain a prudent financial position as we continue to develop the

Jurassic reservoir and advance towards approval of the FDP. As

ever, we remain committed to balancing growth with shareholder

returns and financial strength, confirmed by our declaration today

of a final 2022 ordinary annual dividend of $25 million, increasing

total dividends declared in 2023 to $50 million."

Highlights to 31 December 2022 and post reporting period

Operational

-- Zero Lost Time Incidents ("LTIs") in 2022, despite

significant increase in operational activity

o Following an LTI in January 2023 during drilling operations,

remedial actions have been implemented

-- Gross average production for 2022 of 44,202 bopd (2021:

43,440 bopd), in line with annual guidance

-- Executing the Jurassic scope of the Field Development Plan

("FDP") with the agreement of the Ministry of Natural Resources

("MNR"), with 2022 activity laying the foundation for higher future

production

o Drilled and brought online SH-15 and SH-16, the first two

Jurassic wells in the FDP sequence, on schedule and on budget, and

partially drilled SH-17

o Prepared well pads and flowlines to enable a continuous

drilling programme

o Completed initial engineering and construction works and

procurement of long lead items for production facility expansion

and installation of water handling

-- Realising benefits of 2022 investments with recent material

increase in production to record highs

o 2023 year to date gross average production of c.48,900 bopd,

with gross average production in March to date of c.53,500 bopd and

production of c.55,000 bopd in the last few days

o Production growth driven by continued ramp up of SH-16

following start-up in December 2022, start-up of SH-17 in February

2023, and our well workover programme

o Minor impact from temporary suspension of pipeline exports in

February 2023 following the tragic earthquakes in Turkey and

Syria

-- Continuous drilling programme delivering improvements in drilling performance

o SH-17 drilled, completed and brought onstream in February

2023, under budget and ahead of schedule

o Drilling of SH-18 progressing well with expected start up in

Q2 2023, in line with prior guidance

Financial

-- Record profitability and cash generation in 2022, driven by a

strong increase in the oil price, higher production and our

continued focus on cost control

o Adjusted EBITDA increased by 61% to $358.5 million (2021:

$222.7 million)

o Profit after tax increased 62% to $266.1 million (2021: $164.6

million)

o Gross Opex per barrel of $3.2/bbl (2021: $2.7/bbl), in line

with the Company's 2022 guidance range of $2.9-$3.3/bbl and

reflecting higher operational activity

o Realised price per barrel increased by 49% to $74.1/bbl (2021:

$49.7/bbl)

o While the Company has not accepted the MNR's proposed change

to the pricing mechanism for Shaikan oil sales, changing the

reference price from Dated Brent to the Kurdistan Blend ("KBT")

effective 1 September 2022, revenue from September 2022 to December

2022 has been recognised on this basis, resulting in an average

reduction in the realised sales price versus the previous pricing

mechanism over the period of approximately $12/bbl or $23.4

million

o The KBT discount to Dated Brent has tightened since November

2022, with the impact on Shaikan realised prices versus the

previous pricing mechanism decreasing to $6/bbl in February

2023

-- Increased investment in the Shaikan Field while maintaining

capital discipline to drive future profitable production growth

o Net capital expenditure of $114.9 million (2021: $46.2

million), in line with final 2022 guidance of $110-$120 million

-- $63.4 million: Drilling of SH-15, SH-16 and partial drilling

of SH-17 that was completed in early 2023

-- $35.8 million: Early work for the expansion of the production

facilities with water handling capacity, as well as future well pad

preparation including flowlines

-- $15.7 million: Well workover and interventions to optimise

production

-- Strong free cash flow generation funded continued delivery of

our strategy to balance growth with shareholder returns while

maintaining a robust balance sheet and prudent liquidity levels

o Free cash flow generation of $266.5 million, more than double

the prior year (2021: $122.2 million)

o Record dividends of $215 million, representing a

sector-leading dividend yield of 41% based on the closing share

price on 31 December 2022. Since the beginning of 2023, GKP has

paid an additional interim dividend of $25 million

o Redeemed $100 million outstanding bond in August 2022, leaving

the Company debt free with significant financial flexibility

o Cash balance of $118.8 million at 22 March 2023

-- Revenue receipts of $450.4 million net to GKP received from

the Kurdistan Regional Government ("KRG") in 2022 for crude oil

sales and repayment of historical revenue arrears

o While the Company has received $65.7 million net from the KRG

in 2023 for August and September 2022 oil sales, overdue

receivables for the months of October to December 2022 total $76.0

million net on the basis of the KBT pricing mechanism

2022 Competent Person's Report

-- GKP announces today the 2022 Competent Person's Report ("2022

CPR"), an updated independent third-party evaluation of the Shaikan

Field's reserves and resources prepared by ERC Equipoise

("ERCE")

-- 2022 CPR incorporates significant incremental information,

including an updated field development plan, new wells, production

data and further technical analysis, since the previous 2020 CPR

also prepared by ERCE

-- Gross 2P+2C reserves and resources of 817 MMstb as at 31

December 2022, 52 MMstb higher than the previous 2020 CPR after

adjusting for production in 2021 and 2022

o Gross 2P reserves of 506 MMstb increased 34 MMstb or 7%

relative to 2020 CPR volumes adjusted for production, resulting in

100% reserves replacement over the two-year period

o Increase driven by higher plateau rate of 85,000 bopd from the

Jurassic reservoir

o Gross 1P reserves of 199 MMstb decreased 8 MMstb or 4%

relative to 2020 CPR volumes adjusted for production due to prudent

management of production rates to avoid traces of water ahead of

water handling installation

o Gross 2C resources of 311 MMstb increased 18 MMstb or 6%

relative to 2020 CPR volumes due to higher planned production

processing capacity

-- 2022 CPR highlights the significant growth potential of the Shaikan Field, with a gross 2P reserves-to-production ratio of 31 years based on 2022 gross average production, and reaffirms our deep understanding and prudent management of the reservoir, which has produced over 117 MMstb to date

Gross reserves and resources(1) based on the 2022 CPR compared

to the 2020 CPR are as follows:

Reserves Resources

---------- -----------------

Formation (MMstb) 1P 2P 2C(2) 2P+2C(2,3)

------------------ ---- ---- ----- ----------

31 December 2022

Jurassic 199 506 101 607

Triassic - - 157 157

Cretaceous - - 53 53

------------------ ---- ---- ----- ----------

Total (gross) 199 506 311 817

------------------ ---- ---- ----- ----------

31 December 2020

Jurassic 240 505 80 585

Triassic - - 157 157

Cretaceous - - 56 56

------------------ ---- ---- ----- ----------

Total (gross) 240 505 293 798

------------------ ---- ---- ----- ----------

The reconciliation of changes in reserves and resources between

the 2020 CPR and the 2022 CPR is as follows:

Reserves Resources

---------- -----------------

Gross (MMstb) 1P 2P 2C(2) 2P+2C(2,3)

------------------------------------------- ---- ---- ----- ----------

31 December 2020 240 505 293 798

2021 & 2022 production (33) (33) - (33)

------------------------------------------- ---- ---- ----- ----------

31 December 2020 (adjusted for production) 207 472 293 765

------------------------------------------- ---- ---- ----- ----------

Revisions (8) 34 18 52

------------------------------------------- ---- ---- ----- ----------

31 December 2022 199 506 311 817

------------------------------------------- ---- ---- ----- ----------

GKP's 80% net working interest ("WI")(4) share of reserves and

resources at 31 December 2022 are:

Reserves Resources

---------- -----------------

Formation (80% WI) (MMstb) 1P 2P 2C(2) 2P+2C(2,3)

--------------------------- ---- ---- ----- ----------

Jurassic 159 405 81 486

Triassic - - 126 126

Cretaceous - - 42 42

--------------------------- ---- ---- ----- ----------

Total (net WI) 159 405 249 654

--------------------------- ---- ---- ----- ----------

(1) Reserves and resources have been calculated in accordance with the June 2018 SPE/WPC/AAPG/ SPEE/SEG/SPWLA/EAGE Petroleum Resources Management System).

(2) Contingent resources volumes are classified as such because

there is technical and commercial risk involved with their

extraction. In particular, there may be a chance that accumulations

containing contingent resources will not achieve commercial

maturity. The 2C (best estimate) contingent resources presented are

not risked for chance of development. All Contingent resource

volumes quoted in this document are volumes which could be

extracted prior to license expiry.

(3) Aggregated 2P+2C estimates should be used with caution as 2C

contingent resources are commercially less mature than the 2P

reserves.

(4) Net working interest reserves and resources do not represent

the net entitlement resources under the terms of the Production

Sharing Contract ("PSC").

Outlook

-- Given continued delays to KRG payments, we are currently

reviewing our forward capital programme and 2023 net capital

expenditure guidance of $160-$175 million

o With further clarity around KRG payments, we would consider

continued drilling following SH-18

o With continued payment delays, we would review reductions to

our capital programme

-- Looking ahead, subject to timely KRG payments and oil prices,

we are focused on transitioning towards capitalising on the

significant growth potential of the Shaikan Field, as confirmed by

the 2022 CPR, and attractive returns on capital from the

accelerated payback of investment as we recover our historic

costs

o Targeting step up in production levels through execution of

the Jurassic scope of the FDP, drilling additional Jurassic wells

and expanding the production facilities

o While timing of FDP approval remains uncertain, we continue to

advance towards key project sanction milestones, including the

conclusion of the Gas Management Plan ("GMP") tendering process

and, as appropriate, financing arrangements

-- We are committed to balancing profitable production growth,

shareholder returns and a robust balance sheet according to our

disciplined financial framework, in line with our historic track

record

o Following payment of $25 million interim dividend in March, we

are pleased to announce declaration of a final 2022 ordinary annual

dividend of $25 million, in line with the Company's dividend

policy

o Subject to approval at the AGM on 16 June 2023, we expect to

pay final dividend on 21 July 2023, based on a record date of 7

July 2023 and ex-dividend date of 6 July 2023

o Total dividends declared in 2023 of $50 million, equating to

an 11% yield for year to date 2023, based on the closing share

price on 22 March 2023

o The Board remains committed to distributing excess cash to

shareholders via dividends and/or share buybacks and will continue

to review distributions based on our disciplined financial

framework, as outlined in our 30 January 2023 trading update, which

includes regular assessment of the Company's expected liquidity,

cash flow generation and investment needs

-- Continue to monitor discussions between the Federal Iraqi

Government and the KRG on the management of oil and gas assets in

Kurdistan following the Iraqi Federal Supreme Court ruling in

February 2022. GKP's operations currently remain directly

unaffected

2023 guidance

-- 2023 guidance remains dependent on timely KRG payments and

oil prices. The Company will consider adjustments to the capital

programme based on how the business environment evolves

-- We remain focused on delivering 2023 gross average production

of 46,000-52,000 bopd, representing a 11% increase from 2022 at the

mid-point

o Reflects anticipated contributions from SH-17 and SH-18, as

well as the benefits of well workovers

o Continue to manage natural field declines, well production

rates ahead of water handling installation and higher gas

production from one of our wells near the gas cap, in line with our

reservoir modelling

-- Current 2023 net capital expenditure guidance of $160-$175 million:

o $30-$35 million: Completion of SH-17, drilling and completion

of SH-18 and well workover programme to optimise production

o $45-$50 million: Long lead items and preparing well pads to

enable continuous drilling

o $85-$90 million: Continued expansion of production facilities,

targeting by H2 2024 an increase in total field capacity from

c.60,000 bopd currently to 85,000 bopd and installation of water

handling capacity, potentially enabling the increase in production

rates from constrained wells

-- 2023 gross Opex guidance of $3.0-$3.4/bbl unchanged,

underpinned by the Company's continued focus on strict cost

control

Investor & analyst presentation

GKP's management team will be hosting a presentation for

analysts and investors at 10:00am (GMT) today via live audio

webcast:

https://brrmedia.news/GKP_FY2022

Management will also be hosting an additional webcast

presentation focused on retail investors via the Investor Meet

Company ("IMC") platform at 12:00pm (GMT) today. The presentation

is open to all existing and potential shareholders and participants

will be able to submit questions at any time during the event.

https://www.investormeetcompany.com/gulf-keystone-petroleum-ltd/register-investor

This announcement contains inside information for the purposes

of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone: +44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations aclark@gulfkeystone.com

FTI Consulting +44 (0) 20 3727 1000

Ben Brewerton GKP@fticonsulting.com

Nick Hennis

or visit: www.gulfkeystone.com

Notes to Editors:

Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading independent

operator and producer in the Kurdistan Region of Iraq. Further

information on Gulf Keystone is available on its website

www.gulfkeystone.com

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the risks and uncertainties associated with the

oil & gas exploration and production business. These statements

are made by the Company and its Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent risks and uncertainties, including both

economic and business factors and/or factors beyond the Company's

control or within the Company's control where, for example, the

Company decides on a change of plan or strategy. This announcement

has been prepared solely to provide additional information to

shareholders to assess the Group's strategies and the potential for

those strategies to succeed. This announcement should not be relied

on by any other party or for any other purpose.

Chairman's statement

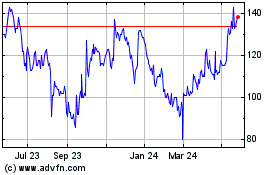

Gulf Keystone benefitted from strong oil prices in 2022, with

Dated Brent averaging $101/bbl in the year, up $30/bbl from 2021.

However, volatility was high, with peaks of around $130/bbl in the

first half of the year declining in the second half to around

$80/bbl in December, as concerns around energy security and supply

deficits, driven primarily by the tragic conflict in Ukraine and

recovery in global economic demand, transitioned to market fears of

inflationary pressures, fiscal tightening and recession.

From an operational perspective, working patterns in the Shaikan

Field and our offices returned to normal following the disruption

caused by the COVID-19 pandemic. Safety was a major focus for the

team as activity ramped up, and the Board and I are pleased with

the Company's performance in 2022. The Company is continuing to

manage tightness in regional and global supply chains, with ongoing

pressure on equipment lead times and cost pressures.

Looking at the geopolitical environment, while security in

Kurdistan was relatively stable in the year, the Iraqi Federal

Supreme Court ruling in February 2022 led to heightened tensions in

the longstanding dispute between Federal Iraq and the KRG regarding

oil and gas assets in Kurdistan. The situation has improved since

the formation of a new Federal Iraqi government in October 2022,

with an active dialogue taking place between both sides.

Nonetheless, it remains difficult to predict outcomes and the Board

continues to monitor the situation closely. We also continue to

closely monitor and engage with the KRG regarding the delays to

recent oil sales payments and the negotiation of a new lifting

agreement. While historically payments have been made, the recent

delays have been disappointing. We are experienced operating in

Kurdistan and look to maintain a prudent level of liquidity and

flexible capital programme to manage through periods of

uncertainty.

Against this backdrop, GKP delivered strong operational and

financial results in 2022 and continued execution of its strategy

of balancing investment in growth with sustainable shareholder

returns, while maintaining a robust balance sheet and prudent

liquidity levels.

From an operational perspective, the Company achieved its 2022

production guidance and completed a significant work programme,

paving the way for expected future increases in production. The

Company also advanced towards approval of the Shaikan Field

Development Plan ("FDP"). From a financial perspective, strong oil

prices and continued cost control and capital discipline supported

significant cash flow generation, enabling the Company to fund its

investment programme, pay record dividends to shareholders of $215

million and strengthen its balance sheet through the early

redemption of the outstanding $100 million bond. The Company

delivered top quartile total shareholder returns of 57% in the

year, assuming dividends reinvested.

The Company has seen a material increase in production in 2023,

with production recently exceeding 55,000 bopd. The achievement of

this important milestone has been supported by the Company's 2022

investments and decision to proceed with the execution of the FDP's

Jurassic scope.

Looking ahead to 2023, the Company is currently reviewing its

forward capital programme in light of continued delays to KRG

payments. Subject to timely payments and oil prices, the Company

will continue to transition to increased investment in profitable

production growth while advancing towards key project sanction

milestones of the full FDP, which the Board expects to maximise

long-term value for shareholders and Kurdistan. The Board and I are

pleased the 2022 Competent Person's Report reaffirms the

significant growth potential of the Shaikan Field, with 817 MMstb

2P reserves and 2C resources, 100% reserves replacement since the

2020 CPR and a 2P reserves-to-production ratio of 31 years.

As the Company progresses, the Board will manage the balance

between investment in growth, shareholder returns and balance sheet

strength according to a disciplined financial framework.

The Board is committed to paying an ordinary dividend of at

least $25 million per annum and distributing excess cash to

shareholders by way of dividends and/or share buybacks. In

determining the level of distributions, the Board regularly reviews

the Company's expected liquidity, cash flow generation and

investment needs. We are pleased to have declared total dividends

in 2023 date of $50 million, including the declaration of a $25

million 2022 ordinary annual dividend for shareholder approval at

the Company's AGM on 16 June 2023.

Sustainability continues to be a strategic priority for GKP and

the Board has direct oversight and responsibility for the Company's

strategy. The strategy has a number of objectives, of which

addressing climate-related risks and opportunities is key. For

fiscal year 2022, the Company's disclosures are fully consistent

with all of the Taskforce on Climate-related Financial Disclosures

("TCFD") recommendations, reflecting how a focus on climate-related

risks and opportunities is embedded into the Company's strategy and

governance, including risk management. The Company also continued

to make significant progress in the year in supporting the

development of its workforce, increasing gender diversity,

generating material economic and social value for Kurdistan and the

Company's local communities, as well as continuing to maintain

strong corporate governance, ethical business conduct and

compliance.

The Board continued to engage with the Company's shareholders in

2022 and welcomes ongoing interaction and feedback with all

investors. We encourage GKP shareholders to participate in our

Annual General Meetings, which are accessible virtually to all

investors. While we saw voting turnout improve at the 2022 AGM, it

remained low relative to prior years and we continue to look at

ways to improve shareholder participation and voting at future

general meetings.

We were delighted in July 2022 to welcome Wanda Mwaura to the

Board as a new Non-Executive Director and member of the Audit and

Risk Committee. Wanda brings over 25 years of expertise and

experience in accounting, external and internal audit, consulting,

regulatory and corporate governance to GKP. She is highly respected

and complements the Board with her extensive skill set.

GKP's 2022 Full Year Results and Annual Report will be my last

as Non-Executive Chairman, as I prepare to hand over the role

following the 2023 AGM. It has been a distinct privilege to serve

as Chairman of GKP and I am proud of the significant achievements

and progress the Company has made during my tenure to create value

for its shareholders, Kurdistan and broader stakeholder base.

Since my appointment in 2018, GKP has increased gross average

production from an average of 31,563 bopd in 2018 to over 55,000

bopd recently. In the same period, GKP has distributed $440 million

in dividends and share buybacks to shareholders, generated more

than $1.8 billion in gross revenues for the KRG from the Shaikan

Field and maintained a strong balance sheet throughout, against a

backdrop of commodity price volatility and the COVID-19 pandemic.

This performance has been underpinned by a rigorous focus on safety

and sustainability and strong leadership from the Board, with

regular Director visits to the Company's operations in

Kurdistan.

I am delighted to be succeeded by Martin Angle, my esteemed

fellow Director and current Deputy Chairman and Senior Independent

Director ("SID"), and that Martin's Deputy Chair and SID roles will

be taken on by Kimberley Wood, currently independent Non-Executive

Director. I have worked with both Martin and Kimberley since 2018

and they have both made an enormous contribution to the Company and

to the Board. Their experience and expertise will be invaluable to

GKP's future success.

On behalf of the Board, I would like to thank GKP's leadership

team and all of the Company's employees for their continued

commitment to safety, delivery of the Company's strategy and

relentless focus on creating value for GKP's shareholders and

stakeholder base. We are excited about the future and the year of

significant activity ahead.

Jaap Huijskes

Non-Executive Chairman

22 March 2023

CEO review

In 2022, we delivered strong operational and financial

performance as we continued to execute our clear strategy of

balancing investment in profitable growth with shareholder returns

while maintaining a robust balance sheet.

We commenced the execution of the Phase 1 Shaikan Field

Development Plan ("FDP") Jurassic scope with the agreement of the

MNR, comprising additional wells (with SH-15 and SH-16 completed in

2022 and SH-17 and SH-18 completed or currently underway in 2023)

and early works related to the expansion of our production

facilities. We also delivered another year of record production and

made good progress towards key FDP sanction milestones.

We generated record Adjusted EBITDA in 2022, driven by higher

production, strong oil prices and a continued focus on cost

management and efficiency, resulting in a more than doubling of

free cash flow to $266 million. Strong cash flow generation enabled

us to fund our capital programme and pay sector leading dividends

to our shareholders of $215 million, bringing total shareholder

distributions to $415 million since 2019, while at the same time

strengthening our balance sheet through the redemption of our $100

million bond. We are now debt free.

Our performance, as always, was underpinned by a rigorous focus

on safety, with zero Lost Time Incidents ("LTI") in the year and

only one recordable incident.

Gross average production in 2022 was 44,202 bopd, within our

annual guidance range. Despite the small increase versus 2021, our

2022 work programme has laid the foundations for a material

increase in future production. Our drilling performance is

improving and we are delivering wells on or below budget. The

latest well, SH-18, is progressing well and we expect start up in

Q2 2023, in line with our previous guidance. Continuous drilling

has been facilitated by our investment in well pad preparation,

flowlines and long lead items. In addition, completion of early

work for the production facility expansion in 2022 has positioned

us to increase total field processing capacity to 85,000 bopd and

install water handling capacity in H2 2024.

As we enter 2023, it is clear that our investments in 2022 and

decision to progress the Jurassic scope of the FDP are beginning to

pay off. Gross average production in 2023 year to date has been

c.48,900 bopd, while gross average production in March to date has

been c.53,500 bopd, including the achievement of a new production

record of over 55,000 bopd in the last few days, an important

milestone for the Company.

We continue to see significant growth potential from the Shaikan

Field, with the 2022 Competent Person's Report confirming gross 2P

reserves and 2C resources of 817 MMstb, 52 MMstb higher than the

previous CPR from 2020 after adjusting for production. The 2022 CPR

shows 100% reserves replacement, driven by a higher plateau rate of

85,000 bopd from the Jurassic reservoir and accelerating post

license production.

In addition, we see an excellent opportunity to create value for

our shareholders. Returns on capital from incremental investment in

the Shaikan Field are attractive, as the payback of investment

under the Shaikan Production Sharing Contract accelerates as we

recover our historic costs. By increasing profitable production, we

also expect to enhance the sustainability and longevity of the

Company's capacity for shareholder distributions.

Looking ahead, our intention is to continue our transition

towards increased investment in profitable production growth,

expanding the Jurassic reservoir while advancing towards key

project sanction milestones of the FDP. However, given continued

delays to KRG payments, we are currently reviewing our forward

capital programme and 2023 net capital expenditure guidance of

$160-$175 million. With further clarity around KRG payments, we

would consider continued drilling following SH-18. However, we will

also review potential reductions to our capital programme should

payment delays continue.

As we increase investment in profitable production growth

through a flexible capital programme, we remain focused on

delivering against our strategy of balancing growth with

sustainable shareholder returns, while maintaining a robust balance

sheet and prudent liquidity levels. We are pleased to declare a

final 2022 ordinary annual dividend of $25 million subject to

shareholder approval at the AGM on 16 June 2023, increasing total

dividends declared in 2023 to $50 million and equating to an 11%

yield for 2023, based on the closing share price on 22 March 2023.

The Board remains committed to distributing excess cash to

shareholders by way of dividends and/or share buybacks and will

continue to review distribution decisions based on a disciplined

financial framework.

We have an exciting year ahead of us at Gulf Keystone and a

number of opportunities to create significant value for our

shareholders and broader stakeholder base. I want to provide my

heartfelt thanks to GKP's teams in Kurdistan and the UK, whose

continued hard work and innovation are enabling the Company to

deliver against its strategy. I would also like to thank Jaap

Huijskes, who will be stepping down following the 2023 AGM, for all

his help and stewardship in my first two years as CEO. I wish him

well for the future.

Jon Harris

Chief Executive Officer

22 March 2023

Operational review

We delivered strong operational performance in 2022, safely

achieving higher production while investing in future growth and

further advancing towards approval of the Shaikan Field Development

Plan ("FDP"). We also continued to execute our sustainability

strategy with progress in several areas.

Throughout the year, the health and safety of our workforce and

local communities remained our priority. We were pleased to record

zero Lost Time Incidents ("LTIs") in 2022, despite a more than 50%

increase in working hours to 2.2 million hours. Unfortunately, we

experienced an LTI in January 2023 during drilling operations and

we are implementing remedial actions. As at 22 March 2023, we have

been operating for over 60 days without an LTI.

We achieved gross average production of 44,202 bopd in 2022, a

2% increase versus 2021 and in line with our revised annual

guidance range of 44,000-47,000 bopd. Production was supported by

incremental volumes from SH-13 and SH-14, brought on-stream in

December 2021, and from SH-15 and SH-16, which started up in April

and December 2022 respectively. Increases were mostly offset by the

continued prudent management of well production rates to avoid

trace amounts of water production ahead of installation of water

handling capacity, including the shut-in of SH-12 for most of H1

2022, as well as the temporary shut-in of one well during Q4 2022

due to an isolated Electrical Submersible Pump ("ESP") electrical

failure.

We delivered a significant work programme in 2022 as we

commenced execution of the FDP Jurassic scope that positions us to

drive profitable future production growth. Drilling activities in

2022 included the start-up of SH-15 and SH-16 and spud of SH-17

which was completed in early 2023 and started producing in February

2023. We have seen the benefit of a continuous drilling programme

with a general decline in drilling costs and times, while

investments in the year in well pad preparation, flowline

installation and long lead items have enabled us to maintain

momentum.

In addition, we advanced the expansion of the production

facilities in the year, carrying out early engineering and

construction work and progressing the procurement of long lead

items, despite ongoing equipment lead time and cost pressures,

positioning us to increase total field processing capacity to

85,000 bopd and install water handling capacity in H2 2024. Water

handling capacity will potentially enable us to increase production

rates from constrained wells which we are currently prudently

managing to avoid traces of water.

Shaikan Field Development Plan

We are continuing to progress towards approval of the FDP. Since

the initial draft was submitted in November 2021, we have engaged

extensively with the MNR and have substantially finalised the

technical scope and future work programme. We continue to progress

key project milestones, including optimising the work programme to

phase activity and facilitate accelerated cost recovery,

negotiating commercial terms including a potential update to the

Shaikan Production Sharing Contract ("PSC") with the target of

ensuring changes are at least value neutral, and concluding the Gas

Management Plan tendering process and, as appropriate, financing

arrangements.

As we progress, we have agreed with the MNR to execute the

Jurassic scope of the FDP before approval, to date drilling or in

the process of drilling a total of four FDP wells - SH-15, SH-16,

SH-17 and SH-18 - and advancing the expansion of the production

facilities. We remain focused on testing the Triassic reservoir,

targeting initial pilot production of up to 10,000 bopd, and

implementing the Gas Management Plan, which, depending on timely

sanction and implementation, will enable us to eliminate almost all

routine flaring, a requirement of the PSC, and more than halve our

Scope 1 emissions intensity by 2025 versus the original 2020

baseline.

2022 Competent Person's Report

We are pleased to announce the 2022 Competent Person's Report,

an updated independent third-party evaluation of the Company's

reserves and resources prepared by ERC Equipoise. The 2022 CPR

incorporates significant incremental information, including an

updated field development plan, new wells, production data and

further technical analysis, since the previous CPR dated 31

December 2020 also prepared by ERCE.

The 2022 CPR confirms the Shaikan Field's significant gross 2P

reserves and 2C resources of 817 MMstb, 52 MMstb higher than the

previous 2020 CPR after adjusting for production during the period.

It underlines the significant growth potential of the asset, with a

gross 2P reserves-to-production ratio of 31 years, based on 2022

gross production. It also reaffirms our deep understanding of the

reservoir, which has produced over 117 MMstb to date.

Gross 2P reserves have increased 7% to 506 MMstb relative to

2020 CPR volumes adjusted for production, with 100% reserves

replacement during the period. The increase is driven by the higher

plateau rate of 85,000 bopd from the Jurassic reservoir, bringing

more reserves volumes into the license period. Gross 1P reserves of

199 MMstb are 4% lower relative to 2020 CPR volumes adjusted for

production due to prudent management of production rates to avoid

traces of water ahead of water handling installation.

Gross 2C resources of 311 MMstb have increased 6% relative to

2020 CPR volumes due to higher planned production processing

capacity.

Current operational activity and 2023 outlook

We have seen a step-up in production in 2023, with gross average

year to date production of c.48,900 bopd and gross average

production in March to date of c.53,500 bopd. In the last few days,

we are delighted that production has exceeded 55,000 bopd.

Production growth has been supported by the continued ramp up of

SH-16, production from SH-17, which we are gradually ramping up,

and our well workover programme. Production increases have more

than offset the minor impact of the temporary suspension of

pipeline exports in February following the tragic earthquakes in

Turkey and Syria.

Looking ahead to the rest of the year, we are currently

reviewing our forward capital programme and 2023 net capital

expenditure guidance of $160-$175 million, given continued delays

to KRG payments. Our current guidance includes the completion of

SH-17 and the drilling and completion of SH-18, further investment

in well pad preparation and long lead items for continuous drilling

and the continued progression of the production facility expansion.

With further clarity around KRG payments, we would consider

continued drilling following SH-18. However, we will also moderate

investment levels should payment delays continue.

We remain focused on delivering our production guidance of

46,000-52,000 bopd, representing 11% growth at the mid-point versus

2022, as we continue to target start-up of SH-18 in Q2 2023. While

we have seen strong recent production, we continue to manage well

production rates ahead of water handling installation and are

optimising production from a single well near the gas cap due to

higher gas production, in line with our reservoir modelling.

Estimated base natural declines of 6-10% per annum across the

Shaikan Field remain low relative to the industry and are in line

with our expectations and development plan, even following

production of over 117 million barrels to date.

Sustainability strategy

We continued to deliver against our sustainability strategy in

2022, which is critical to the creation of long-term value for all

our stakeholders and our licence to operate. Our strategic

priorities include working safely, minimising our impact on the

environment, addressing climate change, enhancing diversity &

inclusion, generating local economic value and strong governance

and compliance.

There were a number of highlights to note, which we will publish

as part of our 2022 Annual Report and Sustainability Report, but I

am particularly pleased that this year our disclosures are fully

consistent with all of the TCFD recommendations as the Company

continues to address climate-related risks and opportunities, in

particular through progression of the Gas Management Plan tendering

process and development of a number of other decarbonisation

opportunities.

As we progress, we expect to see increases in our emissions

principally due to higher oil production and higher gas production

from a single well near the gas cap. Subject to timely sanction and

implementation, the Gas Management Plan will enable us to eliminate

almost all our routine flaring and more than halve our Scope 1

emissions intensity by 2025. We are also targeting further

emissions reductions through other decarbonisation projects and are

proceeding in the near term to eliminate methane venting from our

production facility storage tanks, which we expect to complete in

2024.

We also continued to make a significant contribution to

Kurdistan and our local communities, generating $515 million net

from the Shaikan Field for the KRG, employing almost 350 Kurdistan

nationals, representing three-quarters of our workforce in country,

increasing our purchasing and contracting with local suppliers by

31% to $64 million and spending over $1 million gross on impactful

projects for our local communities focused on agriculture,

education and infrastructure. In addition, we remain focused on

investing in the development of our people and improving the

diversity of our teams. The proportion of women in our workforce

increased to 14% in 2022 from 9% in 2021, a figure which we hope to

build momentum on into 2023 and beyond.

John Hulme

Chief Operating Officer

22 March 2023

Financial review

Year ended Year ended

31 December 2022 31 December 2021

Gross average production (1) bopd 44,202 43,440

Dated Brent (2) $/bbl 101.4 70.8

R ealised price (1) $/bbl 74.1 49.7

Discount to Dated Brent $/bbl 27.2 21.1

Revenue $m 460.1 301.4

Operating costs $m 41.9 34.4

Gross operating costs per barrel

(1) $/bbl 3.2 2.7

Other general and administrative

expenses $m 12.2 13.6

Incurred in relation to Shaikan

Field $m 5.2 4.1

Corporate G&A $m 7.0 9.5

Share option expense $m 13.8 8.5

Adjusted EBITDA (1) $m 358.5 222.7

Profit after tax $m 266.1 164.6

Basic earnings/(loss) per share cents 123.5 77.14

Revenue and arrears receipts

(1) $m 450.4 221.7

Net capital expenditure (1)(3) $m 114.9 46.2

Free cash flow (1) $m 266.5 122.2

Dividends $m 215 100

Cash and cash equivalents $m 119.5 169.9

Face amount of the Notes $m 0.0 100.0

Net cash (1) $m 119.5 69.9

------------------------------------ ------ ---------------- ----------------

(1) Gross average production, realised price, gross operating

costs per barrel, Adjusted EBITDA, revenue and arrears receipts,

net capital expenditure, free cash flow and net cash are either non

-- financial or non-IFRS measures and, where necessary, are

explained in the summary of non-IFRS measures.

(2) Weighted average GKP sales volume price.

(3) 2021 restated as the definition of net capital expenditure

was amended to no longer exclude the increase/decrease of drilling

and other equipment.

Record profitability and cash flow generation in 2022 were

driven by an increase in the oil price, higher production and a

continued focus on cost control. The Company increased net capital

expenditure while maintaining capital discipline to drive future

production growth and paid oil and gas sector leading dividends,

while maintaining a robust balance sheet and prudent liquidity

levels to manage potential risks, including KRG payment delays.

Adjusted EBITDA

Adjusted EBITDA increased by 61% in 2022 to $358.5 million

(2021: $222.7 million), driven by a strong increase in the oil

price and higher production, partly offset by higher operating

costs, share option expense and capacity building payments.

Gross average production was 44,202 bopd in 2022, up 2% from

43,440 bopd in 2021 and within the Company's 2022 guidance range.

Revenue increased by 53% to $460.1 million (2021: $301.4 million),

driven by our leverage to the 43% increase in Dated Brent price

from an average of $70.8/bbl in 2021 to $101.4/bbl in 2022. The

increase was partially offset by a corresponding $11.4 million

increase in capacity building payments to $34.9 million (2021:

$23.5 million), which is a component of the KRG's entitlement from

the Shaikan Field.

The average realised price per barrel increased by 49% in the

year to $74.1/bbl (2021: $49.7/bbl), including the impact of an

increase in the discount to Dated Brent to $27.2/bbl (2021:

$21.1/bbl). The increase in the discount reflected a new pricing

mechanism proposed by the KRG for Shaikan oil sales changing the

reference price from Dated Brent to KBT, effective 1 September

2022, and increased pipeline tariffs.

While the Company has not accepted the proposed pricing

mechanism, revenue from September 2022 to December 2022 has been

recognised on this basis, resulting in an average reduction in the

realised sales price versus the previous pricing mechanism over the

four-month period of approximately $12/bbl or $23.4 million.

If the new pricing mechanism had been in place throughout 2022,

the reduction in monthly Shaikan realised prices would have ranged

from $4/bbl to $13/bbl versus the previous pricing mechanism,

assuming KBT crude specs during Q3 2022 were representative of

those during H1 2022. While it is difficult to predict how pricing

will evolve going forward given the historic fluctuation of KBT

prices, the KBT discount to Dated Brent has tightened since

November 2022, with the impact on Shaikan realised prices versus

the previous pricing mechanism decreasing to $6/bbl in February

2023.

Gulf Keystone continues to maintain a rigorous focus on cost

control. Gross operating costs per barrel increased to $3.2/bbl in

2022 (2021: $2.7/bbl), in line with the Company's 2022 guidance

range of $2.9-$3.3/bbl. The increase in operating costs in 2022 to

$41.9 million (2021: $34.4 million) was primarily driven by an

increase in staff costs reflecting increased activity, as well as

incremental maintenance activity.

Other general and administrative expenses ("G&A"),

comprising Shaikan Field and corporate G&A, were 10% lower in

2022 at $12.2 million (2021: $13.6 million), reflecting increased

capitalisation due to accelerating capital activity resulting in a

more than doubling of net capital expenditure. Share option expense

in the period increased by $5.3 million to $13.8 million (2021:

$8.5 million), principally due to the final contractual exercise of

share option entitlements by former Directors under the 2016 Value

Creation Plan ("VCP").

Profit after tax

Profit after tax increased to $266.1 million (2021: $164.6

million) driven by the increase in Adjusted EBITDA, partly offset

by higher depreciation, depletion and amortisation ("DD&A")

expense of $80.2 million (2021: $54.1 million) due to increased

production, accelerated cost recovery as result of recent high oil

prices, and updated future capital cost estimates.

Cash flows

The Company more than doubled cash from operating activities to

$374.3 million (2021: $178.5 million) primarily due to the increase

in Adjusted EBITDA.

In 2022, Gulf Keystone received revenue receipts from the KRG of

$450.4 million net to GKP for crude oil sales related to the

September 2021 to July 2022 invoices and repayment of arrears

outstanding from November 2019 to February 2020 invoices, which

were fully recovered with payment of the March 2022 invoice.

Since the beginning of 2023, the Company has received a further

$65.7 million net to GKP for crude oil sales related to the August

and September 2022 invoices. Discussions are ongoing with the KRG

regarding payments for October to December 2022 crude oil sales,

which are overdue and amount to $76.0 million net on the basis of

the KBT pricing mechanism.

During the year, the Company invested net capital expenditure of

$114.9 million (2021 restated: $46.2 million), in line with final

2022 guidance of $110-$120 million, to drive future profitable

production growth. $63.4 million was spent on the drilling of

SH-15, SH-16 and SH-17 that was completed in early 2023. $35.8

million was invested in early work for the expansion of the

production facilities with water handling capacity, as well as

future well pad preparation costs. $15.7 million was invested in

well workover and interventions to optimise production.

Free cash flow generation was $266.5 million in 2022, more than

double the prior year (2021: $122.2 million), enabling the Company

to continue to deliver against its strategic commitment of

balancing investment in growth with returns to shareholders, while

maintaining a robust balance sheet.

In 2022, GKP paid record dividends of $215 million, representing

a sector-leading dividend yield of 41% based on the closing share

price on 31 December 2022.

In early August 2022, the Company redeemed the $100 million of

notes outstanding leaving the Company debt free with significant

financial capacity. Net cash increased from $69.9 million at 31

December 2021 to $119.5 million at 31 December 2022. The Company

continues to maintain a robust balance sheet with cash and cash

equivalents of $118.8 million at 22 March 2023.

As at 31 December 2022, there were $213 million gross of

unrecovered costs, subject to potential cost audit by the KRG. The

R-factor, calculated as cumulative gross revenue receipts of $2,078

million divided by cumulative gross costs of $1,760 million, was

1.18. The unrecovered cost pool and R-factor are used to calculate

monthly cost oil and profit oil entitlements, respectively, owed to

the Company from crude oil sales.

The Group performed a cash flow and liquidity analysis,

including the impact on the Group's working capital position due to

delays in revenue receipts from the KRG and the proposed revision

to the lifting agreement, based on which the Directors have a

reasonable expectation that the Group has adequate resources to

continue to operate for the foreseeable future. Therefore, the

going concern basis of accounting is used to prepare the financial

statements.

Outlook

Given continued delays to KRG payments, we are currently

reviewing our forward capital programme and 2023 net capital

expenditure guidance of $160-$175 million. Our guidance includes

$30-$35 million related to drilling costs and well workovers,

$45-$50 million related to long lead items and well pad preparation

and $85-$90 million related to the expansion of the production

facilities and installation of water handling. With further clarity

around KRG payments, we would consider continued drilling following

SH-18. However, with continued payment delays we would review

reductions to our capital programme.

We remain focused on delivering 2023 gross average production of

46,000-52,000 bopd, representing an 11% increase from 2022 at the

mid-point. We also continue to target gross Opex of $3.0-$3.4/bbl

in 2023, implying no change from 2022 gross Opex per barrel at the

mid-point of guidance.

Financial framework & shareholder distributions

As we continue to transition towards increased investment in

profitable production growth from the Jurassic reservoir through a

flexible capital programme, we remain focused on balancing

investment in growth with sustainable shareholder returns, while

looking to maintain a robust balance sheet and prudent liquidity

levels.

Given our oil price outlook and flexible capital programme, we

currently have no hedging programme in place. We consider hedging

on an ongoing basis, taking into account macro-economic and

corporate considerations.

In line with the Company's dividend policy and financial

framework, we paid an interim dividend of $25 million to

shareholders on 3 March 2023 and we are pleased to declare a $25

million final 2022 ordinary dividend for shareholder approval at

the Company's AGM on 16 June 2023. Total dividends declared in 2023

of $50 million equate to an 11% yield based on the closing share

price on 22 March 2023.

The Board remains committed to distributing excess cash to

shareholders by way of dividends and/or share buybacks and will

continue to review further distributions based on a rigorous

framework that includes an assessment of the outlook for oil

prices, timeliness of payments from the KRG, expected liquidity,

cash flow generation and future PSC and capital commitments.

Ian Weatherdon

Chief Financial Officer

22 March 2023

Non-IFRS measures

The Group uses certain measures to assess the financial

performance of its business. Some of these measures are termed

"non-IFRS measures" because they exclude amounts that are included

in, or include amounts that are excluded from, the most directly

comparable measure calculated and presented in accordance with

IFRS, or are calculated using financial measures that are not

calculated in accordance with IFRS. These non -- IFRS measures

include financial measures such as operating costs and

non-financial measures such as gross average production.

The Group uses such measures to measure and monitor operating

performance and liquidity, in presentations to the Board and as a

basis for strategic planning and forecasting. The Directors believe

that these and similar measures are used widely by certain

investors, securities analysts and other interested parties as

supplemental measures of performance and liquidity.

The non-IFRS measures may not be comparable to other similarly

titled measures used by other companies and have limitations as

analytical tools and should not be considered in isolation or as a

substitute for analysis of the Group's operating results as

reported under IFRS. An explanation of the relevance of each of the

non-IFRS measures and a description of how they are calculated is

set out below. Additionally, a reconciliation of the non-IFRS

measures to the most directly comparable measures calculated and

presented in accordance with IFRS and a discussion of their

limitations is set out below, where applicable. The Group does not

regard these non-IFRS measures as a substitute for, or superior to,

the equivalent measures calculated and presented in accordance with

IFRS or those calculated using financial measures that are

calculated in accordance with IFRS.

Gross operating costs per barrel

Gross operating costs are divided by gross production to arrive

at operating costs per barrel.

2022 2021

--------------------------------------------- ---- ----

Gross production (MMstb) 16.1 15.9

Gross operating costs ($ million)(1) 52.3 43.0

--------------------------------------------- ---- ----

Gross operating costs per barrel ($ per bbl) 3.2 2.7

--------------------------------------------- ---- ----

(1) Gross operating costs equate to operating costs (see note 3)

adjusted for the Group's 80% working interest in the Shaikan

Field.

Adjusted EBITDA

Adjusted EBITDA is a useful indicator of the Group's

profitability, which excludes the impact of costs attributable to

tax (expense)/credit, finance costs, finance revenue, depreciation,

amortisation and impairment of receivables.

2022 2021

$ million $ million

-------------------------------------------------- ----------- ----------

Profit after tax 266.1 164.6

Finance costs 9.7 11.4

Finance revenue (0.6) (0.4)

Tax credit (0.3) (0.9)

Depreciation of oil and gas assets 80.2 54.1

Depreciation of other PPE assets and amortisation

of intangibles 1.4 1.0

Impairment of receivables 2.0 (7.1)

-------------------------------------------------- ----------- ----------

Adjusted EBITDA 358.5 222.7

-------------------------------------------------- ----------- ----------

Net capital expenditure

Net capital expenditure is the value of the Group's additions to

oil and gas assets excluding the change in value of the

decommissioning asset or any asset impairment.

2021

2022 Restated(1)

$ million $ million

---------------------------------- ----------- ------------

Net capital expenditure (note 11) 114.9 46.2

---------------------------------- ----------- ------------

(1) The definition of net capital expenditure has been amended

to no longer exclude the increase/decrease of drilling and other

equipment.

Net cash

Net cash is a useful indicator of the Group's indebtedness and

financial flexibility because it indicates the level of cash and

cash equivalents less cash borrowings within the Group's business.

Net cash is defined as cash and cash equivalents, less current and

non-current borrowings and non-cash adjustments. Non-cash

adjustments include unamortised arrangement fees and other

adjustments.

2022 2021

$ million $ million

---------------------------------- ----------- ----------

Outstanding Notes - (99.1)

Unamortised issue costs (note 16) - (0.9)

Cash and cash equivalents 119.5 169.9

---------------------------------- ----------- ----------

Net cash 119.5 69.9

---------------------------------- ----------- ----------

Free cash flow

Free cash flow represents the Group's cash flows, before any

dividends, share buybacks and notes redemption, including related

fees.

2022 2021

$ million $ million

--------------------------------------------- ----------- ----------

Net cash generated from operating activities 374.3 178.6

Net cash used in investing activities (107.4) (55.7)

Payment of leases (0.4) (0.7)

--------------------------------------------- ----------- ----------

Free cash flow 266.5 122.2

--------------------------------------------- ----------- ----------

Consolidated income statement

For the year ended 31 December 2022

Notes 2022 2021

$'000 $'000

----- --------- ---------

Revenue 2 460,113 301,389

Cost of sales 3 (158,651) (111,721)

(Increase)/decrease of impairment

provision on trade receivables 14 (1,960) 7,065

--------- ---------

Gross profit 299,502 196,733

Other general and administrative

expenses 4 (12,202) (13,643)

Share option related expenses 5 (13,756) (8,490)

Profit from operations 273,544 174,600

Finance revenue 7 648 419

Finance costs 7 (9,655) (11,353)

Foreign exchange gains 1,232 57

--------- ---------

Profit before tax 265,769 163,723

Tax credit 8 325 874

--------- ---------

Profit after tax for the year 266,094 164,597

--------- ---------

Profit per share (cents)

Basic 9 123.52 77.14

Diluted 9 118.62 73.04

Consolidated statement of comprehensive income

For the year ended 31 December 2022

2022 2021

$'000 $'000

------- -------

Profit after tax for the year 266,094 164,597

Items that may be reclassified to

the income statement in subsequent

periods:

Fair value losses arising in the

period - (2,021)

Cumulative losses arising on hedging

instruments reclassified to revenue - 3,753

Exchange differences on translation

of foreign operations (1,950) (254)

------- -------

Total comprehensive income for the

year 264,144 166,075

======= =======

Consolidated balance sheet

Notes 31 December 31 December

2022 2021

$'000 $'000

----- ----------- -----------

Non-current assets

Intangible assets 10 4,307 3,583

Property, plant and equipment 11 436,443 404,205

Deferred tax asset 18 1,576 1,385

442,326 409,173

----------- -----------

Current assets

Inventories 13 6,372 6,018

Trade and other receivables 14 176,203 179,200

Cash and cash equivalents 119,456 169,866

----------- -----------

302,031 355,084

----------- -----------

Total assets 744,357 764,257

=========== ===========

Current liabilities

Trade and other payables 15 (128,561) (98,800)

Non-current liabilities

Trade and other payables 15 (325) (789)

Borrowings 16 - (99,123)

Provisions 17 (42,546) (43,841)

----------- -----------

(42,871) (143,753)

----------- -----------

Total liabilities (171,432) (242,553)

----------- -----------

Net assets 572,925 521,704

=========== ===========

Equity

Share capital 20 216,247 213,731

Share premium 20 528,125 742,914

Exchange translation reserve (4,718) (2,768)

Accumulated losses (166,729) (432,173)

Total equity 572,925 521,704

=========== ===========

The financial statements were approved by the Board of Directors

and authorised for issue on 22 March 2023 and signed on its behalf

by:

Jon Harris

Chief Executive Officer

Ian Weatherdon

Chief Financial Officer

Consolidated statement of changes in equity

For the year ended 31 December 2022

Attributable to equity holders of the Company

Cost Exchange

Share Share Treasury of hedging translation Accumulated Total

capital premium shares reserve reserve losses equity

Notes $'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1 January

2021 211,371 842,914 (2,592) (1,732) (2,514) (593,422) 454,025

--------- --------- ---------- ----------- ------------ ----------- ---------

Profit after tax for

the year - - - - - 164,597 164,597

Cash flow hedge - fair

value movements - - - 1,732 - - 1,732

Exchange difference

on translation of foreign

operations - - - - (254) - (254)

--------- --------- ---------- ----------- ------------ ----------- ---------

Total comprehensive

income/(expense) for

the year - - - 1,732 (254) 164,597 166,075

--------- --------- ---------- ----------- ------------ ----------- ---------

Dividends paid 25 - (100,000) - - - - (100,000)

2

Employee share schemes 4 - - - - - 1,604 1,604

Share options exercised - - 2,592 - - (2,592) -

Share issues 20 2,360 - - - - (2,360) -

Balance at 31 December

2021 213,731 742,914 - - (2,768) (432,173) 521,704

--------- --------- ---------- ----------- ------------ ----------- ---------

Profit after tax for

the year - - - - - 266,094 266,094

Exchange difference

on translation of foreign

operations - - - - (1,950) - (1,950)

--------- --------- ---------- ----------- ------------ ----------- ---------

Total comprehensive

income for the year - - - - (1,950) 266,094 264,144

--------- --------- ---------- ----------- ------------ ----------- ---------

Dividends paid 25 - (214,789) - - - - (214,789)

2

Employee share schemes 4 - - - - - 1,866 1,866

Share issues 20 2,516 - - - - (2,516) -

Balance at 31 December

2022 216,247 528,125 - - (4,718) (166,729) 572,925

========= ========= ========== =========== ============ =========== =========

Consolidated cash flow statement

For the year ended 31 December 2022

Notes 2022 2021

$'000 $'000

--------- ---------

Operating activities

Cash generated from operations 21 383,846 189,155

Interest received 7 648 419

Interest paid 16 (10,194) (10,000)

Payment of put option premium - (1,043)

Net cash generated from operating

activities 374,300 178,531

--------- ---------

Investing activities

Purchase of intangible assets 10 (2,074) (2,725)

Purchase of property, plant and

equipment 21 (105,291) (52,959)

Net cash used in investing activities (107,365) (55,684)

--------- ---------

Financing activities

Payment of dividends 25 (214,789) (100,000)

Payment of leases 22 (458) (688)

Notes redemption 16 (100,000) -

Notes repayment fee 16 (2,000) -

Net cash used in financing activities (317,247) (100,688)

--------- ---------

Net (decrease)/increase in cash

and cash equivalents (50,312) 22,159

Cash and cash equivalents at

beginning of year 169,866 147,826

Effect of foreign exchange rate

changes (98) (119)

Cash and cash equivalents at

end of the year being bank balances

and cash on hand 119,456 169,866

========= =========

Summary of significant accounting policies

General information

Gulf Keystone Petroleum Limited (the "Company") is domiciled and

incorporated in Bermuda (registered address: Cedar House, 3rd

Floor, 41 Cedar Avenue, Hamilton, HM12, Bermuda); together with its

subsidiaries it forms the "Group". On 25 March 2014, the Company's

common shares were admitted, with a standard listing, to the

Official List of the United Kingdom Listing Authority ("UKLA") and

to trading on the London Stock Exchange's Main Market for listed

securities. Previously, the Company was quoted on Alternative

Investment Market, a market operated by the London Stock Exchange.

In 2008, the Company established a Level 1 American Depositary

Receipt programme in conjunction with the Bank of New York Mellon,

which has been appointed as the depositary bank. The Company serves

as the holding company for the Group, which is engaged in oil and

gas exploration, development and production, operating in the

Kurdistan Region of Iraq.

The financial information set out in this Results Announcement

does not constitute the Company's annual report and accounts for

the years ended 31 December 2021 or 2022 but is derived from those

accounts. The auditors have reported on those accounts; their

reports were unqualified and did not draw attention to any matters

by way of emphasis without qualifying their report.

Amendments to International Financial Reporting Standards

("IFRS") that are mandatorily effective for the current year

In the current year, the Group has applied a number of

amendments to IFRSs issued by the International Accounting

Standards Board (IASB) that are mandatorily effective for an

accounting period that begins on or after 1 January 2022.

The following new accounting standards, amendments to existing

standards and interpretations are effective on 1 January 2022:

Reference to the Conceptual Framework (Amendments to IFRS 3),

Property, Plant and Equipment - Proceeds before Intended Use

(Amendments to IAS 16), Onerous Contracts - Cost of Fulfilling a

Contract (Amendments to IAS 37), and Annual Improvements to IFRS

Standards 2018-2020. These standards do not and are not expected to

have a material impact on the Company's results or financials

statement disclosures in the current or future reporting

periods.

New and revised IFRSs issued but not yet effective

At the date of approval of these financial statements, the Group

has not applied the following new and revised IFRSs that have been

issued but are not yet effective by United Kingdom adopted

International Accounting Standards:

IFRS 17 Insurance Contracts

Amendments to IFRS Applying IFRS 9 'Financial Instruments' with

4 IFRS 4 'Insurance Contracts'; Extension of the

Temporary Exemption from Applying IFRS 9

Amendments to IAS Classification of Liabilities as Current or

1 Non-current; Classification of Liabilities as

Current or Non-current - Deferral of Effective

Date; Non-current Liabilities with Covenants

Amendments to IFRS Lease Liability in a Sale and Leaseback

16

Amendments to IFRS Initial Application of IFRS 17 and IFRS 9 -

17 Comparative Information; Amends IFRS 17 to address

concerns and implementation challenges that were

identified after IFRS 17 Insurance Contracts

was published in 2017

Amendments to IAS Disclosure of Accounting Policies

1 and IFRS Practice

Statement 2

Amendments to IAS Definition of Accounting Estimates

8

Amendments to IAS Deferred Tax related to Assets and Liabilities

12 arising from a Single Transaction

The directors do not expect that the adoption of the Standards

listed above will have a material impact on the financial

statements of the Group in future periods .

Statement of compliance

The financial statements have been prepared in accordance with

United Kingdom adopted International Accounting Standards .

Basis of accounting

The financial statements have been prepared under the historical

cost basis, except for the valuation of hydrocarbon inventory and

the valuation of certain financial instruments, which have been

measured at fair value, and on the going concern basis.

Equity-settled share-based payments are recognised at fair value at

the date of grant, and are not subsequently revalued. The principal

accounting policies adopted are set out below.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the Chairman's statement, the Chief Executive

Officer's review, the Operational review and the Management of

principal risks and uncertainties. The financial position of the

Group at the year end and its cash flows and liquidity position are

included in the Financial review.

As at 22 March 2023, the Group had $118.8 million of cash and no

debt. The Group continues to closely monitor and manage its

liquidity. Cash forecasts are regularly produced and sensitivities

run for different scenarios including, but not limited to, change

in commodity prices, different production rates from the Shaikan

block, cost contingencies, disruptions and delays to revenue

receipts, impact of climate change and geopolitical risks on the

Group's operations, including the Iraqi Supreme Court ruling on 15

February 2022, as further described in key sources of uncertainty

below.

In the current year, further consideration has been given to the

impact on the Group's working capital position due to delays in

revenue receipts from the KRG and the proposed revision to the

lifting agreement:

-- Revenue receipts - The timing of revenue receipts over the

last 12 months has increased from an average of 20-30 days past due

to 100 days for the most recent September production month payment.

At the date of this report, $76.0 million is overdue for October to

December 2022 oil sales; and

-- Lifting agreement: There has been no lifting agreement in

place since 1 September 2022 and negotiations are ongoing around

the pricing mechanism of oil sales. Instead of a Dated Brent based

pricing mechanism, the KRG has proposed a Kurdistan Blend (KBT)

based pricing mechanism to recognise the value they receive for oil

sales, as further described in note 2.

The Directors believe an agreement will ultimately be reached on

the terms of a revised lifting agreement, and we reasonably expect

that overdue balances will be paid and payments will return to a

more regular basis. However, a deferral of revenue receipts from

the KRG for an extended period of time could result in liquidity

pressures within the twelve month going concern period.

The Directors have considered sensitivities to assess the impact

on the Group's liquidity position if revenue receipts from the KRG

are deferred for an extended period of time. While the payment of

such amounts are outside of management's control, the Directors

believe sufficient mitigating actions are available to withstand

potential further delays in revenue receipts until such receipts

return to more routine payment terms. Mitigating actions include

deferring planned capital expenditures, reducing operating and

general and administrative expenses and managing supplier payment

timing.

Overall, the Group's forecasts, taking into account the

applicable risks, stress test scenarios and potential mitigating

actions, show that it has sufficient financial resources for the

twelve months from the date of approval of the 2022 annual report

and accounts.

Based on the analysis performed, the Directors have a reasonable

expectation that the Group has adequate resources to continue to

operate for the foreseeable future. Thus the going concern basis of

accounting is used to prepare the annual consolidated financial

statements.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and enterprises controlled by the Company

(its subsidiaries) made up to 31 December each year. Control is

achieved where the Company has the power to govern the financial

and operating policies of an investee entity, so as to obtain

benefits from its activities.

Joint arrangements

The Group is engaged in oil and gas exploration, development and

production through unincorporated joint arrangements; these are

classified as joint operations in accordance with IFRS 11. The

Group accounts for its share of the results and net assets of these

joint operations. Where the Group acts as Operator of the joint

operation, the gross liabilities and receivables (including amounts

due to or from non-operating partners) of the joint operation are

included in the Group's balance sheet.

Sales revenue

The recognition of revenue is considered to be a key accounting

judgement.

Revenue is earned based on the entitlement mechanism under the

terms of the Shaikan Production Sharing Contract ("PSC").

Entitlement has two components: cost oil, which is the mechanism by

which the Company recovers its costs incurred, and profit oil,

which is the mechanism through which profits are shared between the

Company, its partner and the Kurdistan Regional Government ("KRG").

The Company is liable for capacity building payments calculated as

a proportion of profit oil entitlement. Entitlement from cost oil

and profit oil are reported as revenue, and capacity building

payments are included in cost of sales.

All oil is sold by the Shaikan Contractor (the Company and

Kalegran BV, a subsidiary of MOL Hungarian Oil & Gas Plc,